SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

A customer prepares to check out at a grocery store on January 15, 2025 in Chicago, Illinois.

"As Americans plead for their government to help with soaring costs," one expert said, "Trump is not just ignoring their struggles, he's actively making them worse with reckless policies that drive up prices on essentials."

Yet another poll exposes the pain that working-class Americans are enduring thanks to US President Donald Trump's policies, the economic justice advocates behind the new survey said Tuesday.

Polling released in recent months has highlighted how most Americans don't believe that merely working hard is enough to get ahead, a majority blames Trump for the country's economic woes, and large shares are concerned about the price of groceries, housing, and unexpected medical expenses.

The new survey—conducted by Data for Progress less than two weeks ago for Groundwork Collaborative and Protect Borrowers—shows that "American families are trapped in a cycle of debt," the groups said.

Specifically, the Data for Progress found that 55% of likely voters have at least some credit card debt, and another 18% said that they "had this type of debt in the past, but not anymore." Additionally, over half have or previously had car loan or medical debt, more than 40% have or had student debt, and over 35% are or used to be behind on utility payments.

More than two-thirds of respondents said that the federal government's resumption of student loan collections had an impact on their family's finances, and almost a quarter said they would need a one-time infusion of cash, "such as from inheritance, lottery, government assistance, etc.," to be able to pay off all of their debt.

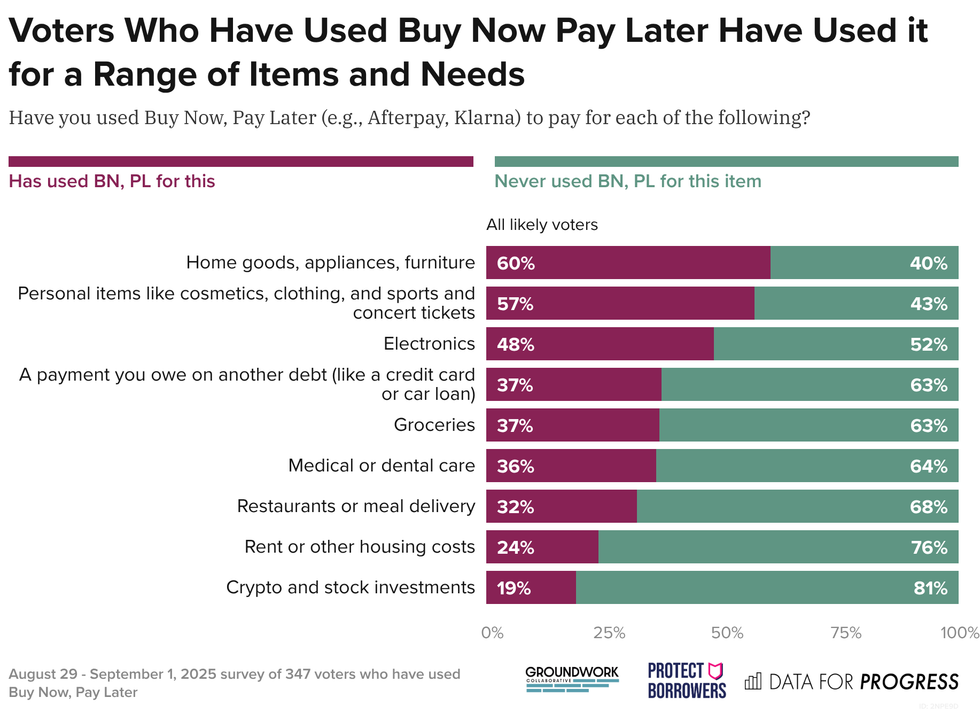

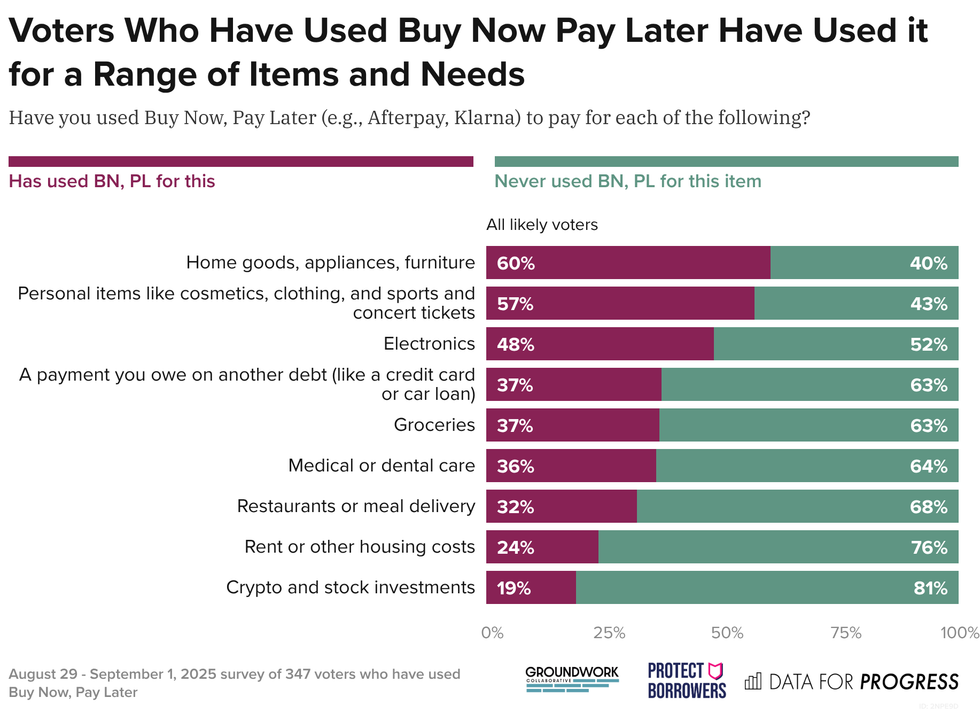

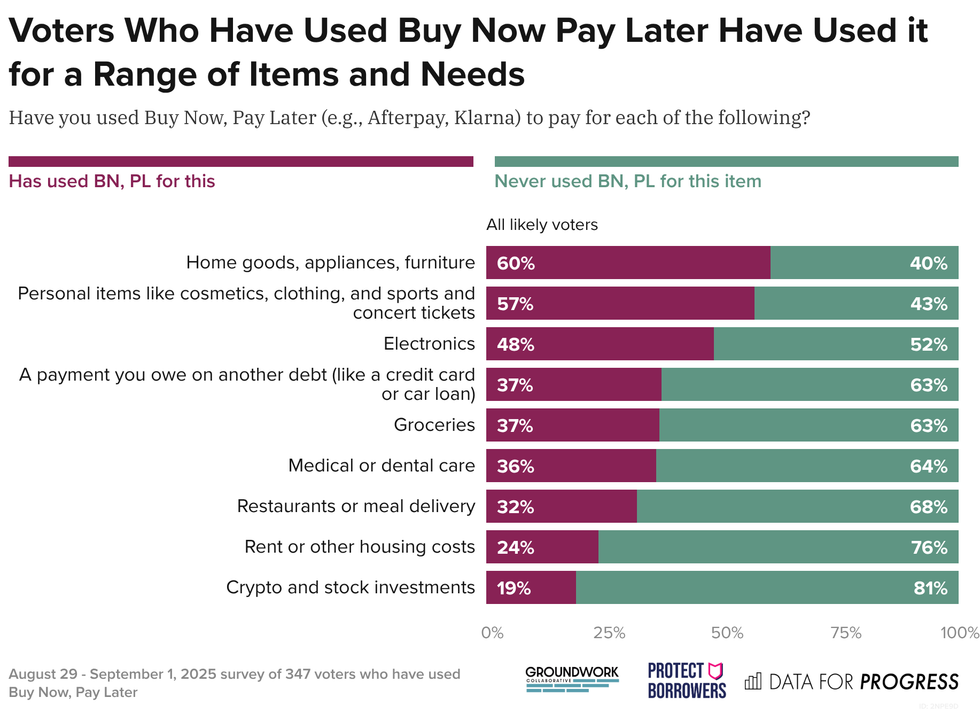

The pollsters also found nearly 30% have or had "buy now, pay later" debt. Nearly 1-in-3 said they had taken out this type of loan—through options such as Afterpay or Klarna—in the past year to pay for basic needs and monthly expenses.

"Today's poll reveals a troubling rise in families relying on buy now, pay later loans just to stay afloat, trapping hardworking Americans in a cycle of debt that some fear will take years to climb out of," said Groundwork's executive director, Lindsay Owens. "As Americans plead for their government to help with soaring costs, President Trump is not just ignoring their struggles, he's actively making them worse with reckless policies that drive up prices on essentials like food and energy."

Trump's legally dubious tariffs—which are headed to the US Supreme Court after another legal loss last month—have negatively impacted Americans' wallets by elevating the costs of basics while also failing to deliver on his campaign promise to turn the United States back into a "manufacturing powerhouse."

"Today's poll exposes a startling new reality in Donald Trump's economy: As prices climb and money gets tight, Americans are going into debt to buy groceries, make rent, get healthcare, and even make payments on other debt," said Protect Borrowers executive director Mike Pierce. "Driving families into debt is a policy choice—voters across party lines are demanding lawmakers act now to deliver debt relief and help working families make ends meet."

The GOP controls both chambers of Congress and the White House. This summer, Republicans on Capitol Hill passed and Trump signed their so-called One Big Beautiful Bill Act, which is expected to further imperil working-class families by kicking millions of people off their healthcare and federal food assistance to give more tax cuts to the ultrarich.

To combat that agenda, "fight for families in debt, and hold corporations and corrupt politicians accountable," Protect Borrowers officially relaunched on Tuesday, rebranding from the Student Borrower Protection Center, which focused on educational debt.

"As the Trump administration turns its back on working-class families," said Pierce, "Protect Borrowers will fight back—exposing the greedy financial companies cutting backroom deals with regulators, taking corrupt government officials and corporations to court, and advancing new laws to hold the system accountable to working people."

Protect Borrowers announced 17 new members of its advisory board, including people who previously served in the Consumer Financial Protection Bureau (CFPB), Federal Trade Commission, National Labor Relations Board, and White House.

The group is also backed by US Sen. Elizabeth Warren (D-Mass.), a bankruptcy expert and the mastermind behind the CFPB.

"With wages flat and costs skyrocketing, families are drowning in debt—mortgages, credit cards, student loans, buy now, pay later, you name it," Warren said in a statement to Politico. "Protect Borrowers is exposing how rigged our economy is, and how the Trump administration is making it worse. I'm glad to stand with them in this fight."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Yet another poll exposes the pain that working-class Americans are enduring thanks to US President Donald Trump's policies, the economic justice advocates behind the new survey said Tuesday.

Polling released in recent months has highlighted how most Americans don't believe that merely working hard is enough to get ahead, a majority blames Trump for the country's economic woes, and large shares are concerned about the price of groceries, housing, and unexpected medical expenses.

The new survey—conducted by Data for Progress less than two weeks ago for Groundwork Collaborative and Protect Borrowers—shows that "American families are trapped in a cycle of debt," the groups said.

Specifically, the Data for Progress found that 55% of likely voters have at least some credit card debt, and another 18% said that they "had this type of debt in the past, but not anymore." Additionally, over half have or previously had car loan or medical debt, more than 40% have or had student debt, and over 35% are or used to be behind on utility payments.

More than two-thirds of respondents said that the federal government's resumption of student loan collections had an impact on their family's finances, and almost a quarter said they would need a one-time infusion of cash, "such as from inheritance, lottery, government assistance, etc.," to be able to pay off all of their debt.

The pollsters also found nearly 30% have or had "buy now, pay later" debt. Nearly 1-in-3 said they had taken out this type of loan—through options such as Afterpay or Klarna—in the past year to pay for basic needs and monthly expenses.

"Today's poll reveals a troubling rise in families relying on buy now, pay later loans just to stay afloat, trapping hardworking Americans in a cycle of debt that some fear will take years to climb out of," said Groundwork's executive director, Lindsay Owens. "As Americans plead for their government to help with soaring costs, President Trump is not just ignoring their struggles, he's actively making them worse with reckless policies that drive up prices on essentials like food and energy."

Trump's legally dubious tariffs—which are headed to the US Supreme Court after another legal loss last month—have negatively impacted Americans' wallets by elevating the costs of basics while also failing to deliver on his campaign promise to turn the United States back into a "manufacturing powerhouse."

"Today's poll exposes a startling new reality in Donald Trump's economy: As prices climb and money gets tight, Americans are going into debt to buy groceries, make rent, get healthcare, and even make payments on other debt," said Protect Borrowers executive director Mike Pierce. "Driving families into debt is a policy choice—voters across party lines are demanding lawmakers act now to deliver debt relief and help working families make ends meet."

The GOP controls both chambers of Congress and the White House. This summer, Republicans on Capitol Hill passed and Trump signed their so-called One Big Beautiful Bill Act, which is expected to further imperil working-class families by kicking millions of people off their healthcare and federal food assistance to give more tax cuts to the ultrarich.

To combat that agenda, "fight for families in debt, and hold corporations and corrupt politicians accountable," Protect Borrowers officially relaunched on Tuesday, rebranding from the Student Borrower Protection Center, which focused on educational debt.

"As the Trump administration turns its back on working-class families," said Pierce, "Protect Borrowers will fight back—exposing the greedy financial companies cutting backroom deals with regulators, taking corrupt government officials and corporations to court, and advancing new laws to hold the system accountable to working people."

Protect Borrowers announced 17 new members of its advisory board, including people who previously served in the Consumer Financial Protection Bureau (CFPB), Federal Trade Commission, National Labor Relations Board, and White House.

The group is also backed by US Sen. Elizabeth Warren (D-Mass.), a bankruptcy expert and the mastermind behind the CFPB.

"With wages flat and costs skyrocketing, families are drowning in debt—mortgages, credit cards, student loans, buy now, pay later, you name it," Warren said in a statement to Politico. "Protect Borrowers is exposing how rigged our economy is, and how the Trump administration is making it worse. I'm glad to stand with them in this fight."

Yet another poll exposes the pain that working-class Americans are enduring thanks to US President Donald Trump's policies, the economic justice advocates behind the new survey said Tuesday.

Polling released in recent months has highlighted how most Americans don't believe that merely working hard is enough to get ahead, a majority blames Trump for the country's economic woes, and large shares are concerned about the price of groceries, housing, and unexpected medical expenses.

The new survey—conducted by Data for Progress less than two weeks ago for Groundwork Collaborative and Protect Borrowers—shows that "American families are trapped in a cycle of debt," the groups said.

Specifically, the Data for Progress found that 55% of likely voters have at least some credit card debt, and another 18% said that they "had this type of debt in the past, but not anymore." Additionally, over half have or previously had car loan or medical debt, more than 40% have or had student debt, and over 35% are or used to be behind on utility payments.

More than two-thirds of respondents said that the federal government's resumption of student loan collections had an impact on their family's finances, and almost a quarter said they would need a one-time infusion of cash, "such as from inheritance, lottery, government assistance, etc.," to be able to pay off all of their debt.

The pollsters also found nearly 30% have or had "buy now, pay later" debt. Nearly 1-in-3 said they had taken out this type of loan—through options such as Afterpay or Klarna—in the past year to pay for basic needs and monthly expenses.

"Today's poll reveals a troubling rise in families relying on buy now, pay later loans just to stay afloat, trapping hardworking Americans in a cycle of debt that some fear will take years to climb out of," said Groundwork's executive director, Lindsay Owens. "As Americans plead for their government to help with soaring costs, President Trump is not just ignoring their struggles, he's actively making them worse with reckless policies that drive up prices on essentials like food and energy."

Trump's legally dubious tariffs—which are headed to the US Supreme Court after another legal loss last month—have negatively impacted Americans' wallets by elevating the costs of basics while also failing to deliver on his campaign promise to turn the United States back into a "manufacturing powerhouse."

"Today's poll exposes a startling new reality in Donald Trump's economy: As prices climb and money gets tight, Americans are going into debt to buy groceries, make rent, get healthcare, and even make payments on other debt," said Protect Borrowers executive director Mike Pierce. "Driving families into debt is a policy choice—voters across party lines are demanding lawmakers act now to deliver debt relief and help working families make ends meet."

The GOP controls both chambers of Congress and the White House. This summer, Republicans on Capitol Hill passed and Trump signed their so-called One Big Beautiful Bill Act, which is expected to further imperil working-class families by kicking millions of people off their healthcare and federal food assistance to give more tax cuts to the ultrarich.

To combat that agenda, "fight for families in debt, and hold corporations and corrupt politicians accountable," Protect Borrowers officially relaunched on Tuesday, rebranding from the Student Borrower Protection Center, which focused on educational debt.

"As the Trump administration turns its back on working-class families," said Pierce, "Protect Borrowers will fight back—exposing the greedy financial companies cutting backroom deals with regulators, taking corrupt government officials and corporations to court, and advancing new laws to hold the system accountable to working people."

Protect Borrowers announced 17 new members of its advisory board, including people who previously served in the Consumer Financial Protection Bureau (CFPB), Federal Trade Commission, National Labor Relations Board, and White House.

The group is also backed by US Sen. Elizabeth Warren (D-Mass.), a bankruptcy expert and the mastermind behind the CFPB.

"With wages flat and costs skyrocketing, families are drowning in debt—mortgages, credit cards, student loans, buy now, pay later, you name it," Warren said in a statement to Politico. "Protect Borrowers is exposing how rigged our economy is, and how the Trump administration is making it worse. I'm glad to stand with them in this fight."