"While pushing for more tax cuts to line their own pockets," the report notes, "many of the richest Republican members are pushing for draconian cuts to the very social programs that millions of their constituents rely on," including federal student aid, Medicaid, and the Supplemental Nutrition Assistance Program (SNAP).

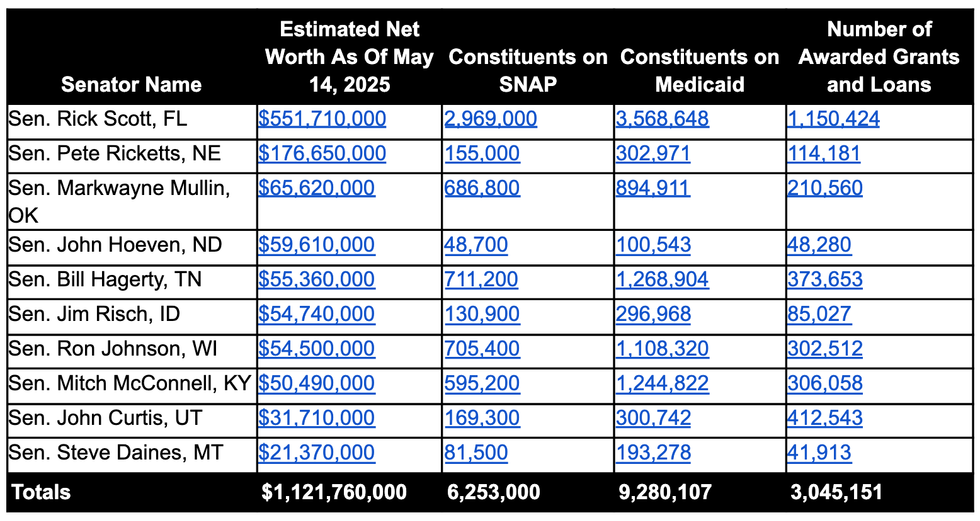

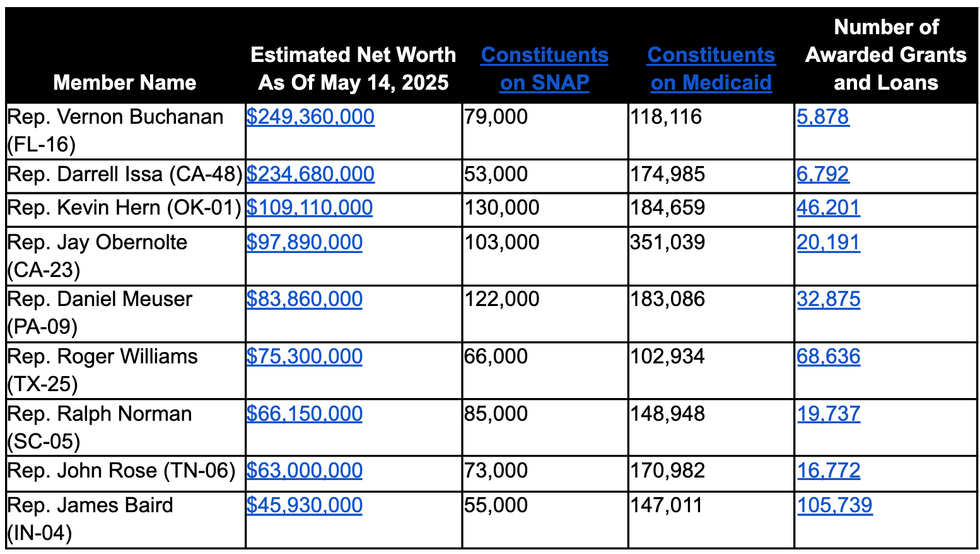

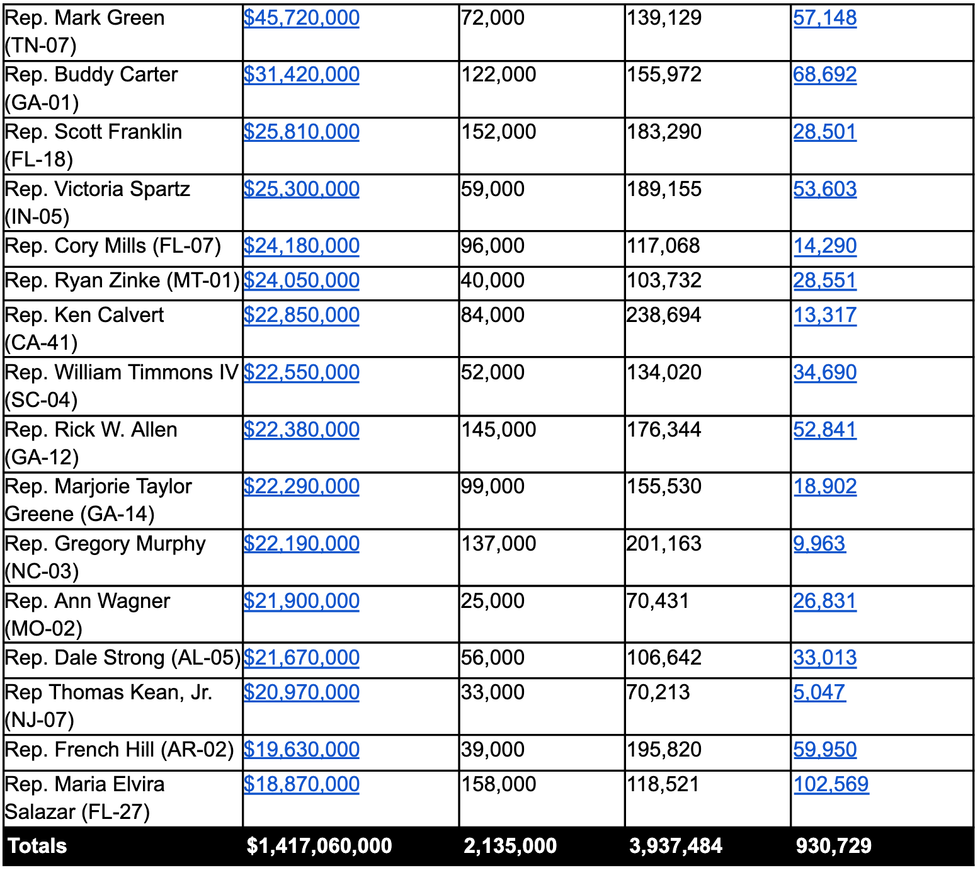

According to Accountable.US, "6.3 million constituents represented by the top 10 richest senators and 2.1 million constituents represented by the top 25 richest representatives use SNAP and are at risk of losing their food security."

Additionally, "9.2 million constituents represented by the top 10 richest senators and 4 million constituents represented by the top 25 richest representatives use Medicaid and are at risk of losing critically needed healthcare," the report warns.

The watchdog also found that 3 million and 930,000 federal student aid grants were given to constituents within these lawmakers' states and districts, respectively, and proposed cuts threaten "to price students out of pursuing higher education."

The richest Republican senator, by a significant margin, is Sen. Rick Scott of Florida, who made his money from the nation's for-profit healthcare system before serving as governor of his state. As of mid-May, his estimated net worth was around half a billion dollars, according to the new report.

Nine of the 10 senators—all but Sen. John Curtis (R-Utah)—"sit on five committees instrumental in shaping budget reconciliation," the report points out, as the upper chamber

takes up the package following its passage in the House last week.

"As Trump's Big Beautiful Bill moves to the Senate, we must make it clear: There is nothing 'beautiful' about giving huge tax breaks to billionaires while cutting healthcare, nutrition, and education for working families. It is grossly immoral and, together, we must defeat it," Sen. Bernie Sanders (I-Vt.), who has been traveling the country for his Fighting Oligarchy Tour,

said on social media Tuesday.

Just two House Republicans, Reps. Thomas Massie of Kentucky and Warren Davidson of Ohio, joined Democrats in opposing the bill, and GOP Rep. Andy Harris of Maryland, chair of the House Freedom Caucus, voted present.

All other Republicans present voted in favor of the bill—even though, as Accountable.US detailed last week, a dozen

wrote to GOP leadership last month saying that they represent "districts with high rates of constituents who depend on Medicaid," so they "cannot and will not support a final reconciliation bill that includes any reduction in Medicaid coverage for vulnerable populations."

The watchdog

stressed that six of those Republican lawmakers—Reps. Rob Bresnahan of Pennsylvania, Rob Wittman of Virginia, Jen Kiggans of Virginia, Young Kim of California, Juan Ciscomani of Arizona, and Jeff Van Drew of New Jersey—could directly benefit from the expansion of the "pass-through deduction" in the package.

Meanwhile, Tuesday's report calls out the richest House GOP members, led by Rep. Vern Buchanan of Florida, and Rep. Darrell Issa of California, who are each worth nearly a quarter-billion dollars.

"The One Big Beautiful Bill Act is the definition of promises made and promises kept," Buchanan, vice chair of the House Ways and Means Committee,

said in a statement after last week's vote. "This is a commonsense, pro-growth, pro-family, America First bill. We will not stop fighting until we get this bill across the finish line and to the president's desk."

Of the top 25 Republicans in the House, by estimated net worth, 19 sit on five key panels, the report states.

"The richest Republicans in Congress are happy to raise costs for millions of their own constituents and jeopardize healthcare for millions more, while they get a tax cut for themselves," said Accountable.US executive director Tony Carrk in a statement. "The Trump tax scam is a grift for the ultrarich, including those who are in charge of passing this legislation themselves, and a betrayal to hardworking Americans everywhere."