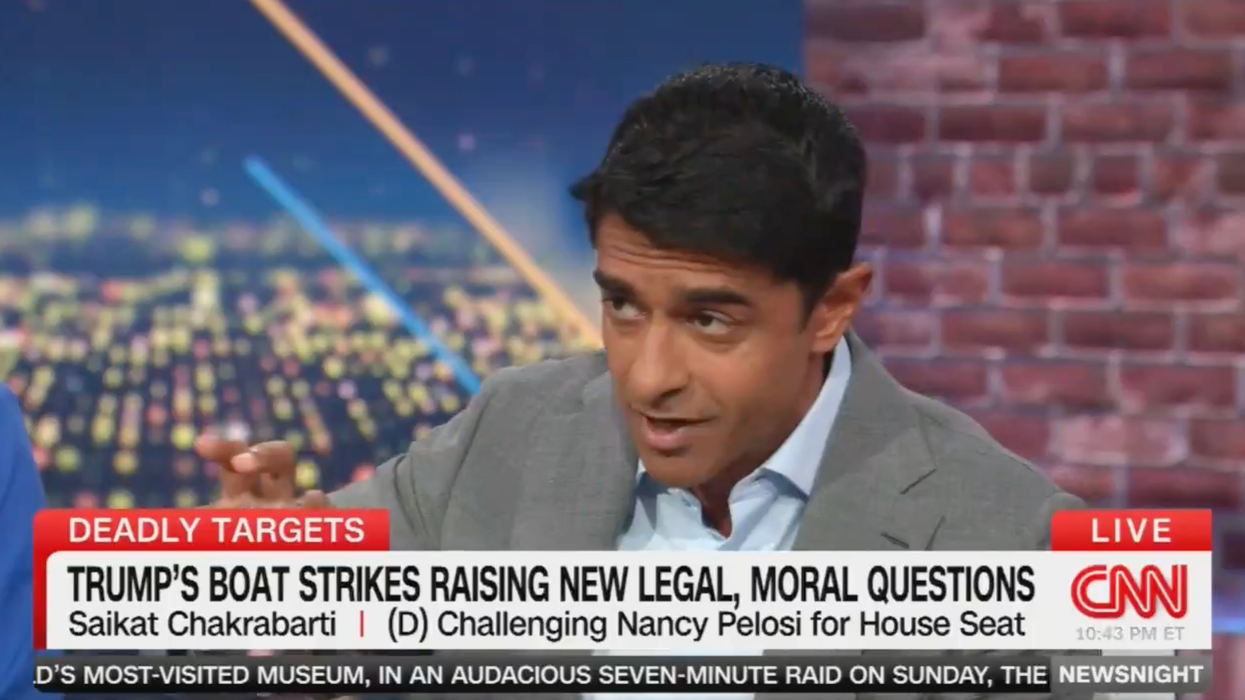

The discussion covered the weekend's No Kings rallies, racist texts attributed to a nominee of President Donald Trump, and US Immigration and Customs Enforcement's (ICE) raids in cities across the country before turning to the administration's recent strikes on boats in the Caribbean Sea, which it says have been aimed at stopping drug trafficking and which have killed dozens of people.

Chakrabarti said the administration's policy of bombing boats in the Caribbean—vessels that, Vice President JD Vance admitted, could very well be fishing boats—to kill people the White House has claimed without evidence are "narco-terrorists," raises alarm about the president's push to unilaterally define who qualifies as a "terrorist."

Trump's policy in the Caribbean, Chakrabarti suggested, represents just one way in which the president is attempting to designate groups as terrorists. In the wake of right-wing activist Charlie Kirk's killing—which he baselessly blamed on left-wing groups—he signed an executive order in September designating "antifa"—an anti-fascist ideology embraced by autonomous groups and individuals—as a "domestic terrorist organization," despite the fact that there is no such legal designation in the US.

Days later, Trump signed National Security Presidential Memorandum 7 (NSPM-7), which focuses on left-wing and anti-fascist organizations and mandates a “national strategy to investigate and disrupt networks, entities, and organizations that foment political violence so that law enforcement can intervene in criminal conspiracies before they result in violent political acts.”

The memo has recently garnered outrage from Democratic lawmakers, more than 30 of whom signed a letter condemning Trump's threats against progressive groups and organizers, but it has received little attention in the corporate media, and Chakrabarti's fellow guests on CNN Monday displayed little recognition of what he was talking about when he raised alarm about NSPM-7.

"Here's what concerns me—Trump is saying, 'I can define who's a terrorist, and that means I can kill him.' At the same time, we're seeing executive orders defining whole parts of Democratic Party as domestic terrorists," said Chakrabarti. "Here we're seeing NSPM-7, which says any anti-American or anti-capitalist or anti-Christian speech, is extremist speech."

While claiming to protect the US from drug traffickers, he added, the administration has created "a task force of 4,000 agents who are being taken off of drug trafficking and human trafficking, and the actual crime, and being put on prosecuting those people who are saying anti-capitalist things."

"Do you think that's okay?" he asked the other panelists. "Can you put two and two together about what's going on here?"

None of the other guests responded, and Seat looked blankly at Chakrabarti before Sidner said the show was going to a commercial break.

"We will answer that question, coming up," Sidner said, laughing. "We're going to leave it there for that conversation."

When the show returned, the conversation turned to Ukraine and Russia.

"Look how CNN shut down his question and moved on," said commentator Guy Christensen.

Ken Klippenstein, who has reported on NSPM-7 and tracked mentions of the memo in the corporate press—some of which have downplayed the threat—expressed alarm that "the moment NSPM-7 comes up, [the] CNN anchor laughs nervously and ends the segment."

On Tuesday, however, Klippenstein reported that the "NSPM-7 dam" in the corporate media was continuing to break, with CNN airing a second segment that mentioned the memo.

"This would be like if George W. Bush had said CodePink was al-Qaeda," explained former national security official Miles Taylor, "or people protesting the wars in Iraq and Afghanistan were associated with the Islamic State."