SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Mazher Ali, 617-423-2148 x101, mali@faireconomy.org

Tim Sullivan, 617-423-2148 x127, tsullivan@faireconomy.org

Responding to reports that

Democratic leaders will hold an up-or-down vote on extending middle

class tax cuts but will also allow a vote on the McConnell tax plan,

which includes complete repeal of the estate tax, United for a Fair

Economy (UFE) today issued the following statement:

"It's heartening to hear the

Democrats finally sticking up for the people they represent. The

wealthiest 2% in this country need this tax cut extended about as much

as Washington needs more lobbyists. We deserve an up-or-down vote on

middle class cuts," said Mike Lapham, director of UFE's Responsible

Wealth project. "Tax cuts for the wealthy simply do not create jobs, so

we need to stop acting like they do. We have a $700 billion opportunity

to roll back the Bush cuts on the wealthiest 2% and use those funds to

create jobs. Let's keep the tax cuts for the other 98% who will spend

them in the economy. I have to wonder about the agenda of anyone who

would bypass this opportunity to get our country back on track."

Lee Farris, UFE's Estate Tax Policy

Coordinator, added, "Senator McConnell's plan to fully repeal the estate

tax - at a cost of $698 billion over ten years - is reckless and out of

tune with current fiscal reality. The estate tax has been the elephant

in the room during these debates and repeal would be nothing but a

giveaway to the wealthiest of the wealthy. Now is the time to pass

permanent estate tax legislation at 2009 levels or stronger. How can

anyone even suggest repealing the estate tax at a time like this?"

United for a Fair Economy has been

working to preserve the estate tax and roll back the top tier Bush tax

cuts since 2001. UFE supports the Sanders-Harkin-Whitehouse Responsible

Estate Tax Act, which includes a $3.5 million exemption per spouse and a

45% rate on estates up to $10 million, with a graduated rate for

estates above that size. The difference in revenue between the strongest

estate tax proposal (Sanders) and the weakest (Kyl) is almost $200

billion, so the fate of the estate tax deserves serious attention.

Lee Farris and Mike Lapham are

available to speak to the press on the Bush tax cuts, including income

tax rates, capital gains, dividends and the estate tax. UFE can also

arrange interviews with business owners, farmers, investors and other

wealthy individuals.

United for a Fair Economy challenges the concentration of wealth and power that corrupts democracy, deepens the racial divide and tears communities apart. We use popular economics education, trainings, and creative communications to support social movements working for a resilient, sustainable and equitable economy. United for a Fair Economy believes another world is possible. We envision a global society which respects the humanity, rights, and creativity of all people.

"His campaign paired moral conviction with concrete plans to lower costs and expand access to services, making it unmistakable what he stood for and whom he was fighting for."

Amid calls for ousting Democratic congressional leadership because the party caved in the government shutdown fight over healthcare, a YouGov poll released Monday shows the nationwide popularity of New York City Mayor-elect Zohran Mamdani's economic agenda.

Mamdani beat former New York Gov. Andrew Cuomo in both the June Democratic primary and last week's general election by campaigning unapologetically as a democratic socialist dedicated to making the nation's largest city more affordable for working people.

Multiple polls have suggested that Mamdani's progressive platform offers Democrats across the United States a roadmap for candidates in next year's midterms and beyond. As NYC's next mayor began assembling his team and the movement that worked to elect him created a group to keep fighting for his ambitious agenda, YouGov surveyed 1,133 US adults after his victory.

While just 31% of those surveyed said they would have voted for Mamdani—more than any other candidate—and the same share said they would vote for a candidate who identified as a "democratic socialist," the policies he ran on garnered far more support.

YouGov found:

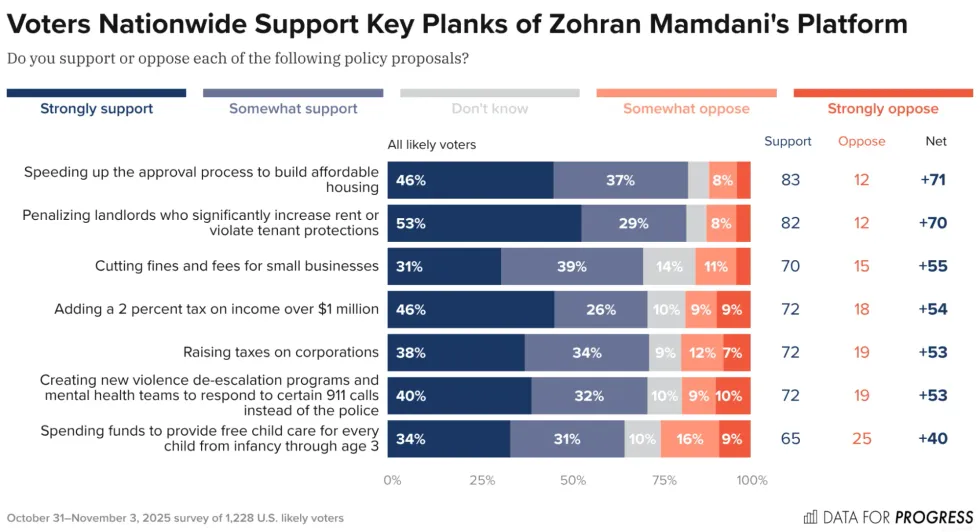

Data for Progress similarly surveyed 1,228 likely voters from across the United States about key pieces of Mamdani's platform before his win. The think tank found that large majorities of Americans support efforts to build more affordable housing, higher taxes for corporations as well as millionaires and billionaires, and free childcare, among other policies.

"There's a common refrain from some pundits to dismiss Mamdani's victory as a quirk of New York City politics rather than a sign of something bigger," Data for Progress executive director Ryan O'Donnell wrote last week. "But his campaign paired moral conviction with concrete plans to lower costs and expand access to services, making it unmistakable what he stood for and whom he was fighting for. The lesson isn't that every candidate should mimic his style—you can't fake authenticity—but that voters everywhere respond when a candidate connects economic populism to clear, actionable goals."

"Candidates closer to the center are running on an affordability message as well," he noted, pointing to Democrat Mikie Sherrill's gubernatorial victory in New Jersey. "When a center-left figure like Sherill is running on taking on corporate power, it underscores how central economic populism has become across the political spectrum. Her message may have been less fiery than Mamdani's, but she drew from a similar well of voter frustration over rising costs and corporate influence. In doing so, Sherrill demonstrated to voters that her administration would play an active role in lowering costs—something that voters nationwide overwhelmingly believe the government should be doing."

"When guys like Jeffries and Schumer say 'effective' they're talking about effectively flattering large-dollar donors," said one critic.

Progressive anger and calls for primary challenges followed House Minority Leader Hakeem Jeffries' Monday endorsement of top Senate Democrat Chuck Schumer—under whose leadership numerous Democratic lawmakers caved to Republicans to pave the way to ending the government shutdown without winning any meaningful concessions.

As progressives demanded the resignation or ouster of Schumer (D-NY), Jeffries (D-NY) was asked during a press conference whether the 74-year-old senator is effective and whether he should remain as the upper chamber's minority leader.

"Yes and yes," replied Jeffries. "As I've indicated, listen, Leader Schumer and Senate Democrats over the last seven weeks have waged a valiant fight on behalf of the American people."

"I don't think that the House Democratic Caucus is prepared to support a promise, a wing and a prayer, from folks who have been devastating the healthcare of the American people for years," he said.

Asked if he thinks Schumer is effective and should keep his job, Hakeem Jeffries replies: "Yes and yes."

[image or embed]

— Ken Klippenstein (@kenklippenstein.bsky.social) November 10, 2025 at 2:07 PM

Both Schumer and Jeffries say they will vote "no" on the the GOP bill to end the shutdown.

Activist and former Democratic National Committee Co-Vice Chair David Hogg said on social media that Schumer's "number one job is to control his caucus," and "he can't do that."

Eight members of the Senate Democratic caucus—Catherine Cortez Masto (Nev.), Dick Durbin (Ill.), John Fetterman (Pa.), Maggie Hassan (NH), Tim Kaine (Va.), Angus King (I-Maine), Jacky Rosen (Nev.), and Jeanne Shaheen (NH)—enabled their Republican colleagues to secure the 60 votes needed for a cloture vote to advance legislation to end the shutdown.

Critics say the proposal does nothing to spare Americans from soaring healthcare premiums unleashed in the One Big Beautiful Bill Act signed by President Donald Trump in July.

"Standing up to a tyrant—who is willing to impose pain as leverage to compel loyalty or acquiescence—is hard," Sen. Chris Murphy (D-Conn.) said Monday. "You can convince yourself that yielding stops the pain and brings you back to 'normal.' But there is no 'normal.' Submission emboldens the tyrant. The threat grows."

Rep. Ro Khanna (D-Calif.) said on X: "Sen. Schumer is no longer effective and should be replaced. If you can’t lead the fight to stop healthcare premiums from skyrocketing for Americans, what will you fight for?"

New York City Councilman Chi Ossé (D-36)—who on Sunday said that Schumer and Senate Democrats "failed Americans" by capitulating to "MAGA fascists"—laughed off Jeffries' ringing endorsement of Schumer's leadership.

Former Democratic Ohio state Sen. Nina Turner called Jeffries and Schumer "controlled opposition" while demanding that they both "step down."

The progressive political action group Our Revolution published a survey last week showing overwhelming grassroots support for running primary challenges to Schumer and Jeffries. The poll revealed that 90% of respondents want Schumer to step down as leader, while 92% would support a primary challenge against him when he’s next up for reelection in 2028. Meanwhile, 70% of respondents said Jeffries should step aside, with 77% backing a primary challenge.

Turner also called for a ban on corporate money in politics and ousting "corporate politicians."

Left Reckoning podcast host Matt Lech said on X that "when guys like Jeffries and Schumer say 'effective' they're talking about effectively flattering large-dollar donors."

In a letter to the British public broadcaster, Trump cited a memo from a Conservative Party-linked former BBC adviser who claimed the network displayed an "anti-Israel" bias, despite ample evidence to the contrary.

The BBC in the United Kingdom is the latest target of US President Donald Trump's attempts to root out all unflattering portrayals of him from media coverage, with the president citing a memo penned by a former BBC adviser reported to have ties to the British Conservative Party.

Trump wrote to the BBC Monday, warning that he would file a lawsuit demanding $1 billion in damages unless the publicly funded broadcaster retracts a documentary film about him from last year, issues a formal apology, and pays him an amount that would “appropriately compensate President Trump for the harm caused.”

The president gave the network until Friday to act in regard to Trump's complaint about a section of the film Trump: A Second Chance? by the long-running current affairs series Panorama.

The film was broadcast days before the 2024 US election, and included excerpts from the speech Trump gave to his supporters on January 6, 2021 just before thousands of them proceeded to the US Capitol to try to stop the election results from being certified.

It spliced together three quotes from two sections of the speech that were made about 50 minutes apart, making it appear that Trump urged supporters to march with him to the Capitol and called for violence.

"We’re going to walk down to the Capitol... and I’ll be there with you... and we fight. We fight like hell," Trump is shown saying in the edited footage.

In the unedited quote, Trump said, "We’re going to walk down to the Capitol, and we’re going to cheer on our brave senators and congressmen and women, and we’re probably not going to be cheering so much for some of them.”

BBC chairman Samir Shah said the network's standards committee had discussed the editing of the clips earlier this year and had expressed concerns to the Panorama team. The film is no longer available online at the BBC's website.

"The furor over the Trump documentary is not about journalistic integrity. It’s a power play... It’s a war over words, where the vocabulary of journalism itself is weaponized."

“We accept that the way the speech was edited did give the impression of a direct call for violent action," said Shah. "The BBC would like to apologize for that error of judgment.”

Two top executives, director general Tim Davie and head of news Deborah Turness, also resigned on Sunday under pressure over the documentary.

The uproar comes days after the right-wing Daily Telegraph published details from a memo by former BBC standards committee adviser Michael Prescott, "managing director at PR agency Hanover Communications, whose staff have gone on to work for the Conservative Party," according to Novara Media.

Prescott's memo took aim at the documentary as well as what he claimed was a pro-transgender bias in BBC news coverage and an anti-Israel bias in stories by the BBC's Arabic service.

According to the Guardian, Robbie Gibb, a member of the BBC board who previously worked as a communications official for former Tory Prime Minister Theresa May, "amplified" the criticisms in Prescott's memo in key board meetings ahead of Davie's and Turness' resignations.

Deadline reported Monday that "insiders" at the BBC have alleged that Prescott's memo, the resignations, and Trump's threat of legal action all stem from a right-wing "coup" attempt at the broadcaster.

Journalists including Mehdi Hasan of Zeteo News and Mikey Smith of The Mirror noted that while Panorama's editing of Trump's speech could be seen as misleading, the documentary wasn't responsible for accusations that the president incited violence on January 6, which pre-dated the film.

"To understand how insane it is that the BBC is being accused of ‘making it look like’ Trump was inciting violence with their bad edit, as opposed to Trump actually having incited violence, we know even his own kids that day were desperately trying to get him to call off the mob," said Hasan.

Others suggested the memo cited in Trump's letter to the broadcaster should be discredited entirely for its claim that the BBC has exhibited an anti-Israel bias—an allegation, said author and international relations professor Norrie MacQueen, that amounted to "an entirely new level" of George Orwell's "newspeak."

While the BBC "has been shaken by one of the smallest of its sins," wrote media analyst Faisal Hanif at Middle East Eye, "the greater one—its distortion of Palestinian reality—goes unpunished."

Hanif pointed to a report published in June by the Center for Media Monitoring, which showed that despite Gaza suffering 34 times more casualties than Israel since October 2023, the BBC "gave Israeli deaths 33 times more coverage per fatality and ran almost equal numbers of humanizing victim profiles (279 Palestinians vs. 201 Israelis)."

The network also used "emotive terms four times more for Israeli victims" and shut down allegations that Israel has committed genocide in Gaza, as well as "making zero mention of Israeli leaders’ genocidal statements," even as Israel faces a genocide case at the International Court of Justice.

"The furor over the Trump documentary is not about journalistic integrity," wrote Hanif. "It’s a power play: the disciplining of a public broadcaster that still, nominally, answers to the public rather than the billionaire-owned media. It’s a war over words, where the vocabulary of journalism itself is weaponized."

"The BBC is punished for the wrong things. It loses its leaders over an editing error, while escaping accountability for its editorial failures on Gaza," Hanif continued. "The Trump documentary might have been misedited, but the story of Gaza has been mistold for far longer. If the BBC still believes in its own motto—'Nation shall speak peace unto nation'—then peace must begin with honesty."