Analysis Reveals Wall Street Titans Behind Big Oil Profiteering Push in Venezuela

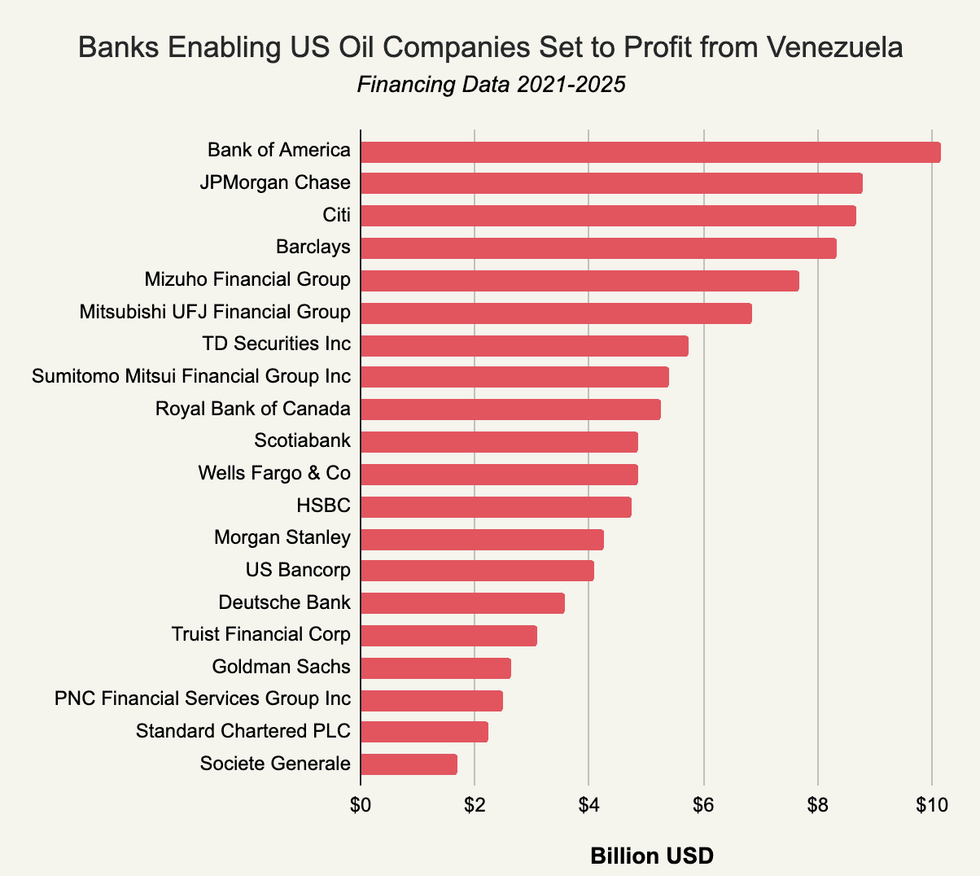

Since 2021, top Wall Street banks have committed more than $124 billion in investments to the nine companies set to profit most from the toppling of Venezuela's government.

As oil industry giants are being set up to profit from President Donald Trump's invasion of Venezuela, a new analysis shows the ample backing those companies have received from Wall Street's top financial institutions.

Last week, Bloomberg reported that stock traders and tycoons were "pouncing" after Trump's kidnapping of President Nicolás Maduro earlier this month, after having pressured the Trump administration to "create a more favorable business environment in Venezuela."

A dataset compiled by the international environmental advocacy group Stand.earth shows the extent to which these interests are intertwined.

Stand.earth found that since 2021, banks—including JPMorgan Chase, HSBC, TD, RBC, Citigroup, Wells Fargo, and Bank of America—have committed more than $124 billion in investments to the nine companies set to profit most from the toppling of Venezuela's government.

More than a third of that financing, $42 billion, came in 2025 alone, when Trump launched his aggressive campaign against Venezuela.

Among the companies expected to profit most immediately are refiners like Valero, PBF Energy, Citgo, and Phillips 66, which have large operations on the Gulf Coast that can process the heavy crude Venezuela is known to produce. These four companies have received $41 billion from major banks over the past five years.

Chevron, which also operates many heavy-crude facilities, benefits from being the only US company that operated in Venezuela under the Maduro regime, where it exported more than 140,000 barrels of oil per day last quarter.

At a White House gathering with top oil executives on Friday, the company's vice chair, Mark Nelson, told Trump the company could double its exports "effective immediately."

According to Jason Gabelman, an analyst at TD Cowen, the company could increase its annual cash flow by $400 million to $700 million as a result of Trump's takeover of Venezuelan oil resources.

Chevron was also by far the number-one recipient of investments in 2025, with more than $11 billion in total coming from the banks listed in the report—including $1.78 billion from Barclays, another $1.78 billion from Bank of America, and $1.32 billion from Citigroup.

According to Bloomberg, just weeks before Maduro's removal, analysts at Citigroup predicted 60% gains on the nation's more than $60 billion in bonds if he were replaced.

Even ExxonMobil, whose CEO Darren Woods dumped cold water on Trump's calls to set up operations in Venezuela on Friday, calling the nation "uninvestable," potentially has something major to gain from Maduro's overthrow.

Exxon and ConocoPhillips each have outstanding arbitration cases against Venezuela over the government's 2007 nationalization of oil assets, which could award them $20 billion and $12 billion, respectively.

The report found that in 2025, ExxonMobil and ConocoPhillips received a combined total of more than $12.8 billion in investment from major financial institutions, which vastly exceeded that from previous years.

Data on these staggering investments comes as oil companies face increased scrutiny surrounding possible foreknowledge of Trump's attack on Venezuela.

Last week, US Senate Democrats launched a formal investigation into “communications between major US oil and oilfield services companies and the Trump administration surrounding last week’s military action in Venezuela and efforts to exploit Venezuelan oil resources.”

Richard Brooks, Stand.earth's climate finance director, said the role of the financial institutions underwriting those oil companies should not be overlooked either.

"Without financial support from big banks and investors, the likes of Chevron, Exxon, ConocoPhillips, and Valero would not have the power that they do to start wars, overthrow governments, or slow the pace of climate action," he said. "Banks and investors need to choose if they are on the side of peace, or of warmongering oil companies.”