SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Michael Briggs: (202) 228-6492

With working families across the country increasingly bearing the brunt of growing economic pain and inequality - amidst the conflict in Ukraine, the ongoing coronavirus pandemic, and spiking prices of critical necessities - Sen. Bernie Sanders (I-Vt.) on Friday introduced legislation in the Senate that would impose a 95 percent windfall tax on the excess profits of major companies. A temporary emergency measure, Sanders' Ending Corporate Greed Act could raise an estimated $400 billion in one year from 30 of the largest corporations alone and would apply only in 2022, 2023, and 2024.

With working families across the country increasingly bearing the brunt of growing economic pain and inequality - amidst the conflict in Ukraine, the ongoing coronavirus pandemic, and spiking prices of critical necessities - Sen. Bernie Sanders (I-Vt.) on Friday introduced legislation in the Senate that would impose a 95 percent windfall tax on the excess profits of major companies. A temporary emergency measure, Sanders' Ending Corporate Greed Act could raise an estimated $400 billion in one year from 30 of the largest corporations alone and would apply only in 2022, 2023, and 2024.

Sen. Ed Markey (D-Mass.) is cosponsoring the legislation in the Senate, and Rep. Jamaal Bowman (D-N.Y.) will introduce companion legislation in the House of Representatives.

This would not be the first time the United States implemented a windfall profits tax. Sanders' legislation is modelled after the broad-based windfall profits tax implemented by the U.S. during the first and second World Wars and the Korean War. During World War II, the tax rate reached as high as 95 percent, which ensured that companies could not profiteer off the war. The U.S. also enacted a windfall profits tax on oil and gas companies as recently as the mid-1980s.

"The American people are sick and tired of the unprecedented corporate greed that exists all over this country. They are sick and tired of being ripped-off by corporations making record-breaking profits while working families are forced to pay outrageously high prices for gas, rent, food, and prescription drugs," said Sen. Sanders. "We cannot allow big oil companies and other large, profitable corporations to continue to use the war in Ukraine, the COVID-19 pandemic, and the specter of inflation to make obscene profits by price gouging Americans at the gas pump, the grocery store, or any other sector of our economy. During these troubling times, the working class cannot bear the brunt of this economic crisis, while corporate CEOs, wealthy shareholders, and the billionaire class make out like bandits. The time has come for Congress to work for working families and demand that large, profitable corporations make a little bit less money and pay their fair share of taxes."

"My constituents are hurting, and they are rightly asking what Congress can do about surging prices for food, energy, and other necessities," said Rep. Bowman. "What we cannot do is ask working Americans to shoulder any more of this burden. Corporate price-gouging is playing a big role in the inflation we are experiencing right now, putting families in a financial squeeze in the middle of an ongoing pandemic. These are the same corporations that are eroding our democracy, eviscerating workers' rights, and fueling the climate crisis -- and it is time to make them pay. The Ending Corporate Greed Act will take away any incentive for large companies to exploit our current crisis for profit, and it will protect workers, families, and small businesses in New York and across the country. Our country has successfully used windfall profits taxes in the past, and I look forward to working with Senator Sanders to pass this bill as soon as possible."

"Oil companies are raking in record profits, while Americans are facing price hikes at the pump," said Sen. Markey. "Something is fundamentally broken when the biggest corporations in the country are leveraging a pandemic and a war to pad their profit margins as average Americans suffer. That is why I am co-sponsoring Senator Sanders' Ending Corporate Greed Act to protect consumers from profiteering and stand against economic inequality."

If signed into law, Sanders' Ending Corporate Greed Act would:

Under this legislation, even with the 95 percent windfall profits tax, companies would still be able to make a reasonable profit compared to previous years. Additionally, as the tax is on profit, not revenue, companies that raise prices for legitimate reasons related to rising expenses would not be penalized. However, companies that have chosen to raise prices in the pursuit of obscene profiteering, to further enrich their CEOs and wealthy shareholders, would pay a tax of up to 95 percent on their windfall profits. For example:

This legislation has been endorsed by: the Economic Policy Institute, American Economic Liberties Project, Groundwork Action, Sunrise Movement, Friends of the Earth, Food & Water Watch, and Center for Biological Diversity. Numerous scholars and policy experts have also voiced support for the windfall profits tax as a strong measure to fight inflation and limit corporate profiteering, including tax scholar Reuven Avi-Yonah, economists Emmanuel Saez and Gabriel Zucman, and Economic Policy Institute economist Josh Bivens.

Read the summary, here.

Read the fact sheet and statements of support, here.

Read the bill text, here.

"Your Department of Justice initially released this list of 32 survivors' names, with only one name redacted," Rep. Pramila Jayapal told Attorney General Pam Bondi.

US Attorney General Pam Bondi on Wednesday refused to apologize to victims of late sex offender Jeffrey Epstein during a contentious hearing before the House Judiciary Committee.

During the hearing, Rep. Pramila Jayapal (D-Wash.) grilled Bondi on why her office failed repeatedly to comply with a law passed in 2025 requiring the US Department of Justice (DOJ) to release "all unclassified records, documents, communications, and investigative materials in DOJ’s possession that relate to the investigation and prosecution of Jeffrey Epstein."

In particular, Jayapal noted that some of the files released by the DOJ so far have kept victims' names intact, even while redacting the names of several powerful men who are implicated in Epstein's sex trafficking operation.

"Your Department of Justice initially released this list of 32 survivors' names, with only one name redacted," said Jayapal, who then slammed the DOJ for releasing files that not only included victims' names but also their email and residential addresses, and even nude photographs of them.

🚨HISTORIC. Rep. Jayapal asks Epstein survivors to raise their hand if they still haven't been invited to meet with Pam Bondi or the DOJ.

Every single one raises their hand.

Sometimes gestures are more powerful than words. Damn this Administration.

pic.twitter.com/jyYG7Mj6tN

— CALL TO ACTIVISM (@CalltoActivism) February 11, 2026

"Survivors are now telling us that their families are finding out for the first time that they were trafficked by Epstein," Jayapal continued. "In their words, 'This release does not provide closure, it feels like a deliberate attempt to intimidate survivors, punish those who came forward, and reinforce the same culture of secrecy that allowed Epstein's crimes to continue for decades.'"

Jayapal then invited the Epstein survivors who were in attendance at the hearing to stand if they so wished, and asked them to raise their hands if they had still yet to meet with the DOJ to discuss the case.

After several women stood and raised their hands, Jayapal asked Bondi if she would apologize to them failing to redact their names and personal information before releasing the Epstein files.

Bondi responded by trying to deflect blame for past failures onto former Attorney General Merrick Garland. Jayapal interrupted the attorney general and asked her if she would apologize to the survivors for disclosing their information.

Bondi again tried to redirect the conversation to Garland, after which Jayapal again objected.

Finally, Bondi responded, "I'm not going to get in the gutter for [Jayapal's] theatrics."

A report released Wednesday by a key Democratic senator details how President Donald Trump's "economic policies are making life unaffordable for millions of American small businesses, their workers, and their customers."

Since Trump returned to power last year, "America's 36 million small businesses and their workers have faced increased costs for everything from healthcare to electricity, groceries, childcare, housing, and other everyday necessities," notes Pain Street, the new report from Sen. Ed Markey (D-Mass.), ranking member of the Senate Committee on Small Business and Entrepreneurship.

The report highlights Republicans' so-called One Big Beautiful Bill Act (OBBBA), which slashed various benefits for US families, and their refusal to extend Affordable Care Act (ACA) subsidies that helped over 20 million Americans afford health insurance.

The OBBBA's $1 trillion Medicaid cut "is devastating for small businesses," the document declares, noting that 630,000 owners and more than 7.5 million workers at such companies rely on the federal program for healthcare coverage. Additionally, over 10 million owners and employees relied on the ACA tax credits that expired at the end of last year.

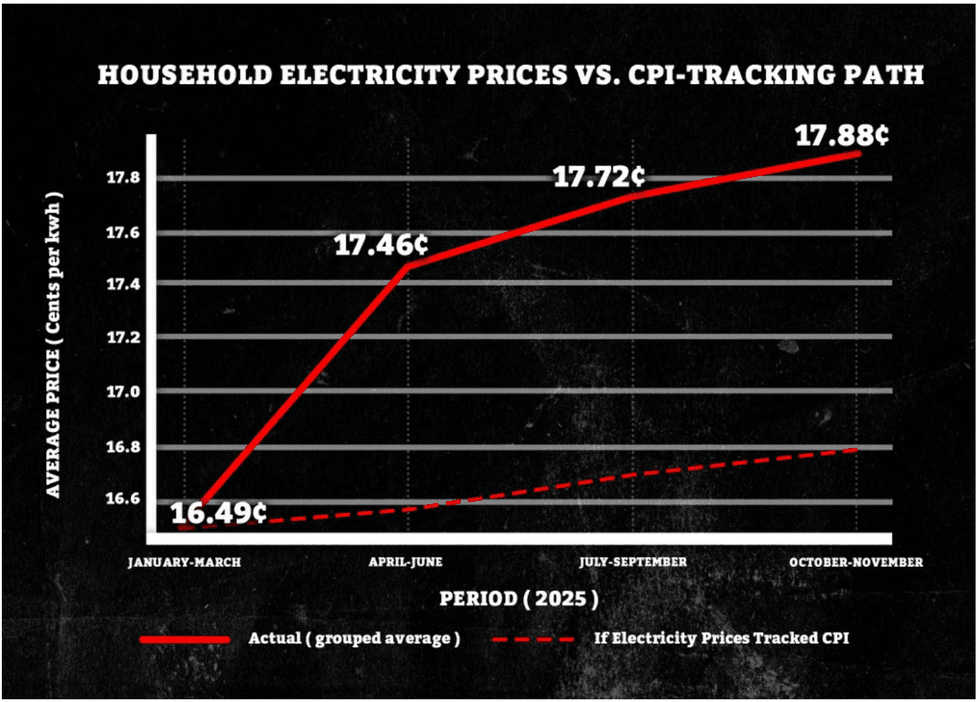

The publication also points to the president's attacks on clean energy and support for the planet-wrecking fossil fuel industry that helped him secure a second term. It says that "household electric bills have increased by 11.5%, and commercial electric bills have increased by 9%," stressing that such costs have climbed "more than three times faster than the overall rate of inflation."

The report also spotlights the "whiplash and cost of Trump's reckless tariffs," emphasizing that while the president often claims foreign countries are paying for his import taxes, "analysis by the Kiel Institute for the World Economy found that 96% of Trump's tariffs are being paid by American importers and consumers."

Specifically, since last March, US small businesses have shelled out more than $63.1 billion because of Trump tariffs. California—the world's fifth-largest economy—leads the state-by-state breakdown, at $14.3 billion, followed by Texas ($7 billion), New York ($4.9 billion), New Jersey ($4.1 billion), Georgia ($3.9 billion), Florida ($3.6 billion), Illinois ($2.3 billion), Ohio ($2 billion), Michigan ($1.7 billion), and South Carolina ($1.6 billion).

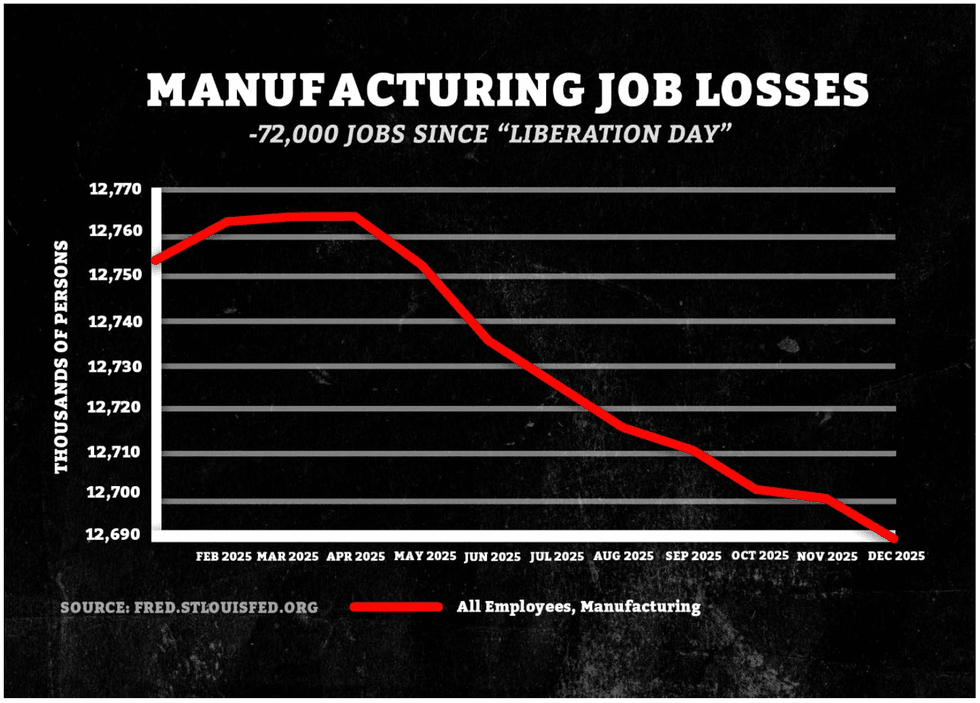

The president also claims that his tariffs are spurring a "manufacturing renaissance," but "approximately 98% of manufacturers in the United States employ fewer than 500 workers, with 75% of manufacturers employing fewer than 20," the report states. "US manufacturing shrank for the 10th consecutive month in December, and US factories have shed 72,000 jobs since Trump's 'liberation day' in April."

Adding to the evidence of Trump's negative impact, the Bureau of Labor Statistics announced Wednesday that across all sectors, US employers added just 181,000 jobs last year, far below its initial estimate of 584,000, and the country's economy has more than a million fewer jobs than previously reported.

Markey's staff further found that "soaring rents have left a record 22.6 million renters—approximately 50% of all renters in the US—struggling to afford their rent," 70% of families said last year that raising children is too expensive, and Trump's deportation agenda is estimated to reduce the number of immigrant and US-born workers by more than 5 million.

"Small businesses don't have Mar-a-Lago memberships, golden gifts, or ballroom invitations granting them special exemptions from Trump’s reckless economic policies, including his tariff taxes," Markey said in a statement announcing the report.

"Since Inauguration Day, Trump has made life more expensive for Americans—driving up costs on everything from healthcare, electricity, and groceries to childcare and housing—all while giving tax cuts to CEO billionaires and currying favors with big business," he continued. "As Trump's affordability crisis wreaks havoc on Main Street, we must fight back to protect small businesses, working families, and communities in Massachusetts and across the country."

As part of that fight, Markey has tried to pass multiple pieces of legislation that would exempt small businesses from Trump's tariffs, but both chambers of Congress remain narrowly controlled by the president's Republican Party.

"The American people want real change," the senator said. "Let's do it."

Recent progressive electoral victories have been followed by assurances from centrist Democratic politicians and strategists that such successes can't be replicated elsewhere, and congressional candidate Analilia Mejía's primary win this week was no exception—but Sen. Bernie Sanders implored voters not to listen to the naysayers who continue to insist that "moderation" is the key to winning elections for Democrats.

Emphasizing that Mejía, a grassroots organizer, was known to just 5% of voters in New Jersey's 11th Congressional District when she launched her campaign in November, Sanders said Wednesday: "Make no mistake. This can be done everywhere."

Mejía ran against 10 other candidates, including former US Rep. Tom Malinowski (D-NJ), in the Democratic primary ahead of the April 16 special election to fill the seat left vacant by Gov. Mikie Sherrill.

The progressive candidate was outspent 4-1, said Sanders, but proved unstoppable "because she had the courage to stand up for the working class in her area and throughout this country."

Mejía is a vocal supporter of shifting from the for-profit health insurance system to Medicare for All and has called for other progressive policies including tuition-free community college, a moratorium on new artificial intelligence data centers, and a federal law guaranteeing paid sick leave.

She has also called to abolish US Immigration and Customs Enforcement, the 23-year-old agency that President Donald Trump has deployed to cities across the US to carry out his violent mass deportation agenda, demanded an end to ICE's mass surveillance, and held training sessions for voters on anti-authoritarianism, civil disobedience, and how to prepare for encounters with federal immigration agents.

After Malinowski conceded to Mejía, Democratic strategist Steve Schale, who led former President Barack Obama's campaign operations in Florida in 2008, attempted to throw cold water on the progressive victory.

“The loudest voices are on the progressive left, but I don’t know if that’s where the party is,” Schale told The Hill Wednesday, asserting that Democratic voters in “southern states with large Black populations... don’t sound like progressives in New York and Northern New Jersey."

After New York Mayor Zohran Mamdani's victory in the Democratic primary last June against former Gov. Andrew Cuomo, former Transportation Secretary Pete Buttigieg—who has been named as a possible contender in the 2028 presidential race—was similarly dismissive, even though Mamdani, like Mejía, went from being barely known among voters to beating his establishment rival in just a few short months after focusing relentlessly on affordability and working-class issues.

Other progressive victories victories could be on the horizon in Maine, where Democratic Senate candidate Graham Platner has had a double-digit lead over Gov. Janet Mills in polls ahead of the June primary and raised three times as much as Mills and Sen. Susan Collins (R-Maine) combined in small donations in the final quarter of 2025; and North Carolina, where Durham County Commissioner Nida Allam is challenging Rep. Valerie Foushee for a second time after losing a close race in 2022.

Allam raised more than twice as much money as Foushee in the last quarter, according to numbers released last week.

Like Sanders, the New Jersey Working Families Party expressed optimism about Mejía's victory, with Antoinette Miles, the party's state director, saying Tuesday that "she has sent a clear signal that it’s a new day in New Jersey politics, and that our country is ready for bold, working-class leadership."

"In just 10 weeks, through the dead of winter, Analilia built a grassroots campaign for and by all New Jerseyans. Her bold message of an economy that works for all of us and an end to ICE’s brutality resonated with voters who are fed up with the status quo," said Miles. "Together, we’ve proved that organized people can defeat organized money."

Sanders added that "what Analilia did in New Jersey can in fact be done in every part of this country."

"The American people want real change," he said. "Let's do it."