SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

One group noted "the irony of a billionaire being in charge of collecting pennies from debtors."

The US Education Department confirmed Monday that, starting next month, it will resume seizing the pay of student loan borrowers in default as the Trump administration wages a broader war on debt relief and cancellation efforts.

The department, led by billionaire Linda McMahon—who is working to gut the agency from the inside—told the Washington Post that "it will notify about 1,000 defaulted borrowers of plans to withhold a portion of their wages to pay down their past-due debt," beginning the week of January 7, 2026.

"After that, the department said, notices will be sent to larger numbers of borrowers each month," the Post reported. "There were about 5.3 million borrowers who had not made a payment on their federal student loans for at least 360 days as of June 30, according to the latest available data from the Education Department. Many of them were in default before the federal government stopped collecting defaulted loans because of the pandemic nearly six years ago."

Persis Yu, deputy executive director and managing counsel of the advocacy group Protect Borrowers, said in a statement Tuesday that "at a time when families across the country are struggling with stagnant wages and an affordability crisis, this administration's decision to garnish wages from defaulted student loan borrowers is cruel, unnecessary, and irresponsible."

"As millions of borrowers sit on the precipice of default, this administration is using its self-inflicted limited resources to seize borrowers' wages instead of defending borrowers' right to affordable payments," said Yu. "There are still nearly a million unprocessed Income-Driven Repayment applications, and this administration has admitted to denying en masse borrowers who applied and requested the US Department of Education’s help in accessing the most affordable payment option."

“Finally, during the last Trump administration, hundreds of thousands had their wages improperly taken at the peak of the pandemic because the US Department of Education was unable to control this tool," Yu added. "It is irresponsible to turn on a debt collection tool that the administration cannot turn off."

In May, the Trump administration ended a pause on student loan repayments that had been in place since the onset of the Covid-19 pandemic in 2020.

The administration has also attacked student debt relief efforts launched under former President Joe Biden. Earlier this month, the Trump Education Department cut a deal to effectively end the Saving on a Valuable Education (SAVE) plan, jacking up monthly payments for millions of borrowers enrolled in the Biden-era program.

"While millions of student loan borrowers struggle amidst the worsening affordability crisis—as the rising costs of groceries, utilities and healthcare continue to bury families in debt—billionaire Education Secretary Linda McMahon chose to strike a backroom deal with a right-wing state attorney general and strip borrowers of the most affordable repayment plan that would help millions to stay on track with their loans while keeping a roof over their head," Yu said in a statement after the deal was announced.

"The real story here," Yu added, "is the unrelenting, right-wing push to jack up costs on working people with student debt."

"The federal government also wields vast extrajudicial powers to collect student debt, including garnishing wages and seizing Social Security payments."

The Education Department is legally allowed to withhold up to 15% of a borrower's after-tax income to pay down defaulted debt. As the Post noted, the Trump administration has already resumed seizing tax refunds and Social Security benefits student loan borrowers in default.

The Debt Collective, the first debtors' union in the US, noted "the irony of a billionaire being in charge of collecting pennies from debtors."

"The Department of Education pushes debtors toward payment to get out of default," the group added. "They don’t want you to know that you have other options. These include traditional repayment options, nonpayment options, and lesser-known options."

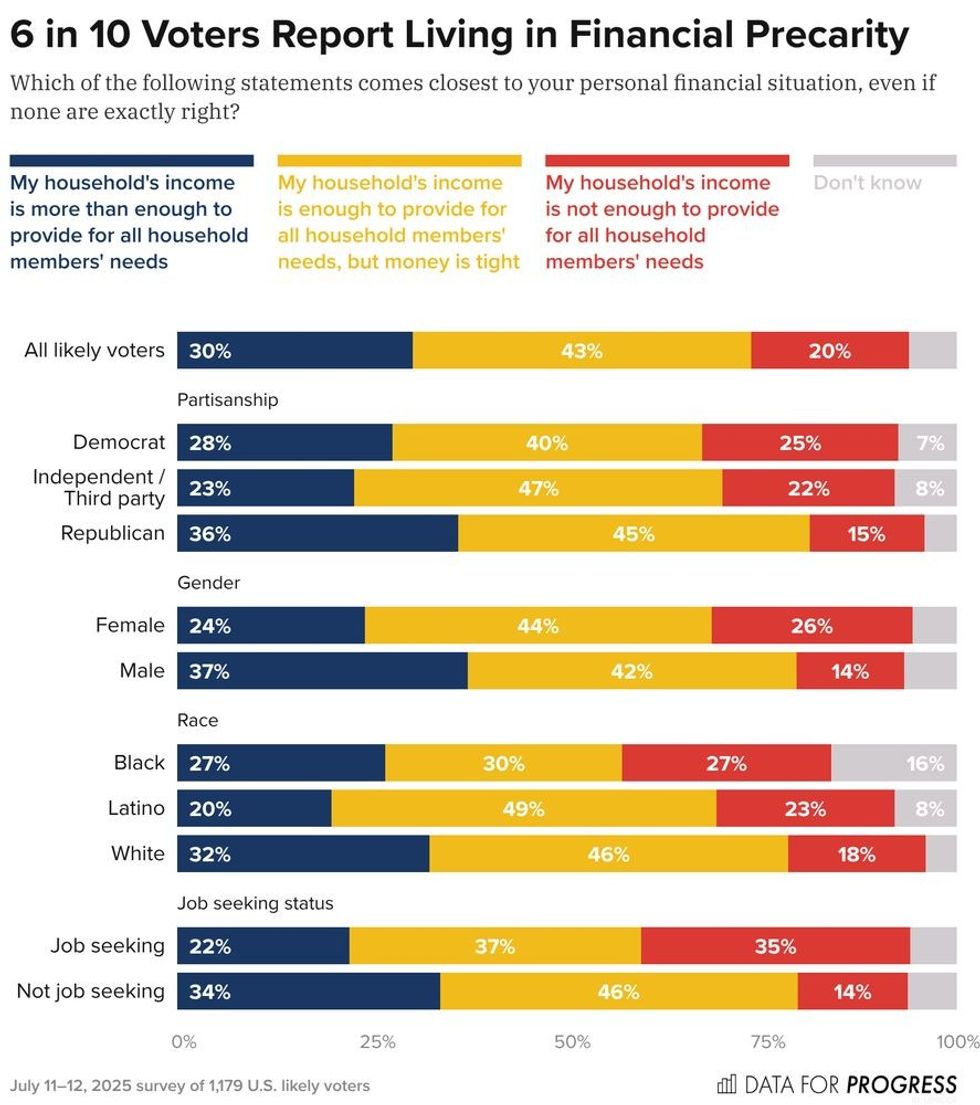

The Trump administration's decision to resume garnishing borrowers' wages comes as advocates are warning of a "default cliff" as borrowers struggle to afford basic necessities, leaving them unable to keep up with loan repayments. A Data for Progress survey released earlier this month found that more than 40% of borrowers report making tradeoffs between covering basic needs and staying current on student loan debt payments."

"Student loan default comes with severe and punitive consequences," Michele Zampini, associate vice president of federal policy and advocacy at the Institute for College Access and Success, wrote in a blog post earlier this month.

"In addition to ongoing credit score damage and hefty collection fees, the federal government also wields vast extrajudicial powers to collect student debt, including garnishing wages and seizing Social Security payments and tax refunds that are targeted to households with very low incomes, including the Child Tax Credit and the Earned Income Tax Credit," Zampini added. "These seizures compound financial hardship for those who can least afford it."

"It seems to me like we are looking at a labor market with near-zero labor force growth and near-zero real wage growth," wrote economist Dean Baker. "This means that real labor income in the economy is essentially flat."

Even without the benefit of recent federal jobs data, which the Trump administration has withheld amid the government shutdown, a prominent US economist argued Wednesday that it's clear the labor market under Donald Trump's leadership is increasingly grim.

Citing private figures that have been used to fill the void left by two consecutive missed jobs reports from the federal government, Dean Baker of the Center for Economic and Policy Research argued that "we can infer" weak job growth in September and suggested Trump or his aides "likely reviewed the September data and made a decision not to release it."

More broadly, Baker wrote, the payroll firm ADP "shows average private sector job growth of just 10,000 a month for the three months from July to October. Since this excludes the government sector, which likely shed jobs over this period due to federal layoffs (even pre-shutdown), the ADP data imply essentially zero job growth over this period."

"The other part of the story is that wage growth also seems to have slowed especially for workers at the bottom end of the wage distribution," Baker added. "It looks to me like we are looking at a labor market with near-zero labor force growth and near-zero real wage growth. This means that real labor income in the economy is essentially flat."

"That is not a pretty picture from the standpoint of the bulk of the population, and it does not describe a very stable path of economic growth," he continued. "When the AI bubble bursts, things might get really ugly really fast."

Baker's assessment came as CNN reported that President Donald Trump considered "traveling the country to give economy-focused speeches" as consumer sentiment craters, tariffs drive up prices, millions face skyrocketing health insurance premiums, and people across the country reel from the administration's assault on safety net programs.

Publicly, Trump has dismissed the notion that people are struggling economically under his administration, calling polling to that effect "fake."

"The economy's the strongest it's ever been," Trump falsely declared during a recent Fox News interview.

On Tuesday, the White House was widely mocked for citing extremely limited data from the food delivery company DoorDash to proclaim that Trump's agenda is "delivering real results for American families."

They’ve laid off so many people that the government is now getting its economic data from DoorDash.

[image or embed]

— Dare Obasanjo (@carnage4life.bsky.social) Nov 11, 2025 at 8:09 PM

Economist Paul Krugman wrote in a blog post on Wednesday that Trump is beginning to face "backlash against his attempts to gaslight the public about the true state of the economy," pointing to "the blowout Democratic victories in last week’s elections" as just part of that backlash.

"Once again, these attempts aren’t about putting a positive spin on the data. They’re just flat-out lies," Krugman wrote. "And Democrats should hammer those lies as proof not just that Trump is utterly dishonest, but that he’s completely out of touch with the reality of American life."

Amid intensifying tariffs, just 30% of Americans say they can afford the cost of living, according to a poll from Data for Progress.

The White House says the U.S. is in the midst of an "economic boom" under President Donald Trump. But voters aren't feeling it in their wallets.

Polling released by Gallup Thursday found the president's approval rating at just 37%, the lowest point of his second term so far, with an all-time low approval rating of 29% among independents.

This precipitous decline has been helped along by sagging approval on the economy, which has historically been the issue where he gets the most support. After a high of 42% in February, approval for his handling of the economy is likewise down to just 37%.

An uptick in inflation seen over the past month has exacerbated the cost of living crisis Trump promised to abate on the campaign trail.

A poll released Friday by Data for Progress found that, "Only 30% of likely voters report having enough income to be able to comfortably provide for their household's needs, while a plurality of voters (43%) say they have enough income but money is tight, and 20% say they do not make enough to provide for all household members' needs."

"As his approval tanks, President Trump has finally lost voters on the one issue where they've historically trusted him: the economy," said Lindsay Owens, the executive director of the Groundwork Collaborative. "Not only has Trump shirked his promise to lower prices, he's made the situation substantially worse as his tax and tariff policies have landed a double blow to household budgets."

According to data from Indeed, cited by Forbes, 43% of Americans have seen their wages lagging behind the cost of living over the past year. The jobs feeling the worst crunch are those "at the low-to-middle end of the pay spectrum."

Trump has imposed the highest tariffs on imported goods since the Great Depression. After months of relative quiet, they began to make their impact felt this past month, with consumer prices up 2.7% from the previous year, compared with just 2.4% in May.

While rising rent costs were the top driver of inflation in June, prices for clothing, toys, and consumer appliances all rose, as did food and energy.

The president was elected on promises to tackle the cost of living. But now 70% say that he is not focused enough on lowering prices, according to polling released Sunday by CBS News. Meanwhile, 61% say Trump is focusing too much on his tariff policy, which remains broadly unpopular.

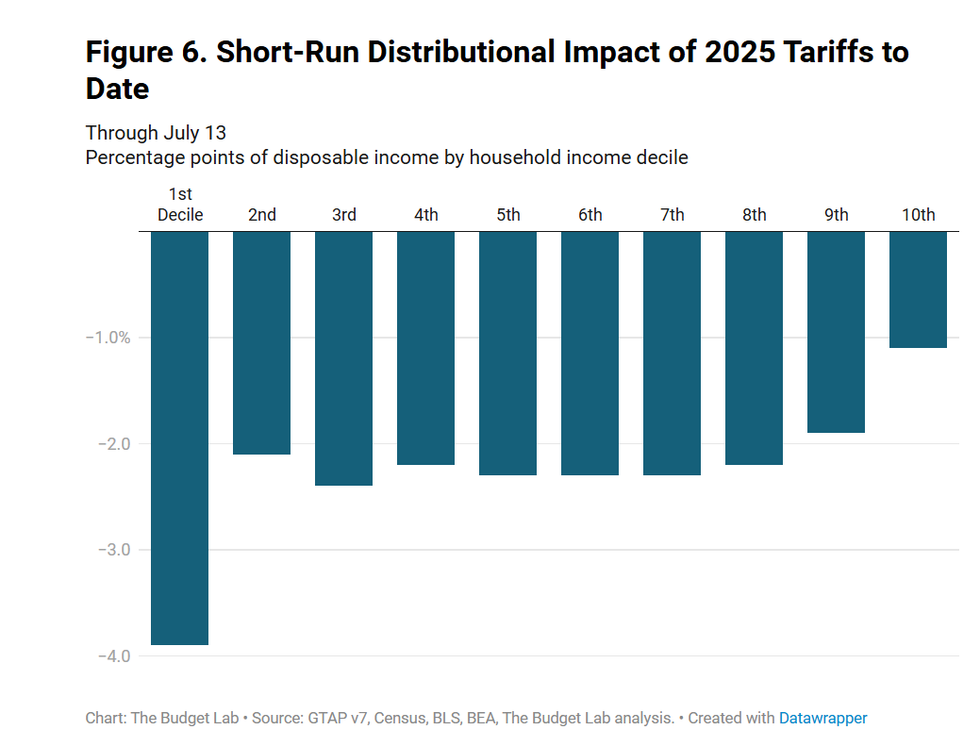

Yale's Budget Lab estimates that it would cost the average household $2,770 worth of disposable income per year if tariffs stayed at their current rate indefinitely, with the worst impact—especially in the short term—on the poorest Americans.

But they are set to grow more intense beginning on August 1, when Trump has said he'll roll out new levies on imports from some of America's top trading partners, including Canada, the European Union, Mexico, Brazil, and South Korea.

According to economists who spoke with Vox, the worst effects are likely yet to come. Preston Caldwell, chief U.S. economist for Morningstar, said inflation would likely peak in 2026 rather than 2025.

"Companies have started paying tariffs on their imported goods, but as far as the goods that are being sold in stores right now, those are primarily being drawn from the inventory of goods that were brought in before the tariffs," Caldwell said. "So most companies are still not really having to recognize the loss of tariffs yet to a great degree."

"The more that it becomes clear that tariffs are here for at least the foreseeable future," he continued, "the more that they are going to have to eventually adjust to this new reality, which will entail increasing their prices."

Owens said that will likely translate to even fiercer backlash against Trump.

"Working families," she said, "know exactly who to blame as they pay higher prices on everything from groceries and electricity bills to school supplies and appliances."