Trump dubiously designated drug cartels—including the Venezuela-based group Tren de Aragua—as foreign terrorist organizations in an executive order signed on his first day back in the White House.

The resolution was defeated 210-216, with seven lawmakers not voting. Two Republicans—Reps. Don Bacon of Nebraska and Thomas Massie of Kentucky—voted in favor of the measure. Democratic Texas Reps. Henry Cuellar and Vicente Gonzalez joined their GOP colleagues in voting down the proposal.

The second resolution, introduced by Rep. Jim McGovern (D-Mass.), would have directed Trump to "remove the use of United States armed forces from hostilities within or against Venezuela, unless explicitly authorized by a declaration of war or specific statutory authorization for use of military force."

The resolution failed by a vote of 211-213, with nine members not voting. Republicans Bacon, Massie, and Rep. Marjorie Taylor Greene of Georgia voted "yes" on the legislation, while Cuellar voted against the proposal.

"The Trump administration's ongoing lethal US military strikes on alleged drug boats in the Western Hemisphere are legally questionable, and ineffective," Meeks and Reps. Adam Smith (D-Wash.), Jim Himes (D-Conn.), Bennie Thompson (D-Miss.), Jason Crow (D-Colo.), and Ilhan Omar (D-Minn.)—all members of the House Foreign Affairs Committee—said in a statement following the vote.

"Under existing US law, these vessels could have been interdicted and their occupants subjected to judicial process," the lawmakers noted. "Instead of pursuing prosecutions, this administration has deliberately avoided judicial scrutiny by conducting lethal strikes, repatriating survivors, and in at least one instance, carrying out a second strike on defenseless persons."

The Democrats continued:

The president has failed to demonstrate the necessary authority under US or international law to conduct lethal military strikes on these boats. No one can credibly claim that these vessels, in some cases not even traveling to the United States and located thousands of miles from US soil, posed an imminent threat to the American people warranting the use of military force. Our war powers resolution sought to terminate these extrajudicial strikes, yet most Republicans chose loyalty to Donald Trump over their oath to the Constitution. By not reining in Trump’s gross abuse of power, they are sending a dangerous signal that any president can unilaterally commit US armed forces to hostilities without congressional authorization. We hope our Republican colleagues find their courage in the face of President Trump’s threats to expand this military operation into Venezuela. Should he be allowed to do so, he will no doubt provoke another forever war that the American people do not support and Congress has certainly not authorized.

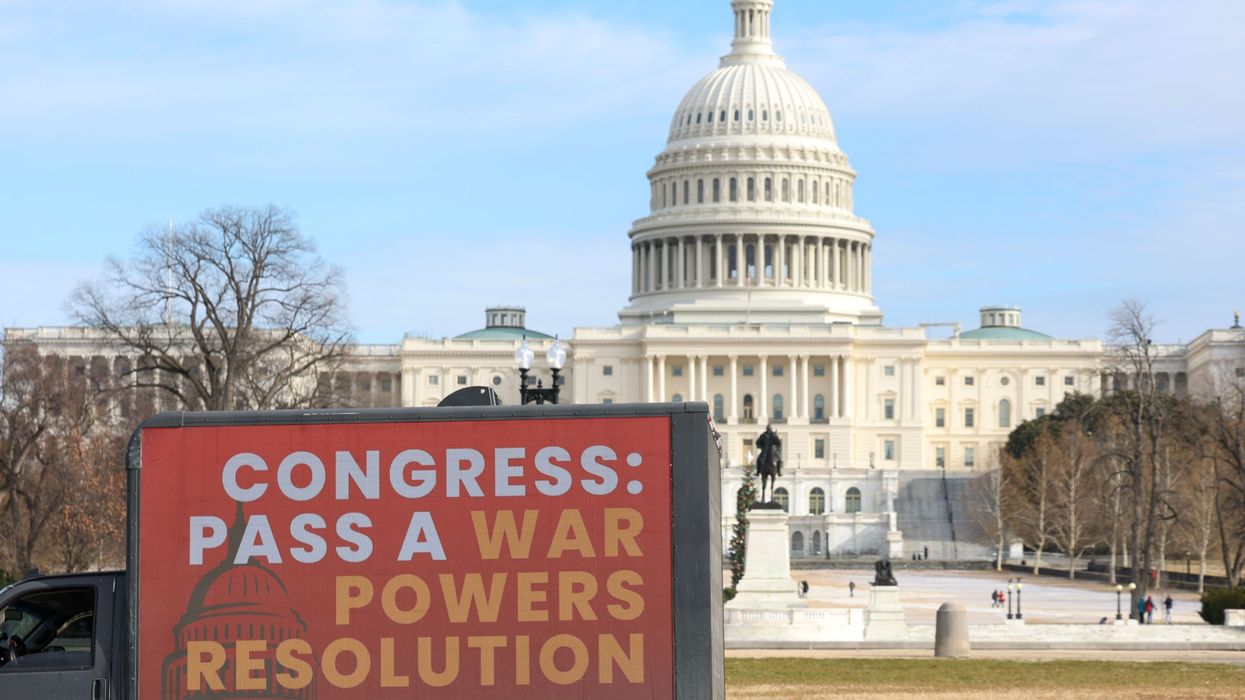

The House votes follow two failed Senate attempts to stop Trump from continuing military action against alleged drug cartels without congressional approval. A vote on a war powers resolution introduced earlier this month by Senate Minority Leader Chuck Schumer (D-NY) and Sens. Tim Kaine (D-Va.), Rand Paul (R-Ky.), and Adam Schiff (D-Calif.) is expected this week. Meanwhile, Sen. Ruben Gallego (D-Ariz.) on Monday announced a separate resolution to stop US forces from launching more boat strikes.

Wednesday's votes came after Trump escalated US aggression toward Venezuela by ordering a “total and complete blockade" on "all sanctioned oil tankers" approaching and leaving the South American country. In a social media post divorced from historical fact, Trump accused Venezuela of stealing "oil, land, and other assets" from the United States.

This, after Trump's deployment of an armada of warships and thousands of troops to the southern Caribbean, his authorization of CIA covert action against the government of Venezuelan President Nicolás Maduro, and his threats of a land invasion of Venezuela. Most of the at least 95 people killed in the more than two dozen US strikes on boats allegedly transporting drugs have also been Venezuelans.

Undeterred by Wednesday's votes, members of the Congressional Progressive Caucus (CPC) vowed to "continue to fight to stop Trump's illegal war on Venezuela."

“Tonight’s razor-thin, 211-to-213 vote on the bipartisan war powers resolution to end these illegal hostilities puts Trump on notice," Omar, the deputy CPC chair, said in a statement.

Omar continued:

Nearly a quarter-century ago, the American people were misled by a lawless president promoting lies about weapons of mass destruction, all to invade an oil-rich country that posed no threat to us. The result was a disaster that killed thousands of American service members, triggered a humanitarian crisis in Iraq, and destabilized the entire region. Trump is pursuing the same course today in Venezuela, absurdly designating fentanyl a WMD while blockading Venezuela until the country gives him "all of the Oil, Land, and other Assets."

"Trump has no mandate to push his unconstitutional military campaign against Venezuela," Omar added. "If Trump continues to carry out oil tanker seizures, impose a naval blockade, and put American service members in harm’s way for an illegal regime change war, he can surely expect a vote to immediately stop this disastrous conflict."