Working People Must Recognize the Basis of Class Struggle

Polls suggest that working people are becoming more aware that our economic model is failing them. Regrettably, this increasing discontent stops at addressing the symptoms rather than the cause cemented into our economic model.

Currently working people are inveterately distracted with attacks on the Constitution by MAGA gangsters, thugs, and reprobates.

Another distraction is the heinous protection of the international cabal of rich men guilty of exploiting young girls in the Epstein criminal network.

A third distraction is indoctrinating working people into supporting a glutted military budget while cutting programs for working people.

Distractions

General Dwight D. Eisenhower warned working people in 1961 of the dangers of the "military-industrial complex."

The root cause of unemployment, underemployment, and inflation is the wage and salary component of our economic model.

It results in violations of international laws to protect corporate profits in foreign countries like Venezuela; that includes the murder of innocent civilians in cruising boats.

However, a not so obvious din of these distractions is designed to numb Americans from zeroing in on the foundation of their chronic economic adversity and anxiety.

That foundation is the wage and salary construct of our economic model.

Economic Model Decline

The symptoms of the decline of our economic model are well documented.

The Ludwig Institute of Shared Economic Prosperity (LISEP) reported a functional unemployment rate in November 2025 of 24.8%. LISEP reported a real inflation rate of 9.4%.

Asset Limited, Income Constrained, Employed, (ALICE) reported that 42% of households in the US were below the ALICE threshold of poverty.

The underemployment rate reported by the Burning Glass Institute in February 2024 was 52% for college graduates.

These are chronic symptoms of an economic model that cannot provide an equitable and moral distribution of employment opportunities. If you harbor the belief that anyone here can become rich or wealthy, think again.

Progressives recognize that the Republican Party has devolved into a fascist cult. The evidence is Project 2025 and screams daily that our government is being replaced by rich con artists inside the Trump administration swamp.

However, polls do suggest that working people are becoming more aware that our economic model is failing them.

Regrettably, this increasing discontent stops at addressing the symptoms rather than the cause cemented into our economic model.

Many progressive politicians, scholars, academics, and journalists go to the water's edge of the cause, but cravenly avoid a discussion of the that cause.

Upton Sinclair’s assertion in 1935 is applicable:

It is difficult to get a man to understand something, when his salary depends on his not understanding it. (“I, Candidate for Governor: And How I Got Licked”)

Root Cause

The root cause of unemployment, underemployment, and inflation is the wage and salary component of our economic model. To understand how that model is inherently exploitative and inequitable, the basics must be understood.

The following is a simplified example on that process.

The primary purpose of our economy is to return a private profit to the business owner.

The basic opportunities for a contented lifestyle are decreasing.

There are two types of investment that the business owner must spend.

First is expenditures on space, plant, machinery, tools, hardware, software, technological advances, and raw materials. This includes legal registrations, licenses, permits, and financial services. Often, the business owner inherits the business so this expenditure may be minimized.

Next, the business owner must purchase the physical or mental efforts of the employees. It is realized in the form of wages and salaries.

The employees create the products or services that the business owner sells in the market. In spite of the delusions of many business owners, no business owner creates those products or services alone. It is a social process.

If the business owner paid the employees the salary and wages equal to the value of the products or services created by them, there would be no profit.

Hence, there would be no reason to continue the business. Moreover, the business owner must compete with other business owners to sell as much as possible and minimize costs. Parenthetically, layoffs and recessions crushing working people are the usual remedy for the business owner.

Specific Example

The business owner must sell the products or services created by the employees at a price above the amount spent on wages and salaries.

In this example, a male employee works a typical nine to five workday.

In that workday, the employee works for wages or a salary that will allow him to maintain himself or his family.

However, inside that workday is the key to the exploitation and moral flaw in this economic process. It appears that the employee is being paid for working a full day, but that is not the case.

The business owner must calculate the amount paid to the employee based on how much is required for a private profit.

The employee is working some hours to provide a profit for the owner and some hours to maintain himself or his family.

In this example, in one workday the business owner pays $50 an hour for all the initial expenditures listed above to create one product.

The employee must be paid to create the product or service. By an arbitrary calculation of the business owner, it is $10 an hour.

The business owner must sell the product or service in the market by charging an amount above what has been spent already to produce it. It was created for $50 plus $10 which equals $60.

However, the business owner must sell the product or service for $70 each to obtain a profit of $10. The “new” value of the product or service is $70, yet it cost $60 to create.

If the employee created a product or service that is worth $70, it is inescapable that the employee is not being compensated for the value that he created. This is basic exploitation of unpaid labor and, in most spiritual belief systems, immoral.

Perceptive Voices

Pope John XXIII wrote on this subject:

We therefore consider it our duty to reaffirm that the remuneration of work is not something that can be left to the laws of the marketplace; nor should it be a decision left to the will of the more powerful. It must be determined in accordance with justice and equity; which means that workers must be paid a wage which allows them to live a truly human life and to fulfill their family obligations in a worthy manner. (Mater et Magistra May 15, 1961)

Martin Luther King commented on this moral flaw:

We are saying that something is wrong... with capitalism... There must be better distribution of wealth and maybe America must move toward a democratic socialism. Call it what you may, call it democracy, or call it democratic socialism, but there must be a better distribution of wealth within this country for all of God’s children (1966)

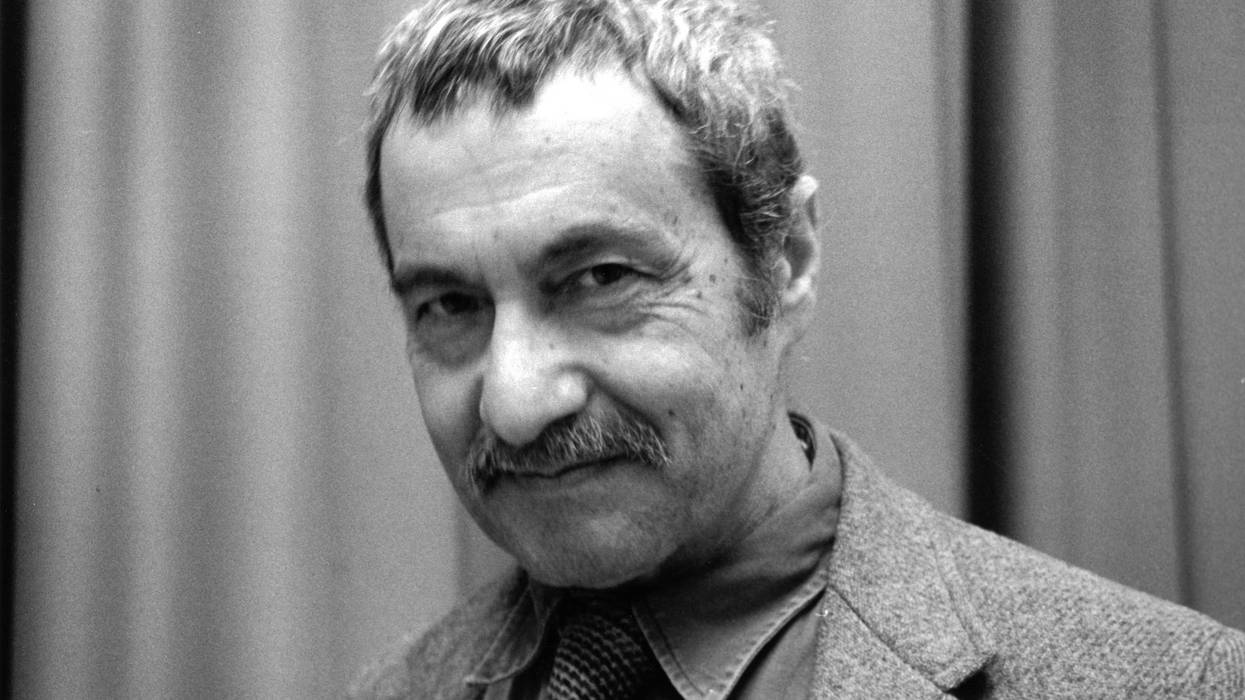

Malcolm X, American Muslim leader, spoke at one of his speeches at the Audubon Ballroom in New York City in 1964:

You show me a capitalist, and I’ll show you a bloodsucker.

Consequences

The inherent exploitation of our economic model begins at the wage and salary level. From there we organize, produce, transport and distribute goods and services. Private profit for the business owner supersedes all other values.

In the US we have seen the values of community, family, and social sentiment diminished. Those values are overwhelmed by a tsunami of advertising urging working people into a conspicuous consumption of material items whether needed or not.

Simultaneously is the harsh economic reality for working people. The basic opportunities for a contented lifestyle are decreasing. Those opportunities are quality and affordable healthcare, smart and accessible education, safe and comfortable housing, healthy nutrition, and a clean environment.

This dilemma can be addressed by providing the material opportunities above with policies formed by the best of spiritual and secular values.

That can only be realized by a transition to an economic model based on realistic democratic principles and collective profits.

Otherwise, the present economic immiseration and despair will continue to transform working people into a morass of fear and hatred seeking scapegoats to blame. They will become an alienated, vapid mass of untethered individuals at the mercy of the soulless and parasitic oligarchs who live off the products and services of their labor.