Maine Progressive Matt Dunlap Launches Bid for Jared Golden's US House Seat

"I’m running because Mainers deserve a fighter who won’t cave to Donald Trump. Jared Golden said Trump is ‘OK’ and that we’ll be ‘just fine’ but Mainers are being hurt by his policies."

Maine Auditor Matt Dunlap on Monday launched a Democratic primary campaign against US Rep. Jared Golden, citing the incumbent congressman's frequent siding with President Donald Trump and Republicans and promising a "People's Agenda" that centers working-class needs.

"I’m running because Mainers deserve a fighter who won’t cave to Donald Trump," Dunlap, who is also a former Maine secretary of state, said in a statement announcing his candidacy. "Jared Golden said Trump is ‘OK’ and that we’ll be ‘just fine’ but Mainers are being hurt by his policies."

"Golden has repeatedly sided with Trump, even when it means that healthcare costs will skyrocket for thousands of Mainers," Dunlap added. "When I’m in Congress, I’ll stand up for Maine, and I’ll fight for affordable healthcare, a lower cost of living, and higher wages for hardworking people.”

Dunlap's platform—which includes Medicare for All and universal childcare—stands in stark contrast with Golden's record as the sole House Democrat to vote against unemployment benefits, child tax credits, and affordable healthcare in the American Rescue Plan pandemic relief package signed by former President Joe Biden in 2021.

Golden was also the only House Democrat who voted for Republicans' government funding bill last month, blaming "hardball politics driven by the demands far-left groups" for the ongoing government shutdown.

Taking aim at both Golden and former Gov. Paul LePage, the likely Republican nominee, Dunlap said in his first campaign ad that "we can do better than bad and worse."

The ad also highlights Dunlap's purported accessibility, a sore spot among voters who accuse Golden of dodging his constituents by refusing to hold town hall meetings.

Dunlap faces a steep uphill battle in a district that Trump won by 9.6% in 2024.

“If Matt Dunlap thinks this district will choose him over Paul LePage, he’s got another thing coming,” Golden said in response to Monday's announcement.

LePage campaign spokesperson Brent Littlefield welcomed Dunlap's entry into the race, saying the progressive candidate "sees what we see, Jared Golden is hiding."

"From Aroostook to Oxford and every county in between, Maine people say they never see Jared Golden in their towns or communities," he added.

Dunlap already has a history of clashing with Trump. During his first term, the president appointed the then-secretary of state to a bipartisan panel tasked with investigating alleged voter fraud. Dunlap sued the commission to obtain files he said were being withheld from him. A judge ruled in his favor; Trump subsequently shut down the commission.

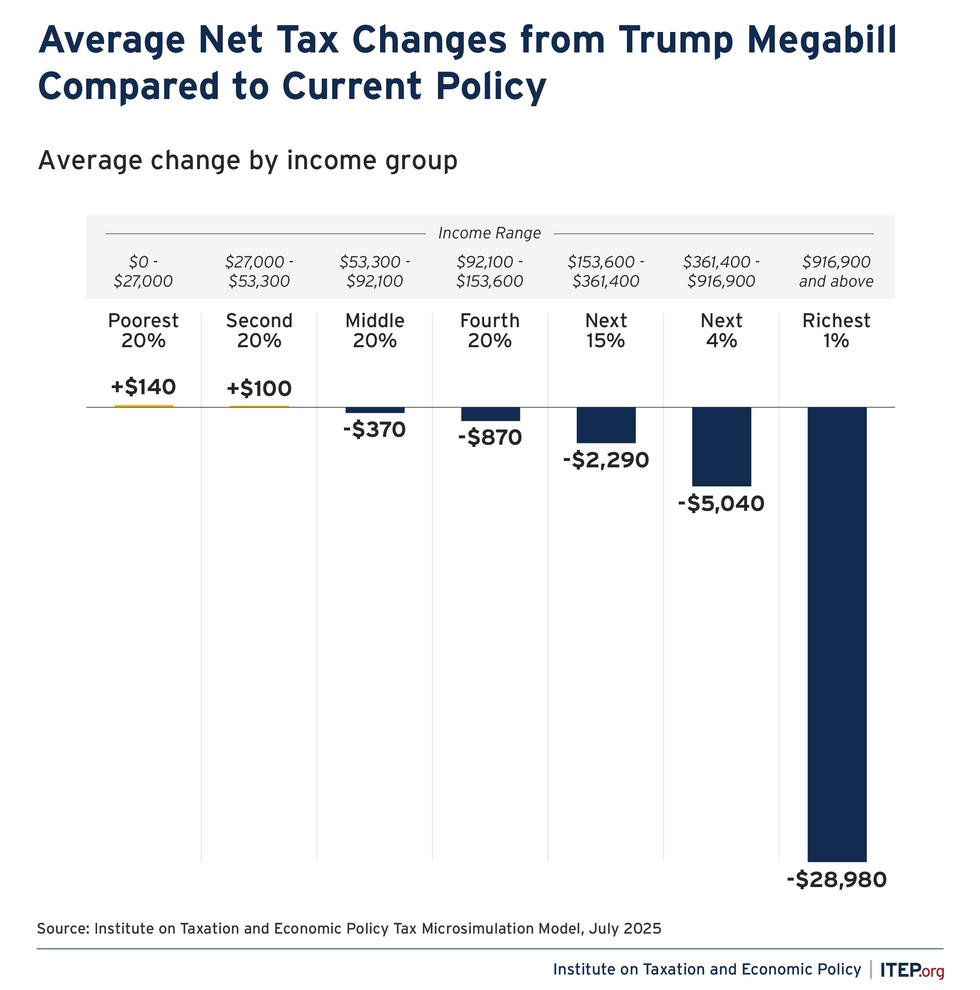

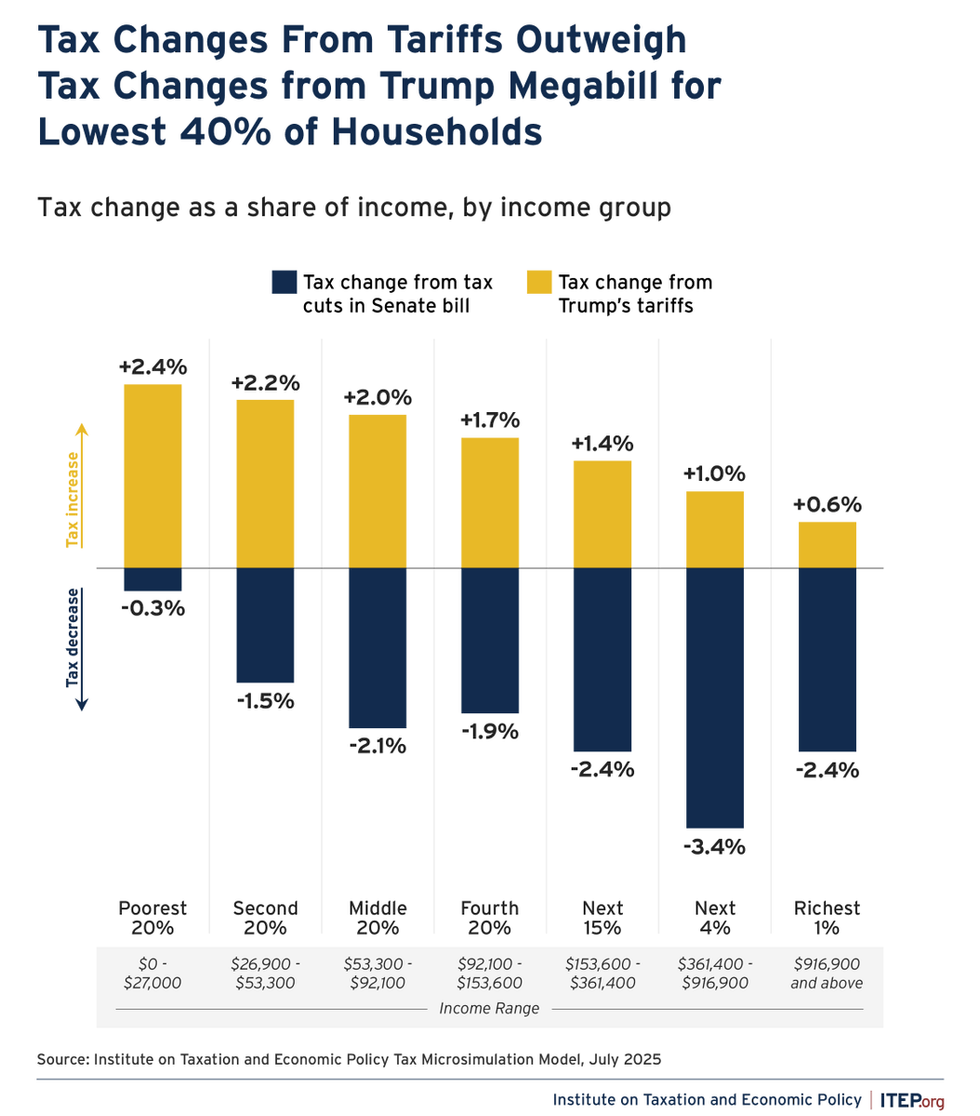

(Chart: Institute on Taxation and Economic Policy)

(Chart: Institute on Taxation and Economic Policy)  (Chart: Institute on Taxation and Economic Policy)

(Chart: Institute on Taxation and Economic Policy)