Supporters are currently collecting the 900,000 signatures needed for the CBTA to qualify for California's 2026 ballot. Meanwhile, billionaires including venture capitalist Peter Thiel and Google co-founder Sergey Brin are among those fighting the proposal.

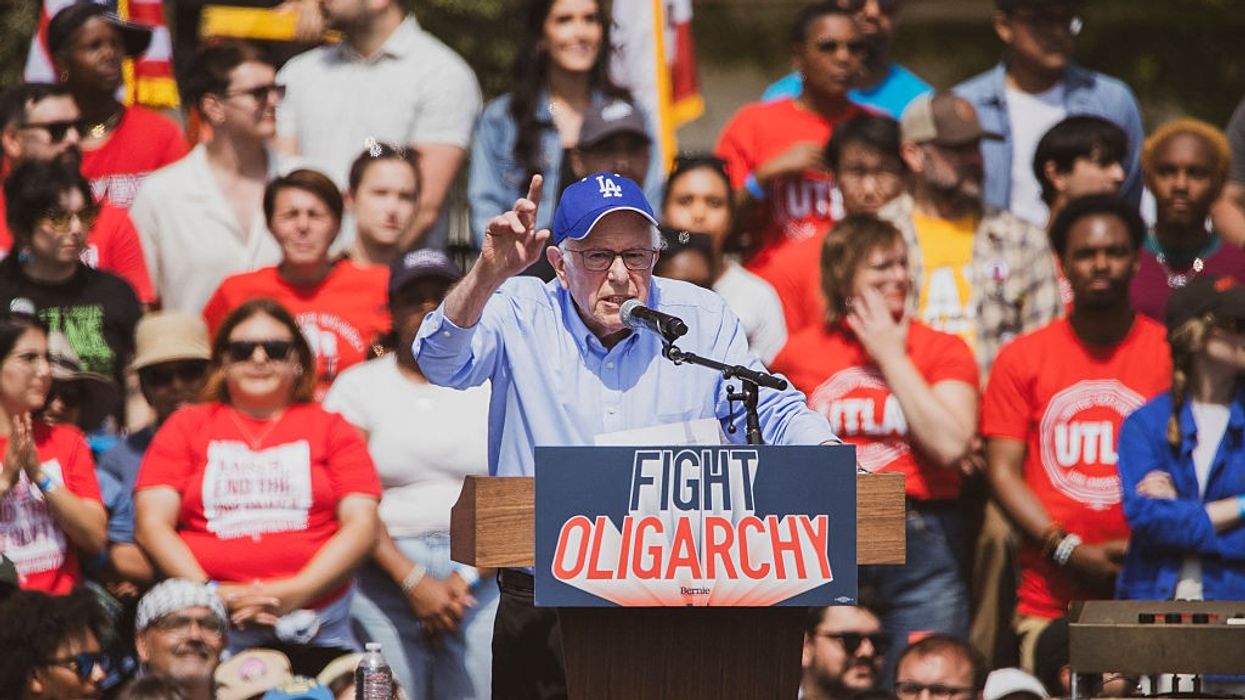

Public opinion polling in recent years has shown that around three-quarters of all California voters, and over 9 in 10 Democrats, back a billionaire wealth tax. So do unions, social and economic justice groups, progressive economists, and congressional lawmakers including Sen. Bernie Sanders (I-Vt.) and Rep. Ro Khanna (D-Calif.)—another possible presidential aspirant whose support for the CBTA incensed Thiel and other Silicon Valley billionaires like Larry Page and Elon Musk.

However, Newsom finds himself aligned with Thiel—a seven-figure supporter of President Donald Trump's presidential campaigns—in opposing the proposed tax.

“This will be defeated—there’s no question in my mind,” Newsom said of the CBTA in a Tuesday interview with the New York Times. “I’ll do what I have to do to protect the state."

Newsom—who has close personal, business, or political ties with billionaires including the Getty family, GAP co-founder Doris Fisher, Salesforce CEO Marc Benioff, and Siebel Systems co-founder and cousin-by-marriage Tom Siebel—said he is against the CBTA because it could stifle California's world-leading technological innovation and drive away businesses and wealthy individuals.

"The impacts are very real—not just substantive economic impacts in terms of the revenue, but start-ups, the indirect impacts of … people questioning long term-commitments," Newsom told Politico Monday. “That’s not what we need right now, at a time of so much uncertainty."

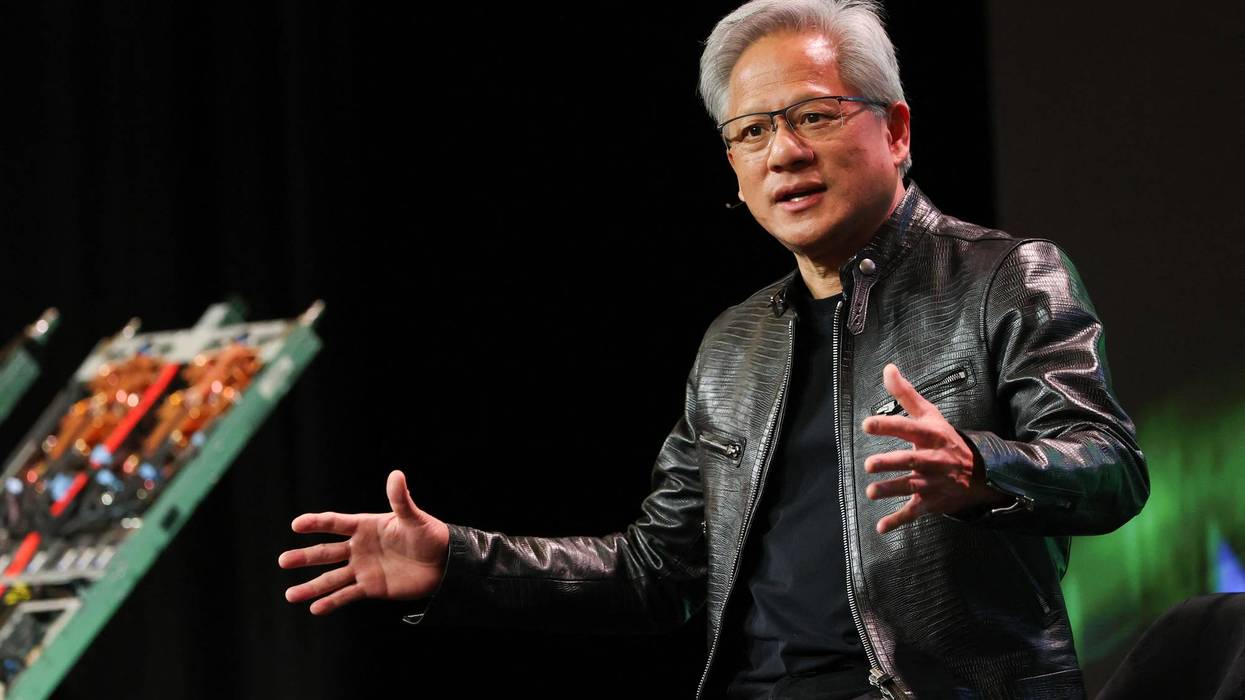

Not all plutocrats oppose a billionaire wealth tax. Benioff, Warren Buffet, Abigail Disney, Bill Gates, Jensen Huang, Chris Hughes, and George Soros have all advocated higher taxes on the ultrarich.

Huang, CEO of tech titan Nvidia and one of the 10 richest people on the planet, said last week that he is "perfectly fine" with the CBTA.

Responding to Newsom's opposition to the CBTA, Progressive Mass political director Jonathan Cohn said on Bluesky: "Gavin Newsom wants a future for the Democratic Party that consists of sucking up to conservative billionaires. That's a path destined for losses."

Civil rights attorney and professor Alejandra Caraballo also took to Bluesky, writing, "Another reason I'm never Newsom. He's a billionaires' errand boy beholden to them."

Progressive organizer Jonathan Rosenblum asked on X, "Which side are you on?"

"Gavin Newsom is on the side of the billionaires, not the millions of working people who stand to lose healthcare because of the Trump cuts," Rosenblum added. "Shamefully typical of the Democratic establishment."