SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

A new report released today shows that the New York State Teachers' Retirement System (NYSTRS) has more than $300 million invested in companies with substantial coal reserves. NYSTRS owns stocks in 36 companies on the Carbon Underground Coal 100 List and increased their investments in 24 of those same companies by a total of 6.2 million shares as recently as the last quarter of 2020. This includes an addition of 1.1 million shares of the Chinese coal company, Shaanxi Coal Industry Co, that has the second largest coal reserves in the world estimated to represent 27.8 gigatonnes of CO2 emissions, more than five times the annual CO2 emissions of the United States.

The expansion of NYSTRS' investments in the dirtiest fossil fuel companies flies in the face of increased recognition that these fuels represent unprecedented financial and climate risk and are set to decline even further under recent modeling released by the International Energy Agency. The chief of the IEA last week called fossil fuels "junk investments".

"As a recent public school teacher, I can tell you just how devastating it is to work so hard every day to protect our community's future and its children, only to have your pension invested in an industry that's actively harming that future and those children. The fact that coal is also such a financially risky investment of already under-paid teachers' pensions adds more insult to injury." said Senator Jabari Brisport, lead Senate sponsor on the Teachers' Fossil Fuel Divestment Act (S4783A/A6331A). The Act would force the pension fund to responsibly divest from coal within 1 years and from all fossil fuels within 2 years.

"In a time of rapidly increasing global temperatures reaching levels that can lead to runaway climate change, we are all being called on to play a role in reducing our collective greenhouse gas production. Continuing to invest in oil and gas companies and companies that are based on significant coal production and consumption no longer makes fiscal sense and puts the future of our youth at stake. The bill I have introduced with Senator Brisport requiring the NYS Teachers' Retirement System to divest $4 billion from fossil fuel companies, including $311 million from coal is an investment in the future teachers are working so hard to build." said Assembly Member Anna Kelles, who is Assembly lead sponsor of the Teachers Divestment Act which now has more than 62 sponsors.

NYSTRS has over $120 billion in assets making it the second largest pension fund in New York State and one of the ten largest in the country. The New York State Common Retirement Fund (CRF) that is overseen by Comptroller Thomas DiNapoli is the largest New York pension.

Comptroller DiNapoli divested the CRF from 22 coal companies in July 2020 as part of his Climate Action Plan. "Investors who fail to face the risks and seize the opportunities presented by climate change put their portfolios in jeopardy," DiNapoli said in his press release announcing the coal review and divestment process. "We are assessing minimum standards for transition readiness at coal mining companies first, because they face the greatest risk as the world turns to cleaner and renewable energies." Most recently, the CRF divested from oil sands companies and is now reviewing shale oil and gas investments.

Out of the 22 coal companies that Comptroller DiNapoli divested from, NYSTRS still owns stocks in seven of them worth $9.6 million. NYSTRS' investments in 5 of these seven companies increased in the last quarter of 2020.

"The blindfold needs to be taken off. We are far too deep into the climate crisis to be taking steps backwards. My teachers who are working tirelessly to cultivate my mind for the future should not be receiving their pension funds from the investments made in the destruction of my future," said Mandy Berghela, a high school student and member of the New York Youth Climate Leaders.

Teachers have expressed support for divestment. Sixteen NYSUT locals submitted resolutions calling on NYSTRS to divest including the statewide UUP, PSC CUNY, Buffalo, Albany and Troy locals. These resolutions were sent to NYSUT's general assembly. Last year, NYSUT passed a resolution in support of divestment. NYSTRS, which has over 434,000 members and beneficiaries, is under the oversight of the State Legislature. It has an estimated $4.5 billion in fossil fuel holdings.

New York's climate law requires net zero greenhouse gas emissions by 2050. In addition to the CRF's commitment to divest from risky coal, oil and gas companies, three of five New York City pensions, including the NYC teachers, are currently divesting $4 billion from fossil fuels. Governor Cuomo has directed public authorities with assets valued at over $40 billion to divest from fossil fuels. Yet the NYS Teachers Retirement System (NYSTRS) has neglected to develop a divestment plan or any type of climate action plan.

Across the world and here in New York State, more than 1,300 institutions with assets over $14 trillion including over 300 pension funds and governments have committed to divest from fossil fuels. Both the American Federation of Teachers and NYS United Teachers have passed resolutions in favor of divestment.

The report can be downloaded here

Additional Quotes:

"Coal has been one of the biggest contributors to the climate crisis we are confronting today. Coal's financially lucrative days peaked years ago. Continuing to invest and even increasing investments in the dirtiest fossil fuel is simply unacceptable and must stop now. The fiduciaries of NYSTRS are complicit in contributing to climate catastrophe by choosing to invest New York State's public school teachers' retirement fund in coal. Investing in any other sector besides fossil fuels would yield more money for the pension. NYSTRS must divest from coal now." - Barbara Pal, Divest NY Coalition Coordinator, VicePresident of 350NJ-Rockland, Co-Chair of Divest NJ

"NYSTRS' investment in coal and other fossil fuels allows these companies to profit from products that are jeopardizing all life on this planet. And, as Divest NY's coal report shows, these investments represent an unacceptable financial risk to the retired teachers who have entrusted NYSTRS to responsibly invest. NYSTRS's investment in coal is morally unacceptable and violates its fiduciary responsibility to retired teachers. The Interfaith Climate Justice Community of WNY calls on NYSTRS to follow the lead of NYS Comptroller Thomas DiNapoli who has divested the Common Retirement Fund of its coal holdings on environmental and fiduciary grounds," said Sister Eileen O'Connor and Roger Cook, ICJC Co-conveners

"Divestment works -- just ask leading scientists, economists, investors, or fossil fuel companies themselves. Not only is it the prudent financial choice, given the industry's longstanding financial underperformance and future risk. It's the moral imperative, given the immense racial, social, and economic injustice that accompanies a warming world." said Connor Chung, a student and organizer with Fossil Fuel Divest Harvard.

"As the climate crisis continues to accelerate, and as fossil fuels become more and more obsolete everyday, divestment is absolutely necessary for the protection of life on earth as well as providing a sustainable future for the youth of today," said Matt Oill, member of Divest NY and the New York Youth Climate Leaders.

"As a teacher I am concerned about the future of my students, AND I'm concerned about the financial stability of my retirement fund. If Comptroller DiNapoli believes it is financially irresponsible to invest in fossil fuels why is my pension fund still invested?" said Lauren Kirkwood, a teacher and Divest NY member.

"With the state pension fund already showing leadership by divesting from coal and oil sands companies, citing increased risk, it makes no sense for its sister fund, the Teachers fund, to remain invested in these same companies and industries. It's time for the Teachers fund to enter the 21st century and stop invested in the fuels of the 19th century," said Richard Brooks, Stand.earth's Climate Finance Director.

"As the world moves away from and replaces coal projects with renewables and banks and insurance companies decide to stop investing and underwriting coal, it seems almost unbelievable that NYSTRS is increasing its holdings in coal. The fiduciaries are betraying their obligation to achieve acceptable risk for their members and retirees. Teachers, demand that your pension divest from coal immediately and oil and gas thereafter. Stranded assets won't fund your retirement!" said Tina Weishaus, Co-Chair of Divest New Jersey

350 is building a future that's just, prosperous, equitable and safe from the effects of the climate crisis. We're an international movement of ordinary people working to end the age of fossil fuels and build a world of community-led renewable energy for all.

In some cases, the administration has kept immigrants locked up even after a judge has ordered their release, according to an investigation by Reuters.

Judges across the country have ruled more than 4,400 times since the start of October that US Immigration and Customs Enforcement has illegally detained immigrants, according to a Reuters investigation published Saturday.

As President Donald Trump carries out his unprecedented "mass deportation" crusade, the number of people in ICE custody ballooned to 68,000 this month, up 75% from when he took office.

Midway through 2025, the administration had begun pushing for a daily quota of 3,000 arrests per day, with the goal of reaching 1 million per year. This has led to the targeting of mostly people with no criminal records rather than the "worst of the worst," as the administration often claims.

Reuters' reporting suggests chasing this number has also resulted in a staggering number of arrests that judges have later found to be illegal.

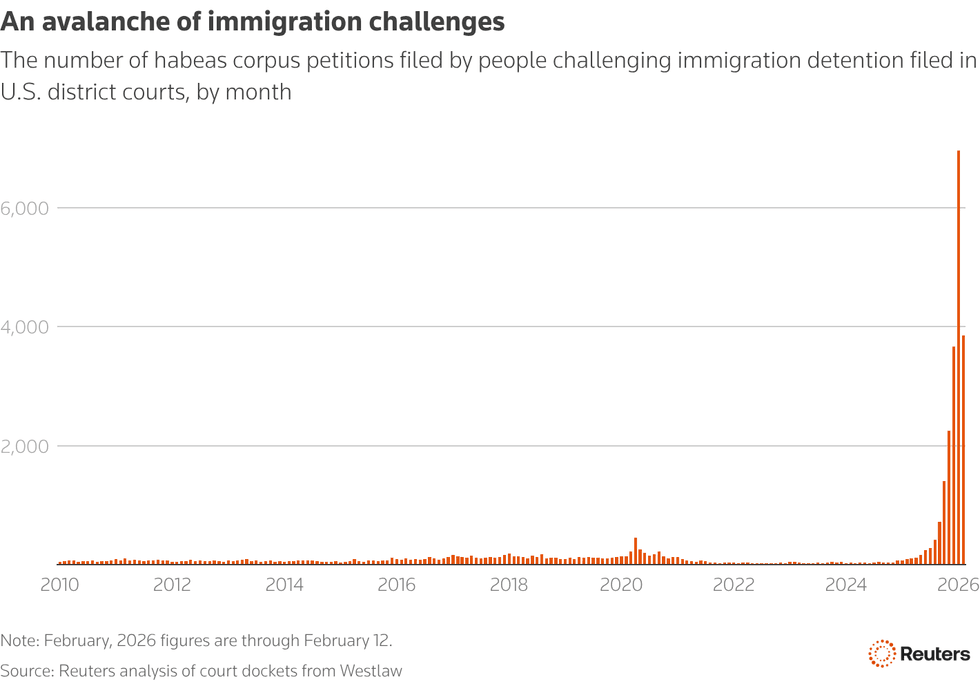

Since the beginning of Trump's term, immigrants have filed more than 20,200 habeas corpus petitions, claiming they were held indefinitely without trial in violation of the Constitution.

In at least 4,421 cases, more than 400 federal judges have ruled that their detentions were illegal.

Last month, more than 6,000 habeas petitions were filed. Prior to the second Trump administration, no other month dating back to 2010 had seen even 500.

In part due to the sheer volume of legal challenges, the Trump administration has often failed to comply with court rulings, leaving people locked up even after judges ordered them to be released.

Reuters' new report is the most comprehensive examination to date of the administration's routine violation of the law with respect to immigration enforcement. But the extent to which federal immigration agencies have violated the law under Trump is hardly new information.

In a ruling last month, Chief Judge Patrick J. Schiltz of the US District Court in Minnesota—a conservative jurist appointed by former President George W. Bush—provided a list of nearly 100 court orders ICE had violated just that month while deployed as part of Trump's Operation Metro Surge.

The report of ICE's systemic violation of the law comes as the agency faces heightened scrutiny on Capitol Hill, with leaders of the agency called to testify and Democrats attempting to hold up funding in order to force reforms to ICE's conduct, which resulted in a partial shutdown beginning Saturday.

Following the release of Reuters' report, Rep. Ted Lieu (D-Calif.) directed a pointed question over social media to Kristi Noem, the secretary of the Department of Homeland Security, which oversees ICE.

"Why do your out-of-control agents keep violating federal law?" he said. "I look forward to seeing you testify under oath at the House Judiciary Committee in early March."

"Aggies do what is necessary for our rights, for our survival, and for our people,” said one student organizer at North Carolina A&T State University, the largest historically Black college in the nation.

As early voting began for the state primaries, North Carolina college students found themselves walking more than a mile to cast their ballots after the Republican-controlled State Board of Elections closed polling places on their campuses.

The board, which shifted to a 3-2 GOP majority, voted last month to close a polling site at Western Carolina University and to reject the creation of polling sites at two other colleges—the University of North Carolina at Greensboro (UNC Greensboro), and the North Carolina Agricultural and Technical State University (NC A&T), the largest historically Black college in the nation. Each of these schools had polling places available on campus during the 2024 election.

The decision, which came just weeks before early voting was scheduled to begin, left many of the 40,000 students who attend these schools more than a mile away from the nearest polling place.

It was the latest of many efforts by North Carolina Republicans to restrict voting ahead of the 2026 midterms: They also cut polling place hours in dozens of counties and eliminated early voting on Sundays in some, which dealt a blow to "Souls to the Polls" efforts led by Black churches.

A lawsuit filed late last month by a group of students at the three schools said, “as a result, students who do not have access to private transportation must now walk that distance—which includes walking along a highway that lacks any pedestrian infrastructure—to exercise their right to vote.

The students argued that this violates their access to the ballot and to same-day registration, which is only available during the early voting period.

Last week, a federal judge rejected their demand to open the three polling centers. Jay Pavey, a Republican member of the Jackson County elections board, who voted to close the WCU polling site, dismissed fears that it would limit voting.

“If you really want to vote, you'll find a way to go one mile,” Pavey said.

Despite the hurdles, hundreds of students in the critical battleground state remained determined to cast a ballot as early voting opened.

On Friday, a video posted by the Smoky Mountain News showed dozens of students marching in a line from WCU "to their new polling place," at the Jackson County Recreation Center, "1.7 miles down a busy highway with no sidewalks."

The university and on-campus groups also organized shuttles to and from the polling place.

A similar scene was documented at NC A&T, where about 60 students marched to their nearest polling place at a courthouse more than 1.3 miles away.

The students described their march as a protest against the state's decision, which they viewed as an attempt to limit their power at the ballot box.

The campus is no stranger to standing up against injustice. February 1 marked the 66th anniversary of when four Black NC A&T students launched one of the most pivotal protests of the civil rights movement, sitting down at a segregated Woolworth's lunch counter in downtown Greensboro—an act that sparked a wave of nonviolent civil disobedience across the South.

"Aggies do what is necessary for our rights, for our survival, and for our people,” Jae'lah Monet, one of the student organizers of the march, told Spectrum News 1.

Monet said she and other students will do what is necessary to get students to the polls safely and to demonstrate to the state board the importance of having a polling place on campus. She said several similar events will take place throughout the early voting period.

"We will be there all day, and we will all get a chance to vote," Monet said.

"We need massive reforms in DHS with real accountability before we send another dime their way," said Rep. Pramila Jayapal.

The US Department of Homeland Security partially shut down on Saturday at midnight after Congress failed to reach an agreement to reform its immigration agencies, which have faced mounting scrutiny after the killings of multiple US citizens and rampant civil rights violations.

A shutdown was virtually assured when lawmakers left town for a recess on Thursday without a deal that included Democrats' key demands to rein in Immigration and Customs Enforcement (ICE) and Customs and Border Protection (CBP).

Sixty votes are needed to pass any deal through the Senate, meaning seven Democrats would need to join every Republican to break the stalemate.

Democrats have demanded that agents around the nation wear body cameras, carry identification, and stop hiding their identities with masks. They said agents must adhere to the Constitution by obtaining judicial warrants before entering private property and ending the use of racial profiling.

Senate Republicans on Thursday attempted to pass another short-term funding measure that would keep the agency running while negotiations play out. But without adopting any of the Democrats' reforms, Senate Minority Leader Chuck Schumer (D-NY) said his party would "not support a blank check for chaos."

The bill was voted down 47-52, with only one Democrat, the ICE-defending Sen. John Fetterman (D-Pa.) voting in support.

The lapse in funding comes amid a whirlwind of scandals surrounding DHS, most notably the fatal shootings in Minneapolis of two US citizens, Alex Pretti and Renee Good, last month. DHS officials, including Secretary Kristi Noem, immediately leapt to justify the killings in contradiction to video evidence, which smeared the victims as "domestic terrorists" before any investigation took place.

Earlier this week, unsealed body camera footage showed definitively that the agency also lied about the shooting of 30-year-old US citizen Marimar Martinez in Chicago in October.

On Friday, it was reported that two ICE agents are under investigation for making false statements about the events leading up to yet another shooting of a Venezuelan national, Julio Cesar Sosa-Celis, in Minnesota last month.

In a rare acknowledgement of wrongdoing by his agency, ICE's acting director, Todd Lyons, said on Friday that the agents appear “to have made untruthful statements” about what led to his shooting.

An explosive Wall Street Journal report also recently put Noem further under the microscope, revealing an alleged romantic relationship with top Trump adviser Corey Lewandowski, who insiders said has been put in charge of the agency's contracting despite being only a temporary "special government employee" and has reportedly doled out contracts in an "opaque and arbitrary manner."

The DHS shutdown will not affect funding for immigration agencies, since both ICE and CBP received more than $70 billion from Congress last summer as part of the GOP's massive tax and spending bill.

Their activities are expected to continue normally during the shutdown. But other functions of the agency may see delays and funding lapses.

While most Transportation Security Administration (TSA) employees are considered essential and expected to stay on the job, more may begin to stay home if the shutdown drags on and they miss paychecks. Some Federal Emergency Management Agency (FEMA) funding for states' disaster recovery may also be delayed as a result of the shutdown, and employees may be furloughed, slowing the process.

Congress is expected to reconvene on February 23 after a weeklong recess, but may return earlier if a deal is reached during the break.

Democrats have appeared largely united on holding out unless significant reforms are achieved, though party leaders—Schumer and House Minority Leader Hakeem Jeffries (D-NY) have faced a crisis of confidence within their own caucus, as they've appeared willing to taper back some demands—including masking requirements—in order to find a compromise.

As the clock inched toward midnight on Friday, Rep. Pramila Jayapal (D-Wash.), the chair emerita of the Congressional Progressive Caucus, emphasized the existential stakes of the fight ahead.

"If the government shuts down, it will be because Republicans refuse to hold DHS and their deplorable actions accountable," she said. "The reality is if we start to erode the rights of some, we start to erode the rights of all—and I will not stand for it. We need massive reforms in DHS with real accountability before we send another dime their way."