April, 17 2012, 01:15pm EDT

Release: Women Are Still Earning Less than Men Across the Board

WASHINGTON

Today is Equal Pay Day, and the Center for American Progress released a package of products highlighting the importance of closing the gender wage gap.

Equal Pay Day symbolizes how far into 2012 the average woman must work to earn what the average man earned in 2011. While the wage gap has certainly narrowed with the past generation of working women--in 1967 women only earned about 58 cents to a man's dollar--progress has stalled in recent years. If progress continues at its current rate, it will take 45 years to eradicate the wage gap.

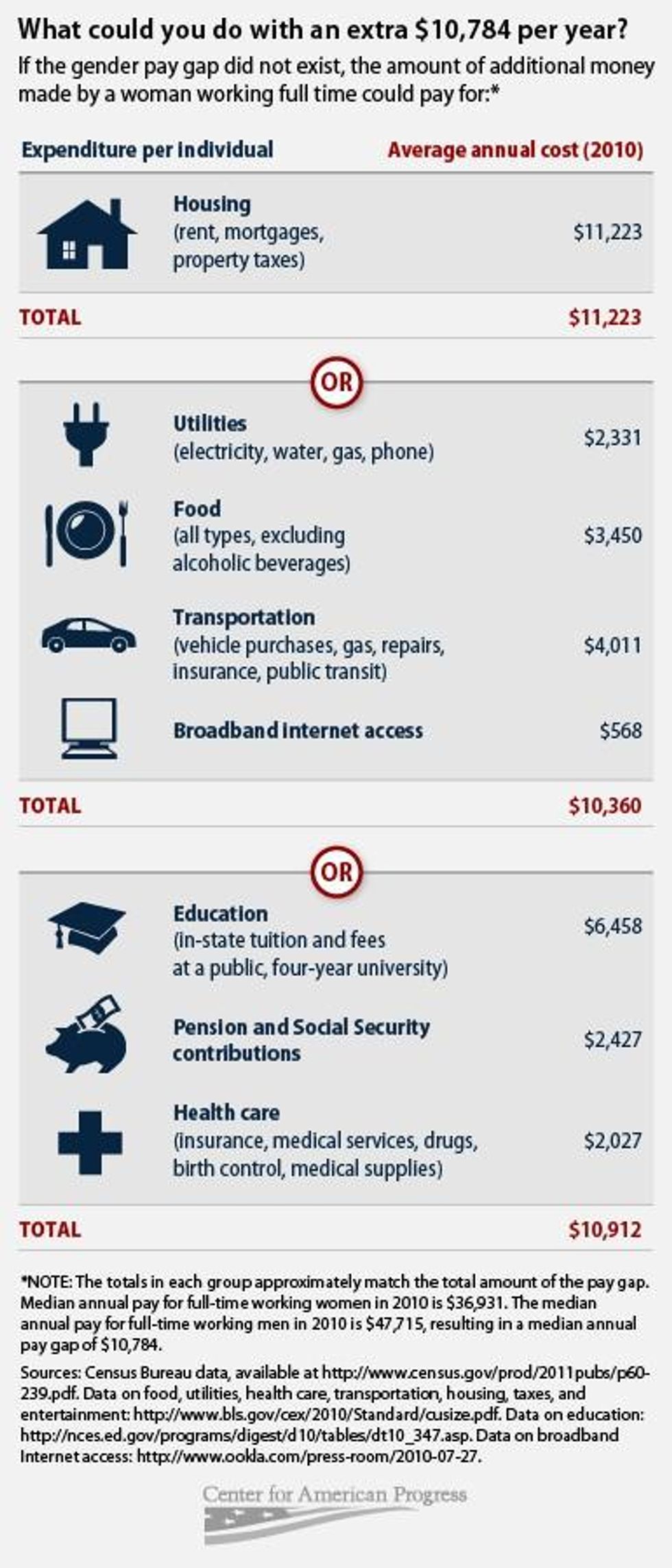

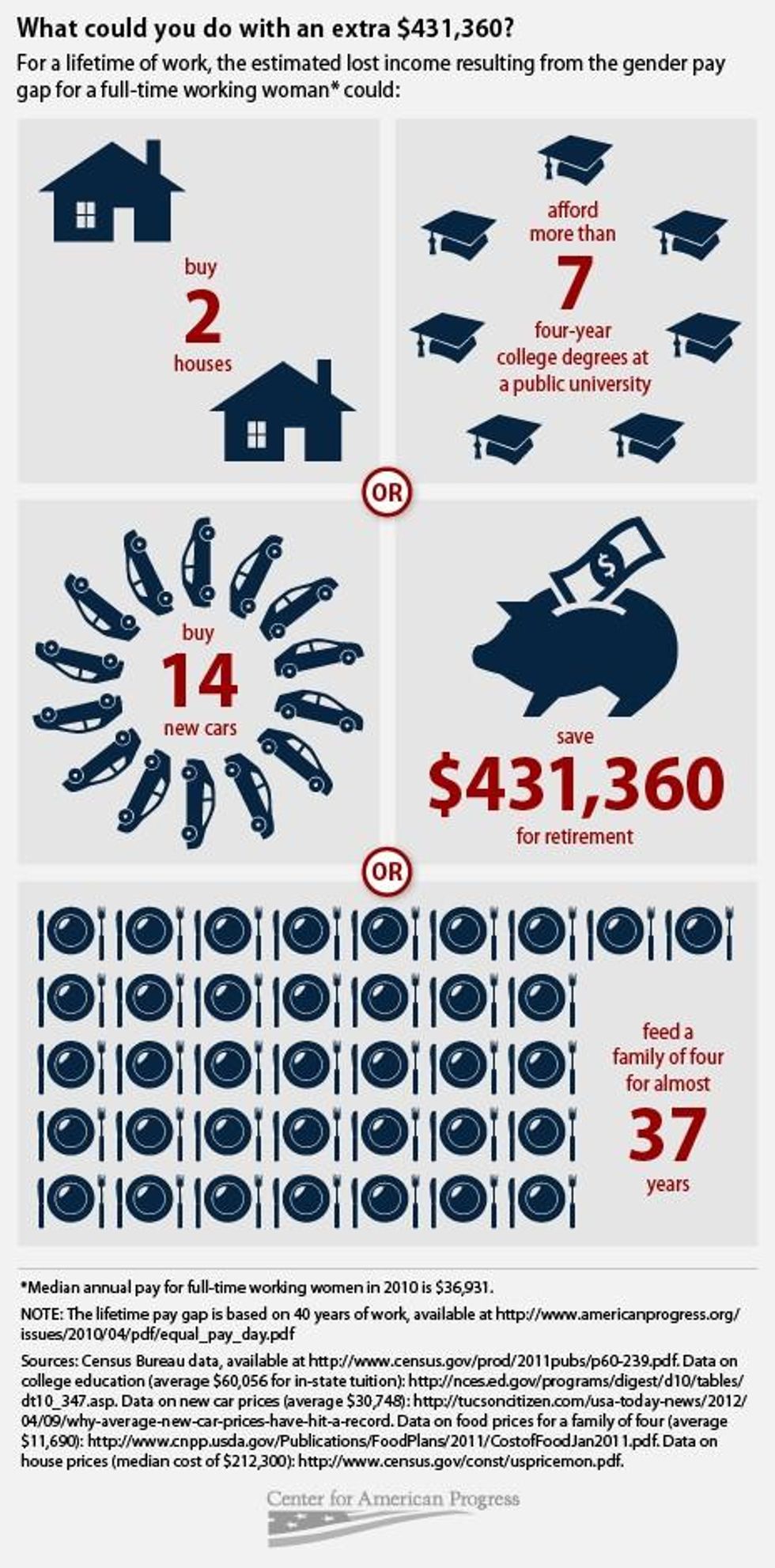

The gender pay gap is not just an issue of fairness. It is also a question of economic empowerment, both for working women and for their families. In 2010 the median full-time working man took home $47,715 in earnings, while the median full-time working woman made only $36,931--77.4 percent of the man's earnings, or $10,784 less. Two new infographics released yesterday by the Center for American Progress illustrate what a woman could buy with an extra $10,784 per year, or an extra $431,360 over 40 years.

Also included in the package of resources on the gender wage gap is a list of the top 10 facts about the wage gap:

- In 2010 women who worked full time, year round, still only earned 77 percent of what men earned. The median earnings for women were $36,931 compared to $47,715 for men, and neither real median earnings nor the female-to-male earnings ratio have increased since 2009.

- The gender wage gap does not only affect individuals--entire families are impacted by women's earnings. In 2010, in nearly two-thirds of families (63.9 percent), a mother was either the breadwinner--either a single working mother or bringing home as much or more than her husband--or a co-breadwinner--bringing home at least a quarter of the family's earnings. When women's wages are lowered due to gender discrimination, their families' incomes are often significantly lowered as well.

- Women earn less than men within all racial and ethnic groups. In 2010, the latest year for which data are available, white women earned 78.1 percent compared to white men, African American women earned 89.8 percent compared to black men, Hispanic women earned 91.3 percent compared to Hispanic men, and Asian women earned 79.7 percent compared to Asian men. The wage gap is lower for black and Hispanic women in part because wages for people of color tend to be lower overall. This gap occurs within racial/ethnic groups as well. In 2010, according to the Census Bureau, African Americans earned only 58.7 percent of what whites earned, while Hispanics earned only 69.1 percent of what whites earned.

- Even though women are outpacing men in getting college degrees that's not enough to close the gender pay gap. The American Association of University Women tackled the pay gap question by looking at workers of the same educational attainment--same kind of college, same grades--holding the same kinds of jobs, and having made the same choices about marriage and number of kids. They found that college-educated women earn 5 percent less the first year out of school than their male peers. Ten years later, even if they keep working on par with those men, the women earn 12 percent less.

- Women are more likely to work in low-wage, "pink-collar" jobs such as teaching, child care, nursing, cleaning, and waitressing. The top 10 jobs held by women include secretaries and administrative assistants (number one); elementary and middle-school teachers (number four); retail salespeople (number six); and maids and housekeepers (number 10). These jobs typically pay less than male-dominated jobs and are fueling the gender wage gap. These are also the "jobs of the future," the kinds of jobs that the Department of Labor projects will grow faster than other occupations, so addressing the pay gap here will have long-term consequences.

- The wage gap accumulates over time. Over a 40-year working career, the average woman loses $431,000 as the result of the wage gap. The pay gap accumulates in no small part because initial pay matters: If a woman earns less in her first job, when she takes a new job and her new employer sets her pay scale, they will often base it on her pay history. The lifetime wage gap for a woman who did not finish high school is $300,000, while the lifetime wage gap for a woman with at least a bachelor's degree is $723,000. Making sure that young women understand the importance of negotiating for good pay from day one should be a pressing policy concern and is included in the Paycheck Fairness Act.

- As women age the wage gap continues to grow. For working women between the ages of 25 to 29, the annual wage gap is $1,702. In the last five years before retirement, however, the annual wage gap jumps to $14,352.

- Single women are even more adversely affected by the wage gap than married women. Single women earn only 78.8 percent of what married women earn, and only 57 cents for every dollar that married males earn.

- More than 40 percent of the wage gap cannot be explained by occupation, work experience, race, or union membership. More than one-quarter of the wage gap is due to the different jobs that men and women hold, and about 10 percent is due to the fact that women are more likely to leave the workforce to provide unpaid care to family members. But even when controlling for gender and racial differences, 41 percent is "unexplainable by measureable factors." Even if women and men have the same background, the wage gap still exists, highlighting the fact that part of the discrepancy can be attributed to gender-based pay discrimination.

- Mothers earn about 7 percent less per child than childless women. For women under 35 years of age, the wage gap between mothers and women without children is greater than the gap between women and men.

Related resources from the Center for American Progress:

- The Top 10 Facts About the Wage Gap by Audrey Powers and Sarah Jane Glynn

- Infographic: The Gender Pay Gap by Matt Separa

- The New Breadwinners: 2010 Update by Sarah Jane Glenn

- The Gender Wage Gap Double Whammy by Sarah Jane Glynn

- Pay Equity and Single Mothers of Color by Sophia Kerby

- Unequal Pay Day for Black and Latina Women by Julie Ajinkya

- 10 Facts About Latino Women and Pay Inequity by Vanessa Cardenas

- The Gay and Transgender Wage Gap by Crosby Burns

- Gender Equality for Green Jobs Worldwide by Rebecca Lefton and Jorge Madrid with Lejla Sadiku

- The Health Insurance Compensation Gap by Jessica Arons and Lindsay Rosenthal

To speak with CAP expert about Equal Pay Day, please contact Katie Peters at 202.741.6285 or email kpeters@americanprogress.org

The Center for American Progress is a think tank dedicated to improving the lives of Americans through ideas and action. We combine bold policy ideas with a modern communications platform to help shape the national debate, expose the hollowness of conservative governing philosophy and challenge the media to cover the issues that truly matter.

LATEST NEWS

ICE Goons Pepper Spray Congresswoman Adelita Grijalva During Tucson Raid

"If federal agents are brazen enough to fire pellets directly at a member of Congress, imagine how they behave when encountering defenseless members of our community," Grijalva said.

Dec 05, 2025

In what Arizona's attorney general slammed as an "unacceptable and outrageous" act of "unchecked aggression," a federal immigration officer fired pepper spray toward recently sworn-in Congresswoman Adelita Grijalva during a Friday raid on a Tucson restaurant.

Grijalva (D-Ariz.) wrote on social media that US Immigration and Customs Enforcement (ICE) officers "just conducted a raid by Taco Giro in Tucson—a small mom-and-pop restaurant that has served our community for years."

"When I presented myself as a member of Congress asking for more information, I was pushed aside and pepper sprayed," she added.

Grijalva said in a video uploaded to the post that she was "sprayed in the face by a very aggressive agent, pushed around by others, when I literally was not being aggressive, I was asking for clarification, which is my right as a member of Congress."

The video shows Grijalva among a group of protesters who verbally confronted federal agents over the raid. Following an order to "clear," an agent is seen firing what appears to be a pepper ball at the ground very near the congresswoman's feet. Video footage also shows agents deploying gas against the crowd.

"They're targeting small mom-and-pop businesses that don't have the financial resources to fight back," Grijalva told reporters after the incident. "They're targeting small businesses and people that are helping in our communities in order to try to fill the quota that [President Donald] Trump has given them."

Mocking the incident on social media, Department of Homeland Security spokesperson Tricia McLaughlin contended that Grijalva "wasn’t pepper sprayed."

"She was in the vicinity of someone who *was* pepper sprayed as they were obstructing and assaulting law enforcement," she added. "In fact, two law enforcement officers were seriously injured by this mob that [Grijalva] joined."

McLaughlin provided no further details regarding the nature of those injuries.

Democrats in Arizona and beyond condemned Friday's incident, with US Sen. Ruben Gallego writing on social media that Grijalva "was doing her job, standing up for her community."

"Pepper spraying a sitting member of Congress is disgraceful, unacceptable, and absolutely not what we voted for," he added. "Period."

Democratic Arizona Attorney General Kris Mayes said on social media: "This is unacceptable and outrageous. Enforcing the rule of law does not mean pepper spraying a member of Congress for simply asking questions. Effective law enforcement requires restraint and accountability, not unchecked aggression."

Congresswoman Pramila Jayapal (D-Wash.) also weighed in on social media, calling the incident "outrageous."

"Rep. Grijalva was completely within her rights to stand up for her constituents," she added. "ICE is completely lawless."

Friday's incident follows federal agents' violent removal of Sen. Alexa Padilla (D-Calif.) from a June press conference held by Homeland Security Secretary Kristi Noem.

Congresswoman LaMonica McIver (D-NJ) was federally indicted in June for allegedly “forcibly impeding and interfering with federal officers" during an oversight visit at a privately operated migrant detention center in Newark, New Jersey and subsequent confrontation with ICE agents outside of the lockup in which US Reps. Bonnie Watson Coleman and Rob Menendez, both New Jersey Democrats, were also involved.

Violent assaults by federal agents on suspected undocumented immigrants—including US citizens—protesters, journalists, and others are a regular occurrence amid the Trump administration's mass deportation campaign.

"If federal agents are brazen enough to fire pellets directly at a member of Congress, imagine how they behave when encountering defenseless members of our community," Grijalva said late Friday on social media. "It’s time for Congress to rein in this rogue agency NOW."

Keep ReadingShow Less

Gavin Newsom Wants a 'Big Tent Party,' But Opposes Wealth Tax Supported by Large Majority of Americans

"A wealth tax is a big tent policy unless the only people you care about are billionaires," said one progressive organizer.

Dec 05, 2025

California Gov. Gavin Newsom, considered by some to be the frontrunner to be the next Democratic presidential nominee, said during a panel on Wednesday that he wants his party to be a “big tent” that welcomes large numbers of people into the fold. But he’s “adamantly against” one of the most popular proposals Democrats have to offer: a wealth tax.

In October, progressive economists Emmanuel Saez and Robert Reich joined forces with one of California's most powerful unions, the Service Employees International Union's (SEIU) United Healthcare Workers West, to propose that California put the nation’s first-ever wealth tax on the ballot in November 2026.

They described the measure as an "emergency billionaires tax" aimed at recouping the tens of billions of dollars that will be stripped from California's 15 million Medicaid recipients over the next five years, after Republicans enacted historic cuts to the program in July with President Donald Trump's One Big Beautiful Bill Act, which dramatically reduced taxes for the wealthiest Americans.

Among those beneficiaries were the approximately 200 billionaires living in California, whose average annual income, Saez pointed out, has risen by 7.5% per year, compared with 1.5% for median-income residents.

Under the proposal, they would pay a one-time 5% tax on their total net worth, which is estimated to raise $100 billion. The vast majority of the funds, about 90%, would be used to restore Medicaid funding, while the rest would go towards funding K-12 education, which the GOP has also slashed.

The proposal in California has strong support from unions and healthcare groups. But Newsom has called it “bad policy” and “another attempt to grab money for special purposes.”

Meanwhile, several of his longtime consultants, including Dan Newman and Brian Brokaw, have launched a campaign alongside “business and tech leaders” to kill the measure, which they’ve dubbed “Stop the Squeeze." They've issued familiar warnings that pinching the wealthy too hard will drive them from the state, along with the critical tax base they provide.

At Wednesday's New York Times DealBook Summit, Andrew Ross Sorkin asked Newsom about his opposition to the wealth tax idea, comparing it to a proposal by recent New York City Mayor-elect Zohran Mamdani, who pledged to increase the income taxes of New Yorkers who earn more than $1 million per year by 2% in order to fund his city-wide free buses, universal childcare, and city-owned grocery store programs.

Mamdani's proposal was met with a litany of similar warnings from Big Apple bigwigs who threatened to flee the city and others around the country who said they'd never move in.

But as Robin Kaiser-Schatzlein explained in October for the American Prospect: "The evidence for this is thin: mostly memes shared by tech and finance people... Research shows that the truth of the matter is closer to the opposite. Wealthy individuals and their income move at lower rates than other income brackets, even in response to an increase of personal income tax." Many of those who sulked about Mamdani's victory have notably begun making amends with the incoming mayor.

Moreover, the comparison between Mamdani's plan and the one proposed in California is faulty to begin with. As Harold Meyerson explained, also for the Prospect: "It is a one-time-only tax, to be levied exclusively on billionaires’ current (i.e., 2025) net worth. Even if they move to Tasmania, they will still be liable for 5% of this year’s net worth."

"Crucially, the tax won’t crimp the fortunes of any billionaire who moves into the state next year or any later year, as it only applies to the billionaires living in the state this year," he added. "Therefore... the horrific specter of billionaire flight can’t be levied against the California proposal."

Nevertheless, Sorkin framed Newsom as being in an existential battle of ideas with Mamdani, asking how the two could both represent the Democratic Party when they are so "diametrically opposed."

"Well, I want to be a big-tent party," Newsom replied. "It's about addition, not subtraction."

Pushed on the question of whether there should be a "unifying theory of the case," Newsom responded that “we all want to be protected, we all want to be respected, we all want to be connected to something bigger than ourselves. We have fundamental values that I think define our party, about social justice, economic justice.”

"We have pre-distribution Democrats, and we have re-distribution Democrats," he continued. "Therein lies the dialectic and therein lies the debate."

Polling is scarce so far on the likelihood of such a measure passing in California. But nationally, polls suggest that the vast majority of Democrats fall on the "re-distribution" side of Newsom's "dialectic." In fact, the majority of all Americans do, regardless of party affiliation.

Last year, Inequality.org examined 55 national and state polls about a number of different taxation policies and found:

A billionaire income tax garnered the most support across party identification. On average, two out of three (67%) of Americans supported the tax including 84% of Democrats, 64% of Independents, and 51% of Republicans.

In national polls, a wealth tax had similarly high levels of support. More than three out of five Americans supported the tax including 78% of Democrats, 62% of Independents, and 51% of Republicans.

That sentiment only seems to have grown since the return of President Donald Trump. An Economist/YouGov poll released in early November found that 72% of Americans said that taxes on billionaires should be raised—including 95% of Democrats, 75% of independents, and 48% of Republicans. Across the board, just 15% said they should not be raised.

Support remains high when the proposal is more specific as well. On the eve of Mamdani's election, despitre months of fearmongering, 64% of New Yorkers said they backed his proposal, including a slight plurality of self-identified conservatives, according to a Siena College poll.

Many observers were perplexed by how Newsom proposes to maintain a “big tent” while opposing policies supported by most of the people inside it.

"A wealth tax is a big tent policy unless the only people you care about are billionaires," wrote Jonathan Cohn, the political director for Progressive Mass, a grassroots organization in Massachusetts, on social media.

"Gavin Newsom—estimated net worth between $20 and $30 million—says he's opposed to a billionaire wealth tax. Color me shocked," wrote the Columbia University lecturer Anthony Zenkus. "Democrats holding him up as a potential savior for 2028 is a clear example of not reading the room."

Keep ReadingShow Less

Supreme Court Agrees to Hear Case That Could Bless Trump's Bid to End Birthright Citizenship

"That the Supreme Court is actually entertaining Trump’s unconstitutional attack on birthright citizenship is the clearest example yet that the Roberts Court is broken beyond repair," said one critic.

Dec 05, 2025

The United States Supreme Court on Friday agreed to decide whether US President Donald Trump's executive order ending birthright citizenship—as guaranteed under the 14th Amendment for more than 150 years—is constitutional.

Next spring, the justices will hear oral arguments in Trump's appeal of a lower court ruling that struck down parts of an executive order—titled Protecting the Meaning and Value of American Citizenship—signed on the first day of the president's second term. Under the directive, which has not taken effect due to legal challenges, people born in the United States would not be automatically entitled to US citizenship if their parents are in the country temporarily or without legal authorization.

Enacted in 1868, the 14th Amendment affirms that "all persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the state wherein they reside."

While the Trump administration argues that the 14th Amendment was adopted to grant US citizenship to freed slaves, not travelers or undocumented immigrants, two key Supreme Court cases have affirmed birthright citizenship under the Constitution—United States v. Wong Kim Ark (1898) and Afroyim v. Rusk (1967).

Here is the question presented. It's a relatively clean vehicle for the Supreme Court to finally decide whether it is lawful for the president to deny birthright citizenship to the children of immigrants. www.supremecourt.gov/DocketPDF/25...

[image or embed]

— Mark Joseph Stern (@mjsdc.bsky.social) December 5, 2025 at 10:55 AM

Several district court judges have issued universal preliminary injunctions to block Trump's order. However, the Supreme Court's right-wing supermajority found in June that “universal injunctions likely exceed the equitable authority that Congress has given to federal courts."

In July, a three-judge panel of the US Court of Appeals for the 9th Circuit unanimously ruled that executive order is an unconstitutional violation of the plain language of the 14th Amendment. In total, four federal courts and two appellate courts have blocked Trump's order.

“No president can change the 14th Amendment’s fundamental promise of citizenship,” Cecillia Wang, national legal director at the ACLU—which is leading the nationwide class action challenge to Trump's order—said in a statement Friday. “We look forward to putting this issue to rest once and for all in the Supreme Court this term.”

Brett Edkins, managing director of policy and political affairs at the advocacy group Stand Up America, was among those who suggested that the high court justices should have refused to hear the case given the long-settled precedent regarding the 14th Amendment.

“This case is a right-wing fantasy, full stop. That the Supreme Court is actually entertaining Trump’s unconstitutional attack on birthright citizenship is the clearest example yet that the Roberts Court is broken beyond repair," Edkins continued, referring to Chief Justice John Roberts.

"Even if the court ultimately rules against Trump, in a laughable display of its supposed independence, the fact that fringe attacks on our most basic rights as citizens are being seriously considered is outrageous and alarming," he added.

Aarti Kohli, executive director of the Asian Law Caucus, said that “it’s deeply troubling that we must waste precious judicial resources relitigating what has been settled constitutional law for over a century," adding that "every federal judge who has considered this executive order has found it unconstitutional."

Tianna Mays, legal director for Democracy Defenders Fund, asserted, “The attack on the fundamental right of birthright citizenship is an attack on the 14th Amendment and our Constitution."

"We are confident the court will affirm this basic right, which has stood for over a century," Mays added. "Millions of families across the country deserve and require that clarity and stability.”

Keep ReadingShow Less

Most Popular