SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Twelve of the largest central banks around the globe continue to support climate chaos-causing fossil fuels through policy and direct finance, a new report released today finds.

Twelve of the largest central banks around the globe continue to support climate chaos-causing fossil fuels through policy and direct finance, a new report released today finds. Ahead of an annual convening of central bankers in Jackson Hole, Wyoming later this week, the analysis strikes a critical contrast to promises in recent months by the same central banks to align their operations with climate goals.

Using a ten-point rubric to gauge central banks' responses to the climate crisis, the new analysis finds that not one of the twelve major central banks analyzed comes close to alignment with the Paris Agreement on any of the criteria. The analysis reviews policies and financing of central banks from Canada, China, the European Union, France, Germany, India, Italy, Japan, Russia, Switzerland, the United Kingdom and the United States.

The criteria focus on three aspects of central banks' functions:

"Central banks have access to powerful tools to confront the climate crisis, but they aren't using them. Instead of using their power to cut off finance for fossil fuels, they are making themselves busy tinkering around the edges of the climate crisis," said David Tong, Global Industry Campaign Manager at Oil Change International and an author of the report. "The climate crisis is too dire and too urgent for such critical institutions to be dawdling when they could be leading the finance sector in a new, climate-safe direction."

While some central banks have taken steps to increase transparency and reporting of climate-related risks, the limited measures taken are overshadowed by inaction on financial flows to fossil fuels. Between 2016 and 2020, central banks have failed to prevent financial flows to fossil fuels on the order of USD 3.8 trillion from commercial banks. Financial flows to exploration and development projects, which will allow fossil fuel production to grow in future - as well as to other aspects of fossil fuel producers' businesses - have continued to increase.

The report finds that, in their role as supervisors of commercial banks, central banks have largely failed to use the levers at their disposal to stem the flow of fossil fuel finance. Central banks have ignored proposals to use reserves requirements or prudential regulation to this end and have resisted calls to adjust their mandates in light of the climate crisis.

"Central banks' roles have evolved over time. They reinterpreted their roles to confront the 2008-2009 financial crisis, and again in response to the COVID-19 crisis. Now, they must do the same to confront the climate crisis - not just as a threat to financial stability, but as a threat to humanity," Tong of Oil Change International said. "If these central banks won't act, the governments they report to must step in. They need to make it clear that central banks can be leaders in ending dangerous fossil fuel finance, rather than laggards propping up an industry driving our climate chaos."

The report provides a series of recommendations to better align central banks' activities with climate goals:

The report, entitled "Unused Tools: How Central Banks Are Fueling the Climate Crisis" was published by Oil Change International in partnership with 350.org, Alliance Climatique Suisse, BankTrack, Campax, CIEL, Democracy Collaborative, E3G, Earthworks, Environmental Defense, Fossil Free Schweiz, Friends of the Earth United States, Indigenous Environmental Network, Laudato Si Movement, Public Citizen, Positive Money, Rainforest Action Network, Reclaim Finance, Recourse, Shift, Stand.earth, The Sunrise Project, Urgewald, and WECAN. It can be found at https://priceofoil.org/2021/08/24/unused-tools-central-banks.

With a focus on the U.S. Federal Reserve, Tracey Lewis of 350.org said:

"This report is yet another reminder that central banks are the referees of our economy. When banks do bad -- like financing fossil fuel companies hell-bent on planetary destruction -- the ref is supposed to blow the whistle. Ahead of COP26 in November, the Federal Reserve must use their legal authority to manage climate risk and steer us off fossil fuels fast."

In response to the report, Danisha Kazi, Senior Economist at UK organization Positive Money, which has endorsed the report, said:

"There is a growing consensus amongst civil society that the world's major central banks are failing to play their part in tackling the climate crisis. By propelling finance towards environmental destruction, they are placing both financial and planetary stability at risk.

"With its new remit to support net-zero and environmental sustainability, the Bank of England is in a particularly good position to lead the way, but it has yet to turn its words into actions and actively transition the financial system to a more sustainable footing.

"While central banks continue to shy away from their duty to the public, the most vulnerable, particularly communities in the Global South, will continue to bear the ever-intensifying brunt of their inaction."

In response to the report, Paul Schreiber of Reclaim Finance said:

"Despite recognizing that climate change is fully relevant to their mandate and being bound by the Paris Agreement, central banks continue to help fossil fuel companies to benefit from cheap and ample funding. While the ECB and Bank of England are contemplating how to align part of their activities with the Paris Agreement, this report underlines that they will fail unless they adopt strong fossil fuel policies, starting with a clear cut of their support to companies that develop new fossil fuel projects. Failure to do so would come down to greenwashing."

With regard to Germany, Regine Richter, finance expert at Urgewald, commented:

"The Deutsche Bundesbank and especially the Federal Financial Supervisory Authority play an important role in setting rules for private banks and their financing. They must use this to stop financial flows into fossil fuel companies - and do it quickly. Bundesbank President Weidmann's constant emphasis on 'market neutrality' is yesterday's news and irresponsible in the face of the climate crisis."

350 is building a future that's just, prosperous, equitable and safe from the effects of the climate crisis. We're an international movement of ordinary people working to end the age of fossil fuels and build a world of community-led renewable energy for all.

"His campaign paired moral conviction with concrete plans to lower costs and expand access to services, making it unmistakable what he stood for and whom he was fighting for."

Amid calls for ousting Democratic congressional leadership because the party caved in the government shutdown fight over healthcare, a YouGov poll released Monday shows the nationwide popularity of New York City Mayor-elect Zohran Mamdani's economic agenda.

Mamdani beat former New York Gov. Andrew Cuomo in both the June Democratic primary and last week's general election by campaigning unapologetically as a democratic socialist dedicated to making the nation's largest city more affordable for working people.

Multiple polls have suggested that Mamdani's progressive platform offers Democrats across the United States a roadmap for candidates in next year's midterms and beyond. As NYC's next mayor began assembling his team and the movement that worked to elect him created a group to keep fighting for his ambitious agenda, YouGov surveyed 1,133 US adults after his victory.

While just 31% of those surveyed said they would have voted for Mamdani—more than any other candidate—and the same share said they would vote for a candidate who identified as a "democratic socialist," the policies he ran on garnered far more support.

YouGov found:

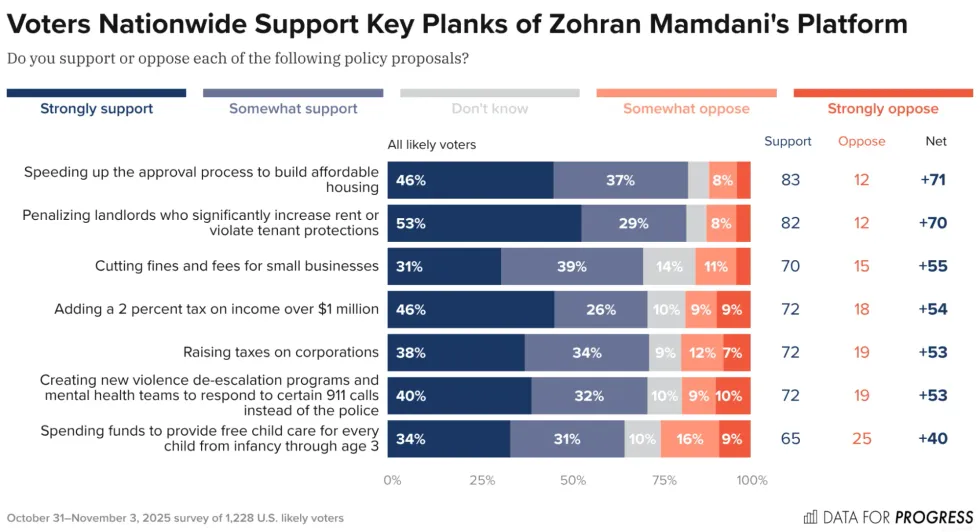

Data for Progress similarly surveyed 1,228 likely voters from across the United States about key pieces of Mamdani's platform before his win. The think tank found that large majorities of Americans support efforts to build more affordable housing, higher taxes for corporations as well as millionaires and billionaires, and free childcare, among other policies.

"There's a common refrain from some pundits to dismiss Mamdani's victory as a quirk of New York City politics rather than a sign of something bigger," Data for Progress executive director Ryan O'Donnell wrote last week. "But his campaign paired moral conviction with concrete plans to lower costs and expand access to services, making it unmistakable what he stood for and whom he was fighting for. The lesson isn't that every candidate should mimic his style—you can't fake authenticity—but that voters everywhere respond when a candidate connects economic populism to clear, actionable goals."

"Candidates closer to the center are running on an affordability message as well," he noted, pointing to Democrat Mikie Sherrill's gubernatorial victory in New Jersey. "When a center-left figure like Sherill is running on taking on corporate power, it underscores how central economic populism has become across the political spectrum. Her message may have been less fiery than Mamdani's, but she drew from a similar well of voter frustration over rising costs and corporate influence. In doing so, Sherrill demonstrated to voters that her administration would play an active role in lowering costs—something that voters nationwide overwhelmingly believe the government should be doing."

"When guys like Jeffries and Schumer say 'effective' they're talking about effectively flattering large-dollar donors," said one critic.

Progressive anger and calls for primary challenges followed House Minority Leader Hakeem Jeffries' Monday endorsement of top Senate Democrat Chuck Schumer—under whose leadership numerous Democratic lawmakers caved to Republicans to pave the way to ending the government shutdown without winning any meaningful concessions.

As progressives demanded the resignation or ouster of Schumer (D-NY), Jeffries (D-NY) was asked during a press conference whether the 74-year-old senator is effective and whether he should remain as the upper chamber's minority leader.

"Yes and yes," replied Jeffries. "As I've indicated, listen, Leader Schumer and Senate Democrats over the last seven weeks have waged a valiant fight on behalf of the American people."

"I don't think that the House Democratic Caucus is prepared to support a promise, a wing and a prayer, from folks who have been devastating the healthcare of the American people for years," he said.

Asked if he thinks Schumer is effective and should keep his job, Hakeem Jeffries replies: "Yes and yes."

[image or embed]

— Ken Klippenstein (@kenklippenstein.bsky.social) November 10, 2025 at 2:07 PM

Both Schumer and Jeffries say they will vote "no" on the the GOP bill to end the shutdown.

Activist and former Democratic National Committee Co-Vice Chair David Hogg said on social media that Schumer's "number one job is to control his caucus," and "he can't do that."

Eight members of the Senate Democratic caucus—Catherine Cortez Masto (Nev.), Dick Durbin (Ill.), John Fetterman (Pa.), Maggie Hassan (NH), Tim Kaine (Va.), Angus King (I-Maine), Jacky Rosen (Nev.), and Jeanne Shaheen (NH)—enabled their Republican colleagues to secure the 60 votes needed for a cloture vote to advance legislation to end the shutdown.

Critics say the proposal does nothing to spare Americans from soaring healthcare premiums unleashed in the One Big Beautiful Bill Act signed by President Donald Trump in July.

"Standing up to a tyrant—who is willing to impose pain as leverage to compel loyalty or acquiescence—is hard," Sen. Chris Murphy (D-Conn.) said Monday. "You can convince yourself that yielding stops the pain and brings you back to 'normal.' But there is no 'normal.' Submission emboldens the tyrant. The threat grows."

Rep. Ro Khanna (D-Calif.) said on X: "Sen. Schumer is no longer effective and should be replaced. If you can’t lead the fight to stop healthcare premiums from skyrocketing for Americans, what will you fight for?"

New York City Councilman Chi Ossé (D-36)—who on Sunday said that Schumer and Senate Democrats "failed Americans" by capitulating to "MAGA fascists"—laughed off Jeffries' ringing endorsement of Schumer's leadership.

Former Democratic Ohio state Sen. Nina Turner called Jeffries and Schumer "controlled opposition" while demanding that they both "step down."

The progressive political action group Our Revolution published a survey last week showing overwhelming grassroots support for running primary challenges to Schumer and Jeffries. The poll revealed that 90% of respondents want Schumer to step down as leader, while 92% would support a primary challenge against him when he’s next up for reelection in 2028. Meanwhile, 70% of respondents said Jeffries should step aside, with 77% backing a primary challenge.

Turner also called for a ban on corporate money in politics and ousting "corporate politicians."

Left Reckoning podcast host Matt Lech said on X that "when guys like Jeffries and Schumer say 'effective' they're talking about effectively flattering large-dollar donors."

In a letter to the British public broadcaster, Trump cited a memo from a Conservative Party-linked former BBC adviser who claimed the network displayed an "anti-Israel" bias, despite ample evidence to the contrary.

The BBC in the United Kingdom is the latest target of US President Donald Trump's attempts to root out all unflattering portrayals of him from media coverage, with the president citing a memo penned by a former BBC adviser reported to have ties to the British Conservative Party.

Trump wrote to the BBC Monday, warning that he would file a lawsuit demanding $1 billion in damages unless the publicly funded broadcaster retracts a documentary film about him from last year, issues a formal apology, and pays him an amount that would “appropriately compensate President Trump for the harm caused.”

The president gave the network until Friday to act in regard to Trump's complaint about a section of the film Trump: A Second Chance? by the long-running current affairs series Panorama.

The film was broadcast days before the 2024 US election, and included excerpts from the speech Trump gave to his supporters on January 6, 2021 just before thousands of them proceeded to the US Capitol to try to stop the election results from being certified.

It spliced together three quotes from two sections of the speech that were made about 50 minutes apart, making it appear that Trump urged supporters to march with him to the Capitol and called for violence.

"We’re going to walk down to the Capitol... and I’ll be there with you... and we fight. We fight like hell," Trump is shown saying in the edited footage.

In the unedited quote, Trump said, "We’re going to walk down to the Capitol, and we’re going to cheer on our brave senators and congressmen and women, and we’re probably not going to be cheering so much for some of them.”

BBC chairman Samir Shah said the network's standards committee had discussed the editing of the clips earlier this year and had expressed concerns to the Panorama team. The film is no longer available online at the BBC's website.

"The furor over the Trump documentary is not about journalistic integrity. It’s a power play... It’s a war over words, where the vocabulary of journalism itself is weaponized."

“We accept that the way the speech was edited did give the impression of a direct call for violent action," said Shah. "The BBC would like to apologize for that error of judgment.”

Two top executives, director general Tim Davie and head of news Deborah Turness, also resigned on Sunday under pressure over the documentary.

The uproar comes days after the right-wing Daily Telegraph published details from a memo by former BBC standards committee adviser Michael Prescott, "managing director at PR agency Hanover Communications, whose staff have gone on to work for the Conservative Party," according to Novara Media.

Prescott's memo took aim at the documentary as well as what he claimed was a pro-transgender bias in BBC news coverage and an anti-Israel bias in stories by the BBC's Arabic service.

According to the Guardian, Robbie Gibb, a member of the BBC board who previously worked as a communications official for former Tory Prime Minister Theresa May, "amplified" the criticisms in Prescott's memo in key board meetings ahead of Davie's and Turness' resignations.

Deadline reported Monday that "insiders" at the BBC have alleged that Prescott's memo, the resignations, and Trump's threat of legal action all stem from a right-wing "coup" attempt at the broadcaster.

Journalists including Mehdi Hasan of Zeteo News and Mikey Smith of The Mirror noted that while Panorama's editing of Trump's speech could be seen as misleading, the documentary wasn't responsible for accusations that the president incited violence on January 6, which pre-dated the film.

"To understand how insane it is that the BBC is being accused of ‘making it look like’ Trump was inciting violence with their bad edit, as opposed to Trump actually having incited violence, we know even his own kids that day were desperately trying to get him to call off the mob," said Hasan.

Others suggested the memo cited in Trump's letter to the broadcaster should be discredited entirely for its claim that the BBC has exhibited an anti-Israel bias—an allegation, said author and international relations professor Norrie MacQueen, that amounted to "an entirely new level" of George Orwell's "newspeak."

While the BBC "has been shaken by one of the smallest of its sins," wrote media analyst Faisal Hanif at Middle East Eye, "the greater one—its distortion of Palestinian reality—goes unpunished."

Hanif pointed to a report published in June by the Center for Media Monitoring, which showed that despite Gaza suffering 34 times more casualties than Israel since October 2023, the BBC "gave Israeli deaths 33 times more coverage per fatality and ran almost equal numbers of humanizing victim profiles (279 Palestinians vs. 201 Israelis)."

The network also used "emotive terms four times more for Israeli victims" and shut down allegations that Israel has committed genocide in Gaza, as well as "making zero mention of Israeli leaders’ genocidal statements," even as Israel faces a genocide case at the International Court of Justice.

"The furor over the Trump documentary is not about journalistic integrity," wrote Hanif. "It’s a power play: the disciplining of a public broadcaster that still, nominally, answers to the public rather than the billionaire-owned media. It’s a war over words, where the vocabulary of journalism itself is weaponized."

"The BBC is punished for the wrong things. It loses its leaders over an editing error, while escaping accountability for its editorial failures on Gaza," Hanif continued. "The Trump documentary might have been misedited, but the story of Gaza has been mistold for far longer. If the BBC still believes in its own motto—'Nation shall speak peace unto nation'—then peace must begin with honesty."