If the Dems Want to Beat Trump, They Should Embrace Medicare for All

If Democrats want to convince voters that they will make their lives better, they need to be identified with policies that will make their lives better.

At a time when we don’t know if we will have real elections in 2026 and 2028, it may seem a bit absurd to be plotting an agenda for Democrats, but it is essential. While polls show approval for US President Donald Trump and Republicans is plummeting, people are not flocking back to the Democrats.

A major reason is that people don’t know what Democrats stand for, other than not being Donald Trump. While that is an important credential, democracy does still mean something to many people, and that alone is not likely to convince voters to come out and pull the Democratic lever.

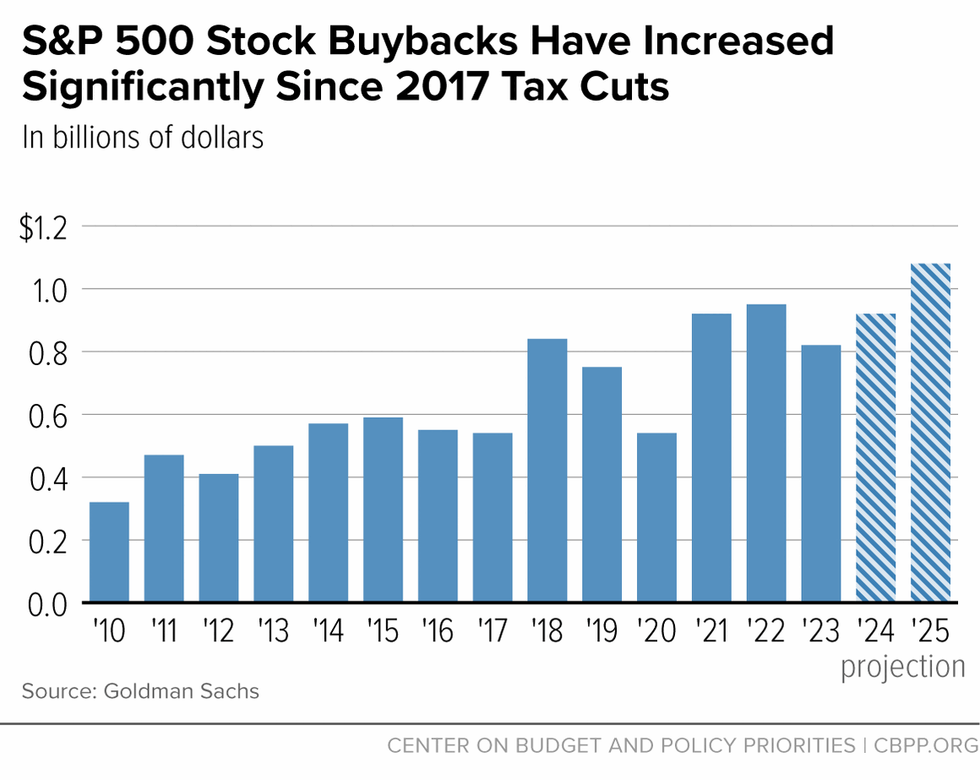

Most people do feel they are being screwed by the rich. They have a good case, which has gotten a lot better in the seven months Donald Trump has been in office. His endless tax breaks for the rich and corporations, coupled with all sorts of government giveaways from his crypto scams to giving the right to dump their crap on our lawns (i.e. pollute without constraints), should convince any doubters that we have a government by and for the rich.

But the Democrats need to make the case that they are something different. That will be hard when so many are openly in bed with crypto scammers and other Wall Street high rollers.

Moving to universal Medicare will be difficult both politically and practically, but it can be done.

If they want to convince voters that they will make their lives better, they need to be identified with policies that will make their lives better. Some of these should be obvious.

Raising the minimum wage to $18 an hour is a straightforward one. Minimum wage hikes always poll well, and when referendums have appeared on the ballot, they win even in heavily Republican states like Arkansas. And there is now extensive research showing that modest increases in the minimum wage do not result in job loss.

Workers want to join unions but are stifled by current labor law. Strong protections for worker rights should go a long way here. Suppose we not only had a worker-friendly National Labor Relations Board, but we also had serious sanctions for violations. I suspect fewer bosses would break the law if they were looking at jail time.

That would at least be symmetric. A union official faces jail time if they ignore a court’s back to work order. It seems an employer who continually breaks the law to obstruct workers’ efforts to organize should face similar consequences.

But an item that really should be top of the list is universal Medicare. This had seemed like a big lift to me and many others, which would require a long phase-in period. But Trump and the Republicans’ radical attack on the current hodgepodge system of providing healthcare, coupled with Trump’s extreme uses of executive power, convinced me that we can move quickly in this direction.

The Budget and the Resources for Universal Medicare

In moving toward universal Medicare, it is important to recognize the distinction between the budgetary implications and the real demands on resources. There is no doubt that a universal Medicare program will require a large amount of additional spending, although the increase can be exaggerated.

We will save at least $400 billion a year (5% of the federal budget) on what we pay the insurance industry to shuffle papers and deny people care. Prescription drugs and other pharmaceutical products would also be cheap if the government didn’t give out patent monopolies for these items. We will spend over $700 billion this year for drugs that would likely cost around $150 billion in a free market. The difference of $550 billion comes to $4,400 per household annually.

Contrary to what is often asserted, government makes drugs expensive. We need less government to make them cheap, not more. The same is true for medical equipment, like scanning machines.

We do need to provide incentives to develop new drugs and equipment, but there are alternatives to granting patent monopolies. We can pay people. The National Institutes of Health and other government agencies used to spend over $50 billion a year on biomedical research.

Insofar as it is necessary to raise revenue, Trump has shown us how easy it can be.

We can triple this sum and make all findings fully open source so that new drugs can be produced as generics the day they are approved. This would both make drugs cheap and eliminate most of the motivation for corruption in the pharmaceutical industry.

It’s also worth pointing out that a major reason insurers are so determined to limit care is the high prices of drugs and medical equipment. If a year’s treatment with a drug costs $100,000, as is the case with some new cancer drugs, an insurer will try to avoid paying it. If the cost were around $1,000, which would likely be the case in the absence of patent monopolies, there would be little concern about using the drug, if a doctor determined it to be the best treatment.

But even moving quickly to bring costs down in the healthcare sector, we will still need considerably more money to pay for a universal healthcare system than what the government pays for our current system. This is a place where Trump’s erratic policies have done us a great service.

First, we need to remember that the actual constraint to the government’s spending is not revenue, it is the availability of real resources. In the case of universal Medicare that means the doctors, physicians’ assistants, nurses, medical technicians, home healthcare aides, and other people who directly provide healthcare to patients.

We currently have over 18 million employed in these jobs. We would need considerably more to adequately meet the country’s healthcare needs. We already have shortages in many occupations, and there is a huge problem of access in rural areas and some inner-city neighborhoods.

We can’t immediately fill this shortfall since many of these fields require years of training. If the country moved to universal Medicare, radically ramping up training programs in healthcare fields should be a top priority. We need to go the Immigration and Customs Enforcement route here and offer huge recruitment bonuses. People can be paid tens of thousands of dollars for entering and then completing programs in physical therapy, nursing, and other health-related fields.

We also should be turning to foreign countries for assistance. There already are large numbers of immigrants working in healthcare in the United States. The Trump administration is hard at work deporting many of them. That will make it more difficult to attract foreign healthcare workers in the future, but hopefully a progressive Democratic administration can convince the world that the United States has returned to sanity.

There is an issue that by bringing large numbers of healthcare workers to the United States, especially doctors, we will be depriving poorer countries of desperately needed healthcare providers. There is a simple answer to this. We pay these countries to train two or three healthcare workers for every one that comes here.

This is a classic story of the winners from trade compensating the losers that economists always talk about when pushing trade deals through Congress, but never actually happens after they take effect. The logic is actually solid; the problem is the political will. Anyhow, we can give this compensation and create a win-win situation, if there is political support for it.

Getting back to the budget situation, the problem from large deficits is that they can push the economy beyond its capacity and lead to inflation. That doesn’t seem to be the problem at present, where the economy is showing considerable weakness. It’s hard to say what the world will look like if and when a progressive Democratic administration comes into power.

Insofar as it is necessary to raise revenue, Trump has shown us how easy it can be. He set the country on a course to raise close to $400 billion a year in taxes (more than $4 trillion over a decade), without even getting approval from Congress.

His method of ad hoc tariffs is probably about the worst way to raise revenue, but it does show that it is possible to raise large amounts of revenue. The better routes would be raising income taxes on high-end earners and a corporate income tax that we actually collect. (Either mandate companies give the government non-voting shares of corporate stock, or make returns to shareholders the basis for the income tax; proposals that are too simple for great policy minds to understand.)

We also should apply a modest sales tax to stock trades of say 0.1%. This will hugely reduce the bloat in the financial sector and cost the vast majority of households nothing. The politicians whining that a middle-class family with $400,000 in a 401(k) could end up paying another $100 a year in taxes should be told to eat shit and die. They are shilling for Wall Street: full stop.

Anyhow, the dire budget calculations showing that if we never do anything about deficits, in 2040 or 2050 we will have an incredibly high interest burden might be a good way to employ budget wonks, but they should not be treated as serious basis for policy. We can and do change budgets all the time, and if we do face problems where deficits are pushing the economy beyond its capacity, we know how to raise taxes and, if need be, cut less useful spending.

Moving to universal Medicare will be difficult both politically and practically, but it can be done. Democrats really should have it at the center of their political agenda.