Larger Sums, Lagging Standards

From FY2017 to 2023, the IFC trade finance portfolio saw a hefty 86% increase. In FY2023, trade finance amounted to 58% of the IFC’s total portfolio. (Trade finance refers to a range of financial instruments and services designed to facilitate international trade. It provides liquidity and risk mitigation for exporters and importers, enabling transactions that might otherwise not be viable. Instruments such as letters of credit, guarantees, and working capital loans ensure that buyers and sellers can engage in global trade with reduced financial risks.)

The private sector’s profit orientation is incompatible with the World Bank Group’s public service mandate.

While the sums for trade finance are growing exponentially, the checks and norms for their disbursal are stagnating. The environmental and social standards that apply to trade finance have not been updated for at least a decade, and financial flows are shrouded in mystery.

The stated goal of ending poverty on a livable planet presupposes transparency, accountability and sustainability. And yet the meteoric rise of IFC trade finance transactions in recent years comes with opacity, outright unwillingness to disclose basic information about individual transactions, and the long shadow of fossil fuel favoritism.

More Trade Finance for More Fossil Fuels

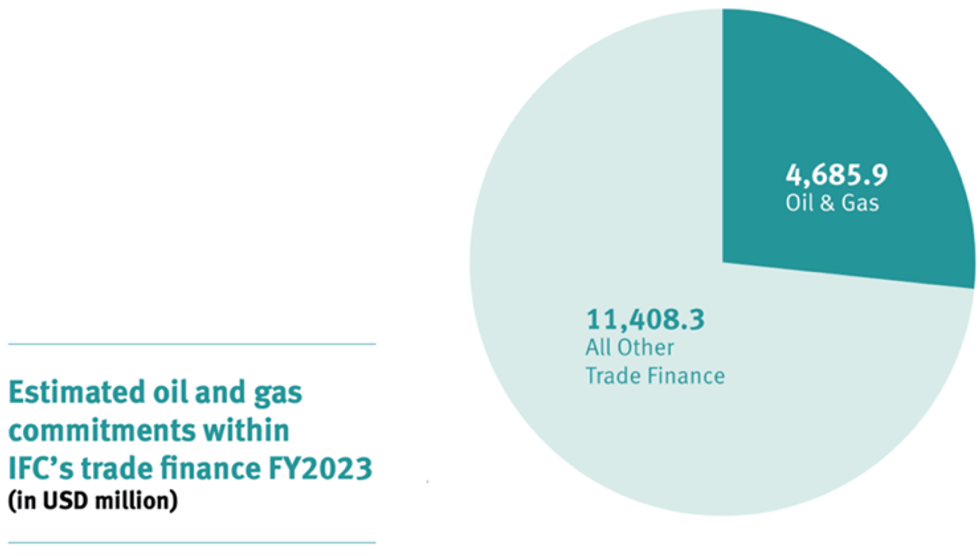

So, what’s the number? In FY2023, $4.7 billion, or nearly one-third of total IFC trade finance commitments, may have supported fossil fuel-related projects. This figure represents a 28% increase compared to FY2022.

The Global Trade Finance Program (GTFP) alone accounted for $3.7 billion of possible oil and gas-related financing, 41.7% of its total commitments. Transparency issues persist as the IFC fails to disclose detailed information about specific trade transactions and beneficiaries.

The World Bank Group’s own Independent Evaluation Group (IEG) indicates that in the past, significant shares of IFC trade finance investments

went into fossil fuel financing, particularly in Africa (50%) and the Middle East (28%).

Money Out the Private Sector Window

The dangerous trend of enabling fossil fuel transactions in fragile countries expands when we look at the IFC Private Sector Window (PSW). It was established in 2017 to encourage private sector investments in high-risk, low-income countries, particularly in IDA-designated regions. The PSW provides risk-sharing mechanisms and facilitates trade finance and other investments that might otherwise be deemed too risky. Between FY2020 and FY2024, $1.03 billion, or about a quarter of PSW approvals, were allocated to trade finance projects. These funds enabled $5.1 billion in trade finance, underscoring the PSW’s leveraged impact.

This fivefold impact, however, remains controversial. Despite its commitment to sustainable development, the PSW lacks exclusion criteria for fossil fuels. Thus, it allows for investments in oil and gas. Transparency remains a significant issue, and information about specific projects and the traded commodities is sparse. PSW-supported trade finance’s environmental and developmental impacts are questionable at best.

Pitting Private Sector Logic Against Public Sector Goals

Many of these problems precede President Banga’s tenure. However, it is vital to highlight and address them now because his laser focus on mobilizing private capital is likely to exacerbate the issues highlighted above. The private sector’s profit orientation is incompatible with the World Bank Group’s public service mandate. The IFC’s growing trade finance portfolio highlights the organization’s critical role in shaping global trade. The significant share of fossil fuel commitments in that portfolio undermines the World Bank Group’s mission of fostering sustainable development.

To align with international climate objectives, the IFC must adopt urgent reforms to enhance transparency; exclude harmful investments; and prioritize clean, fair, decentralized renewable energy—especially in poor and high-risk regions of the world that need them most. To better align the PSW with its mission, the allocation of Private Sector Window funds should prioritize renewable energy and sustainable development projects. Additionally, stringent exclusion criteria and improved reporting standards should ensure greater accountability and alignment with climate and social goals.

These changes are clearly at odds with President Banga’s agenda, and yet only through them can the World Bank Group stay true to its noble goals.