Report Details How Trump Economic Agenda ‘Will Make Ordinary Families Reliably Poorer in the Future’

In just one year, Republicans' 2025 budget package is expected to increase income inequality at quadruple the rate seen over the past 40 years.

President Donald Trump's economic agenda "will make ordinary families reliably poorer in the future," according to the author of a report published Tuesday by the Economic Policy Institute.

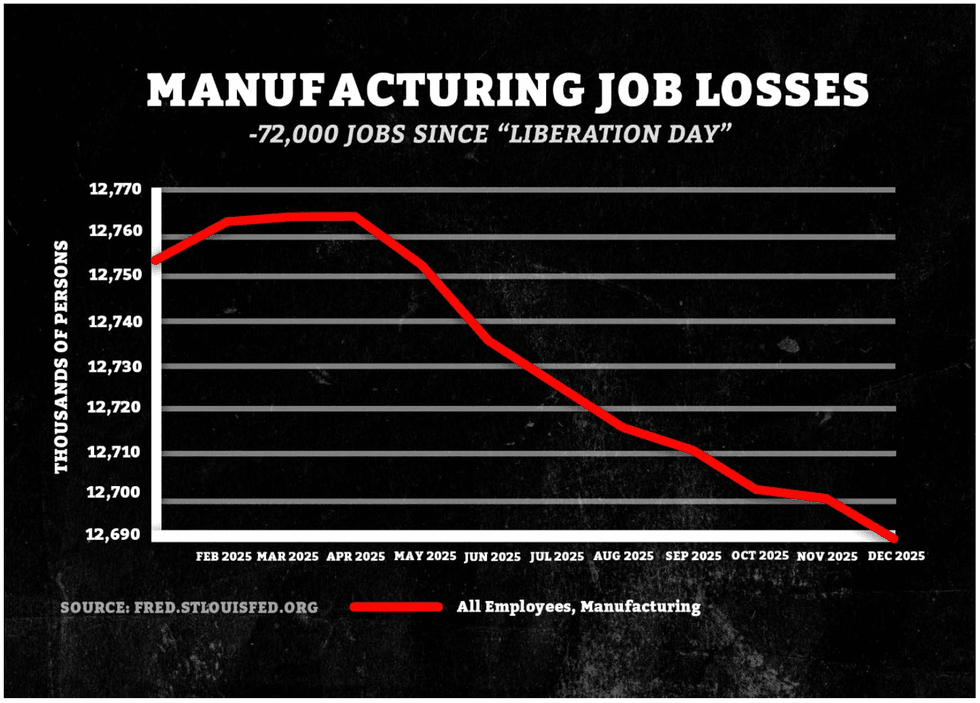

Josh Bivens, EPI's chief economist, said Trump's slashing of federal spending and jobs, mass deportations, chaotic tariffs, and anti-labor policies were suppressing hiring and wages, draining household and business spending, and slowing economic growth.

While a recession is not yet inevitable, Bivens argued that worrying signs are already on the horizon, with 1.4 million fewer new jobs than expected in 2025 and unemployment ticking up to 4.4%, up from the low of 3.4% in April 2023.

For low-wage earners, the past year has been particularly rough. After seeing unusually fast growth during the presidency of Joe Biden, real wages for the bottom 10% of earners fell by 0.3% in 2025.

The report predicts that Republicans' 2025 budget package will reduce “aggregate demand” in the coming years. The so-called One Big Beautiful Bill Act cuts $100 billion annually from Medicaid and the Supplemental Nutrition Assistance Program (SNAP), while allowing health insurance subsidies that saved families thousands to expire, which the report projects will cause many families who rely on these benefits to pull back spending in the economy.

While the law reduced taxes, the vast majority of those benefits went to the wealthiest earners, whose spending was already much less constrained by their incomes.

The report notes the astonishing increase in inequality caused by the law. Between the years of 1979 and 2019, which were considered to have seen an explosion of wealth inequality, the share of income claimed by the richest 10% increased by about 0.25% per year.

It found that the GOP budget law will, in just one year, increase the top decile's share of wealth by a full percentage point. In other words, the rate of inequality will "quadruple in its first year."

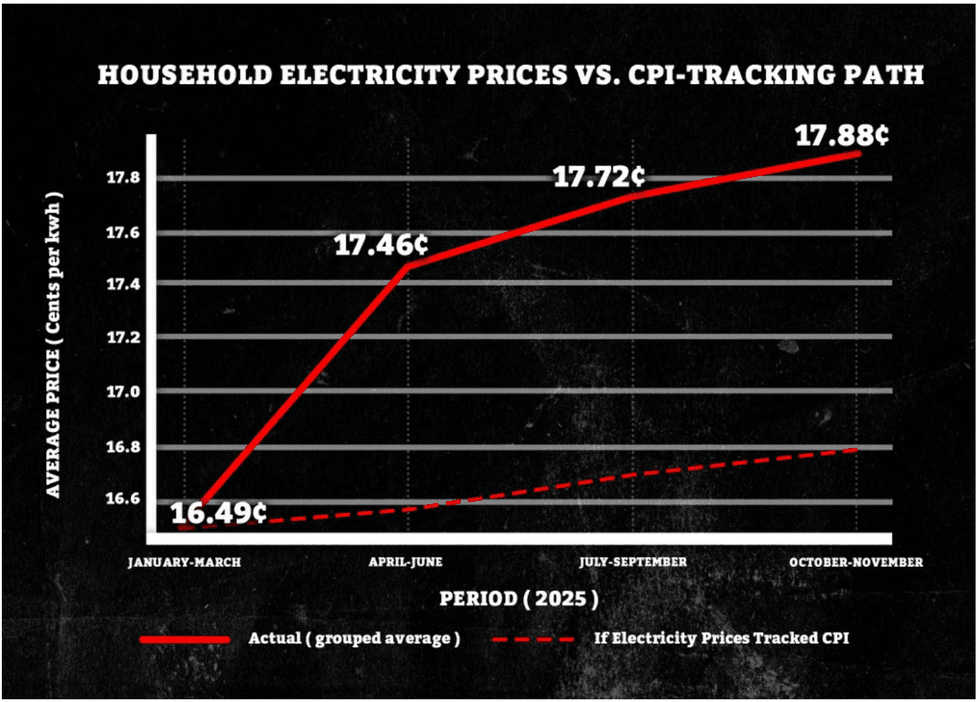

Aside from this major driver of inequality, the report also says that the Trump administration's hostility toward collective bargaining rights and its mass firings of federal workers would further suppress wages by making the labor market less competitive, and that the president's erratic tariff regime would make those wages less valuable by fueling inflation.

“Disastrous policy choices that led to excess unemployment, slower growth in the economy’s productive capacity, and rising inequality have made life less affordable for typical families in recent decades," Bivens said. "The Trump administration’s policies double down on the worst policy decisions of this period and will make ordinary families reliably poorer in the future, even if an outright recession or spiking inflation does not happen."

(Image from Senate Committee on Small Business and Entrepreneurship report Pain Street)

(Image from Senate Committee on Small Business and Entrepreneurship report Pain Street) (Image from Senate Committee on Small Business and Entrepreneurship report Pain Street)

(Image from Senate Committee on Small Business and Entrepreneurship report Pain Street) (Image from Senate Committee on Small Business and Entrepreneurship report Pain Street)

(Image from Senate Committee on Small Business and Entrepreneurship report Pain Street)