Donald Trump seems to be doing everything possible to show his contempt for ordinary working people, many of whom voted for him last fall. Just after signing his big bill, which gave massive tax breaks to the rich while taking away health care insurance for 12 to 17 million people, Trump announced that he will hit workers with one of the largest tax increases ever.

The tax increases take the form of the import taxes, or tariffs, that Trump plans to impose on the goods that we import from the rest of the world. While we won’t know the actual size of these taxes until Trump sends us his letters, based on what he has said to date, it will almost certainly be several trillion dollars if they are left in place over a decade. Taking a low-end figure of $2 trillion, that would come to $16,000 per household over the next decade.

Whatever Trump may say or think, people in the United States will be paying his tariffs.

To be clear, Trump insists that other countries will pay the tariff, but there is no reason for anyone to care about whatever idiocy comes out of Trump’s mouth. Trump said that there are 20 million people, with reported birthdays putting them over 115, getting Social Security (The number of dead people getting checks is in the low thousands.).

He said China doesn’t have any wind power; it leads the world in wind power. And Trump said global warming isn’t happening and slashed the budget for monitoring weather. Now 70 people are dead in Texas from floods for which they and state officials were not adequately warned.

The dead people in Texas, their families, and the rest of the country don’t have time for Donald Trump’s make-believe world. It doesn’t matter that Trump says other countries will pay the tariffs. Who knows what Trump actually believes, but in reality-land we pay the tariffs.

This is not hard to demonstrate. We have data on import prices through May of this year. This is before many of Trump’s tariffs hit, but items for most countries already faced a Trump tax of at least 10 percent, with much higher taxes on goods from China, as well as aluminum and cars and parts.

If other countries were paying the tariffs, then the prices of the goods we import, which do not include the tariff, would be falling. They aren’t.

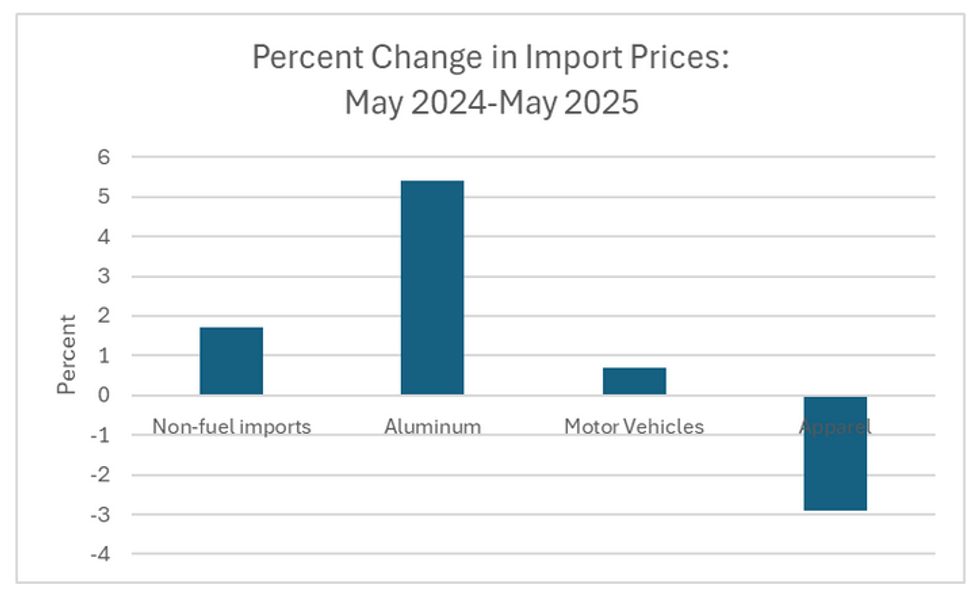

To start with the big picture, the price of all non-fuel imports was 1.7 percent higher in May of 2025 than it had been in May of 2024. That doesn’t look like exporters are eating the tariffs. If we want a base of comparison, non-fuel import prices rose by just 0.5 percent from May of 2023 to May of 2024. If we want to tell a story of exporters eating the tariffs, we’re going in the wrong direction.

If we look to motor vehicles and parts, the numbers again go in the wrong direction. Import prices are 0.7 percent higher than they were in May of 2024. If we turn to aluminum the story is even worse. The price of aluminum imports was 5.4 percent higher in May of this year than a year ago.

There is a small bit of good news on apparel prices. This index for import prices was 2.9 percent lower in May of 2025 than the prior. But before celebrating too much, it’s worth noting that the price of imported apparel goods had already been dropping before Trump’s tariffs. It fell 0.3 percent from May of 2023 to May of 2024.

It’s also worth noting that much of this apparel comes from China, where items now face a 54 percent tariff. Insofar as our imported apparel comes from China, this 2.9 percent price decline would mean exporters are eating just over 5 percent of the tariff. That would mean that if Trump imposed import taxes of $2 trillion over the next decade, we will pay $1.9 trillion of these tariffs.

In short, whatever Trump may say or think, people in the United States will be paying his tariffs. They amount to a very big and not beautiful tax increase on ordinary workers.