Sources told the outlet that "A US military operation in Iran would likely be a massive, weeks-long campaign that would look more like full-fledged war than last month's pinpoint operation in Venezuela."

"Such a war would have a dramatic influence on the entire region and major implications for the remaining three years of the Trump presidency," Ravid wrote.

However, with Congress on recess and the media largely distracted by a whirlwind of other issues, he noted, "there is little public debate about what could be the most consequential US military intervention in the Middle East in at least a decade."

As columnist Adam Johnson pointed out on social media, Trump's sabre-rattling toward Iran was underway well before Congress left town.

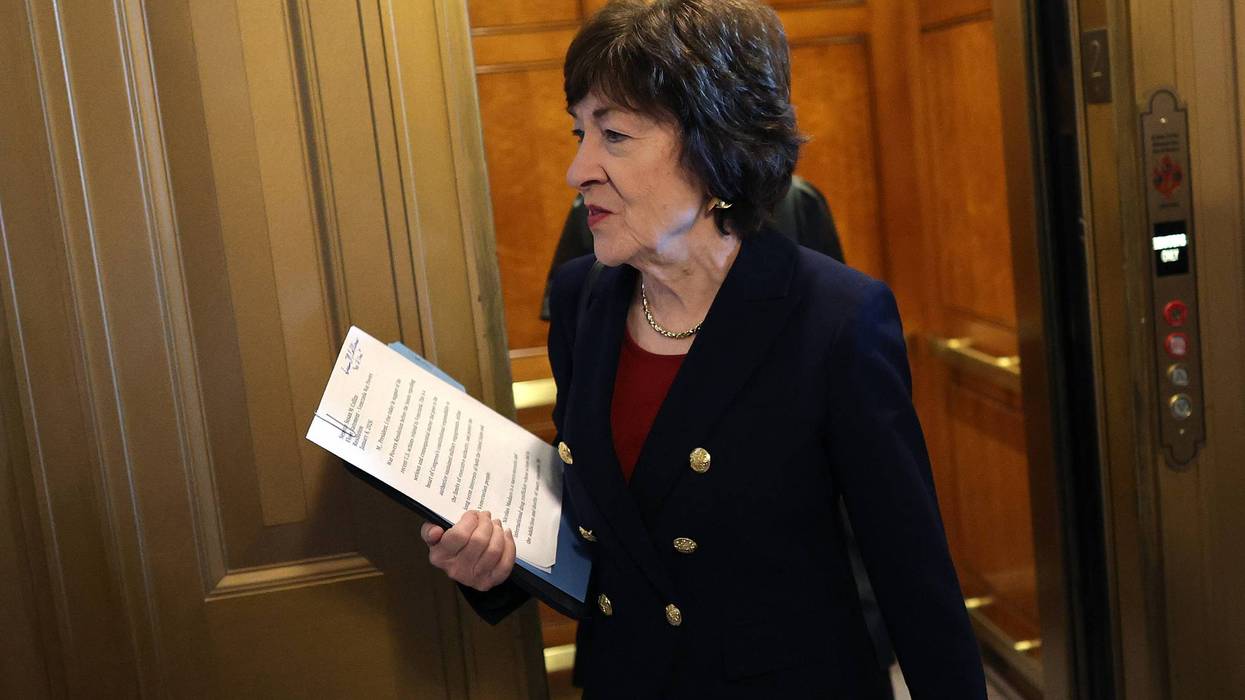

Despite this, Johnson said, the "two most powerful Democrats in the country," Senate Minority Leader Chuck Schumer (D-NY) and House Minority Leader Hakeem Jeffries (D-NY), "have once again not leveled a single word of substantive pushback," as was the case when Trump conducted strikes against Iran over the summer.

He said the top Democrats have only acknowledged Trump's threats "when asked by reporters" and have made only "process criticisms" rather than criticizing the merits of the war itself.

Last month, as Trump threatened to carry out massive strikes in retaliation for Iran's brutalization of protesters, Schumer limited his criticism to the fact that Trump had not consulted Congress.

“It has to be debated by Congress. Something like that, the War Powers Act, the Constitution, requires a discussion in Congress. We’ve had no reach-out from the administration at this point,” he told reporters.

More recently, Jeffries—a member of Congress who is briefed on national security matters—was asked on CBS's Face the Nation what he knew about the war plans or what he would want to know.

He did not answer that question, but vaguely lamented that Trump "has been slow to provide information... to the Gang of Eight members of Congress" and "hasn't provided a significant amount of information to Congress in general."

"When it comes to sanctions, perma-war, and bombings, we do not have an opposition party," Johnson said. "We have sleepy AIPAC-funded hall monitors paid to get wedgies and vaguely object after the craters are smoking in the ground."

New York Times columnist David French agreed: "It's astonishing that we're building up for a significant military clash, and Congress isn't involved, no real case is being made to the public, and the average American has no clue. If this gets serious, it will be a shock for lots of people."

There is little hunger in the American public for a war with Iran. A YouGov survey from early February found that 48% said they strongly or somewhat opposed military action in Iran, compared with just 28% who supported it and 24% who weren't sure.

Trita Parsi, the executive vice president of the Quincy Institute for Responsible Statecraft, said in an interview with Democracy Now! on Wednesday that, despite the public's broadly anti-interventionist attitudes, "their voices are more or less not being heard in the mainstream media."

"We’re seeing exactly what we saw during the Iraq War, in which a large number of pro-intervention Iraqi voices were paraded through mainstream media in order to give the impression that not only is this something that is supported by the overwhelming majority of the Iraqi society, but also that this is the morally right thing to do," Parsi said.

Drop Site News founder Ryan Grim said that when compared with the invasion of Iraq, which was built up over the course of more than a year through persistent propaganda to get the public on board, the Trump administration's effort to sell a war with Iran is laughable.

"We don’t even get the respect of being lied into war anymore," he said. "He’s just going to do it."