"It shouldn't take 11 months and a FOIA lawsuit to learn that the government killed someone," American Oversight said on social media late Friday. Separately, the watchdog noted that "the details sound similar to the death of Renee Good," a 37-year-old US citizen and mother of three fatally shot by officer Jonathan Ross last month in Minneapolis, Minnesota.

Good's killing, and two Customs and Border Protection agents' subsequent fatal shooting of 37-year-old US citizen and nurse Alex Pretti in Minneapolis, have fueled outrage over President Donald Trump's mass deportation agenda, resulting in a congressional funding fight that has partially shut down the US Department of Homeland Security (DHS), which oversees both agencies.

ICE's internal report on the Texas shooting states that HSI agents were helping redirect traffic at the site of a major accident early on March 15, 2025. Martinez and his passengers aren't named, but the document claims that the driver of a blue four-door Ford "failed to follow instructions," including verbal commands to stop and exit the vehicle.

Instead, the driver "accelerated forward, striking a HSI special agent who wound up on the hood of the vehicle. Upon observing this, HSI group supervisory special agent utilized his government-issued service weapon, discharging multiple rounds at the driver through the open driver's side window," according to the ICE report—a version of events that a DHS spokesperson echoed in a Friday statement added to the Newsweek article, which was initially published Wednesday.

The DHS spokesperson also said that the incident remains under investigation by the Texas Department of Public Safety's Ranger Division, whose press secretary, Sheridan Nolen, confirmed that "this is still an active investigation by the Texas Rangers, and no other information is currently available."

Charles Stam, a lawyer for the Martinez family, told the New York Times that the 23-year-old was the driver in the ICE report. Stam and another attorney, Alex Stamm, also said in a statement that eyewitness accounts of the scene don't match the document.

"It is critical that there is a full and fair investigation into why HSI was present at the scene of a traffic collision and why a federal officer shot and killed a US citizen as he was trying to comply with instructions from the local law enforcement officers directing traffic," the lawyers said.

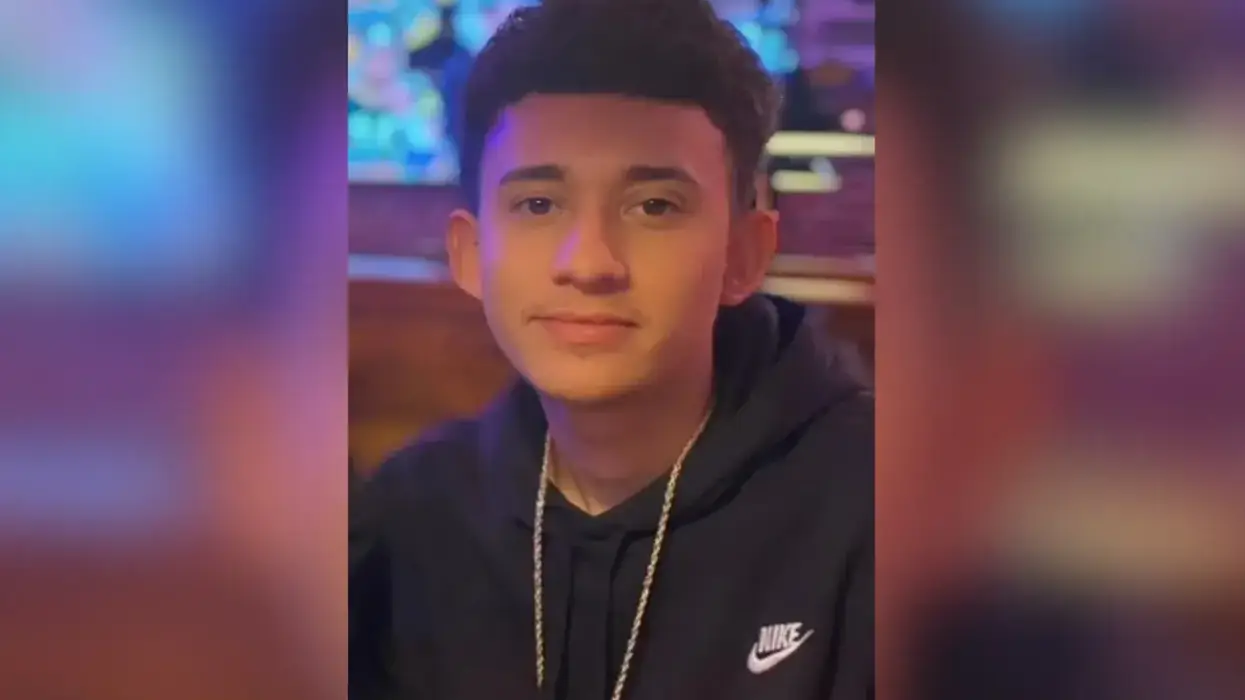

The Times also reached Martinez's mother, Rachel Reyes, who said her son worked at an Amazon warehouse in San Antonio and was out to celebrate his birthday. According to her: "He was a good kid. He doesn't have a criminal history... He never got in trouble. He was never violent."

Reyes challenged the federal government's narrative about her son, telling the newspaper: "What they're saying is different from what they told the family, so that's adding insult to injury... They are making it sound different. I don't appreciate their language."

In a Friday interview with the Texas Tribune, American Oversight executive director Chioma Chukwu also called out the government: "What they're telling the public is very different than what they're doing behind closed doors. The only reason why we're able to make these connections and really call into question the public statements that they're making to mislead the public is because we're able to get our hands on these documents... That should deeply concern everyone."

The revelations this week have generated concern. André Treiber, the Democratic National Committee's Youth Coordinating Council chair, wrote on social media Friday evening that "ICE murdered a Texan last March and we are only just learning about it now. They are once again offering the excuse that this was done in self-defense, but forgive me if I am extremely skeptical after they've been caught lying about that exact same thing multiple times already."

Federal lawmakers also sounded the alarm on Friday. Congressional Progressive Caucus Chair Greg Casar (D-Texas) declared that "Americans deserve immediate answers and an independent investigation of the shooting." Another Texas Democrat, Congressman Joaquin Castro, similarly called for "a full investigation," including into the monthslong "cover-up."

US Rep. Delia Ramirez (D-Ill.), whose Chicagoland district has also faced a recent ICE invasion, pointed to other deaths tied to the agency, including those of Silverio Villegas Gonzalez, who was shot by ICE in the Chicago suburb of Franklin Park last September; Keith Porter Jr., who was shot by an off-duty agent on New Year's Eve in Los Angeles, California; and Linda Davis, a special education teacher in Savannah, Georgia, who was killed in a Monday car crash that involved a man fleeing ICE.

"For a whole year, DHS hid that they murdered Ruben, a young man in Texas, after a traffic stop. Just like they did with Silverio, Renee, Keith, Alex, and Linda, they lied and avoided accountability," said Ramirez, who supports abolishing ICE. "How many more people have to be executed before my colleagues realize that reforms are not enough?"