July, 06 2012, 12:42pm EDT

For Immediate Release

Contact:

Michelle Bazie,202-408-1080,bazie@cbpp.org

Statement by Chad Stone, Chief Economist, on the June Employment Report

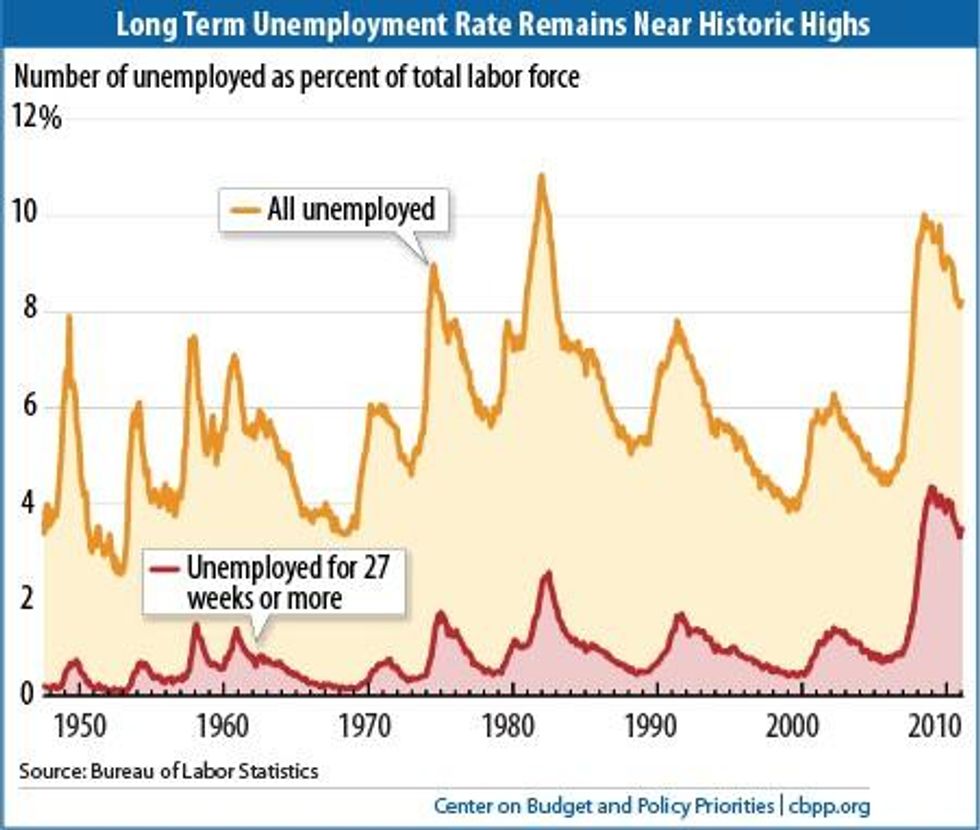

The weak June employment report shows that it remains difficult to find a job in today's job market, especially for the long-term unemployed (those who have been looking for work for 27 weeks or longer). The percentage of people in the labor force who are long-term unemployed remains much higher than in any year prior to the latest recession, in data going back to 1948 (see chart). At the same time, policymakers' decision earlier this year to start reducing the availability of emergency federal unemployment insurance (UI) means that today's long-term unemployed

WASHINGTON

The weak June employment report shows that it remains difficult to find a job in today's job market, especially for the long-term unemployed (those who have been looking for work for 27 weeks or longer). The percentage of people in the labor force who are long-term unemployed remains much higher than in any year prior to the latest recession, in data going back to 1948 (see chart). At the same time, policymakers' decision earlier this year to start reducing the availability of emergency federal unemployment insurance (UI) means that today's long-term unemployed have a weaker UI safety net than was available from late 2009 through the end of last year.

In February, policymakers extended the availability of federal emergency UI through the end of the year, but they decided not to enact the legislation necessary for states with high unemployment rates to continue to provide up to 20 weeks of additional UI through the Extended Benefits (EB) program. As a result, states have been "triggering off" EB through the first half of the year, and after tomorrow, no state will be providing the maximum of 20 weeks (Idaho, with a maximum of 13 weeks, will be the only state providing any EB benefits).

In addition, the February legislation made changes to the Emergency Unemployment Compensation (EUC) program. As a result, the maximum number of weeks of federal UI available through EUC dropped by between 6 and 14 weeks in affected states, depending on the state's unemployment rate.

Although private employers have added jobs for 28 straight months, the pace of job creation has been modest compared with the 200,000 to 300,000 jobs a month or more that would mark a robust job market recovery. Moreover, the unemployment rate remains stubbornly high at 8.2 percent, and forecasters see little or no improvement over the rest of the year.

Under those conditions, the long-term unemployed will continue to find it difficult to find re-employment. It would be unprecedented for policymakers to stay on their current course and allow all federal emergency UI to lapse as scheduled at the end of this year. Since policymakers created the first such program in 1958, they have never allowed it to end when unemployment topped 7.2 percent.

About the June Jobs Report

Job growth was disappointing in June and a strong labor market recovery remains elusive.

- Private and government payrolls combined rose by just 80,000 jobs in June, the third straight month of job growth below 100,000. Private employers added 84,000 jobs, while government employment fell by 4,000. Federal employment fell by 7,000 jobs and state government employment fell by 1,000, while local government employment rose by 4,000.

- This is the 28th straight month of private-sector job creation, with payrolls growing by 4.4 million jobs (a pace of 156,000 jobs a month) since February 2010; total nonfarm employment (private plus government jobs) has grown by 3.8 million jobs over the same period, or 137,000 a month. The loss of 528,000 government jobs over this period was dominated by a loss of 377,000 local government jobs.

- Despite the 28 months of private-sector job growth, there were still 4.9 million fewer jobs on nonfarm payrolls in June than when the recession began in December 2007 and 4.5 million fewer jobs on private payrolls. Payroll job growth has averaged just 75,000 over the last three months, a substantial step backwards from the average of 252,000 jobs a month created in December through February (although warmer than usual weather played a role there).

- The unemployment rate remained at 8.2 percent in June, and the number of unemployed Americans remained 12.7 million. The unemployment rate was 7.4 percent for whites (3.0 percentage points higher than at the start of the recession), 14.4 percent for African Americans (5.4 percentage points higher than at the start of the recession), and 11.0 percent for Hispanics or Latinos (4.7 percentage points higher than at the start of the recession).

- The recession and lack of job opportunities drove many people out of the labor force, and we have yet to see a sustained return to labor force participation (people aged 16 and over working or actively looking for work) that would mark a strong jobs recovery. The labor force rose modestly in June. The number of people with a job rose by 128,000 and the number of people looking for a job rose by 29,000. (These numbers come from a different survey, which shows more month-to-month volatility than the payroll job growth numbers.)

- The labor force participation rate (the percentage of people aged 16 and over working or looking for work) remained a depressed 63.8 percent; before the current economic slump, labor force participation had not been this low since 1983.

- The share of the population with a job, which plummeted in the recession from 62.7 percent in December 2007 to levels last seen in the mid-1980s and has been below 60 percent since early 2009, remained at 58.6 percent in June.

- The Labor Department's most comprehensive alternative unemployment rate measure -- which includes people who want to work but are discouraged from looking (those marginally attached to the labor force) and people working part time because they can't find full-time jobs -- was 14.9 percent in June, down from its all-time high of 17.4 percent in October 2009 in data that go back to 1994, but still 6.1 percentage points higher than at the start of the recession. By that measure, over 23 million people are unemployed or underemployed.

- As discussed above, long-term unemployment remains a significant concern. Over two-fifths (41.9 percent) of the 12.7 million people who are unemployed -- 5.4 million people -- have been looking for work for 27 weeks or longer. These long-term unemployed represent 3.5 percent of the labor force. Before this recession, the previous highs for these statistics over the past six decades were 26.0 percent and 2.6 percent, respectively, in June 1983.

The Center on Budget and Policy Priorities is one of the nation's premier policy organizations working at the federal and state levels on fiscal policy and public programs that affect low- and moderate-income families and individuals.

LATEST NEWS

Trump Tariffs Have Cost Average US Family Nearly $1,200 So Far

"The president’s tax on American families is simply making things more expensive.”

Dec 11, 2025

As President Donald Trump persistently claims the economy is working for Americans, Democrats in the US House and Senate on Thursday released an analysis that puts a number to the recent polling that's found many Americans feel squeezed by higher prices: $1,200.

That's how much the average household in the US has paid in tariff costs over the past 10 months, according to the Joint Economic Committee—and costs are expected to continue climbing.

The Democrats, including Ranking Member Sen. Maggie Hassan (D-NH), Sen. Martin Heinrich (D-NM), and Rep. Sean Casten (D-Ill.), analyzed official US Treasury Department data on the amount of tariff revenue collected since the beginning of Trump's second term as he's imposed tariffs across the European Union and on dozens of other countries—some as high as 50%.

The White House has insisted the tariffs on imports will "pry open foreign markets" and force exporters overseas to pay more, resulting in lower prices for US consumers.

But the JEC combined the Treasury data with independent estimates of the percent of each tariff dollar that is paid by consumers, as companies pass along their higher import prices to them.

At first, US families were paying an average of less than $60 in tariff costs when Trump began the trade war in February and March.

But that amount shot up to more than $80 per family in April when he expanded the tariffs, and monthly costs have steadily increased since then.

In November, a total of $24.04 billion was paid by consumers in tariff costs—or $181.29 per family.

“While President Trump promised that he would lower costs, this report shows that his tariffs have done nothing but drive prices even higher for families."

From February-November, families have paid an average of $1,197.50 each, according to the JEC analysis.

“While President Trump promised that he would lower costs, this report shows that his tariffs have done nothing but drive prices even higher for families,” said Hassan.

If costs remain as high as they were over the next 12 months, families are projected to pay $2,100 per year as a result of Trump's tariffs.

The analysis comes a week after Republicans on a House Ways and Means subcommittee attempted to avoid the topic of tariffs—which have a 61% disapproval rating among the public, according to Pew Research—at a hearing on global competitiveness for workers and businesses.

"Rep. Jimmy Gomez [D-Calif.] read several quotes from [former Rep. Kevin] Brady [R-Texas] during his time in Congress stating that tariffs are taxes that impede economic growth. Brady, who chaired the Ways and Means Committee and drafted Trump’s first tax law in 2017 (and now works as a lobbyist), had no desire to discuss those quotes or the topic of tariffs," wrote Steve Warmhoff, federal policy director at the Institute on Taxation and Economic Policy. "Nor did Republicans address the point made by the Democrats’ witness, Kimberly Clausing, when she explained that Trump’s tariffs are the biggest tax increase on Americans (measured as a share of the economy) since 1982."

Clausing estimated that the tariffs will amount "to an annual tax increase of about $1,700 for an average household" if they stay at current levels, while Trump's decision to lower tariffs on goods such as meat, vegetables, fruits, and coffee last month amounted to just $35 in annual savings per household.

The JEC has also recently released analyses of annual household electricity costs under Trump, which were projected to go up by $100 for the average family despite the president's campaign pledge that "your energy bill within 12 months will be cut in half."

Last month the panel found that the average household is spending approximately $700 more per month on essentials like food, shelter, and energy since Trump took office.

“At a time when both parties should be working together to lower costs," said Hassan on Thursday, "the president’s tax on American families is simply making things more expensive.”

Keep ReadingShow Less

Tlaib Rips Lawmakers Who 'Drool at the Opportunity to Fund War' While Opposing Healthcare for All

"They’re gutting healthcare and food assistance to pay for bombs and weapons. It’s a sick vicious cycle," said Rep. Rashida Tlaib.

Dec 11, 2025

"Imagine if our government funded our communities like they fund war."

That was Rep. Rashida Tlaib's (D-Mich.) response to the House's bipartisan passage Wednesday of legislation that authorizes nearly $901 billion in military spending for the coming fiscal year, as tens of millions of Americans face soaring health insurance premiums and struggle to afford basic necessities amid the nation's worsening cost-of-living crisis.

Tlaib, who voted against the military policy bill, had harsh words for her colleagues who "drool at the opportunity to fund war and genocide, but when it comes to universal healthcare, affordable housing, and food assistance, they suddenly argue that we simply can’t afford it."

"Congress just authorized nearly a trillion dollars for death and destruction but cut a trillion dollars from Medicaid and the Affordable Care Act," said Tlaib, referring to the budget reconciliation package that Republicans and President Donald Trump enacted over the summer.

"They’re gutting healthcare and food assistance to pay for bombs and weapons. It’s a sick vicious cycle," Tlaib continued. "Another record-breaking military budget is impossible to justify when Americans are sleeping on the streets, unable to afford groceries to feed their children, and racking up massive amounts of medical debt just for getting sick."

House passage of the 2026 National Defense Authorization Act (NDAA) came as Republicans in both chambers of Congress pushed healthcare proposals that would not extend enhanced Affordable Care Act (ACA) tax credits that are set to expire at the end of the year, resulting in massive premium hikes for millions.

The nonpartisan Congressional Budget Office estimates that a Senate Democratic plan to extend the ACA subsidies for three years would cost around $85 billion—a fraction of the military spending that House lawmakers just authorized.

The NDAA, which is expected to clear the Senate next week, approves $8 billion more in military spending than the Trump White House asked for in its annual budget request.

According to the National Priorities Project, that $8 billion "would be more than enough" to restore federal nutrition assistance to the millions expected to lose it due to expanded work requirements included in the Trump-GOP budget law.

"Our priorities are disgustingly misplaced," Tlaib said Wednesday.

Keep ReadingShow Less

‘Don't Give the Pentagon $1 Trillion,’ Critics Say as House Passes Record US Military Spending Bill

"From ending the nursing shortage to insuring uninsured children, preventing evictions, and replacing lead pipes, every dollar the Pentagon wastes is a dollar that isn't helping Americans get by," said one group.

Dec 10, 2025

US House lawmakers on Wednesday approved a $900.6 billion military spending bill, prompting critics to highlight ways in which taxpayer funds could be better spent on programs of social uplift instead of perpetual wars.

The lower chamber voted 312-112 in favor of the National Defense Authorization Act (NDAA) for fiscal year 2026, which will fund what President Donald Trump and congressional Republicans call a "peace through strength" national security policy. The proposal now heads for a vote in the Senate, where it is also expected to pass.

Combined with $156 billion in supplemental funding included in the One Big Beautiful Bill signed in July by Trump, the NDAA would push military spending this fiscal year to over $1 trillion—a new record in absolute terms and a relative level unseen since World War II.

The House is about to vote on authorizing $901 billion in military spending, on top of the $156 billion included in the Big Beautiful Bill.70% of global military spending already comes from the US and its major allies.www.stephensemler.com/p/congress-s...

[image or embed]

— Stephen Semler (@stephensemler.bsky.social) December 10, 2025 at 1:16 PM

The Congressional Progressive Caucus (CPC) led opposition to the bill on Capitol Hill, focusing on what lawmakers called misplaced national priorities, as well as Trump's abuse of emergency powers to deploy National Guard troops in Democratic-controlled cities under pretext of fighting crime and unauthorized immigration.

Others sounded the alarm over the Trump administration's apparent march toward a war on Venezuela—which has never attacked the US or any other country in its nearly 200-year history but is rich in oil and is ruled by socialists offering an alternative to American-style capitalism.

"I will always support giving service members what they need to stay safe but that does not mean rubber-stamping bloated budgets or enabling unchecked executive war powers," CPC Deputy Chair Ilhan Omar (D-Minn.) said on social media, explaining her vote against legislation that "pours billions into weapons systems the Pentagon itself has said it does not need."

"It increases funding for defense contractors who profit from global instability and it advances a vision of national security rooted in militarization instead of diplomacy, human rights, or community well-being," Omar continued.

"At a time when families in Minnesota’s 5th District are struggling with rising costs, when our schools and social services remain underfunded, and when the Pentagon continues to evade a clean audit year after year, Congress should be investing in people," she added.

The Congressional Equality Caucus decried the NDAA's inclusion of a provision banning transgender women from full participation in sports programs at US military academies:

The NDAA should invest in our military, not target minority communities for exclusion.While we're grateful that most anti-LGBTQI+ provisions were removed, the GOP kept one anti-trans provision in the final bill—and that's one too many.We're committed to repealing it.

[image or embed]

— Congressional Equality Caucus (@equality.house.gov) December 10, 2025 at 3:03 PM

Advocacy groups also denounced the legislation, with the Institute for Policy Studies' National Priorities Project (NPP) noting that "from ending the nursing shortage to insuring uninsured children, preventing evictions, and replacing lead pipes, every dollar the Pentagon wastes is a dollar that isn't helping Americans get by."

"The last thing Congress should do is deliver $1 trillion into the hands of [Defense] Secretary Pete Hegseth," NPP program director Lindsay Koshgarian said in a statement Wednesday. "Under Secretary Hegseth's leadership, the Pentagon has killed unidentified boaters in the Caribbean, sent the National Guard to occupy peaceful US cities, and driven a destructive and divisive anti-diversity agenda in the military."

Keep ReadingShow Less

Most Popular