SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

President Donald Trump signs H.R. 1: "One Big Beautiful Bill" from the South Lawn of the White House on Independence Day, July 4, 2025 in Washington, D.C.

"The central fiscal priority in the megabill is to reward the wealthiest Americans with even more tax cuts, but to try to disguise that as a boon for working families," one policy expert told Common Dreams.

The Republican budget law that passed earlier this month—which hands out lavish tax breaks to the wealthiest Americans—will result in increased taxes on the poorest 40% of the country's poorest as early as 2026.

Many of low-income Americans will already see net losses to their income due to the law's drastic cuts to Medicaid and food stamps. However, most of those cuts will not begin to hit for multiple years.

But the lawmakers also allowed an enhancement of tax credits that helped millions of Americans pay for health insurance to expire and those effects will be felt much sooner, according to a study published Tuesday by the nonpartisan Institute on Taxation and Economic Policy (ITEP)

That enhancement—passed in 2021 as part of the American Rescue Plan and extended until 2025 by the Inflation Reduction Act—provided nearly 20 million low- and moderate-income Americans who purchased health insurance on state and federal exchanges with tax relief that significantly shrunk their insurance premiums.

According to the Center on Budget and Policy Priorities, recipients saved over $700 on average on their insurance premiums as a result of the tax breaks.

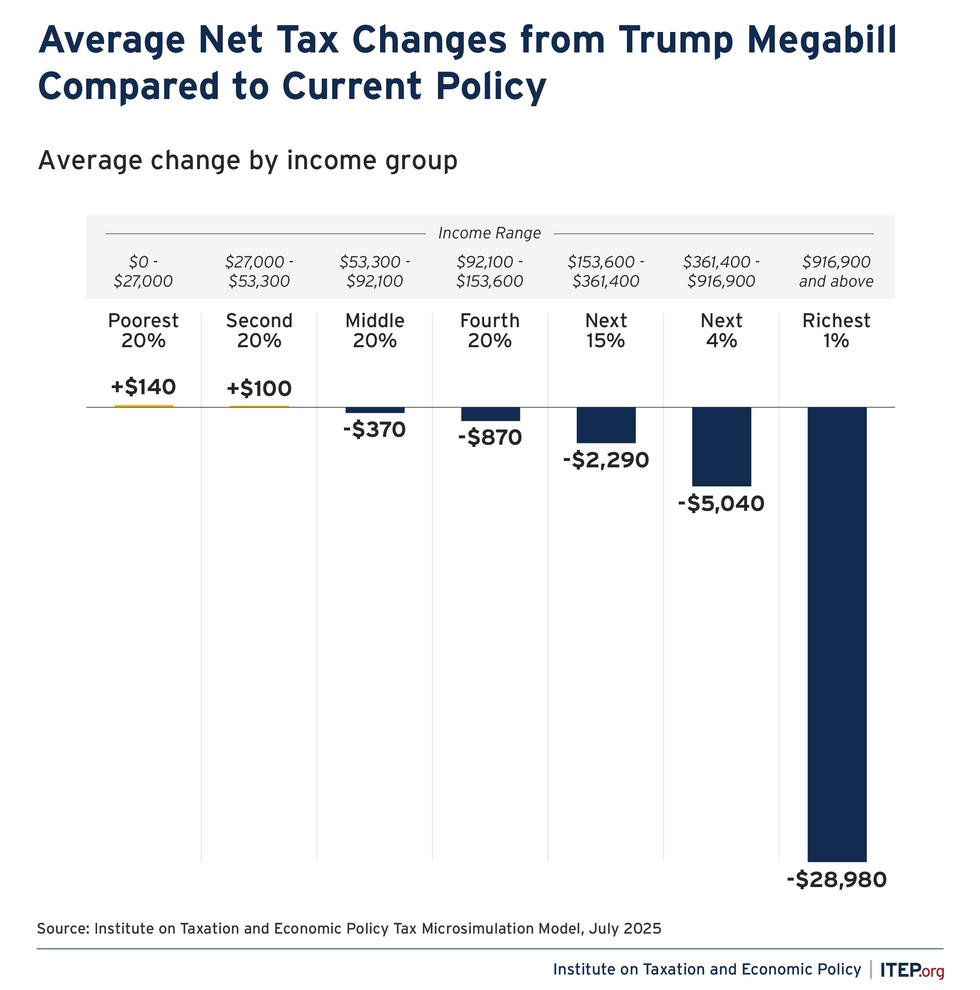

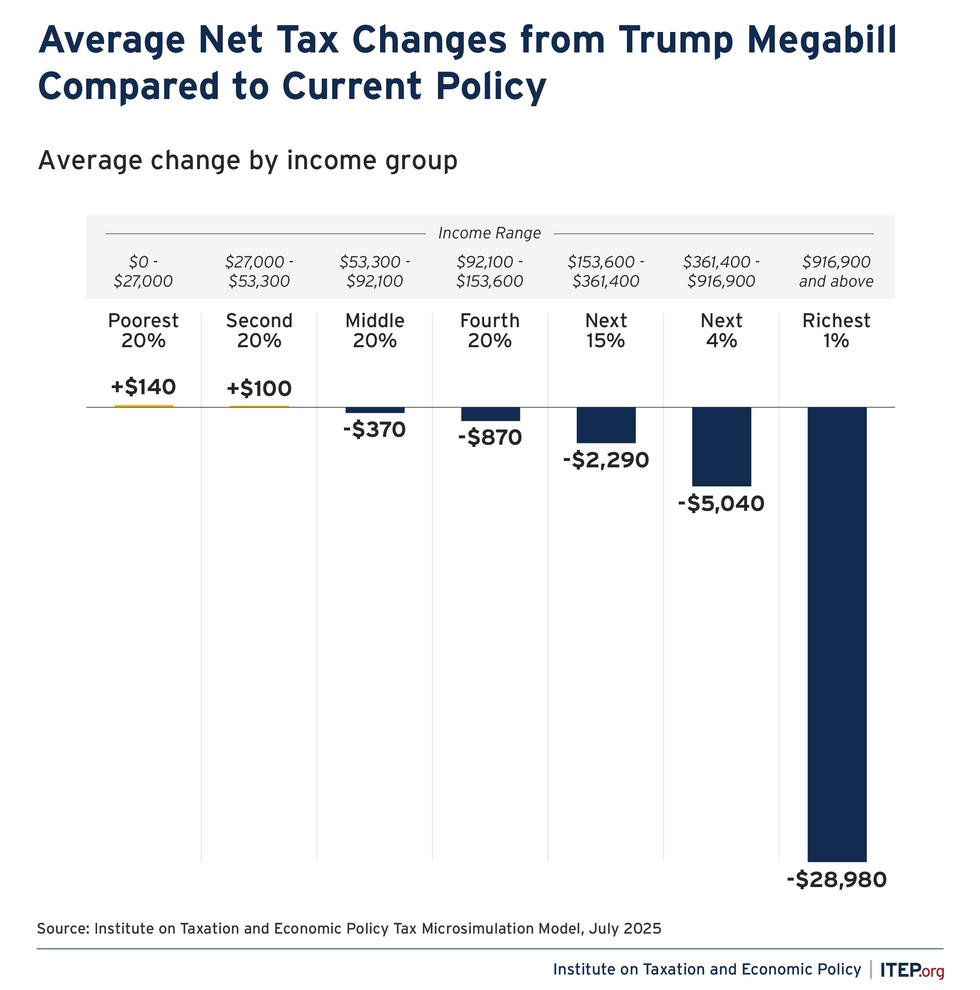

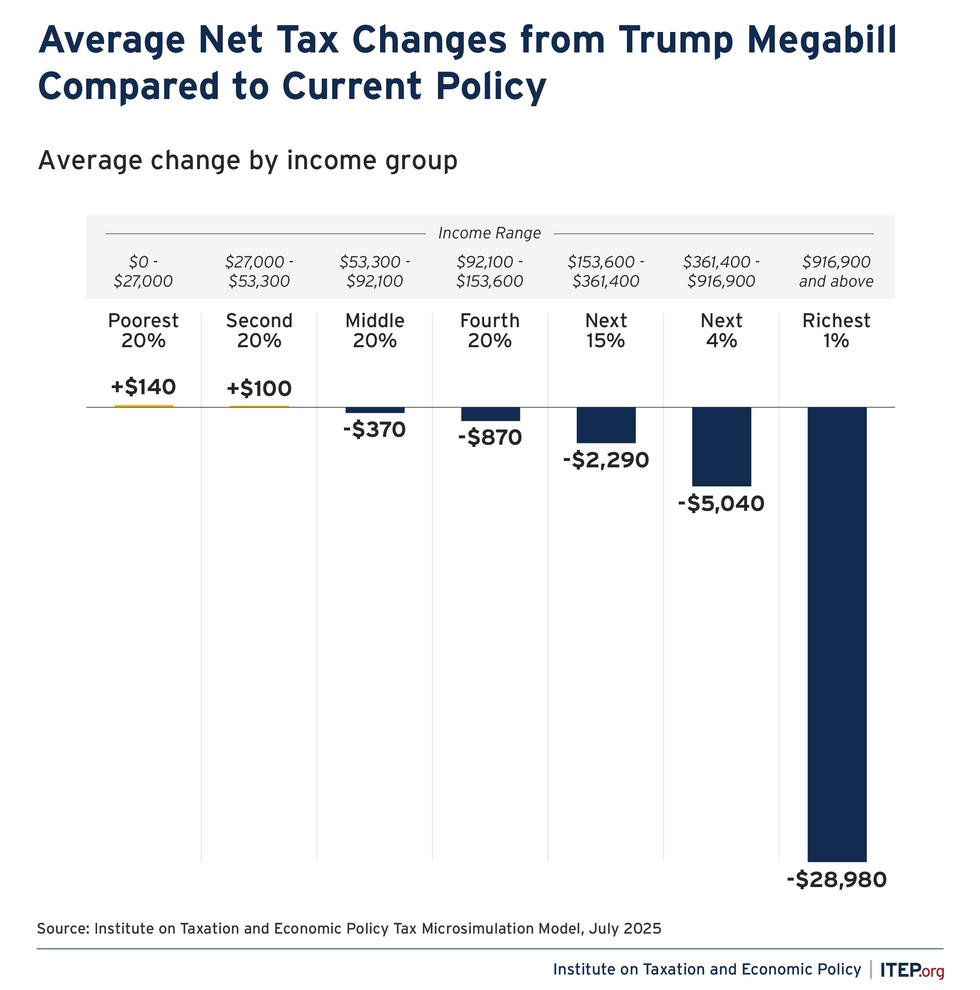

Largely as a result of this policy change, the ITEP study projects that the poorest 20% of Americans will end up paying $140 more on average than they paid before the law passed as soon as next year. The next poorest 20% will end up paying $100 more.

An estimated 4.2 million are also expected to lose health insurance as a result of the change, according to the Congressional Budget Office (CBO), adding to the 10 million it estimates will lose insurance due to Medicaid cuts.

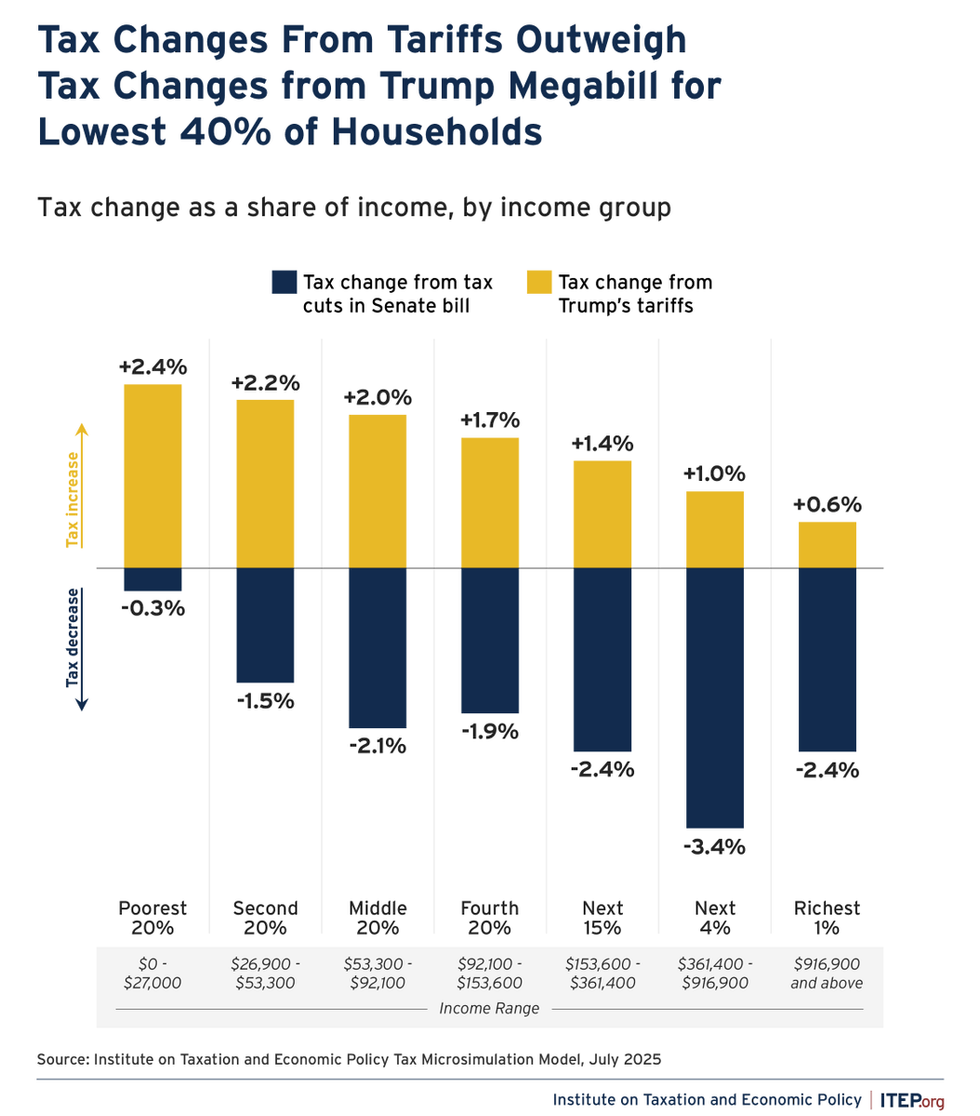

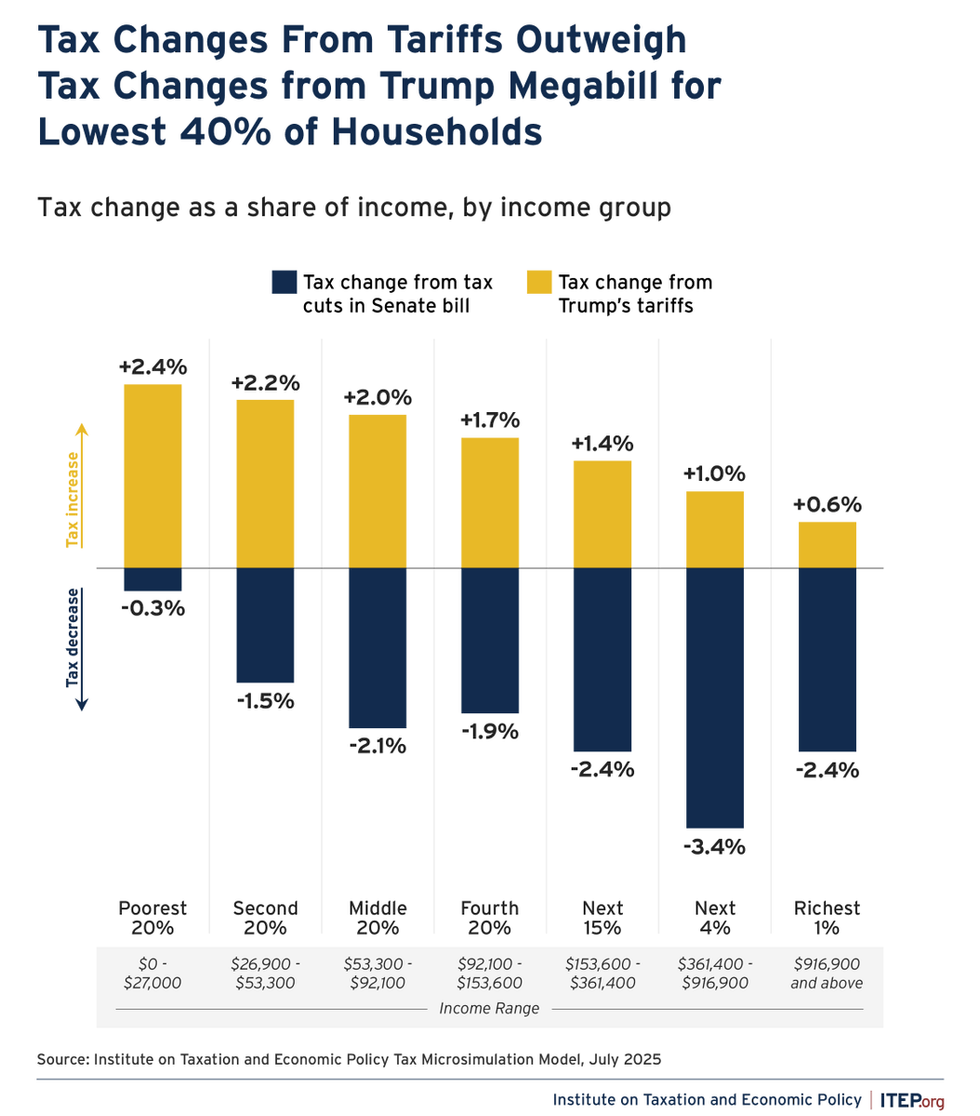

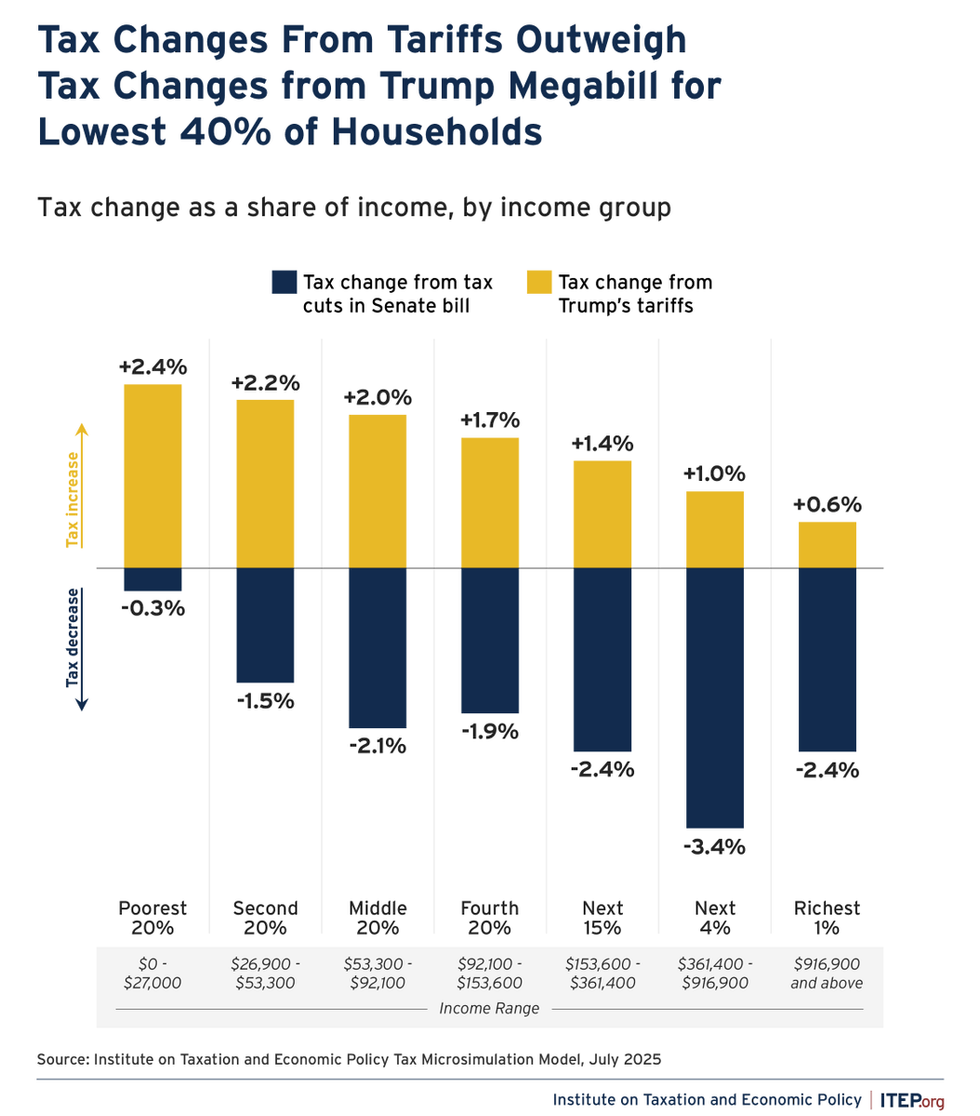

This does not even take into account the effects of President Donald Trump's regressive tariffs, which will also hit the poorest Americans hardest by increasing the cost of goods.

"The central fiscal priority in the megabill is to reward the wealthiest Americans with even more tax cuts, but to try to disguise that as a boon for working families," Jon Whiten, the deputy director of ITEP told Common Dreams.

A previous ITEP estimate found that for everyone except the top 20% of Americans, the cost of the tariffs will either largely offset or surpass the amount they'll save due to the tax breaks in the law.

Meanwhile, the law is estimated to give the richest 1% of Americans $117 billion in tax cuts next year. That amount far exceeds the tax savings of the bottom 60% of Americans put together, who will cumulatively save just $77 billion.

The report found that even foreign investors who own shares in U.S. companies will benefit more in 2026 than many of the poorest Americans due to the law's extension of corporate tax breaks: They will receive $32 billion in tax cuts in 2026 compared to just $1.5 billion for the bottom 20% of Americans.

"This bill is already very unpopular, and most Americans see it for what it is: a big boost for the richest folks and not much for anyone else," said Whiten.

According to polling last week by the Associated Press-NORC Center for Public Affairs Research, 6 in 10 Americans believe the law will do more to hurt than help lower-income people.

Whiten added, "People are likely to continue to sour on it as they learn more about it and see how it impacts their family finances."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The Republican budget law that passed earlier this month—which hands out lavish tax breaks to the wealthiest Americans—will result in increased taxes on the poorest 40% of the country's poorest as early as 2026.

Many of low-income Americans will already see net losses to their income due to the law's drastic cuts to Medicaid and food stamps. However, most of those cuts will not begin to hit for multiple years.

But the lawmakers also allowed an enhancement of tax credits that helped millions of Americans pay for health insurance to expire and those effects will be felt much sooner, according to a study published Tuesday by the nonpartisan Institute on Taxation and Economic Policy (ITEP)

That enhancement—passed in 2021 as part of the American Rescue Plan and extended until 2025 by the Inflation Reduction Act—provided nearly 20 million low- and moderate-income Americans who purchased health insurance on state and federal exchanges with tax relief that significantly shrunk their insurance premiums.

According to the Center on Budget and Policy Priorities, recipients saved over $700 on average on their insurance premiums as a result of the tax breaks.

Largely as a result of this policy change, the ITEP study projects that the poorest 20% of Americans will end up paying $140 more on average than they paid before the law passed as soon as next year. The next poorest 20% will end up paying $100 more.

An estimated 4.2 million are also expected to lose health insurance as a result of the change, according to the Congressional Budget Office (CBO), adding to the 10 million it estimates will lose insurance due to Medicaid cuts.

This does not even take into account the effects of President Donald Trump's regressive tariffs, which will also hit the poorest Americans hardest by increasing the cost of goods.

"The central fiscal priority in the megabill is to reward the wealthiest Americans with even more tax cuts, but to try to disguise that as a boon for working families," Jon Whiten, the deputy director of ITEP told Common Dreams.

A previous ITEP estimate found that for everyone except the top 20% of Americans, the cost of the tariffs will either largely offset or surpass the amount they'll save due to the tax breaks in the law.

Meanwhile, the law is estimated to give the richest 1% of Americans $117 billion in tax cuts next year. That amount far exceeds the tax savings of the bottom 60% of Americans put together, who will cumulatively save just $77 billion.

The report found that even foreign investors who own shares in U.S. companies will benefit more in 2026 than many of the poorest Americans due to the law's extension of corporate tax breaks: They will receive $32 billion in tax cuts in 2026 compared to just $1.5 billion for the bottom 20% of Americans.

"This bill is already very unpopular, and most Americans see it for what it is: a big boost for the richest folks and not much for anyone else," said Whiten.

According to polling last week by the Associated Press-NORC Center for Public Affairs Research, 6 in 10 Americans believe the law will do more to hurt than help lower-income people.

Whiten added, "People are likely to continue to sour on it as they learn more about it and see how it impacts their family finances."

The Republican budget law that passed earlier this month—which hands out lavish tax breaks to the wealthiest Americans—will result in increased taxes on the poorest 40% of the country's poorest as early as 2026.

Many of low-income Americans will already see net losses to their income due to the law's drastic cuts to Medicaid and food stamps. However, most of those cuts will not begin to hit for multiple years.

But the lawmakers also allowed an enhancement of tax credits that helped millions of Americans pay for health insurance to expire and those effects will be felt much sooner, according to a study published Tuesday by the nonpartisan Institute on Taxation and Economic Policy (ITEP)

That enhancement—passed in 2021 as part of the American Rescue Plan and extended until 2025 by the Inflation Reduction Act—provided nearly 20 million low- and moderate-income Americans who purchased health insurance on state and federal exchanges with tax relief that significantly shrunk their insurance premiums.

According to the Center on Budget and Policy Priorities, recipients saved over $700 on average on their insurance premiums as a result of the tax breaks.

Largely as a result of this policy change, the ITEP study projects that the poorest 20% of Americans will end up paying $140 more on average than they paid before the law passed as soon as next year. The next poorest 20% will end up paying $100 more.

An estimated 4.2 million are also expected to lose health insurance as a result of the change, according to the Congressional Budget Office (CBO), adding to the 10 million it estimates will lose insurance due to Medicaid cuts.

This does not even take into account the effects of President Donald Trump's regressive tariffs, which will also hit the poorest Americans hardest by increasing the cost of goods.

"The central fiscal priority in the megabill is to reward the wealthiest Americans with even more tax cuts, but to try to disguise that as a boon for working families," Jon Whiten, the deputy director of ITEP told Common Dreams.

A previous ITEP estimate found that for everyone except the top 20% of Americans, the cost of the tariffs will either largely offset or surpass the amount they'll save due to the tax breaks in the law.

Meanwhile, the law is estimated to give the richest 1% of Americans $117 billion in tax cuts next year. That amount far exceeds the tax savings of the bottom 60% of Americans put together, who will cumulatively save just $77 billion.

The report found that even foreign investors who own shares in U.S. companies will benefit more in 2026 than many of the poorest Americans due to the law's extension of corporate tax breaks: They will receive $32 billion in tax cuts in 2026 compared to just $1.5 billion for the bottom 20% of Americans.

"This bill is already very unpopular, and most Americans see it for what it is: a big boost for the richest folks and not much for anyone else," said Whiten.

According to polling last week by the Associated Press-NORC Center for Public Affairs Research, 6 in 10 Americans believe the law will do more to hurt than help lower-income people.

Whiten added, "People are likely to continue to sour on it as they learn more about it and see how it impacts their family finances."