SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

As rainforests across the tropics face another year of devastating fires, a new report from Friends of the Earth shows that largest U.S. asset managers, BlackRock, State Street and Vanguard--known as the Big Three--have explicitly undermined efforts by consumer brands and agribusiness companies to halt deforestation.

The new report, Doubling Down on Deforestation, reveals that the Big Three collectively hold shares worth almost $700 billion in consumer brands with supply chain links to rainforest destruction, and tens of billions more in the agribusiness producers directly responsible for widespread deforestation. All three firms have voted against or abstained from voting on every single shareholder resolution requiring companies to act on deforestation since 2012, and lack clear policies to engage with companies on the issue, which is the second leading cause of climate change. The report urges asset owners, including city and state pension funds, to advocate for the Big Three to eliminate deforestation from their portfolios.

"Millions of Americans rely on BlackRock, State Street and Vanguard to provide a secure future, but by continuing to neglect the global deforestation crisis while bankrolling the industries responsible, these investors are actively undermining that very future," said Jeff Conant, senior international forest program director with Friends of the Earth. "The destruction of forests is also tied to the epidemic of killings of environmental defenders, many of them Indigenous, and the world's largest investors have stayed silent. This is not just inaction--it is willful neglect."

New York City Comptroller Scott M. Stringer, who oversees the New York City's $194.5 billion pension system, said, "If we don't act now to preserve and protect our world's forest, we will exacerbate an ongoing environmental and human rights crisis. Global deforestation rates have accelerated by 43 percent since 2014 and we need every company, from consumer retailers to financial firms, to realize we can't stand by as forests are razed and burned."

The Brazilian Amazon is facing the worst burning season in a decade, with over 500 major fires so far in 2020, many of them in Indigenous Peoples' territories. In Indonesia, where deadly fires in 2019 released over 700 tons of greenhouse gases, many provinces have already declared an emergency as toxic haze from intentionally lit fires intensifies the already grave COVID-19 pandemic.

"Shareholders have tremendous power to transform our economy for the good of people and the planet," said Josh Zinner, CEO of the Interfaith Center for Corporate Responsibility, a leading consortium of faith and values-based shareholder advocates. "Unfortunately, as this report reveals, the world's largest asset managers have consistently used their power to undermine climate justice and human rights."

"For years the Big Three ignored deforestation, sending a clear signal to industry that the destruction can continue," said Mary Cerulli, co-founder of Climate Finance Action, a Boston-based group advocating for the finance sector to transition justly away from business models that drive the climate crisis.

Doubling Down on Deforestation available for download here, provides a suite of recommendations for government, industry, and finance to take meaningful action to halt deforestation.

The launch of the report was accompanied today by colorful, physically distant actions where Friends of the Earth delivered more than 125,000 petitions to the investors' headquarters in Boston, New York, Philadelphia and San Francisco*.

Background:

In 2010, the Consumer Goods Forum, a consortium of the world's largest retail companies, committed to achieving zero-net deforestation in commodity supply chains by 2020--but failed to meet that commitment. From 2014-2019, global tree cover loss increased by 43%, with an area of forest the size of the United Kingdom lost every year, leading to annual CO2 emissions equal to the annual emissions of the European Union. The destruction of critical wildlife habitat is also a root cause of zoonotic illnesses like COVID-19, with three-quarters of emerging infectious diseases "spilling over" into human hosts due to habitat destruction often linked to agribusiness. In this sense, the new report notes, tropical forests are not only analogous to "the lungs of the Earth," they are also the Earth's immune system - and the world's largest money managers have left them dangerously vulnerable.

Asset managers can address deforestation in companies they invest in through direct engagement with companies, proxy voting, or excluding destructive companies entirely from their portfolios. Numerous investor alliances have arisen in the last decade to take steps in a collective effort to protect the value of their investments. Yet, "the Big Three" asset managers--BlackRock, Vanguard, and State Street--have been largely absent from these efforts and ineffectual in their attempts to address deforestation, the report finds.

*Picures will be added later in the afternoon after the events have concluded.

Key Findings by the Numbers:

Friends of the Earth fights for a more healthy and just world. Together we speak truth to power and expose those who endanger the health of people and the planet for corporate profit. We organize to build long-term political power and campaign to change the rules of our economic and political systems that create injustice and destroy nature.

(202) 783-7400"The Court’s decision today... against ICE’s unlawful effort to obstruct congressional oversight is a victory for the American people," said Rep. Joe Neguse.

Doubling down on a ruling from late last year, a federal judge on Monday once again rejected an effort by the Trump administration to block congressional lawmakers from accessing federal immigration detention facilities.

In the ruling, US District Judge Jia Cobb granted a temporary restraining order sought by Democratic members of the House of Representatives to overturn the US Department of Homeland Security's (DHS) policy of requiring lawmakers to give a week's notice before being granted access to US Immigration and Customs Enforcement (ICE) detention facilities.

Cobb had already overturned this DHS policy in a December ruling, arguing that it "was likely contrary to the terms of a limitations rider attached to" the department's annual appropriated funds.

However, Homeland Security Secretary Kristi Noem in January reimplemented the one-week notice policy and argued that it was now being implemented with separate funds provided to DHS through the 2025 One Big Beautiful Bill Act, which did not contain the language used in the earlier limitations rider.

Cobb rejected this argument and found that "at least some of these resources that either have been or will be used to promulgate and enforce the notice policy have already been funded and paid for with... restricted annual appropriations funds," including "contracts or agreements that predate" the passage of the One Big Beautiful Bill Act.

According to legal journalist Chris Geidner, the effect of Cobb's ruling will be that congressional oversight visits to ICE facilities will now be "allowed on request."

Rep. Joe Neguse (D-Colo.), the lead plaintiff in the case, hailed Cobb's ruling and vowed to keep putting pressure on the Trump administration to comply with the law.

"The Court’s decision today to grant a temporary restraining order against ICE’s unlawful effort to obstruct congressional oversight is a victory for the American people," said Neguse. "We will keep fighting to ensure the rule of law prevails."

One doctor warned that the outbreak "will become an epidemic if we don't act immediately."

Public health experts and immigrant advocates sounded the alarm Sunday over a measles outbreak at a US Immigration and Customs Enforcement internment center in Texas where roughly 1,200 people, including over 400 children, are being held.

Texas officials confirmed Saturday that two detainees at the Dilley Immigration Processing Center, located about 75 miles (120 km) southwest of San Antonio, are infected with measles.

"Medical staff is continuing to monitor the detainees' conditions and will take appropriate and active steps to prevent further infection," the US Department of Homeland Security (DHS) said in a statement. "All detainees are being provided with proper medical care."

DHS spokesperson Tricia McLaughlin said Sunday that ICE "immediately took steps to quarantine and control further spread and infection, ceasing all movement within the facility and quarantining all individuals suspected of making contact with the infected."

Responding to the development, Dr. Lee Rogers of UT Health San Antonio wrote in a letter to Texas state health officials that the Dilley outbreak "will become an epidemic if we don't act immediately" by establishing "a single public health incident command center."

"Viruses are not political," Rogers stressed. "They do not care about one's immigration status. Measles will spread if we allow uncertainty and delay to substitute for reasoned public health action."

Dr. Benjamin Mateus took aim at the Trump administration's wider policy of "criminalizing immigrant families and confining children in camps," which he called a form of "colonial policy" from which disease is the "predictable outcome."

Measles is a highly contagious viral disease that can kill or cause serious complications, particularly among unvaccinated people. The United States declared measles eliminated in 2000, but declining vaccination fueled by misinformation has driven a resurgence in the disease, and public health experts warn that the US is close to following Canada, which lost its elimination status late last year.

Many experts blame this deadly and preventable setback on the vaccine-averse policies and practices of the Trump administration, particularly at the Department of Health and Human Services, led by vaccine conspiracy theorist Robert F. Kennedy Jr.

US measles cases this year already exceed the total for the whole of 2023 and 2024 combined, and it is only January. Yikes.

[image or embed]

— Dr. Lucky Tran (@luckytran.com) January 29, 2026 at 12:29 PM

Critics also slammed ICE's recent halt on payments to third-party providers of detainee healthcare services.

Immigrant advocates had previously warned of a potential measles outbreak at the Dilley lockup. Neha Desai, an attorney at the Oakland, California-based National Center of Youth Law, told CBS News that authorities could use the outbreak as a pretext for preventing lawyers and lawmakers from inspecting the facility.

"We are deeply concerned for the physical and the mental health of every family detained at Dilley," Desai said. "It is important to remember that no family needs to be detained—this is a choice that the administration is making."

Run by ICE and private prison profiteer CoreCivic, the Dilley Immigration Processing Center has been plagued by reports of poor health and hygiene conditions. The facility is accused of providing inadequate medical care for children.

Detainees—who include people legally seeking asylum in the US—report prison-like conditions and say they've been served moldy food infested with worms and forced to drink putrid water. Some have described the facility as "truly a living hell."

The internment center has made headlines not only for its harsh conditions, but also for its high-profile detainees, including Liam Conejo Ramos, a 5-year-old abducted by ICE agents in Minneapolis last month and held along with his father at the facility before a judge ordered their release last week. The child's health deteriorated while he was at Dilley.

On Sunday, the League of United Latin American Citizens (LULAC)—the nation's oldest Latino civil rights organization—held a protest outside the Dilley lockup, demanding its closure.

"Migrant detention centers in America are a moral failure,” LULAC national president Roman Palomares said in a statement. "When a nation that calls itself a beacon of freedom detains children behind razor wire, separates families from their communities, and holds them in isolated conditions, we have crossed a dangerous line."

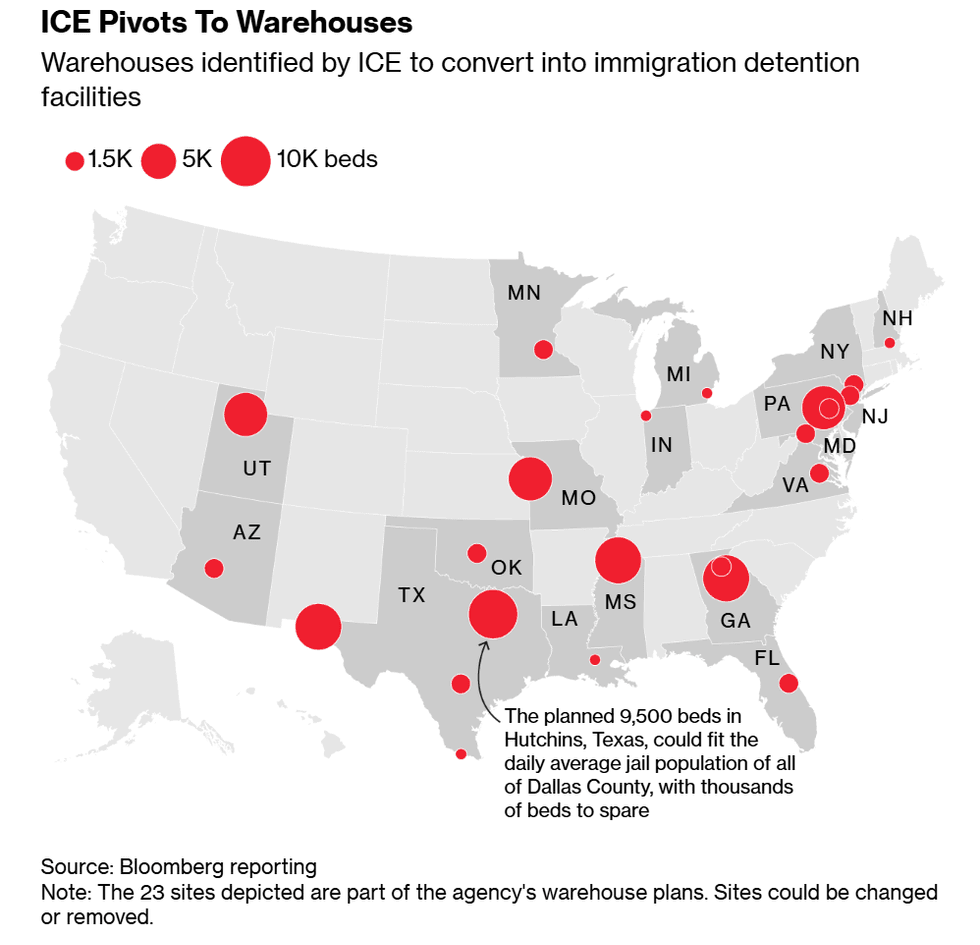

The Department of Homeland Security is using a repurposed $55 billion Navy contract to convert warehouses into makeshift jails and plan sprawling tent cities in remote areas.

In the wake of immigration agents' killings of three US citizens within a matter of weeks, the Department of Homeland Security is quietly moving forward with a plan to expand its capacity for mass detention by using a military contract to create what Pablo Manríquez, the author of the immigration news site Migrant Insider calls "a nationwide 'ghost network' of concentration camps."

On Sunday, Manríquez reported that "a massive Navy contract vehicle, once valued at $10 billion, has ballooned to a staggering $55 billion ceiling to expedite President Donald Trump’s 'mass deportation' agenda."

It is the expansion of a contract first reported on in October by CNN, which found that DHS was "funneling $10 billion through the Navy to help facilitate the construction of a sprawling network of migrant detention centers across the US in an arrangement aimed at getting the centers built faster, according to sources and federal contracting documents."

The report describes the money as being allocated for "new detention centers," which "are likely to be primarily soft-sided tents and may or may not be built on existing Navy installations, according to the sources familiar with the initiative. DHS has often leaned on soft-sided facilities to manage influxes of migrants."

According to a source familiar with the project, "the goal is for the facilities to house as many as 10,000 people each, and are expected to be built in Louisiana, Georgia, Pennsylvania, Indiana, Utah, and Kansas."

Now Manríquez reports that the project has just gotten much bigger after a Navy grant was repurposed weeks ago. It was authorized through the Worldwide Expeditionary Multiple Award Contract (WEXMAC), a flexible purchasing system that the government uses to quickly move military equipment to dangerous and remote parts of the world.

The contract states that the money is being repurposed for "TITUS," an abbreviation for "Territorial Integrity of the United States." While it's not unusual for Navy contracts to be used for expenditures aimed at protecting the nation, Manríquez warned that such a staggering movement of funds for domestic detention points to something ominous.

“This $45 billion increase, published just weeks ago, converts the US into a ‘geographic region’ for expeditionary military-style detention,” he wrote. "It signals a massive, long-term escalation in the government’s capacity to pay for detention and deportation logistics. In the world of federal contracting, it is the difference between a temporary surge and a permanent infrastructure."

He says the use of the military funding mechanism is meant to disburse funds quickly, without the typical bidding war among contractors, which would typically create a period of public scrutiny. Using the Navy contract means that new projects can be created with “task orders,” which can be turned around almost immediately, when “specific dates and locations are identified” by DHS.

"It means the infrastructure is currently a 'ghost' network that can be materialized anywhere in the US the moment a site is picked," Manríquez wrote.

Amid its push to deport 1 million people each year, the White House has said it needs to dramatically increase the scale of its detention apparatus to add more beds for those who are arrested. But Manríquez said documents suggest "this isn't just about bed space; it’s about the rapid deployment of self-contained cities."

In addition to tent cities capable of housing thousands, contract line items include facilities meant for sustained living—including closed tents likely for medical treatment and industrial-sized grills for food preparation.

They also include expenditures on "Force Protection" equipment, like earth-filled defensive barriers, 8-foot-high CONEX box walls, and “Weather Resistant” guard shacks.

Eric Feigl-Ding, an epidemiologist and health economist, said the contract's provision of materials meant to deal with medical needs and death was "extra chilling." According to the report, "services extend to 'Medical Waste Management,' with specific protocols for biohazard incinerators."

The new reporting from Migrant Insider comes on the heels of a report last week from Bloomberg that US Immigration and Customs Enforcement (ICE) has used some of the $45 billion to purchase warehouses in nearly two dozen remote communities, each meant to house thousands of detainees, which it said "could be the largest expansion of such detention capacity in US history."

The plans have been met with backlash from locals, even in the largely Republican-leaning areas where they are being constructed:

This month, demonstrators protested warehouse conversions in New Hampshire, Utah, Texas and Georgia after the Washington Post published an earlier version of the conversion plan.

In mid-January, a planned tour for contractors of a potential warehouse site in San Antonio was canceled after protesters showed up the same day, according to a person familiar with the scheduled visit.

In Salt Lake City, the Ritchie Group, a local family business that owns the warehouse ICE identified as a future “mega center” jail, said it had “no plans to sell or lease the property in question to the federal government” after protesters showed up at their offices to pressure them.

On January 20, Sen. Chris Van Hollen (D-Md.) joined hundreds of protesters outside a warehouse in Hagerstown, Maryland, that was set to be converted into a facility that will hold 1,500 people.

The senator called the construction of it and other detention facilities "one of the most obscene, one of the most inhumane, one of the most illegal operations being carried out by this Trump administration."

Reports of a new influx of funding from the Navy come as Democrats in Congress face pressure to block tens of billions in new funding for DHS and ICE during budget negotiations.

"If Congress does nothing, DHS will continue to thrive," Manríquez said. "With three more years pre-funded, plus a US Navy as a benefactor, Secretary Kristi Noem—or any potential successor—has the legal and financial runway to keep the business of creating ICE concentration camps overnight in American communities running long after any news cycle fades."