August, 24 2011, 03:52pm EDT

For Immediate Release

Contact:

Michelle Bazie,202-408-1080,bazie@cbpp.org

Statement: James R. Horney, Vice President Of Federal Fiscal Policy, on the Congressional Budget Office Update of Its Budget and Economic Outlook

Today's Congressional Budget Office update of the nation's budget and economic outlook reinforces the point that policymakers should not let legitimate concerns about deficits and debt in coming decades prevent them from pursuing policies to boost economic growth and increase jobs in the short run. It also puts the lie to claims that the only way to reduce deficits and debt over the next decade is with big new spending cuts.

WASHINGTON

Today's Congressional Budget Office update of the nation's budget and economic outlook reinforces the point that policymakers should not let legitimate concerns about deficits and debt in coming decades prevent them from pursuing policies to boost economic growth and increase jobs in the short run. It also puts the lie to claims that the only way to reduce deficits and debt over the next decade is with big new spending cuts.

CBO points out that current policies -- including caps on discretionary spending, required deficit reduction under the Budget Control Act (BCA), and the scheduled expiration of existing tax cuts -- will hold back economic growth. Due to these policies and the lingering effects of the recession, financial crisis, and overbuilding in the housing market, CBO expects that economic growth will remain much slower than in a typical recovery and unemployment will fall very slowly, remaining well above 8 percent until 2014.

Proposals to cut deficits by cutting programs deeply in the next few years -- beyond the deficit reduction required by the BCA -- would weaken the economy further. Instead, we need to boost the economy in the short run by enacting legislation that would, for example, extend unemployment insurance benefits and the temporary cut in payroll taxes beyond their scheduled expiration at the end of this year, provide more assistance to states to temper their need to impose more layoffs and cut more spending to balance their budgets, and create programs that would put people back to work on projects such as renovating and modernizing America's schools. Such temporary policies would help boost growth and employment now without adding significantly to long-term deficits and debt.

Policymakers are right to worry about longer-term deficits and debt (although not to the point of letting the economy stagnate in the short run), but CBO's new projections show that problem in a somewhat different light than usual. Deficit "hawks" argue for bold new changes in policies -- some say they should include only budget cuts -- to keep deficits and debt from growing rapidly in coming years. But CBO projects that, if current laws simply remain in place, deficits and debt will come under control in this decade. Deficits would fall dramatically -- from 8.5 percent of gross domestic product (GDP) this year to about 1 percent of GDP in 2017 through 2021. Debt held by the public would peak at about 73 percent of GDP at the end of 2013, but would then fall to 61 percent in 2021. To be sure, policymakers would have to make further changes in policy to keep deficits from beginning to grow again in coming decades as the population ages and health care costs increase. Nevertheless, reducing debt below current levels (67.3 percent by the end of this fiscal year, according to CBO) by 2021 would be a huge accomplishment.

This does not mean, however, that policymakers have actually agreed on policies to generate that outcome. CBO's assumption that current laws will remain unchanged means that tax cuts scheduled to expire under current law (chiefly President Bush's 2001 and 2003 tax cuts and relief from the alternative minimum tax that Congress has routinely enacted) will not be extended, that Congress will not continue to prevent big scheduled cuts in Medicare physician reimbursements from taking effect, that discretionary appropriations in 2012 through 2021 will not exceed the limits enacted under the BCA, and that at least $1.2 trillion in additional savings envisioned by the BCA -- through legislation reported by the new congressional Joint Select Committee on Deficit Reduction or automatic spending cuts ("sequestration") if the Joint Committee fails to reach its target -- will be achieved. (If the other aspects of current law remain in place but the Joint Committee-sequestration savings do not materialize, debt held by the public would fall to just over 66 percent of GDP by 2021).

Many policymakers surely would find this scenario unrealistic. The question, however, is whether it is any more realistic to assume that Congress will enact new laws that would achieve comparable savings through deep cuts in Medicare, Medicaid, Social Security and other programs over the next 10 years -- especially because substantial savings in Medicare should come through changes in the health care system (in the private as well as public sectors) that slow the rate of growth of per-person health care costs, not simply by shifting costs onto the elderly. CBO's projections make clear that we face real choices about how to reduce deficits and debt in future years and decades. Allowing most or all of the 2001 and 2003 tax cuts to expire on schedule would substantially reduce the necessary cuts in important programs like Medicare, Medicaid, and Social Security. And, if letting the tax cuts expire suddenly on January 1, 2013 would unduly weaken a still-struggling economy, policymakers could phase in their expiration over a few years to minimize the short-term economic impact while achieving the long-term savings.

The bottom line is this: for the long run, we must carefully consider the best way to reduce deficits and debt. In the short run, we must focus our efforts on how to get the economy growing more rapidly and put millions of Americans back to work as soon as possible.

The Center on Budget and Policy Priorities is one of the nation's premier policy organizations working at the federal and state levels on fiscal policy and public programs that affect low- and moderate-income families and individuals.

LATEST NEWS

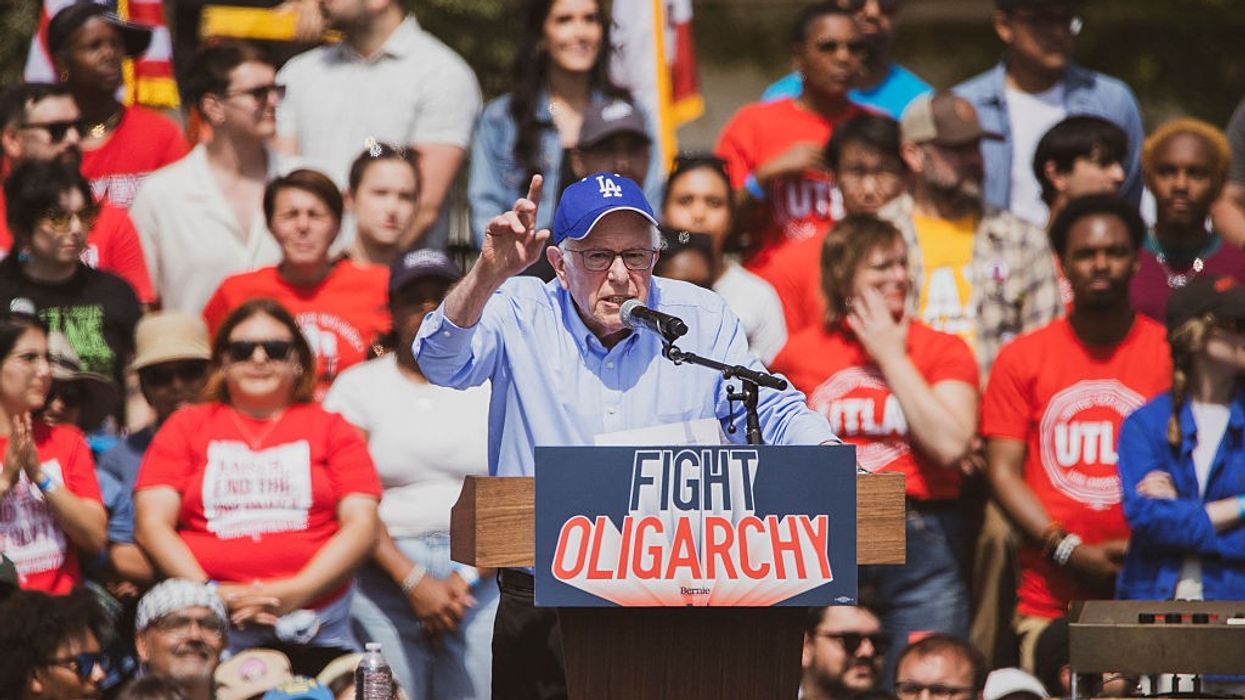

Sanders Backs Push for Billionaire Tax in California as Newsom Raises Money to Fight It

"Yes: We need a wealth tax on billionaires," said US Sen. Bernie Sanders.

Dec 31, 2025

US Sen. Bernie Sanders on Tuesday endorsed an effort in California to impose a one-time tax on the wealth of the state's billionaires, a grassroots campaign that has drawn opposition from Democratic Gov. Gavin Newsom and powerful investors.

Sanders (I-Vt.) said the proposed ballot initiative, which is currently in the signature-gathering phase, "is a model that should be emulated throughout the country." The senator said he plans to introduce a proposal for a national wealth tax in the near future.

"In my view, in a democratic society, we cannot continue to tolerate a rigged economy in which 60% of our people live paycheck to paycheck—struggling to pay for housing, food, and healthcare while the top 1% now owns more wealth than the bottom 93%," Sanders said in a statement posted to social media. "We must not continue a trend in which, over the past 50 years, $79 trillion in wealth in our country has been redistributed from the bottom 90% to the top 1%."

Yes: We need a wealth tax on billionaires. pic.twitter.com/2OUwSos5De

— Bernie Sanders (@BernieSanders) December 30, 2025

If placed on the November 2026 ballot and approved by voters, the California Billionaire Tax Act would levy a single 5% tax on the wealth of the roughly 200 billionaires who reside in the state. Those subject to the tax would have the option of paying the amount owed all at once or over a period of five years.

Organizers say the measure would generate $100 billion in revenue, which the state could use to avert a looming healthcare crisis fueled by the unprecedented Medicaid cuts that US President Donald Trump and congressional Republicans enacted over the summer.

“California is facing massive federal healthcare cuts—$20 to $30 billion a year for the next five years," said Suzanne Jimenez, chief of staff of Service Employees International Union-United Healthcare Workers West, a top supporter of the proposed ballot initiative.

"The billionaire tax would raise dollar-for-dollar emergency funding of $100 billion through a one-time 5% tax on the worldwide net worth of California’s billionaires," Jimenez added. "Any reductions in state income tax would be negligible in comparison to the billions that will be raised by the billionaire tax. And billionaires would still be taxed at lower rates than were in effect under President Reagan."

"We need a tax system that demands that the billionaire class finally pays their fair share of taxes."

Last week, California Attorney General Rob Bonta formally issued the title and summary of the proposed initiative as prominent billionaires—including Peter Thiel and Larry Page—threatened to leave the state over the measure, which would apply retroactively to those living in California as of January 1, 2026. Thiel is facing a potential $1.2 billion tax, while Page would have to pay roughly $12 billion.

The New York Times reported last week that Newsom, "who has been close with people like Mr. Page, is raising money for a committee to oppose the measure."

"The committee received a $100,000 donation from the venture capitalist Ron Conway in November, according to state campaign finance records," the Times added.

Other lawmakers from the state are supporting the measure, including US Rep. Ro Khanna (D-Calif.), who represents Silicon Valley.

Sanders, in his Tuesday statement, applauded Khanna, saying he is "absolutely right to support this effort."

"From a moral, economic, and political perspective, our nation will not thrive when so few own so much while so many have so little," said Sanders. "We need a tax system that demands that the billionaire class finally pays their fair share of taxes."

Keep ReadingShow Less

In Blow to 'Fetal Personhood' Push, Alabamian Serving 18 Years After Stillbirth Gets New Trial

"I'm hopeful that my new trial will end with me being freed, because I simply lost my pregnancy at home because of an infection," said Brooke Shoemaker, who has already spent five years in prison.

Dec 30, 2025

While Brooke Shoemaker and a rights group representing her in court are celebrating this week after an Alabama judge threw out her conviction and ordered a new trial, her case is also drawing attention to the dangers of "fetal personhood" policies.

"Laws and judicial decisions that grant fetuses—and in some cases embryos and fertilized eggs—the same legal rights and status given to born people, such as the right to life, is 'fetal personhood,'" explains the website of the group, Pregnancy Justice. "When fetuses have rights, this fundamentally changes the legal rights and status of all pregnant people, opening the door to criminalization, surveillance, and obstetric violence."

Since the US Supreme Court's Dobbs v. Jackson Women's Health Organization ruling ended the federal right to abortion in 2022, far-right activists and politicians have ramped up their fight for fetal personhood policies. Pregnancy Justice found that in the two years after the decision, the number of people who faced criminal charges related to their pregnancies hit its highest level in US history.

Shoemaker's case began even earlier, in 2017, when she experienced a stillbirth at home about 24-26 weeks into her pregnancy. Paramedics brought her to a hospital, where she disclosed using methamphetamine while pregnant. Although a medical examiner could not determine whether the drug use caused the stillbirth—and, according to Pregnancy Justice, "her placenta showed clear signs of infection"—a jury found her guilty of chemical endangerment of a minor. She's served five years of her 18-year sentence.

"After becoming Ms. Shoemaker's counsel in 2024, Pregnancy Justice filed a petition alongside Andrew Stanley of the Samford Law Office requesting a hearing based on new evidence about the infection that led to the demise of Ms. Shoemaker's pregnancy, leading the judge to agree with Pregnancy Justice's medical witness and to vacate the conviction," the rights group said in a Monday statement.

Lee County Circuit Judge Jeffrey Tickal wrote in his December 22 order that "should the facts had been known, and brought before the jury, the results probably would have been different."

Shoemaker said Monday that "after years of fighting, I'm thankful that I'm finally being heard, and I pray that my next Christmas will be spent at home with my children and parents... I'm hopeful that my new trial will end with me being freed, because I simply lost my pregnancy at home because of an infection. I loved and wanted my baby, and I never deserved this."

Although Tickal's decision came three days before Christmas, the 45-year-old mother of four remained behind bars for the holiday last week, as the state appeals.

"While we are thrilled with the judge's decision, we are outraged that Ms. Shoemaker is still behind bars when she should have been home for Christmas," said former Pregnancy Justice senior staff attorney Emma Roth. "She was convicted based on feelings, not facts. Pregnancy Justice will continue to fight on appeal and prove that pregnancies end tragically for reasons far beyond a mother's control. Women like Ms. Shoemaker should be allowed to grieve their loss without fearing arrest."

AL.com reported Tuesday that "Alabama is unique in that it is one of only three states, along with Oklahoma and South Carolina, where the state Supreme Court allows the application of criminal laws meant to punish child abuse or child endangerment to be applied in the context of pregnancy."

However, similar cases aren't restricted to those states. Pregnancy Justice found that in the two years following Dobbs, "prosecutors initiated cases in 16 states: Alabama, California, Florida, Idaho, Kentucky, Mississippi, Nebraska, New Mexico, Ohio, Oklahoma, Pennsylvania, South Carolina, South Dakota, Texas, Wisconsin, and Wyoming. While prosecutions were brought in all of these states, to date, the majority of the reported cases occurred in Alabama (192) and Oklahoma (112)."

This is fantastic news!!I wrote in my book how the medical examiner ruled the cause of the stillbirth "undetermined," but the coroner (who lacks medical training) instead listed cause of stillbirth as mom's meth usage on the fetal death certificate.

[image or embed]

— Jill Wieber Lens (@jillwieberlens.bsky.social) December 30, 2025 at 12:25 PM

"Prosecutors used a variety of criminal statutes to charge the defendants in these cases, often bringing more than one charge against an individual defendant," the group's report continues. "In total, the 412 defendants faced 441 charges for conduct related to pregnancy, pregnancy loss, or birth. The majority of charges (398/441) asserted some form of child abuse, neglect, or endangerment."

"As has been the case for decades, nearly all the cases alleged that the pregnant person used a substance during pregnancy," the report adds. "In 268 cases, substance use was the only allegation made against the pregnant person. In the midst of a wide-ranging crisis in maternal healthcare and despite maternal healthcare deserts across the country, prosecutors or police argued that pregnant people's failure to obtain prenatal care was evidence of a crime. This was the case in 29 of 412 cases."

When the publication was released last year, Pregnancy Justice president Lourdes A. Rivera said in a statement that "the Dobbs decision emboldened prosecutors to develop ever more aggressive strategies to prosecute pregnancy, leading to the most pregnancy-related criminal cases on record."

"This is directly tied to the radical legal doctrine of 'fetal personhood,' which grants full legal rights to an embryo or fetus, turning them into victims of crimes perpetrated by pregnant women," Rivera argued. "To turn the tide on criminalization, we need to separate healthcare from the criminal legal system and to change policy and practices to ensure that pregnant people can safely access the healthcare they need, without fear of criminalization. This report demonstrates that, in post-Dobbs America, being pregnant places people at increased risk, not only of dire health outcomes, but of arrest."

Keep ReadingShow Less

'A Wake-Up Call': Scientists Find 2025 Among Hottest Years on Record

"2025 was full of stark reminders of the urgent need to cut climate pollution, invest in clean energy, and tackle the climate crisis now."

Dec 30, 2025

Climate change driven by human burning of fossil fuels helped make 2025 one of the hottest years ever recorded, a scientific report published Monday affirmed, prompting renewed calls for urgent action to combat the worsening planetary emergency.

Researchers at World Weather Attribution (WWA) found that "although 2025 was slightly cooler than 2024 globally, it was still far hotter than almost any other year on record," with only two other recent years recording a higher average worldwide temperature.

For the first time, the three-year running average will end the year above the 1.5°C warming goal, relative to preindustrial levels, established a decade ago under the landmark Paris climate agreement.

"Global temperatures remained very high and significant harm from human-induced climate change is very real," the report continues. "It is not a future threat, but a present-day reality."

"Across the 22 extreme events we analyzed in depth, heatwaves, floods, storms, droughts, and wildfires claimed lives, destroyed communities, and wiped out crops," the researchers wrote. "Together, these events paint a stark picture of the escalating risks we face in a warming world."

The WWA researchers' findings tracked with the findings of United Nations experts and others that 2025 would be the third-hottest year on record.

According to the WWA study:

This year highlighted again, in stark terms, how unfairly the consequences of human-induced climate change are distributed, consistently hitting those who are already marginalized within their societies the hardest. But the inequity goes deeper: The scientific evidence base itself is uneven. Many of our studies in 2025 focused on heavy rainfall events in the Global South, and time and again we found that gaps in observational data and the reliance on climate models developed primarily for the Global North prevented us from drawing confident conclusions. This unequal foundation in climate science mirrors the broader injustices of the climate crisis.

The events of 2025 make it clear that while we urgently need to transition away from fossil fuels, we also must invest in adaptation measures. Many deaths and other impacts could be prevented with timely action. But events like Hurricane Melissa highlight the limits of preparedness and adaptation: When an intense storm strikes small islands such as Jamaica and other Caribbean nations, even relatively high levels of preparedness cannot prevent extreme losses and damage. This underscores that adaptation alone is not enough; rapid emission reductions remain essential to avoid the worst impacts of climate change.

“If we don’t stop burning fossil fuels very, very, quickly, very soon, it will be very hard to keep that goal” of 1.5°C, WWA co-founder Friederike Otto—who is also an Imperial College London climate scientist—told the Associated Press. “The science is increasingly clear.”

The WWA study's publication comes a month after this year's United Nations Climate Change Conference—or COP30—ended in Brazil with little meaningful progress toward a transition from fossil fuels.

Responding to the new study, Climate Action Campaign director Margie Alt said in a statement that "2025 was full of stark reminders of the urgent need to cut climate pollution, invest in clean energy, and tackle the climate crisis now."

"Today’s report is a wake-up call," Alt continued. "Unfortunately, [US President Donald] Trump and Republicans controlling Congress spent the past year making climate denial official US policy and undermining progress to stave off the worst of the climate crisis. Their reckless polluters-first agenda rolled back critical climate protections and attacked and undermined the very agencies responsible for helping Americans prepare for and recover from increasingly dangerous disasters."

"Across the country, people are standing up and demanding their leaders do better to protect our families from climate change and extreme weather," Alt added. "It's time those in power started listening.”

Keep ReadingShow Less

Most Popular