Analysis Shows US Lawmakers Traded Up to $113 Million in Arms Stocks This Year

"If Congress wants to wash itself of conflicts of interest it can start by passing a stock trading ban."

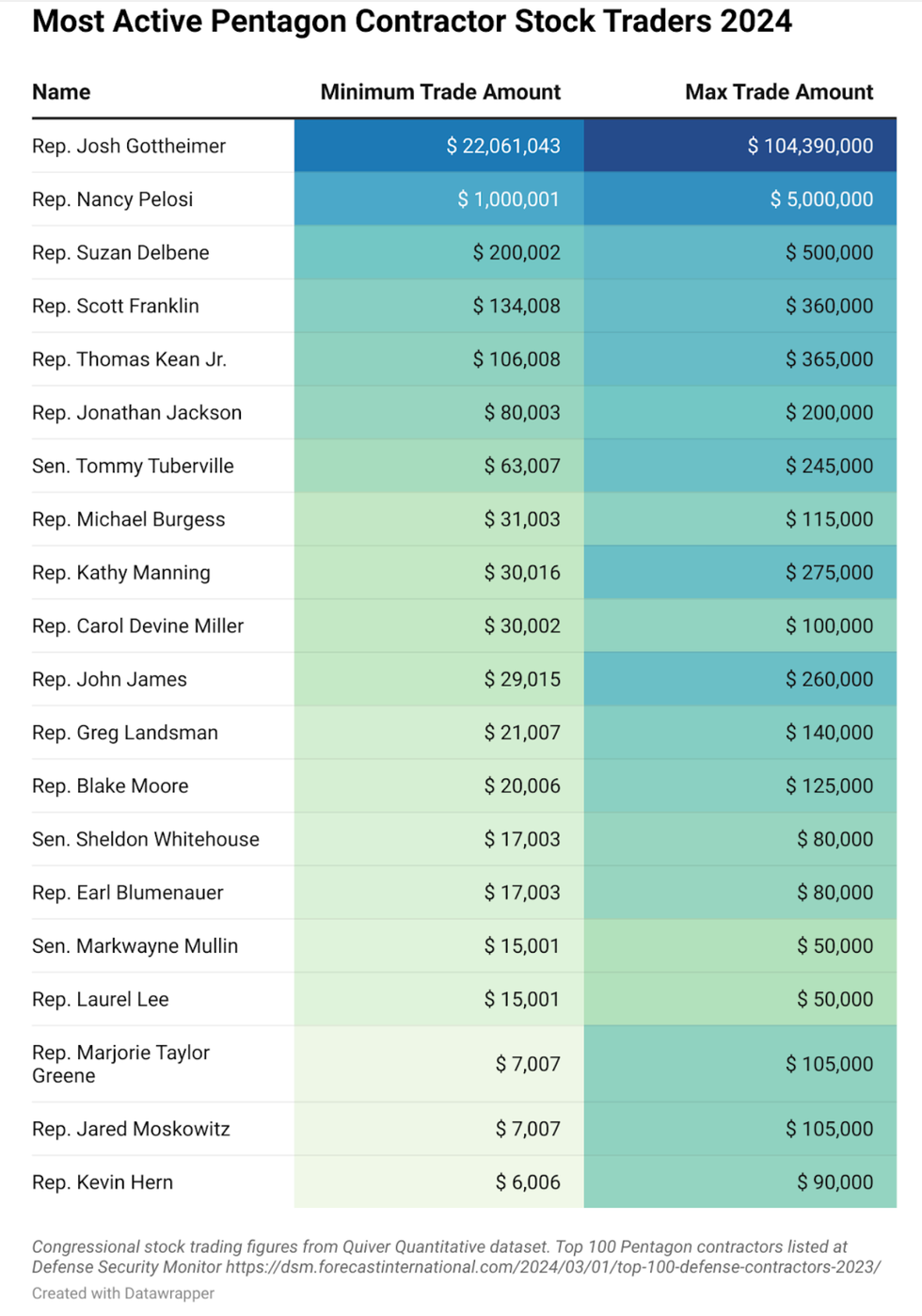

Dozens of U.S. lawmakers and their families bought or sold up to $113 million worth of shares in top Pentagon contractors this year, an analysis published on Wednesday revealed.

The Quincy Institute for Responsible Statecraft found that at least 37 members of Congress and their relatives traded between $24-113 million worth of stock in companies listed on Defense and Security Monitor's Top 100 Defense Contractors index.

As the Quincy Institute noted: "Eight of these members even simultaneously held positions on the Armed Services and Foreign Affairs Committees, the committees overseeing defense policy and foreign relations. Members of Congress that oversee the annual defense bill and are privy to intelligence briefings have an upper hand in predicting future stock prices."

The analysis found that one Democratic congressman accounted for the vast bulk of defense stock trading in 2024.

Rep. Josh Gottheimer of New Jersey traded at least $22 million and as much as $104 million worth of shares in companies on the index, including Microsoft, Northrop Grumman, and IBM. Gottheimer—who said his trades are handled by a third-party firm—sits on both the House Permanent Select Committee on Intelligence and the National Security subcommittee of the Committee on Financial Services.

Next on the list in distant second place is former House Speaker Nancy Pelosi (D-Calif.), who has defended stock trading by lawmakers, and according to Quincy, "sold over $1 million worth of Microsoft stock in late July."

"The timing of Pelosi's Microsoft trades in the past have garnered attention, too; in March 2021, she bought Microsoft call options less than two weeks before the Army announced a $22 billion contract with the software company to supply augmented reality headsets," the analysis states.

"Pelosi had the most profitable 2024 of any lawmaker, netting an estimated $38.6 million from all stock trading activity, according to Quiver Quantitative," the report adds.

Pelosi was followed by Reps. Suzan DelBene (D-Wash.), Scott Franklin (R-Fla.), and Thomas Keane Jr. (R-N.J.).

The Quincy Institute asserted: "If Congress wants to wash itself of conflicts of interest it can start by passing a stock trading ban. The Ending Trading and Holdings in Congressional Stocks Act, or ETHICS Act, would prohibit members of Congress from trading individual stocks."

The ETHICS Act was approved by the Democrat-controlled Senate Committee on Homeland Security and Government Affairs in July. The full Senate—which will be GOP-controlled starting next month—has yet to vote on the bill.

Earlier this month, U.S. President Joe Bide n was applauded by progressive lawmakers for backing a ban on congressional stock trading and asserting that "nobody in the Congress should be able to make money in the stock market while they're in the Congress."

On Monday, Biden signed the $895 billion Servicemember Quality of Life Improvement and National Defense Authorization Act for Fiscal Year 2025. As Sen. Bernie Sanders (I-Vt.) has highlighted, "Of that nearly $1 trillion dollars... about half will go to a handful of hugely profitable defense contractors."

Congresswoman Rashida Tlaib (D-Mich.) decried both the enormity of the military budget, as well as the fact that some of her colleagues have profited from investments in the military-industrial complex.

Tlaib has introduced the Stop Politicians Profiting from War Act, which would ban members of Congress, their spouses, and their dependent children from trading defense stocks or having financial interests in companies that do business with the U.S. Department of Defense.

In 2012, Congress passed the Stop Trading on Congressional Knowledge (STOCK) Act, legislation that has been panned as

weak and ineffective.