October, 18 2021, 07:33am EDT

For Immediate Release

Contact:

Chris Fleming

Email: chris@redhorsestrategies.com

202-234-9382

info@ips-dc.org

U.S. Billionaires Wealth Surged by 70%, or $2.1 Trilion, During Pandemic; They Are Now Worth a Combined $5 Trillion

Sen. Wyden’s Billionaires Income Tax Tapping Those Huge Returns Could Raise Big Revenue to Fund President Biden’s Build Back Better Investment Plan

WASHINGTON

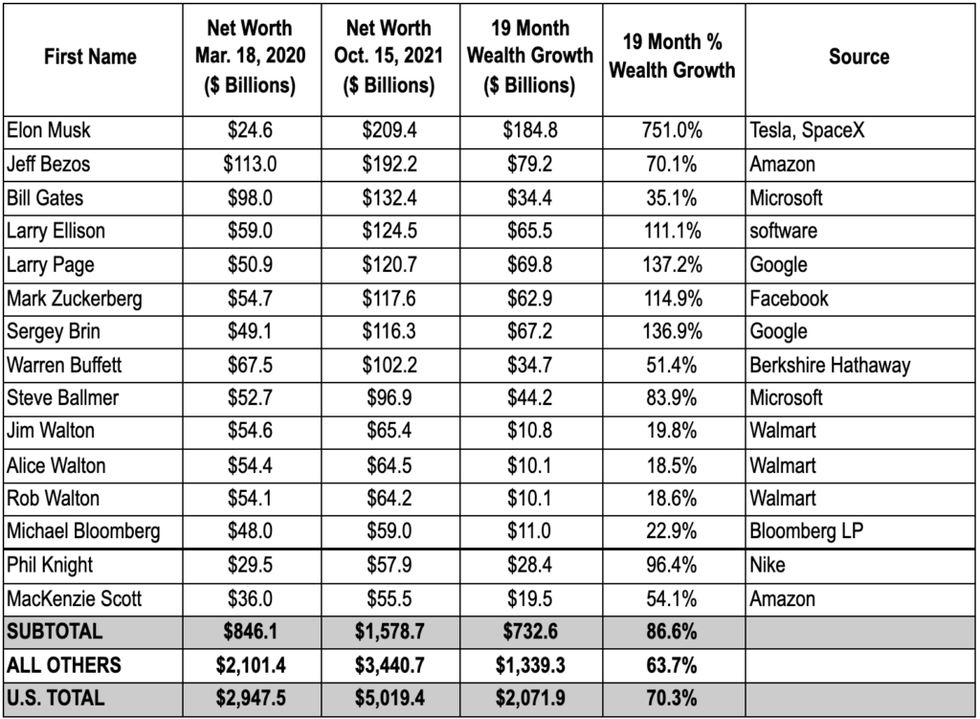

America's billionaires have grown $2.1 trillion richer during the pandemic, their collective fortune skyrocketing by 70%--from just short of $3 trillion at the start of the COVID crisis on March 18, 2020, to over $5 trillion on October 15 of this year, according to Forbes data analyzed by Americans for Tax Fairness (ATF) and the Institute for Policy Studies Program on Inequality (IPS). [A table of the top 15 billionaires is below and the full data set is here.]

Not only did the wealth of U.S. billionaires grow, but so did their numbers: in March of last year, there were 614 with 10-figure bank accounts; this October, there are 745.

The $5 trillion in wealth now held by 745 billionaires is two-thirds more than the $3 trillion in wealth held by the bottom 50% of U.S. households estimated by the Federal Reserve Board.

The great good fortune of these billionaires over the past 19 months is all the more stark when contrasted with the devastating impact of coronavirus on working people. Almost 89 million Americans have lost jobs, over 44.9 million have been sickened by the virus, and over 724,000 have died from it.

To put this extraordinary wealth growth in perspective, the $2.1 trillion gain over 19 months by U.S. billionaires is equal to:

- 60% of the $3.5 trillion ten-year cost of President Biden's Build Back Better plan.

- The entire $2.1 trillion in new revenues over ten years approved by the House Ways and Means Committee to help pay for President Biden's Build Back Better (BBB) investment plan.

Sixty-seven national organizations have sent a letter to Congress expressing concern that neither the Ways and Means committee plan nor President Biden's plan will adequately tax billionaires. They recommend Billionaires Income Tax (BIT) legislation under development by Sen. Ron Wyden, chairman of the Finance Committee, be included in final BBB legislation. It is also supported by President Biden.

Most of these huge billionaires' gains will go untaxed under current rules and will disappear entirely for tax purposes when they're passed onto the next generation. Under Wyden's BIT, billionaires will start paying taxes on their increased wealth each year just like workers pay taxes on their paychecks each year.

The tax will apply only to taxpayers whose wealth exceeds $1 billion: about 700 households. It will be assessed annually on tradable assets, such as stocks, where the value of the asset is known at the beginning and end of the year. For non-tradable assets, such as ownership in a business or real estate holdings, taxes will be deferred until the asset is sold.

Public support for the BIT is very strong. When proposed as a way to pay for President Biden's $3.5 trillion investment package it increases support 20 to 40 points among voters in battleground districts and states.

"This growth of billionaire wealth is unfathomable, immoral, and indefensible in good times let alone during a pandemic when so many have struggled with unemployment, illness and death," said Frank Clemente, executive director of Americans for Tax Fairness. "For practical and moral reasons, Congress must start effectively taxing the outsized gains of billionaires. Many of the proposals under discussion to tax the rich would exempt billionaires because of the way they make their money. The Billionaires Income Tax, on the other hand, squarely focuses on the main source of billionaire income: the growth in their investments."

"Billionaires are undertaxed and playing hide-and-seek with their substantial wealth," said Chuck Collins, of the Institute for Policy Studies, author of The Wealth Hoarders. "Targeted tax increases on billionaires, including the proposed Billionaire Income Tax, would rebalance the tax code and reduce these glaring abuses in who pays for the services we all depend on."

Sources: March 18, 2020 data: Forbes, "Forbes Publishes 34th Annual List Of Global Billionaires" March 18, 2020

October 15, 2021 data: Forbes, "The World's Real-Time Billionaires, Today's Winners and Losers," accessed October 15, 2021

Among the individual stories behind the big numbers:

- Elon Musk of Tesla and SpaceX fame is not only beating Jeff Bezos in space, he has rocketed past him in the billionaires club. Nineteen months ago, Bezos was nearly five times richer than Musk. Now, after a meteoric eight-fold increase in his wealth, Musk is worth $209 billion and Bezos $192 billion. Bezos's wealth still grew by a very large 70% over the period.

- Google founders Sergei Brin and Larry Page are now worth $237 billion combined, a 137% increase from their combined wealth of $100 billion at the beginning of the pandemic.

- Nike head Phil Knight has nearly doubled his fortune from $29.5 billion to almost $58 billion. Maybe that's in part because Nike didn't pay a dime of federal income taxes in 2020 on its $2.9 billion in profits; and between 2018 and 2020 the corporation paid just a 3.3% tax rate on $9 billion in profits.

- MacKenzie Scott, former wife of Amazon founder Jeff Bezos, saw her wealth increase $19.5 billion, or 54%, since the pandemic began even after giving away $8.6 billion of her wealth to charity.

BILLIONAIRES UNDERTAXED

America's billionaire bonanza demonstrates the structural flaws in our current economic and tax systems President Biden and Democrats in Congress are trying to remedy by advancing a $3.5 trillion package of investments in working families and communities, paid for with fairer taxes on the rich and corporations.

On average, billionaires pay an effective federal income tax rate of about 8% when the increased value of their stock is counted, according to the White House. This is a lower rate than many middle-income taxpayers pay like teachers, nurses and firefighters.

Billionaires pay such low tax rates because:

- Most of their income comes from the increased value of their investments such as stocks, a business or real estate, rather than a paycheck like most people, and they don't have to pay taxes on that increased wealth unless they sell the assets. But the ultra-rich don't need to sell assets. Instead, because of the size of their fortunes, they can borrow money at low rates from banks and live lavishly tax free.

- When they sell their assets they pay a top capital gains tax rate of 20% (plus a 3.8% net investment income tax, NIIT) far below the current 37% (40.8%) top rate they would pay on an equivalent salary. This is why many ultra-rich pay a lower tax rate than people in the middle class.

According to ProPublica's analysis of IRS data:

- Billionaires have paid no federal income taxes in some recent years, including Jeff Bezos, Elon Musk, Michael Bloomberg and George Soros.

- The country's 25 top billionaires paid a tax rate of just 3.4% on a $400 billion increase in their collective fortune between 2014-18.

Poll after poll shows that Americans of all political persuasions and by large majorities believe that the wealthy and big corporations need to start paying their fair share of taxes. A June poll by ALG Research and Hart Research shows 62% of voters support Biden's proposed $4 trillion (at the time) investments in healthcare, childcare, education, clean energy and more--paid for by higher taxes on the rich and corporations.

March 18, 2020 is used as the unofficial beginning of the coronavirus crisis because by then most federal and state economic restrictions responding to the virus were in place. March 18 was also the date that Forbes picked to measure billionaire wealth for the 2020 edition of its annual billionaires' report, which provided a baseline that ATF and HCAN compare periodically with real-time data from the Forbes website. PolitiFact has favorably reviewed this methodology.

Americans for Tax Fairness (ATF) is a diverse campaign of more than 420 national, state and local endorsing organizations united in support of a fair tax system that works for all Americans. It has come together based on the belief that the country needs comprehensive, progressive tax reform that results in greater revenue to meet our growing needs. This requires big corporations and the wealthy to pay their fair share in taxes, not to live by their own set of rules.

(202) 506-3264Institute for Policy Studies turns Ideas into Action for Peace, Justice and the Environment. We strengthen social movements with independent research, visionary thinking, and links to the grassroots, scholars and elected officials. I.F. Stone once called IPS "the think tank for the rest of us." Since 1963, we have empowered people to build healthy and democratic societies in communities, the US, and the world. Click here to learn more, or read the latest below.

LATEST NEWS

Demanding Action From Congress, Khanna Says 'The American People Are Tired of Regime Change Wars'

"We don't want to be at war with a country of 90 million people in the Middle East," said Democratic US Rep. Ro Khanna.

Feb 28, 2026

US Rep. Ro Khanna on Saturday demanded swift action from Congress to stop the Trump administration's unauthorized military assault on Iran, saying in a video posted to social media that "the American people are tired of regime change wars that cost us billions of dollars and risk our lives."

"We don't want to be at war with a country of 90 million people in the Middle East," said Khanna (D-Calif.), calling on Congress to reconvene for a vote on Monday.

"Every member of Congress should go on record today on how they will vote on Thomas Massie and my War Powers resolution," Khanna added, referring to the Kentucky Republican who is co-leading the measure.

If passed, the resolution would require the president "to terminate the use of United States Armed Forces from hostilities against the Islamic Republic of Iran or any part of its government or military, unless explicitly authorized by a declaration of war or specific authorization for use of military force against Iran."

Watch Khanna's remarks:

Trump has launched an illegal regime change war in Iran with American lives at risk. Congress must convene on Monday to vote on @RepThomasMassie & my WPR to stop this. Every member of Congress should go on record this weekend on how they will vote. pic.twitter.com/tlRi3Vz849

— Ro Khanna (@RoKhanna) February 28, 2026

Days prior to the US-Israeli attack on Iran, the House Democratic leadership announced it would force a vote next week on the Khanna-Massie War Powers resolution following reports that top Democrats were slowwalking the measure behind closed doors.

Senate Democrats also said they planned to vote next week on a War Powers resolution led by Sens. Tim Kaine of Virginia.

In a statement on Saturday, Kaine called the US attacks on Iran "illegal" and said that "every single senator needs to go on the record about this dangerous, unnecessary, and idiotic action."

“Has President Trump learned nothing from decades of US meddling in Iran and forever wars in the Middle East? Is he too mentally incapacitated to realize that we had a diplomatic agreement with Iran that was keeping its nuclear program in check, until he ripped it up during his first term?" Kaine asked. "These strikes are a colossal mistake, and I pray they do not cost our sons and daughters in uniform and at embassies throughout the region their lives. The Senate should immediately return to session and vote on my War Powers resolution."

The chances of a War Powers resolution getting through the Republican-controlled Congress are virtually nonexistent, even though the American public overwhelmingly opposes US military action against Iran. Senate Majority Leader John Thune (R-SD) and House Speaker Mike Johnson (R-La.) both issued statements applauding Trump for the unauthorized Saturday attacks.

Cavan Kharrazian, senior policy adviser to the advocacy group Demand Progress, said that "Trump has no authority to launch another war on his own."

"The Constitution is clear. The need for a War Powers resolution is clear. Congress decides when this country goes to war, not the president," said Kharrazian. "Next week, every member of Congress will have to choose. Side with illegal, endless war, or side with the American people and reject yet another regime change war in the Middle East. Like with Iraq, the choice they make will echo loudly for years to come.”

Keep ReadingShow Less

'The Behavior of Rogue States': Global Revulsion as US and Israel Launch War on Iran

"The attacks on Iran by Israel and the United States are illegal, unprovoked, and unjustifiable," said Jeremy Corbyn, an independent member of the UK Parliament.

Feb 28, 2026

Elected officials, activists, and experts around the world voiced horror and outrage Saturday as US President Donald Trump and Israeli Prime Minister Benjamin Netanyahu jointly launched an illegal war on Iran with the explicit goal of toppling the nation's government, sparking chaos throughout the Middle East.

The wave of bombings, expected to mark the beginning of a wider assault, spurred airspace closures and flight cancellations across the region as countries braced for the fallout. While European leaders offered milquetoast responses to the unlawful military attack and Canadian and Australian officials openly endorsed it, leftist politicians and others unequivocally condemned the US and Israel as the aggressors.

"The attacks on Iran by Israel and the United States are illegal, unprovoked, and unjustifiable," said Jeremy Corbyn, an independent member of the British Parliament and former leader of the UK Labour Party. "Peace and diplomacy was possible. Instead, Israel and the United States chose war."

"This is the behavior of rogue states—and they have jeopardized the safety of humankind around the world with this catastrophic act of aggression," Corbyn added. "Our government must condemn this flagrant breach of international law, and urgently pursue a foreign policy based on justice, sovereignty, and peace."

Progressive International co-founder Yanis Varoufakis, the former finance minister of Greece, echoed Corbyn's criticism of the US and Israel as "rogue states."

"Israel and the USA," he wrote on social media, "have started a war not against Iran but against the whole world. We stand with Iranians, with humanity, against the notion that Israel and the US can bomb anyone their fancy takes them to bomb."

Badr Albusaidi, the foreign minister of Oman and the mediator of recent US-Iran talks, said he was "dismayed" by news of the US-Israel attacks on Iran, which were quickly followed by reports of horrific atrocities. Albusaidi said hours before the bombs started falling on Iran that a diplomatic resolution was within reach.

"Active and serious negotiations have yet again been undermined," Albusaidi lamented on Saturday. "Neither the interests of the United States nor the cause of global peace are well served by this. And I pray for the innocents who will suffer. I urge the United States not to get sucked in further."

Leftist Colombian President Gustavo Petro said he believes "President Donald Trump has made a mistake today" and implored the "helpless United Nations" to "convene immediately" in response to the US-Israel attacks and retaliation by Iran and allied groups in the region.

Iran vowed a "crushing" response to the US-Israeli onslaught, firing drones and missiles at Israel and pledging to hit US military installations in the region.

Al Jazeera reported that "Iran has targeted United States assets across the Gulf Arab states in retaliation for a huge joint attack on Iran by the US and Israel, as the region’s worst fears of being ignited in the flames of a sustained war loom."

"The Iranian government on Saturday confirmed its attacks on several targets, according to the Fars news agency, including Bahrain, Kuwait, Qatar, and the United Arab Emirates, where US airbases are hosted," the outlet noted.

Keep ReadingShow Less

Oman's Foreign Minister Said US-Iran Deal Was 'Within Our Reach.' Then Trump Started Bombing

"The Omani FM decided to go public," suggested one observer, "so that the American people knew that peace was within reach when Trump instead opted for war."

Feb 28, 2026

Hours before President Donald Trump announced his decision to bomb Iran and pursue the overthrow of its government, the foreign minister of Oman appeared, in person, on one of the most prominent US television news programs to declare that a diplomatic breakthrough was possible.

"I can see that the peace deal is within our reach," Badr Albusaidi, the mediator of recent talks between the US and Iran, told "Face the Nation" host Margaret Brennan on Friday. "I'm asking to continue this process because we have already achieved quite a substantial progress in the direction of a deal. And the heart of this deal is very important, and I think we have captured that heart."

Pressed for specifics, Albusaidi said that Iran committed during the talks to renounce the possibility of amassing "nuclear material that will create a bomb"—a pledge that Trump claimed Iran refused to make as part of his justification for Saturday's strikes.

"This is something that is not in the old deal that was negotiated during President Obama's time," Albusaidi said, referring to the 2015 nuclear accord that Trump ditched during his first term in the White House. "This is something completely new. It really makes the enrichment argument less relevant, because now we are talking about zero stockpiling. And that is very, very important, because if you cannot stockpile material that is enriched, then there is no way you can actually create a bomb, whether you enrich or don't enrich. And I think this is really something that has been missed a lot by the media, and I want to clarify that from the standpoint of a mediator."

"There is no accumulation, so there would be zero accumulation, zero stockpiling, and full verification," the Omani foreign minister continued. "Full and comprehensive verification by the [International Atomic Energy Agency]."

In a social media post following the interview, Albusaidi reiterated that a deal "is now within reach" and implored all parties to "support the negotiators in closing the deal." Prior to Saturday's attacks, additional US-Iran talks were scheduled for next week.

Watch the full segment, which critics highlighted as evidence that the US-Israeli attacks on Saturday were aimed at forestalling a diplomatic resolution:

Trita Parsi, executive vice president of the US-based Quincy Institute for Responsible Statecraft, wrote in response to Albusaidi's remarks that "the Omanis are famously cautious."

"The Omani FM going on CBS to reveal what has actually been achieved in the negotiations is quite unprecedented. And what has been achieved is significant—Trump can indeed declare victory. Listen to this segment—it goes way beyond what Obama achieved," Parsi wrote. "But everything indicates that Trump won't take yes for an answer. That he will start a war of choice very soon."

"Which is probably why the Omani FM decided to go public," Parsi added. "So that the American people knew that peace was within reach when Trump instead opted for war."

According to one survey released earlier this month, just 21% of Americans support "the United States initiating an attack on Iran under the current circumstances."

Keep ReadingShow Less

Most Popular