CBO: Trump Law Will Add $3.4 Trillion to Deficit, Boot 10 Million Off Health Insurance

"The 'Big Beautiful Bill' will cost more than it saves, and working families stand to lose the most," said one union.

A nonpartisan federal agency estimated Monday that the Republican megabill signed into law by U.S. President Donald Trump on July 4 will add $3.4 trillion to the national deficit and cause at least 10 million people to lose health insurance over the next decade.

Warnings about the law's impact on the national debt and the healthcare of millions—particularly Americans on Medicaid—were prominent during the GOP effort to pass the budget reconciliation package by Trump's Independence Day deadline, but they did not stop Republicans in Congress from sending the so-called One Big Beautiful Bill Act to the president's desk.

When asked about the new Congressional Budget Office (CBO) analysis on Monday, White House Press Secretary Karoline Leavitt claimed the package was "a great bill for the American people," and "a fiscally responsible bill."

Meanwhile, critics of the law used the CBO release as an opportunity to call out the GOP. In a Monday floor speech, U.S. Senate Democratic Leader Chuck Schumer (D-N.Y.) highlighted that "the number of people who will lose health insurance could be higher—as many as 15 million," when accounting for other attacks, including on the Affordable Care Act (ACA), or Obamacare.

"It betrays every family worried about paying for groceries, the mortgage, the rent, prescription drugs—all going up because of Donald Trump and his administration."

"This finalized independent analysis from the CBO confirms it: Republicans' signature bill is the ultimate betrayal of the American people," Schumer declared. "It betrays every single family who will lose health insurance. It betrays our financial future. It betrays our children and grandchildren who will pay for these billionaire tax breaks, as the debt rises and rises."

"It betrays every family worried about paying for groceries, the mortgage, the rent, prescription drugs—all going up because of Donald Trump and his administration. And it betrays every rural community that benefits from good-paying energy jobs," he continued. "Republicans' supposed signature bill betrays everyone outside of the billionaire class and the special interests."

Sarah Lueck, vice president for health policy at the progressive think tank Center on Budget and Policy Priorities said on social media that "the latest CBO estimates make clear that the so-called 'Big Beautiful Bill' is anything but—it would cause widespread harm with more than $1 trillion in cuts to Medicaid and ACA marketplaces and higher costs for families trying to afford healthcare and groceries."

Lueck explained that the 15 million estimate factors in the 10 million due to health cuts in the package, 4.2 million because the legislation didn't extend expiring ACA tax credits, and more marketplace losses under Trump administration rule changes.

"The new law will take Medicaid away from people enrolled via the expansion if they don't meet a work requirement, harming parents, people with disabilities, and those with chronic illnesses. Protected groups and working people will lose coverage due to red tape," she warned. Due to the ACA expirations, Lueck added, "self-employed people, gig workers, early retirees, and low-wage workers are among those who will face steep hikes; some will end up uninsured."

The GOP package contains the biggest-ever cuts to not only Medicaid but also the Supplemental Nutrition Assistance Program (SNAP), noted Bobby Kogan, senior director of federal budget policy at another think tank, the Center for American Progress. He stressed that it will lead to "untold amounts of human suffering among the poorest people in the country."

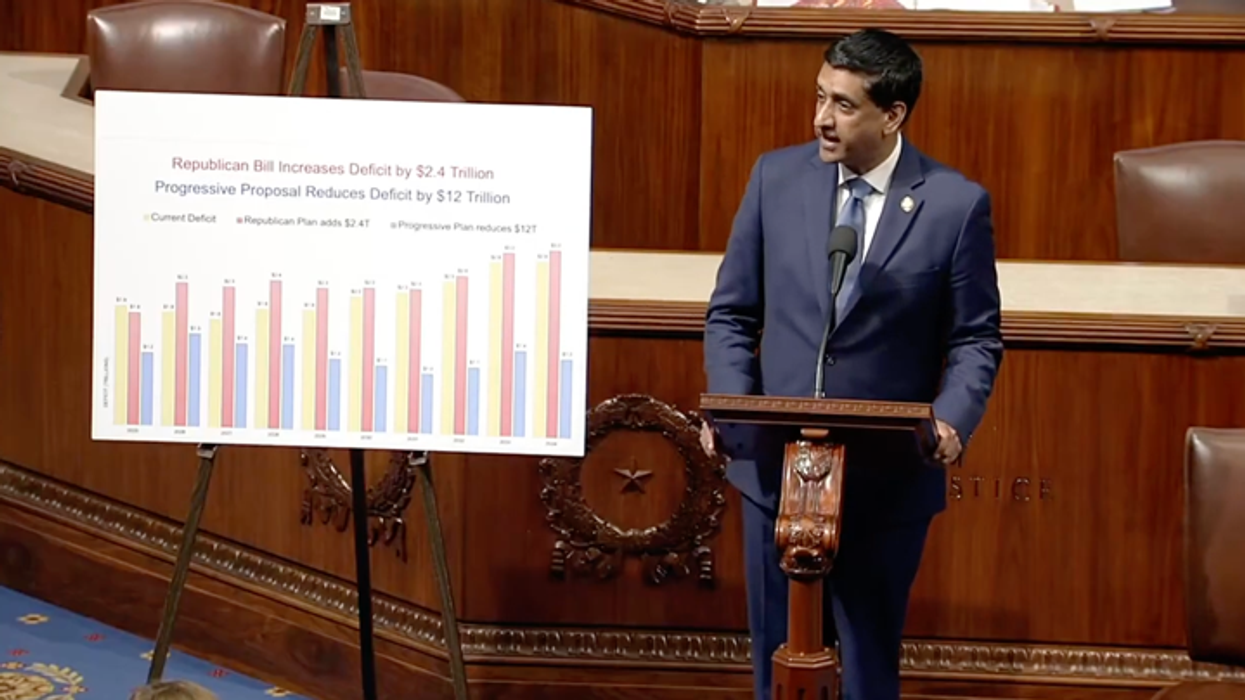

U.S. House Budget Committee Ranking Member Brendan Boyle (D-Pa.) said in a statement that "President Trump and his Republican lapdogs can't hide from the truth. This final nonpartisan CBO estimate confirms their Big Ugly Law adds $3.4 trillion to the deficit to fund tax breaks for billionaires."

"It's one of the most expensive bills ever passed," he said. It's also one of the cruelest. More than 15 million Americans will lose their healthcare because of the law's assault on Medicaid and Republican plans to dismantle the ACA. I was proud to lead the fight against this disastrous law and will continue working to remind the American people who sold them out, and who's still fighting for them."

Unrig Our Economy campaign director Leor Tal responded to the CBO's findings by pointing to recent CNN polling that shows roughly 6 in 10 Americans oppose the new Republican law.

"It's easy to see why the vast majority of Americans oppose this pro-billionaire agenda," said Tal. "Republicans in Congress just jeopardized health coverage for millions of Americans, SNAP benefits for millions of children and families, and the existence of hundreds of rural hospitals across the country—all so they could give another tax break to the richest of the rich. We will continue to hold Republicans' feet to the fire for voting for this massive betrayal of American families."