August, 25 2015, 04:00pm EDT

For Immediate Release

Contact:

Michelle Mascarenhas-Swan, (415) 359-7324,,media@ourpowercampaign.org,Angela Angel (510) 759-3177

10 Years After Katrina: Gulf South Communities Demand an Equitable Recovery

Frontline leaders unite for Gulf South Rising Week of Action

WASHINGTON

Ten years ago this week, Hurricane Katrina devastated the Gulf South and shook the nation. Although some will celebrate the resiliency and recovery of the Gulf region, many continue to feel the painful consequences of Katrina a decade later. Frontline communities in the Gulf are uniting under the banner of Gulf South Rising with a week of action to confront the devastation of this disaster and the inequitable recovery that followed.

The Gulf South Rising Katrina 10 Week of Action is a powerful coming together of community leaders and organizations dedicated to lifting up the leadership and resistance of the people on the frontlines. There are more than 13 events August 21-30 in multiple locations from Coden, AL to Biloxi, MS to New Orleans, LA. The Week of Action features performance arts, policy forums, film screenings, teach-ins, youth gatherings, healing spaces, and the coming together of people throughout the South and the nation.

While Katrina was undoubtedly a climate disaster of epic proportions, the roots of the true crisis run much deeper. During the Katrina 10 Week of Action people are resisting policies and practices that extract power from their communities. Colette Pichon Battle, a native to southern Louisiana and Executive Director of the Gulf Coast Center for Law and Policy, said "Ten years is not enough time to fully recover from a storm like Katrina and the massive government and corporate failures that occurred in her aftermath. But it is a turning point for communities on the frontline of climate-based disaster to reaffirm our legacy of resistance and honor our culture healing practices as a necessary part of building a strong movement for justice."

That sentiment echoes throughout the Gulf South. Katherine Egland, a lifelong resident of Gulfport, Mississippi and the Chair of the NAACP Environmental and Climate Justice Committee, said "Ten years after the storm, we are still awaiting the sunshine. Our state and local governments continue to claim that we have 'recovered'. However, some of the survivors of Katrina still reside in the shadow of the advances by businesses and industries. There is a false sense that all is well. We have planned a commemoration to give the people -the forgotten survivors - a chance to be heard."

Monique Harden, Co-Director of Advocates for Environmental Human Rights and a member of the Greater New Orleans Organizers Round Table said, "Human rights abuses taking place in New Orleans are being masked as 'resilience' and 'recovery' by elected officials, developers, and the tourism industry in the ten years after Katrina. We are supporting the resistance of African American, Vietnamese American, and Latino community organizers to the wide range of oppressive conditions that result from disaster-profiteering."

In the aftermath of disaster, how resources were allocated remains a particularly contentious issue. "Over $880 million came through Plaquemines Parish. We should be walking on golden streets," said Plaquemines Parish Councilwoman Audrey T. Salvant of Ironton, LA. "The question is: where did money go? Ironton was wiped out by Katrina, Rita, and Isaac. The community is still vulnerable to floodwater and hurricanes because the elevation funding never materialized for local residents."

Norris Henderson, Executive Director of Voice of the Ex-Offender and member of the Greater New Orleans Organizers Roundtable said, "Communities that were really impacted were prevented from getting what they need to make themselves whole again. We need to question: where did this money go? We didn't have what we needed to come home. It was systemic that people were forced out and not allowed to come back. That was all by design."

A decade after Katrina, the issue of displacement is significant throughout the Gulf South. Changes heralded by the city as progress often come with a high human and cultural cost. "Gentrification of traditionally Black neighborhoods by new New Orleanians is displacing native New Orleanians who were fortunate enough not to be displaced by Katrina," said Tabitha Mustafa, a native New Orleanian and social justice organizer. "In essence, we are organizing this week of events to tell the world the truth about New Orleans ten years after the storm."

In the face of this false narrative of recovery, Gulf South Rising elevates and unites a diversity of people behind local leadership. "We recognize that we are stronger than our individual parts. Together we can resist injustices that keep our communities divided and conquered. We can build a sustainable future in harmony with the ecological and social environments and with equity and justice for all," said Imani Jacqueline Brown, an organizer and native of New Orleans.

What: Gulf South Rising Katrina 10 Week of Action, a series of community events commemorating Hurricane Katrina and lifting up the leadership and resistance of people who continue to fight on the frontlines of climate, economic, and racial justice. All events are free and open to the public.

Who: Local and regional people and organizations

When: August 21, 2015 - August 30, 2015

Where: Multiple locations from Coden, Alabama to Biloxi, Mississippi to New Orleans, Louisiana

People's Media Hub: Golden Feather, 704 N Rampart St, New Orleans, LA 70116

Climate Justice Alliance (CJA) is a collaborative of over 35 community-based and movement support organizations uniting frontline communities to forge a scalable, and socio-economically just transition away from unsustainable energy towards local living economies to address the root causes of climate change.

LATEST NEWS

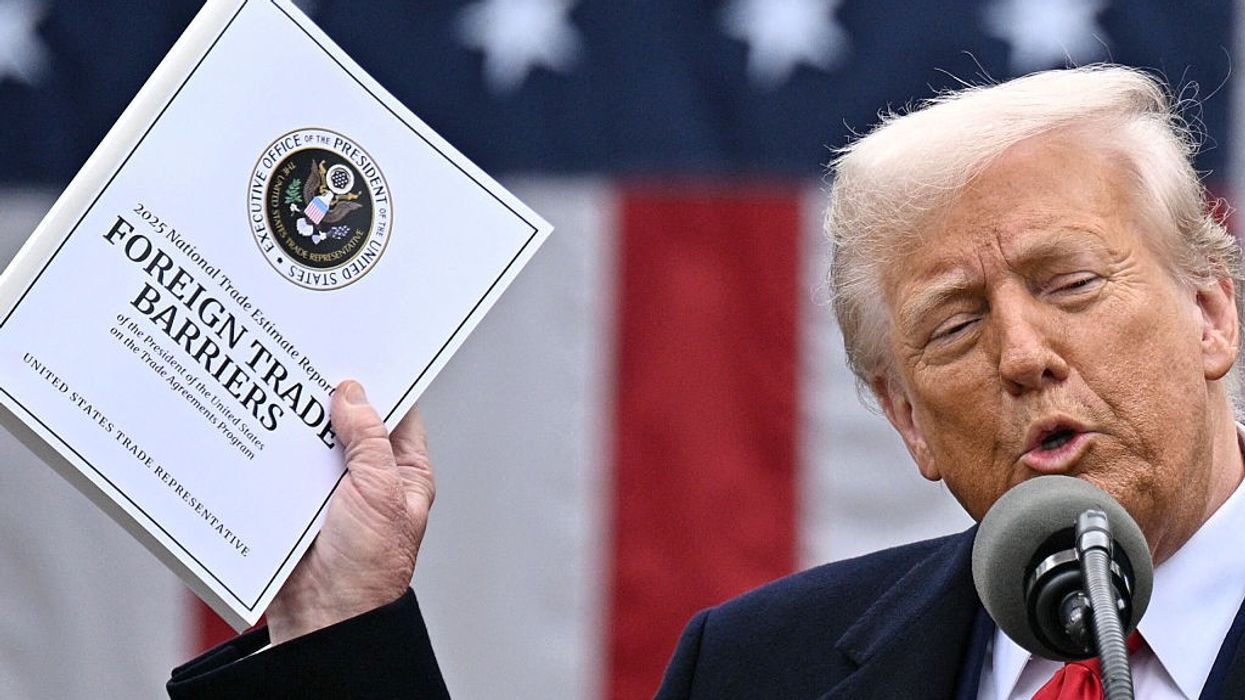

Trump Tariffs Bound for Supreme Court After Another Legal Loss

If the president's policies are struck down, the administration may have to repay billions of dollars in duties, which customs and trade experts warn "would be a logistical nightmare."

Aug 29, 2025

As working-class Americans endure the pain from US President Donald Trump's tariff war, the Republican signaled that he plans to keep fighting for the levies after a loss at the US Court of Appeals for the Federal Circuit.

Trump is the first president to impose tariffs by citing the International Emergency Economic Powers Act (IEEPA) of 1977. In a 7-4 ruling, the appellate court's majority found that most of his tariffs are illegal.

The court said that "tariffs are a core congressional power" and "we discern no clear congressional authorization by IEEPA for tariffs of the magnitude of the reciprocal tariffs and trafficking tariffs."

The decision affirms a May ruling from the US Court of International Trade, which also found that Trump exceeded his authority.

Friday's ruling is paused until October 14, to give the White House time to appeal to the nation's highest court. Trump suggested he would do so in a post on his Truth Social platform, writing:

ALL TARIFFS ARE STILL IN EFFECT! Today a Highly Partisan Appeals Court incorrectly said that our Tariffs should be removed, but they know the United States of America will win in the end. If these Tariffs ever went away, it would be a total disaster for the Country. It would make us financially weak, and we have to be strong. The U.S.A. will no longer tolerate enormous Trade Deficits and unfair Tariffs and Non Tariff Trade Barriers imposed by other Countries, friend or foe, that undermine our Manufacturers, Farmers, and everyone else. If allowed to stand, this Decision would literally destroy the United States of America. At the start of this Labor Day weekend, we should all remember that TARIFFS are the best tool to help our Workers, and support Companies that produce great MADE IN AMERICA products. For many years, Tariffs were allowed to be used against us by our uncaring and unwise Politicians. Now, with the help of the United States Supreme Court, we will use them to the benefit of our Nation, and Make America Rich, Strong, and Powerful Again! Thank you for your attention to this matter.

Politico noted that the Friday decision opens the door "for the administration to potentially have to repay billions worth of duties," and pointed to recent warnings from customs and trade experts "that repayments would be a logistical nightmare, and would likely trigger a wave of legal challenges from other businesses and industry groups seeking reimbursement."

Trump's latest legal loss on the tariff front follows various analyses and polling that show the harm his policies are causing. One Accountable.US report from this month highlights comments from grocery executives about passing costs on to consumers, and a recent survey found that 90% of Americans consider the price of groceries a source of stress.

Democrats on the Joint Economic Committee also released a related report earlier this month. As JEC Ranking Member Maggie Hassan (D-N.H.) said at the time, "While President Trump promised that he would expand our manufacturing sector, this report shows that, instead, the chaos and uncertainty created by his tariffs has placed a burden on American manufacturers that could weigh our country down for years to come."

Another mid-August analysis from the Century Foundation and Groundwork Collaborative details the surging cost of school supplies as American families prepared for the 2025-26 academic year. TCF senior fellow Rachel West said that "from his reckless tariffs to his budget law slashing food assistance and federal student loans, Trump's back-to-school message to America's families is crystal clear: Don't expect help, just expect less."

Keep ReadingShow Less

US 'Denying and Revoking' Visas of Palestinian Officials Ahead of UN General Assembly

The Palestinian presidency said the decision—which comes as more and more nations formally recognize Palestine's statehood—"stands in clear contradiction to international law and the UN Headquarters Agreement."

Aug 29, 2025

The Trump administration said Friday that Secretary of State Marco Rubio "is denying and revoking visas from members of the Palestine Liberation Organization and the Palestinian Authority" ahead of next month's United Nations General Assembly in New York.

The US State Department said Friday that "the Trump administration has been clear: It is in our national security interests to hold the PLO and PA accountable for not complying with their commitments, and for undermining the prospects for peace."

"Before the PLO and PA can be considered partners for peace, they must consistently repudiate terrorism—including the October 7 massacre—and end incitement to terrorism in education, as required by US law and as promised by the PLO," the statement continues.

No US administration in modern times has ever demanded that Israel repudiate its generations-long illegal occupation and settler colonization of Palestine, its ongoing genocide in Gaza, or any other violation of international law or human rights.

"The PA must also end its attempts to bypass negotiations through international lawfare campaigns, including appeals to the [International Criminal Court] and [International Court of Justice], and efforts to secure the unilateral recognition of a conjectural Palestinian state," the State Department added. "Both steps materially contributed to Hamas' refusal to release its hostages, and to the breakdown of the Gaza ceasefire talks."

The ICC last year issued arrest warrants for Israeli Prime Minister Benjamin Netanyahu and former Defense Minister Yoav Gallant for alleged war crimes and crimes against humanity in Gaza, including murder and the forced starvation of Palestinians that is driving a famine that has killed at least hundreds of Palestinians and is starving hundreds of thousands more. The ICJ is currently weighing a genocide case against Israel filed by South Africa—not the PA.

As for ceasefire talks, Matthew Miller, who served as a State Department spokesperson during the Biden administration, recently admitted that Israel habitually torpedoed ceasefire agreements each time they were nearing a conclusion in what he called a sustained effort to "try and sabotage" a deal. Miller repeatedly stood at his podium and told reporters that Hamas was to blame for thwarting a truce.

Miller added that Netanyahu openly admitted to US officials that he wanted to continue the Gaza war for "decades."

It is not clear which Palestinian officials will have their visas denied or revoked. The office of Palestinian Authority President Mahmoud Abbas said in a statement responding to the US announcement that "this decision stands in clear contradiction to international law and the UN Headquarters Agreement—which effectively shields UN member-state officials from US immigration policies—particularly since the state of Palestine is an observer member of the United Nations."

This isn't the first time the US has blocked Palestinian officials from attending a General Assembly. In 1998, the Regan administration denied then-PLO Chair Yasser Arafat a visa and the General Assembly was convened in Geneva instead of New York. There have already been numerous calls to relocate this year's General Assembly to the Swiss city following the US move.

The US announcement comes as more and more countries formally recognize Palestinian statehood or move to do so amid Israel's genocidal assault, siege, and famine in Gaza, which, combined, have left more than 230,000 Palestinians dead, maimed, or missing and the strip in ruins.

Approximately 150 of the UN's 193 member states have officially recognized Palestine. Since October 2023, countries including Australia, Belgium, Canada, France, Malta, Portugal, Slovenia, the United Kingdom, Ireland, Norway, and Spain have either recognized Palestine or announced their intent to do so.

Keep ReadingShow Less

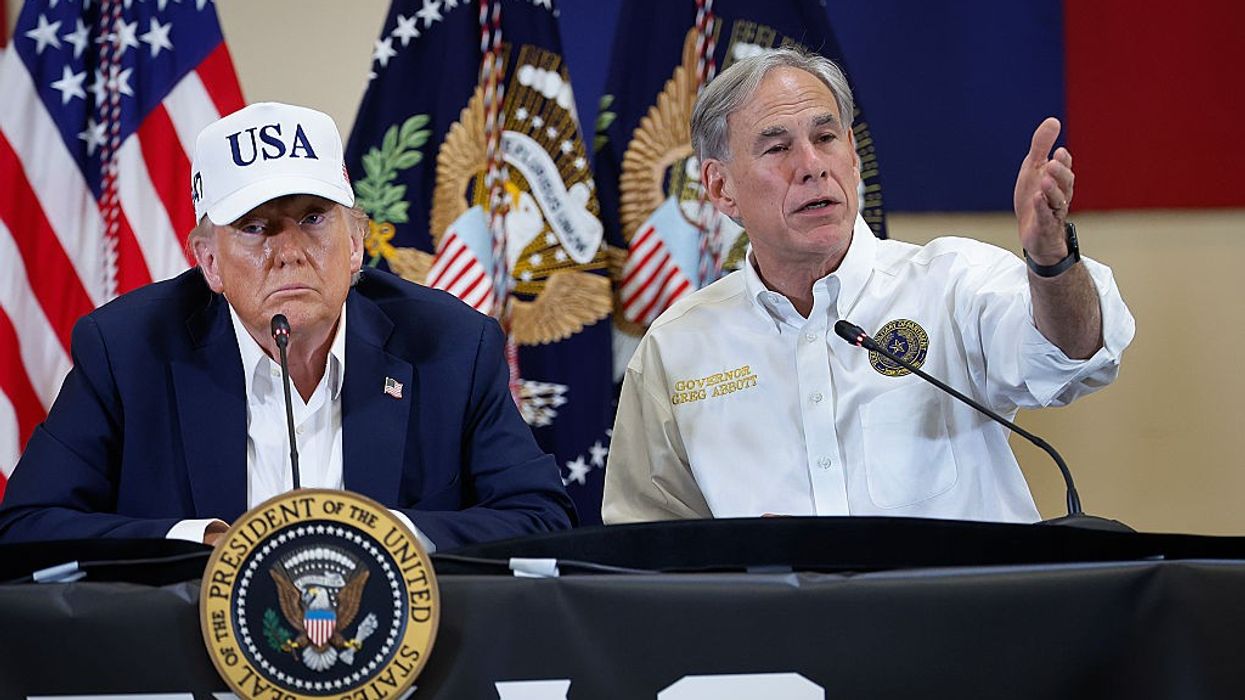

As Abbott Signs Texas Map Rigged for Trump, Missouri GOP Aims to Follow Suit

One critic said Texas Republicans' "reckless, partisan power grab will harm our democracy for years to come."

Aug 29, 2025

Democracy defenders on Friday blasted elected Texas Republicans, including Gov. Greg Abbott, after he signed a new congressional map gerrymandered for the GOP at the request of US President Donald Trump—and Missouri Gov. Mike Kehoe, for launching a copycat effort.

"Gov. Abbott would rather do Trump's dirty work than help the people of Texas," said Brett Edkins, managing director of policy and political affairs at the progressive advocacy group Stand Up America, in a statement.

"For months, he has ignored the real issues affecting Texans, including flood relief, and instead pandered to Trump's demand that he redraw Texas' political maps to rig the 2026 elections and silence communities of color," he continued. "Texas Republicans have started a nationwide redistricting arms race with no end in sight. Their reckless, partisan power grab will harm our democracy for years to come."

Abbott and state lawmakers have been open about aiming to help the GOP retain control of Congress during next year's midterm elections by passing their so-called "One Big Beautiful Map." The governor—who called two special legislative sessions to force through the bill—posted a video of himself signing it on social media and declared that "Texas will be more RED in Congress."

During the first legislative session, dozens of Democrats in the Texas House fled to blue states in a bid to block the map, but they ultimately returned to Austin. After GOP legislators passed the bill, the NAACP and the Lawyers Committee for Civil Rights Under Law filed a lawsuit over the map.

After the governor signed the bill on Friday, Texas Democratic Party Chair Kendall Scudder said in a statement that "with a stroke of the pen, Greg Abbott and the Republicans have effectively surrendered Texas to Washington, DC."

"They love to boast about how 'Texas Tough' they are, but when Donald Trump made one call, they bent over backwards to prioritize his politics over Texans. Honestly, it's pathetic," he said. "I am proud of the Texas Democrats in the House and Senate who chose to fight, whether by a constitutionally protected quorum break, questioning these mapmakers, trying to pass amendments, or even attempting to filibuster."

"This isn't over—we'll see these clowns in court," he pledged. "We aren't done fighting against these racially discriminatory maps, and fully expect the letter of the law to prevail over these sycophantic Republican politicians who think the rules don't apply to them."

The contested map makes five Texas districts for the US House of Representatives that are currently held by Democrats more favorable to Republicans.

While elected Democrats in states such as California have threatened to fight fire with fire and draw Republican congressional districts out of existence, GOP governors—under pressure from the president—have also moved to follow Texas' lead. For example, Missouri Gov. Mike Kehoe on Friday announced a special legislative session to pass his proposed "Missouri First Map."

Responding in a statement, Democratic National Committee (DNC) Chair Ken Martin said that "another Republican governor just caved to the demands of Donald Trump at the expense of Missouri families and American democracy. Time and time again, Missouri Gov. Mike Kehoe has undermined the voice of Missouri voters."

"Now he is attempting to dilute their power altogether by removing the ability of Missourians to stand up against this power grab," Martin continued. "Make no mistake: This all started because Trump and Republicans passed a historically unpopular budget bill that wrecks the working class to reward billionaires. Now, instead of facing the consequences of their votes, Republicans think they can just choose their voters—that's not how this works."

"As California has shown, Democrats are rising up to protect voters' sacred rights, and we're not pulling our punches," he added. "The DNC will stand with Democrats protecting the rights of all Americans as Donald Trump and spineless Republicans try to rig the game against the will of the people."

John Bisognano, president of the National Democratic Redistricting Committee, said that "over the past month, Missourians of all stripes, from proud union members to business leaders, have expressed their opposition to a mid-decade gerrymander, yet Missouri Republicans are choosing to take orders from Washington instead of their constituents."

"Republicans enacted the current congressional map in response to public pressure from Missouri voters," he said. "Their sudden reversal shows that their pursuit of a mid-decade gerrymander is nothing more than a power grab at the expense of the people. Heading into this special session, Missouri Republicans have a choice: They can listen to Missourians, who oppose a mid-decade gerrymander, or they can fold to Donald Trump's demands and face the same level of fierce resistance displayed in Texas."

Keep ReadingShow Less

Most Popular