October, 05 2017, 01:30pm EDT

219 Republican House Members Just Voted To Cut Medicaid, Medicare, And Public Education To Give Tax Breaks to Millionaires And Corporations.

WASHINGTON

Earlier today, the House of Representatives voted 219 to 206 in favor of the Republican House budget resolution that proposed $5.8 trillion in cuts over the next decade to Medicare, Medicaid, education, infrastructure and other critical services while paving the way for trillions of dollars in tax cuts that would mostly benefit the wealthy and corporations. The vote was almost entirely along party lines, with 18 Republicans joining all Democrats against the resolution.

The budget resolution also set up a procedure for fast-track consideration of tax legislation, enabling Senate Republicans to bypass bipartisanship to pass a tax plan with just 51 votes, rather than 60 votes typically required for such contentious legislation.

Congressional Republican leaders and President Trump released a framework for massive tax cuts last week that will cost at least $2.4 trillion, according to the non-partisan Tax Policy Center. The wealthy and corporations, which are primarily owned by rich shareholders, are the big winners. About 80% of the tax cuts will flow to the top 1% by 2027, when they would get a tax cut of $207,000, on average. That year under the plan, 3 out of 10 middle-class families making between $50,000 and $150,000 a year will pay $2,000 more in taxes, on average, depending on their income (the range is $1,300 to $2,500).

These large tax cuts will balloon the deficit and further jeopardize funding for Social Security, Medicare, Medicaid, and education. Included in the $5.8 trillion in cuts to services under the House-passed budget are Medicaid and other healthcare programs ($1.5 trillion), Medicare ($487 billion), and nutrition assistance ($150 billion).

"This budget resolution is the first step toward an immoral tax scheme that will hand trillions of dollars to millionaires and corporations at the expense of millions of America's working families, many of whom will actually see a tax increase" said Frank Clemente, executive director of Americans for Tax Fairness. "These tax cuts for the wealthy and corporations will ultimately be paid for by cuts to Medicaid, Medicare, education, disability services, and other national priorities, while the expansion of the deficit will further threaten Social Security. The Republicans who voted to advance this plan owe their constituents an explanation."

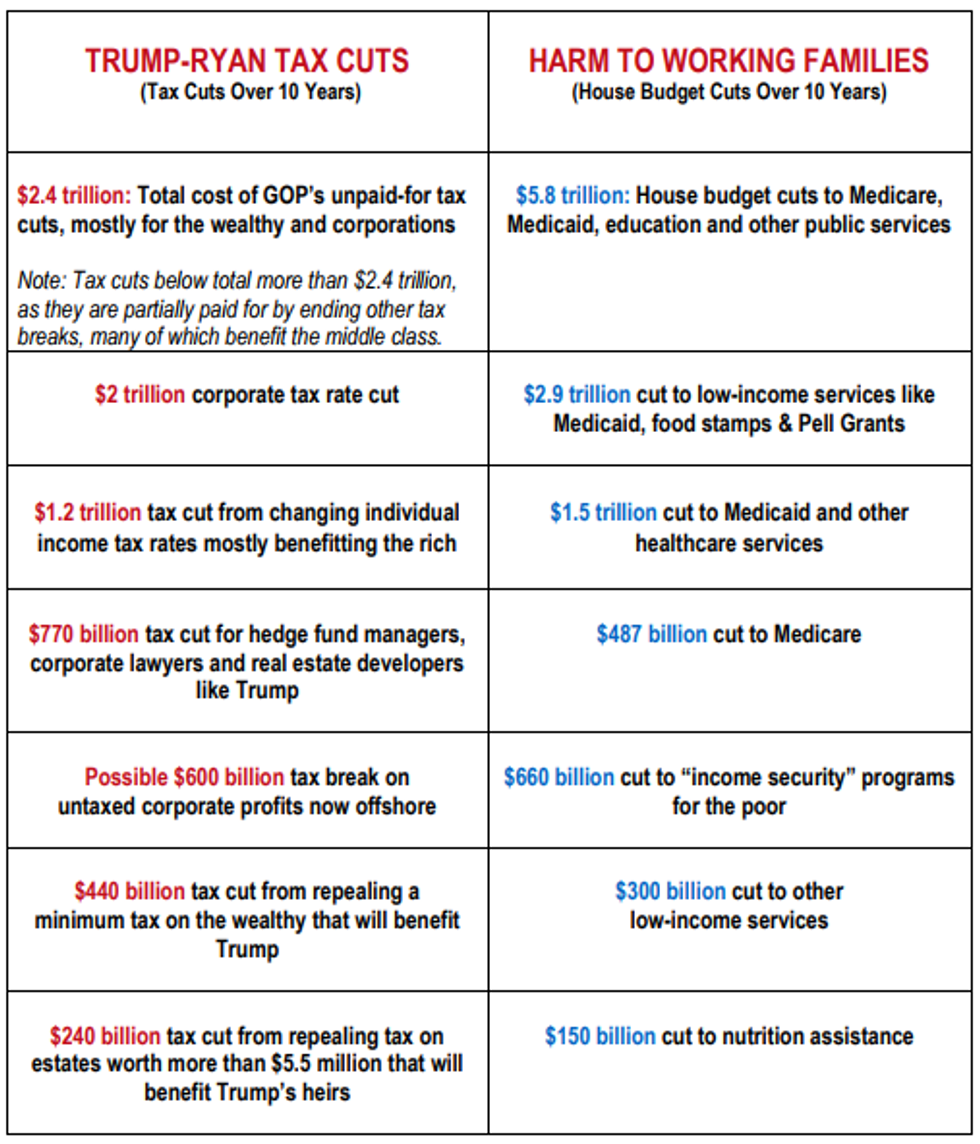

Below is an explanation of the tax cuts proposed under the Trump-GOP tax framework compared with the spending cuts proposed in the House budget resolution.

A more detailed version of this chart with sources is available here: https://americansfortaxfairness.org/wp-content/uploads/ATF-Comparison-of-Trump-Ryan-Tax-Plan-House-Budget-FINAL.pdf

MORE EFFECTS OF THE TRUMP-GOP TAX PLAN:

Tax Breaks for the Richest 1%:

In the U.S., the richest 1% of Americans will get 53% of the total tax cuts in 2018 and 80% after 10 years. They will get a tax cut of $129,000 in 2018, on average, and $207,000 in the 10th year.

Estate Tax Repeal:

The Trump-Ryan tax plan eliminates estate and gift taxes, losing $240 billion over 10 years and boosting the inheritances of the very wealthy.The federal estate tax is paid only by estates worth at least $5.5 million, just 2 out of 1,000 estates, or only 5,500 estates in all of 2017.

Repeal of the State and Local Tax Deduction:

The Trump-Ryan tax plan repeals the deduction for state and local taxes (SALT), raising taxes on the middle class and undermining local public services. Repealing SALT would raise $1.3 trillion over 10 years. Taxpayers can deduct state and local property taxes, and either income or sales taxes, from their federal taxable income. Over a third of taxpayers making $50-75,000 use the SALT deduction, and over half of those making $75-100,000. An average family in this last group would see their federal taxes jump by $1,800 if SALT is repealed. In addition to boosting middle-class taxes, repeal of the SALT deduction will make local taxation more expensive, putting pressure on localities to cut budgets for services like roads and schools. [Sources: Tax Policy Center, Government Finance Officers Assoc.

Americans for Tax Fairness (ATF) is a diverse campaign of more than 420 national, state and local endorsing organizations united in support of a fair tax system that works for all Americans. It has come together based on the belief that the country needs comprehensive, progressive tax reform that results in greater revenue to meet our growing needs. This requires big corporations and the wealthy to pay their fair share in taxes, not to live by their own set of rules.

(202) 506-3264LATEST NEWS

'Insane This Is Legal': Bettors Make Huge Profits From Suspiciously Timed Wagers on Iran War

"Reminder that Donald Trump Jr. sits on Polymarket's advisory board and his firm invested double-digit millions into the platform last year."

Mar 01, 2026

Bettors on the prediction platform Polymarket made a killing with suspiciously timed wagers that the United States would attack Iran by February 28, the day President Donald Trump announced a bombing campaign against the Middle East nation.

Bloomberg reported that six accounts on Polymarket, all newly created this month, "made around $1 million in profit" by betting on the timing of the US attack on Iran. The accounts, according to Bloomberg, "had only ever placed bets on when US strikes might occur," and "some of their shares were purchased, in some cases at roughly a dime apiece, hours before the first explosions were reported in Tehran."

One account with the name Magamyman raked in over $515,000 by betting roughly $87,000 that the "US strikes Iran by February 28, 2026."

The lucrative bets quickly drew scrutiny from lawmakers. US Sen. Chris Murphy (D-Conn.) wrote on social media that "it’s insane this is legal."

"People around Trump are profiting off war and death," Murphy alleged. "I’m introducing legislation ASAP to ban this."

Rep. Mike Levin (D-Calif.) wrote that "prediction markets cannot be a vehicle for profiting off advance knowledge of military action" and demanded "answers, transparency, and oversight."

"Reminder that Donald Trump Jr. sits on Polymarket's advisory board and his firm invested double-digit millions into the platform last year," Levin wrote, referring to the president's eldest son. "The [Justice Department] and [Commodity Futures Trading Commission] both had active investigations into Polymarket that were dropped after Trump took office."

There's no concrete evidence that Trump administration officials or staffers were behind the hugely profitable bets, but the wagers heightened concerns about the possibility of insider trading using increasingly popular prediction market platforms such as Polymarket and Kalshi. Last month, bettors used Polymarket to make big profits on suspiciously timed wagers on when the US would oust Venezuelan President Nicolás Maduro.

Polymarket currently allows users to bet on when Iran will have a new supreme leader, when the US and Iran will reach a ceasefire agreement, and when the US will invade Iran.

The celebrity news tabloid TMZ reported Saturday that "a group at a Washington, DC restaurant was talking openly in the bar area Friday afternoon about a national secret that was about to literally explode hours later—the bombing of Iran."

As journalist David Bernstein noted, that—if true—leaves open the possibility that "these 'insider' bets have been placed by any rich person with good ears in DC."

"Not to mention that for all we know these administration clowns were probably gossiping about it on a text chain with half a dozen people they accidentally invited," Bernstein added. "This is hardly the locked lips brigade we’re dealing with."

Keep ReadingShow Less

Experts Pillory Trump Case for War on Iran: 'Flimsiest Excuse for Initiating a Major Attack' in Decades

"What they posed as the threat they were trying to preempt—an attack by Iran against US forces—is so extremely implausible, it is also laughable," said one analyst.

Mar 01, 2026

Senior Trump administration officials attempted during a briefing with reporters on Saturday to make their case for the joint US-Israeli military assault on Iran that has so far killed hundreds and plunged the Middle East into chaos.

According to experts who listened to the briefing, which was conducted on background, the justification for war was incredibly weak. Daryl Kimball, president of the Arms Control Association, told Laura Rozen of the Diplomatic newsletter that the administration's argument was "the flimsiest excuse for initiating a major attack on another country without congressional authorization, in violation of the UN Charter, in many decades."

During his early Saturday remarks announcing the attacks, President Donald Trump claimed that "imminent threats from the Iranian regime" against "the American people" drove him to act. But Kimball said that administration officials "provided absolutely no evidence" to back that assertion during the briefing.

"What they posed as the threat they were trying to preempt—an attack by Iran against US forces—is so extremely implausible, it is also laughable," said Kimball.

Following the start of Saturday's assault, which Trump explicitly characterized as a war aimed at overthrowing the Iranian government, unnamed administration officials began leaking the claim that Trump feared an Iranian attack on the massive US military buildup in the Middle East, prompting him to greenlight the bombing campaign in coordination with Israel and with a nudge from Saudi Arabia.

Kimball, in a social media post, took members of the US media to task for echoing the administration's narrative. "Reporters need to do more than stenography," he wrote in response to Punchbowl's Jake Sherman.

"The American people were lied to about Iraq. The American people are being lied to again today—and once again, it is ordinary people who will pay the price."

Trump and top administration officials also repeated the longstanding claim from US warhawks that Iran is bent on developing a nuclear weapon, something Iranian leaders have publicly denied—including during recent diplomatic talks. Neither US intelligence assessments nor international nuclear watchdogs have produced evidence indicating that Iran is moving rapidly in the direction of nukes, as claimed by the administration.

Rozen noted that some remarks from administration officials during Saturday's briefing "suggested Trump’s negotiators"—a team that included Jared Kushner and Steve Witkoff—"may not have had the expertise or experience to understand the Iranian proposal to curb its nuclear program." Rozen reported that one administration official kept misstating the acronym for the International Atomic Energy Agency (IAEA), the UN nuclear watchdog.

Trump administration officials, according to Rozen, seemed astonished that Iranian negotiators would not accept the US offer to provide free nuclear fuel "forever" for Iran's peaceful energy development, viewing the rejection as a suspicious indication that Iran was opposed to a diplomatic resolution—even though, according to Oman's foreign minister, Iran had already made concessions that went well beyond the terms of the 2015 nuclear accord that Trump abandoned during his first stint in the White House.

Experts said it should be obvious—particularly given Trump's decision to ditch the previous nuclear accord—why Iran would not trust the US to stick by such a commitment.

The administration's inability to provide a coherent justification for war tracks with the rapidly shifting narrative preceding Saturday's strikes—an indication, according to some observers, that Trump had made the decision to attack Iran even in the face of diplomatic progress and left officials to try to cobble together a rationale after the fact.

In a lengthy social media post, Pentagon Secretary Pete Hegseth insisted war was necessary because Iran "refused to make a deal" and because the Iranian government "has targeted and killed Americans," hardly the claim of an imminent threat push by the president and other administration officials.

Brian Finucane, a senior adviser to the US Program at the International Crisis Group, noted in response that the Trump administration has "sidelined anyone who could articulate... a coherent argument, partly because expertise is deep state and woke and partly because they just don't care."

The result is another potentially catastrophic war that runs roughshod over US and international law, puts countless civilians at risk, and threatens to spark a region-wide conflict.

"President Trump, along with his right-wing extremist Israeli ally Benjamin Netanyahu, has begun an illegal, premeditated, and unconstitutional war," US Sen. Bernie Sanders (I-Vt.) said in a statement on Saturday. "Tragically, Trump is gambling with American lives and treasure to fulfill Netanyahu's decades-long ambition of dragging the United States into armed conflict with Iran."

"The American people were lied to about Vietnam. The American people were lied to about Iraq," Sanders added. "The American people are being lied to again today—and once again, it is ordinary people who will pay the price."

Keep ReadingShow Less

Democratic Leaders Face Backlash Over 'Cowardly' Responses to Trump War on Iran

"As we plunge headlong into another catastrophic war, Sen. Schumer and Rep. Jeffries’ throat-clearing and process critique only serves Trump and the war machine."

Mar 01, 2026

The top Democrats in the US Congress, Senate Minority Leader Chuck Schumer and House Minority Leader Hakeem Jeffries, faced backlash on Saturday over what critics described as tepid, equivocal responses to President Donald Trump's illegal assault on Iran—and for slowwalking efforts to prevent the war before the bombing began.

While both Democratic leaders chided Trump for failing to seek congressional authorization and not adequately briefing lawmakers on the details of Saturday's attacks, neither offered a full-throated condemnation of a military assault that has killed hundreds so far, including dozens of children, and hurled the Middle East into chaos.

Schumer (D-NY)—who infamously worked to defeat the 2015 nuclear deal that Trump later abandoned during his first White House term, setting the stage for the current crisis—said he "implored" US Secretary of State Marco Rubio to "be straight with Congress and the American people about the objectives of these strikes and what comes next."

"Iran must never be allowed to attain a nuclear weapon," he added, "but the American people do not want another endless and costly war in the Middle East when there are so many problems at home."

Jeffries (D-NY), a beneficiary of AIPAC campaign cash, said in his response to the massive US-Israeli assault that "Iran is a bad actor and must be aggressively confronted for its human rights violations, nuclear ambitions, support of terrorism, and the threat it poses to our allies like Israel and Jordan in the region."

"The Trump administration must explain itself to the American people and Congress immediately, provide an ironclad justification for this act of war, clearly define the national security objective, and articulate a plan to avoid another costly, prolonged military quagmire in the Middle East," said Jeffries.

The Democratic leaders' responses bolstered the view that their objections to Trump's attack on Iran are based on procedure, not opposition to war.

This is a disgusting and cowardly statement handwringing about process and the need for a briefing.

No you idiot. This war is a horror and a disaster and must be directly opposed. Any Democrat who can’t say that needs to resign and ESPECIALLY the ones in leadership. https://t.co/CdZoEyNkOy

— Krystal Ball (@krystalball) February 28, 2026

Claire Valdez, a New York state assemblymember who is running for Congress, said that "as we plunge headlong into another catastrophic war, Sen. Schumer and Rep. Jeffries’ throat-clearing and process critique only serves Trump and the war machine."

"Democrats should speak clearly and with one voice: no war," Valdez added.

Schumer and Jeffries both committed to swiftly forcing votes on War Powers resolutions in their respective chambers. But reporting last week by Aída Chávez of Capital & Empire indicated that top Democrats worked behind the scenes to slow momentum behind the resolutions, helping ensure they did not come to a vote before Trump launched the war.

"The preferred outcome of many AIPAC-aligned Senate Democrats, according to a senior foreign policy aide to Senate Democratic Leader Chuck Schumer, is that Trump acts unilaterally, weakening Iran while absorbing the domestic backlash ahead of the midterms," Chávez wrote.

Neither Schumer nor Jeffries backed legislation last year aimed at forestalling US military intervention in Iran.

The top Democrats' responses to Saturday's US-Israeli attacks on Iran, which Trump said would continue "uninterrupted" even after the killing of the nation's supreme leader, contrasted sharply with statements of rank-and-file congressional Democrats—and even some members of leadership—who condemned the president for shredding the Constitution and driving the US into another deadly war that the American public opposes.

Rep. Alexandria Ocasio-Cortez (D-NY), who has been floated as a possible 2028 challenger to Schumer, said Saturday that "the American people are once again dragged into a war they did not want by a president who does not care about the long-term consequences of his actions."

"This war is unlawful. It is unnecessary. And it will be catastrophic," said Ocasio-Cortez. "This is a deliberate choice of aggression when diplomacy and security were within reach. Stop lying to the American people. Violence begets violence. We learned this lesson in Iraq. We learned this lesson in Afghanistan. And we are about to learn it again in Iran. Bombs have yet to create enduring democracies in the region, and this will be no different."

Rep. Rashida Tlaib (D-Mich.), a vice chair of the Congressional Progressive Caucus, was more blunt.

"Congress must stop the bloodshed by immediately reconvening to exert its war powers and stop this deranged president," she said. "But let’s be clear: Warmongering politicians from both parties support this illegal war, and it will take a mass anti-war movement to stop it."

Keep ReadingShow Less

Most Popular