'Disgusting Act of Corruption': Trump Sues IRS, Treasury for $10 Billion Over Tax Return Leak

"While Trump is weaponizing taxpayer privacy laws for his own benefit, his Treasury Department is flouting those exact same laws to send tens of thousands of individual tax records to his anti-immigrant henchmen at ICE."

President Donald Trump has sued the US Treasury Department and Internal Revenue Service for $10 billion over the leak of his tax returns during his first term in the White House, when the president broke with decades of tradition by refusing to voluntarily divulge the records.

The lawsuit—joined by Trump's two eldest sons and his family business, the Trump Organization—was revealed Thursday in a filing with the Miami division of the US District Court for the Southern District of Florida. The suit alleges that the IRS and Treasury Department "caused Plaintiffs reputational and financial harm, public embarrassment, unfairly tarnished their business reputations, portrayed them in a false light, and negatively affected President Donald Trump and the other Plaintiffs' public standing."

Charles Littlejohn, a former IRS contractor who was employed by Booz Allen Hamilton, pleaded guilty in late 2023 to one count of unauthorized disclosure of tax return information and was later sentenced to up to five years in prison.

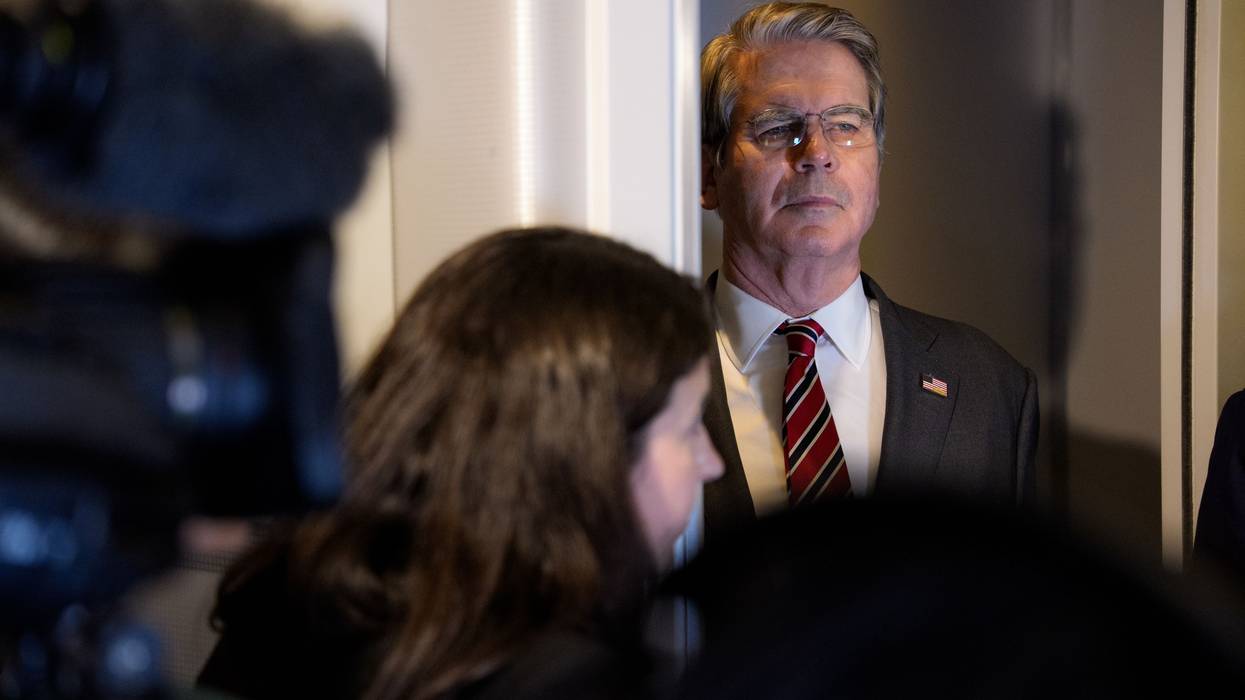

The US Treasury Department, led by Scott Bessent, announced earlier this week that it was canceling all of its contracts with Booz Allen Hamilton, accusing the company of failing to "implement adequate safeguards to protect sensitive data, including the confidential taxpayer information it had access to through its contracts with the Internal Revenue Service."

The leak included the tax records of Trump and other mega-rich Americans, including Amazon founder Jeff Bezos and Tesla CEO Elon Musk. The New York Times, which obtained the records along with ProPublica, reported in 2018 that the returns showed Trump engaged in "outright fraud" and other "dubious" schemes to avoid taxation.

Trump, according to the Times investigation, "paid $750 in federal income taxes in 2016, the year he was elected president, and... he had not paid any income taxes in 10 of the previous 15 years."

US Sen. Ron Wyden (D-Ore.), the top Democrat on the Senate Finance Committee, said in response to the president's lawsuit that “Donald Trump is a cheat and a grifter to his core, and for him to abuse his office in an attempt to steal $10 billion from the American taxpayer is a shameless, disgusting act of corruption."

"While Trump is weaponizing taxpayer privacy laws for his own benefit, his Treasury Department is flouting those exact same laws to send tens of thousands of individual tax records to his anti-immigrant henchmen at ICE," Wyden continued. "It is the height of hypocrisy for Trump to pretend he cares one bit about taxpayer privacy."

Journalist Tim O'Brien, who has covered Trump for decades, called the lawsuit "a flagrant and obvious conflict of interest."

"Trump oversees the IRS. He wants the IRS to pay him a big chunk of change," O'Brien wrote on social media. "He is, and always has been, in it for the money."

The lawsuit isn't the first time Trump has sought a large sum of taxpayer money from a federal agency during his second term in office. Last year, Trump demanded via an administrative claims process that the US Justice Department pay him roughly $230 million in compensation for federal investigations he has faced.

Trump launched his attempt to wring $10 billion in taxpayer money out of the Treasury Department and IRS as he and his allies worked to gut the tax agency, leaving it with inadequate staff and resources to audit wealthy individuals and large corporations. The IRS is currently headed by Frank Bisignano, who was named "chief executive officer" of the agency late last year.

In a letter to Bessent and Bisignano earlier this week, Wyden and a group of fellow Senate Democrats warned that "the administration’s plans for the IRS"—including painful budget cuts—"will shift the burden of audits more heavily onto working Americans while giving rich scofflaws and big businesses a green light to cheat on their taxes."

"The administration has failed to detail any serious plan to avoid that unfair outcome," the senators warned.