Insurance Giant Chubb Breaks 2019 Coal Pledge: Report

"It's absurd for Chubb to continue to underwrite activities that are causing climate change and then turn around and pay for the claims and payouts caused by these activities," said one critic.

Chubb's 2019 decision to stop underwriting new coal projects or offering policies to businesses that generate more than 30% of their revenue or energy production from the fossil fuel was welcomed as a "major step forward" that could pressure other insurance giants to follow suit—but six years later, Wednesday reporting revealed that the company "has reversed its stance."

"It appears to have broken that pledge last week by reinsuring Nghi Son 2, a 1.2GW power plant on Vietnam's coast fueled entirely by coal," The Bureau of Investigative Journalism detailed. "Nghi Son 2 could emit up to 175 million metric tons of CO2 over 25 years—more than the annual emissions of the Philippines—according to Global Energy Monitor, which tracks energy data."

While Chubb CEO Evan Greenberg said six years ago that the company recognizes the reality of climate change and the substantial impact of human activity on our planet," neither the insurer nor Nghi Son 2 Power responded to the outlet's requests for comment.

Meanwhile, Giovanna Eichner, shareholder advocate at Green Century Capital Management, which holds shares in the insurer, said that "it's absurd for Chubb to continue to underwrite activities that are causing climate change and then turn around and pay for the claims and payouts caused by these activities."

In fact, the outlet highlighted, Chubb stopped covering wildfire-prone areas of California in 2021. Experts at the advocacy groups As You Sow and the Consumer Federation of America called out Chubb for contravening its coal policy—and doing so while ditching customers who need coverage in the face of extreme weather made worse by the continued use of fossil fuels.

Chubb, one of the world’s largest insurers, was one of the first to stop covering coal-projects, pledging to ‘do its part as a steward of Earth’But it has now become the lead reinsurer for a coal-fired power plant in Vietnam

[image or embed]

— The Bureau of Investigative Journalism (@tbij.bsky.social) July 23, 2025 at 7:07 AM

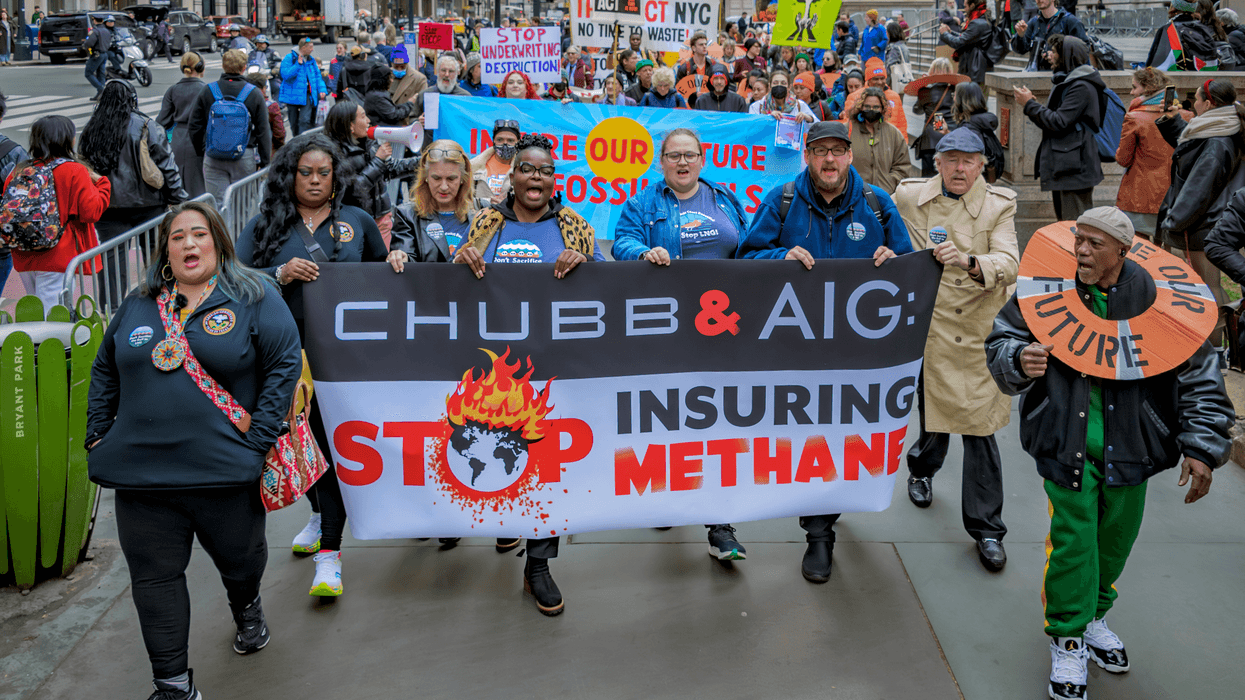

It's not immediately clear what Chubb's reported move in Vietnam will mean for other decisions. For example, as with the 2019 coal announcement, the insurer was praised by climate, environmental, and Indigenous rights defenders last year for abandoning a highly controversial methane gas project on the Texas Gulf Coast after facing months of grassroots community pressure.

Wednesday's reporting comes after a working paper published last month by a trio of researchers at the University of Zurich explained that insurers adopting restrictions on coal were accelerating the shift away from it.

Writing about the findings on Substack, longtime climate campaigner Peter Bosshard noted that "the Insure Our Future campaign has pressured the insurance industry to shift away from coal and other fossil fuels since 2017. We have seen a lot of anecdotal evidence that the restrictions which insurers adopted during this period have created bottlenecks for coal companies and made it impossible to build new coal power plants in much of the world."

"Through freedom of information requests, the Zurich researchers managed to access 9,745 insurance policies across 456 mines during the 2014-24 period, covering more than three-quarters of U.S. coal production," he continued. "Based on this data, they can for the first time offer hard evidence on the impact of insurers' coal restrictions."

While the paper identifies two exceptions to the overall trend—Lloyd's and Zurich—the researchers still concluded that insurers' policies can limit coal mining activity. Given that, Bosshard asserted that "insurance companies should use their clout to accelerate not just the shift away from coal, but also from oil and gas."