March, 25 2020, 12:00am EDT

New Analysis Shows Average Rebate for Families in the Senate Stimulus Bill

Download national and state-by-state estimates

WASHINGTON

The Senate agreed to a compromise stimulus bill last night that improves on flaws in its initial bill but still fails to go as far as other proposals and leaves out immigrants who file taxes via Individual Taxpayer Identification Numbers (ITIN), the Institute on Taxation and Economic Policy said today.

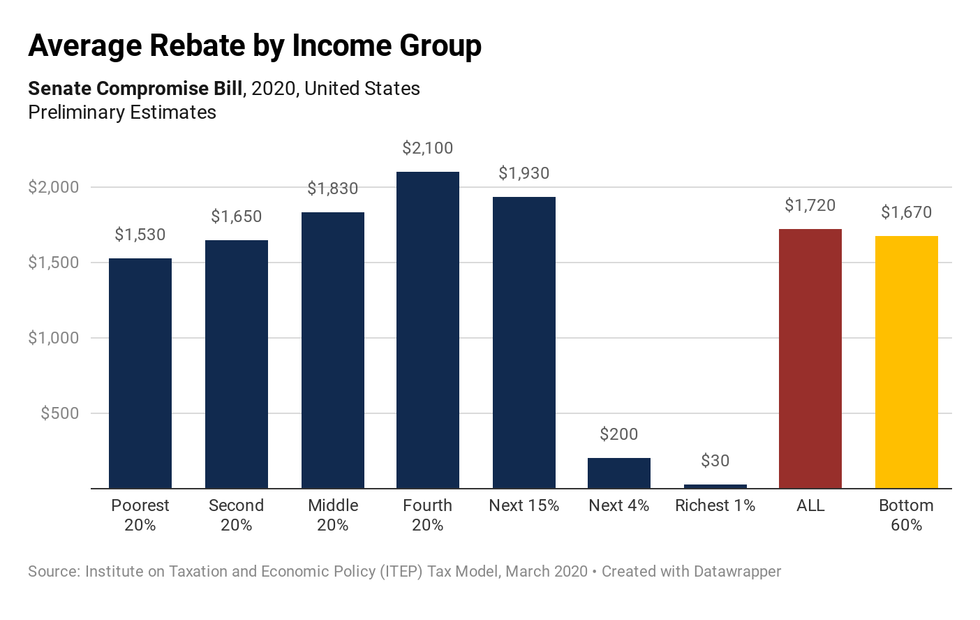

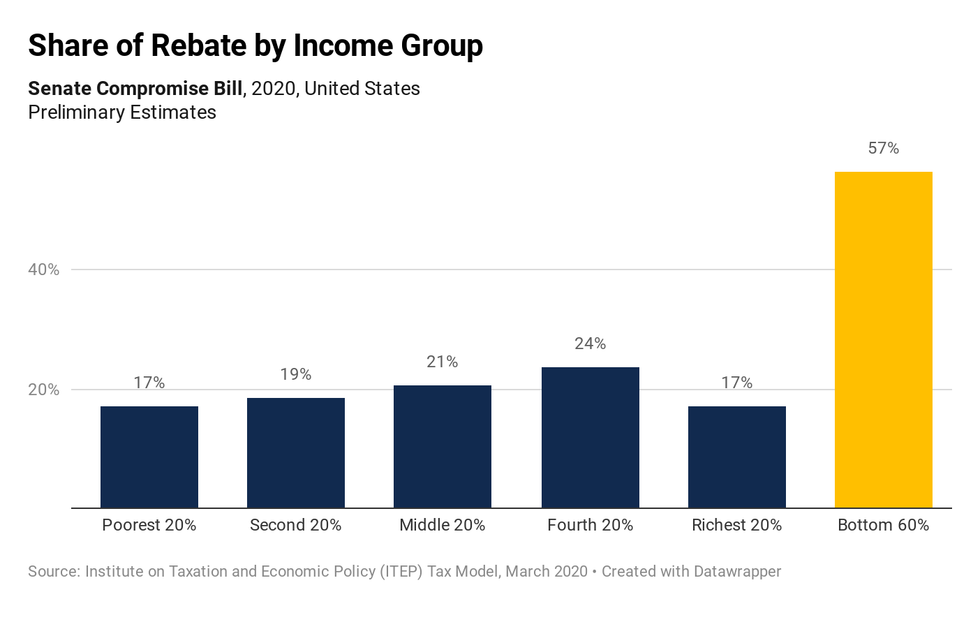

The bill provides up to $1,200 in payments or rebates for individuals with income up to $75,000 a year and $500 per child. Benefits start to phase out for singles with income greater than $75,000 and married couples with incomes greater than $150,000.

The average rebate for households is $1,720. The below chart shows average payments for each income group. State-by-state numbers are also available.

"Compromises are never perfect, but this bill is far closer to addressing the public's needs than the bill Sen. McConnell released five days ago," said Amy Hanauer, executive director of ITEP. "Advocates pushed to strengthen standards around corporate aid in the final deal and Democrats successfully negotiated to expand worker protections, limit stock buybacks and executive bonuses for firms getting aid and expand public oversight. The bill unfortunately leaves out immigrants who file taxes using ITINs, and millions of individuals who didn't file taxes in 2018 will not get immediate relief. But strong fiscal aid to states is essential right now and this $2 trillion package will help the country slow a fast downward spiral."

Founded in 1980, the Institute on Taxation and Economic Policy (ITEP) is a non-profit, non-partisan research organization, based in Washington, DC, that focuses on federal and state tax policy. ITEP's mission is to inform policymakers and the public of the effects of current and proposed tax policies on tax fairness, government budgets, and sound economic policy. ITEP's full body of research is available at www.itepnet.org.

LATEST NEWS

Billionaire Palantir Co-Founder Pushes Return of Public Hangings as Part of 'Masculine Leadership' Initiative

"Immaturity masquerading as strength is the defining personal characteristic of our age," said one critic in response.

Dec 07, 2025

Venture capitalist Joe Lonsdale, a co-founder of data platform company Palantir, is calling for the return of public hangings as part of a broader push to restore what he describes as "masculine leadership" to the US.

In a statement posted on X Friday, Lonsdale said that he supported changing the so-called "three strikes" anti-crime law to ensure that anyone who is convicted of three violent crimes gets publicly executed, rather than simply sent to prison for life.

"If I’m in charge later, we won’t just have a three strikes law," he wrote. "We will quickly try and hang men after three violent crimes. And yes, we will do it in public to deter others."

Lonsdale then added that "our society needs balance," and said that "it's time to bring back masculine leadership to protect our most vulnerable."

Lonsdale's views on public hangings being necessary to restore "masculine leadership" drew swift criticism.

Gil Durán, a journalist who documents the increasingly authoritarian politics of Silicon Valley in his newsletter "The Nerd Reich," argued in a Saturday post that Lonsdale's call for public hangings showed that US tech elites are "entering a more dangerous and desperate phase of radicalization."

"For months, Peter Thiel guru Curtis Yarvin has been squawking about the need for more severe measures to cement Trump's authoritarian rule," Durán explained. "Peter Thiel is ranting about the Antichrist in a global tour. And now Lonsdale—a Thiel protégé—is fantasizing about a future in which he will have the power to unleash state violence at mass scale."

Taulby Edmondson, an adjunct professor of history, religion, and culture at Virginia Tech, wrote in a post on Bluesky that the rhetoric Lonsdale uses to justify the return of public hangings has even darker intonations than calls for state-backed violence.

"A point of nuance here: 'masculine leadership to protect our most vulnerable' is how lynch mobs are described, not state-sanctioned executions," he observed.

Theoretical physicist Sean Carroll argued that Lonsdale's remarks were symbolic of a kind of performative masculinity that has infected US culture.

"Immaturity masquerading as strength is the defining personal characteristic of our age," he wrote.

Tech entrepreneur Anil Dash warned Lonsdale that his call for public hangings could have unintended consequences for members of the Silicon Valley elite.

"Well, Joe, Mark Zuckerberg has sole control over Facebook, which directly enabled the Rohingya genocide," he wrote. "So let’s have the conversation."

And Columbia Journalism School professor Bill Grueskin noted that Lonsdale has been a major backer of the University of Austin, an unaccredited liberal arts college that has been pitched as an alternative to left-wing university education with the goal of preparing "thoughtful and ethical innovators, builders, leaders, public servants and citizens through open inquiry and civil discourse."

Keep ReadingShow Less

Hegseth Defends Boat Bombings as New Details Further Undermine Administration's Justifications

The boat targeted in the infamous September 2 "double-tap" strike was not even headed for the US, Adm. Frank Bradley revealed to lawmakers.

Dec 07, 2025

US Defense Secretary Pete Hegseth on Saturday defended the Trump administration's policy of bombing suspected drug-trafficking vessels even as new details further undermined the administration's stated justifications for the policy.

According to the Guardian, Hegseth told a gathering at the Ronald Reagan presidential library that the boat bombings, which so far have killed at least 87 people, are necessary to protect Americans from illegal drugs being shipped to the US.

"If you’re working for a designated terrorist organization and you bring drugs to this country in a boat, we will find you and we will sink you," Hegseth said. "Let there be no doubt about it."

However, leaked details about a classified briefing delivered to lawmakers last week by Adm. Frank Bradley about a September 2 boat strike cast new doubts on Hegseth's justifications.

CNN reported on Friday that Bradley told lawmakers that the boat taken out by the September 2 attack was not even headed toward the US, but was going "to link up with another, larger vessel that was bound for Suriname," a small nation in the northeast of South America.

While Bradley acknowledged that the boat was not heading toward the US, he told lawmakers that the strike on it was justified because the drugs it was carrying could have theoretically wound up in the US at some point.

Additionally, NBC News reported on Saturday that Bradley told lawmakers that Hegseth had ordered all 11 men who were on the boat targeted by the September 2 strike to be killed because "they were on an internal list of narco-terrorists who US intelligence and military officials determined could be lethally targeted."

This is relevant because the US military launched a second strike during the September 2 operation to kill two men who had survived the initial strike on their vessel, which many legal experts consider to be either a war crime or an act of murder under domestic law.

Rep. Jim Himes (D-Conn.), the ranking member of the House Permanent Select Committee on Intelligence, watched video of the September 2 double-tap attack last week, and he described the footage as “one of the most troubling things I’ve seen in my time in public service.”

“Any American who sees the video that I saw will see its military attacking shipwrecked sailors,” Himes explained. “Now, there’s a whole set of contextual items that the admiral explained. Yes, they were carrying drugs. They were not in position to continue their mission in any way... People will someday see this video and they will see that that video shows, if you don’t have the broader context, an attack on shipwrecked sailors.”

While there has been much discussion about the legality of the September 2 double-tap strike in recent days, some critics have warned that fixating on this particular aspect of the administration's policy risks taking the focus off the illegality of the boat-bombing campaign as a whole.

Daphne Eviatar, director for security and human rights for Amnesty International USA, said on Friday that the entire boat-bombing campaign has been "illegal under both domestic and international law."

"All of them constitute murder because none of the victims, whether or not they were smuggling illegal narcotics, posed an imminent threat to life," she said. "Congress must take action now to stop the US military from murdering more people in the Caribbean and Eastern Pacific."

Keep ReadingShow Less

Leaked Memo Shows Pam Bondi Wants List of 'Domestic Terrorism' Groups Who Express 'Anti-American Sentiment'

"Millions of Americans like you and I could be the target," warned journalist Ken Klippenstein of the new memo.

Dec 07, 2025

A leaked memo written by US Attorney General Pam Bondi directs the Department of Justice to compile a list of potential "domestic terrorism" organizations that espouse "extreme viewpoints on immigration, radical gender ideology, and anti-American sentiment."

The memo, which was obtained by journalist Ken Klippenstein, expands upon National Security Presidential Memorandum-7 (NSPM-7), a directive signed by President Donald Trump in late September that demanded a "national strategy to investigate and disrupt networks, entities, and organizations that foment political violence so that law enforcement can intervene in criminal conspiracies before they result in violent political acts."

The new Bondi memo instructs law enforcement agencies to refer "suspected" domestic terrorism cases to the Joint Terrorism Task Forces (JTTFs), which will then undertake an "exhaustive investigation contemplated by NSPM-7" that will incorporate "a focused strategy to root out all culpable participants—including organizers and funders—in all domestic terrorism activities."

The memo identifies the "domestic terrorism threat" as organizations that use "violence or the threat of violence" to advance political goals such as "opposition to law and immigration enforcement; extreme views in favor of mass migration and open borders; adherence to radical gender ideology, anti-Americanism, anti-capitalism, or anti-Christianity; support for the overthrow of the United States Government; hostility towards traditional views on family, religion, and morality."

Commenting on the significance of the memo, Klippenstein criticized mainstream media organizations for largely ignoring the implications of NSPM-7, which was drafted and signed in the wake of the murder of right-wing activist Charlie Kirk.

"For months, major media outlets have largely blown off the story of NSPM-7, thinking it was all just Trump bluster and too crazy to be serious," he wrote. "But a memo like this one shows you that the administration is absolutely taking this seriously—even if the media are not—and is actively working to operationalize NSPM-7."

Klippenstein also warned that NSPM-7 appeared to be the start of a new "war on terrorism," but "only this time, millions of Americans like you and I could be the target."

Keep ReadingShow Less

Most Popular