April, 13 2023, 08:45am EDT

For Immediate Release

Contact:

Ginny Cleaveland, Deputy Press Secretary, Fossil-Free Finance, Sierra Club, ginny.cleaveland@sierraclub.org

Banking on Climate Chaos Report: World's Biggest Banks Continue to Pour Billions into Fossil Fuel Expansion

Annual report details massive bank support for climate-destroying corporations

Released today, the 14th annual Banking on Climate Chaos report is the most comprehensive global analysis on fossil fuel banking. Endorsed by over 625 organizations from 75 countries, it reveals the truth of banks’ commitments to the climate by examining their financing of the fossil fuel industry.

- Read the report: bankingonclimatechaos.org

For the first time since 2019, a Canadian bank is the #1 annual financier of fossil fuels rather than US bank JP Morgan Chase. Royal Bank of Canada (RBC) showered fossil fuel projects with $42.1 billion dollars in 2022, including $4.8 billion for tar sands and $7.4 billion into fracking. Canadian banks are becoming the banks of last resort for fossil fuels, providing $862 billion to fossil fuel companies since the Paris Agreement. RBC continues to bankroll expansion projects like the Coastal GasLink fracked gas pipeline. That project violates human rights and Indigenous sovereignty, and has proceeded without consent from Wet’suwet’en Hereditary leadership.

The report shows that overall, U.S. banks dominate fossil fuel financing, accounting for 28% of all fossil fuel financing in 2022. JPMorgan Chase remains the world’s worst funder of climate chaos since the Paris Agreement. Citi, Wells Fargo, and Bank of America are still among the top 5 fossil financiers since 2016.

“In a critical year for climate action, fossil fuel giants doubled down on reckless expansion projects and walked back their climate commitments. Meanwhile, major US banks stalled on their net-zero plans and failed to adopt stronger and more robust financing restrictions for companies pushing unsustainable fossil fuel expansion. As big banks face shareholder votes in the coming weeks, we will keep up pressure on banks and investors to adopt credible policies to achieve their climate commitments and take real steps to accelerate the clean energy transition,” said Adele Shraiman, senior campaign representative for the Sierra Club's Fossil-Free Finance Campaign.

In the seven years since the Paris Agreement was adopted, the world’s 60 largest private banks financed fossil fuels with USD $5.5 trillion. The report lays bare the shocking fact that even as fossil fuel companies made $4 trillion in profits in 2022, banks still provided $673 billion in financing. Remarkably, this happened while oil majors like Exxon Mobil and Shell PLC asked for $0 financing from banks in 2022.

While Europeans and Ukrainians called for a transition to renewables to stop funding Russian atrocities, fossil fuel companies doubled down on expansion and weakened their climate commitments. The top 30 companies expanding LNG used the crisis to secure nearly 50% more financing in 2022 compared to 2021 from the banks in the report — even as most energy experts agree that the LNG expansion plans in Europe are unnecessary, and new projects would contribute to a supply glut and long-term dependence on this fossil fuel.

The report includes detailed maps of this explosion of expansion projects in the US Gulf Coast and the Philippines. It also features case studies of climate leaders in Myanmar and the Philippines who are resisting the devastating effect of fossil fuel expansion.

Global banks’ net zero pledges have netted nothing so far, according to the report. Forty nine of the 60 banks profiled in the report made net zero commitments, but most are not paired with rigorous policies excluding finance for fossil fuel expansion. The policies contain many loopholes that allow banks to continue financing fossil fuel clients. Banks with restrictions on Arctic project financing, for example, nevertheless financed ConocoPhillips, which is developing the Willow project in the Arctic, the largest proposed oil project in the United States.

As the Intergovernmental Panel on Climate Change affirmed in its March 2023 report, to give humanity a chance at avoiding unacceptable harm to millions of people alive today and countless generations to come, fossil fuel expansion must stop, and use of fossil fuels across all sectors must decline sharply. They assert that the window of opportunity to remain below 1.5˚C and to build a secure, liveable, and sustainable future is rapidly closing.

“Our window of opportunity for keeping global warming below 1.5ºC is closing fast. We need a people-centered energy transition now. Profits now are a false economy because we simply cannot afford to continue burning fossil fuels – the costs down the road will be devastating. Fossil fuel companies are the ones dousing the planet in oil, gas, and coal, but big banks hold the matches. Without financing, fossil fuels won’t burn,” said April Merleaux , Research and Policy Manager at Rainforest Action Network.

Banking on Climate Chaos is authored by Rainforest Action Network, BankTrack, Indigenous Environmental Network, Oil Change International, Reclaim Finance, Sierra Club, and Urgewald. Over 550 organizations from more than 70 countries around the world endorsed the report and are calling on banks to stop funding climate destruction.

Fossil fuel sector trends

- Expansion: The 60 banks profiled in this report funneled $150 billion in 2022 into the top 100 companies expanding fossil fuels, including TC Energy, TotalEnergies, Venture Global, ConocoPhillips, and Saudi Aramco.

- Liquefied Natural Gas (LNG): The top bankers of liquefied “natural” gas (LNG) in 2022 were Morgan Stanley, JPMorgan Chase, Mizuho, ING, Citi, and SMBC Group. Overall finance for LNG increased nearly 50% from $15.2 billion in 2021 to $22.7 billion in 2022.

- Tar sands oil: The top tar sands companies received $21.0 billion in financing in 2022, led by the biggest Canadian banks, who provided 89% of those funds. TD, RBC, and Bank of Montreal top the list.

- Arctic oil and gas: Chinese banks ICBC, Agricultural Bank of China, and China Construction Bank led financing for Arctic oil and gas, which totaled $2.9 billion for the top companies in this sector in 2022. 26 banks are still financing Arctic oil and gas, including U.S. banks JPMorgan Chase, Citi, and Bank of America.

- Amazon oil and gas: Spanish bank Santander leads financing for companies extracting in the Amazon biome, followed closely by U.S. bank Citi. Financing totaled $769 million in 2022.

- Fracked oil and gas: Finance for fracking companies totaled $67.0 billion dollars in 2022, which is an 8% increase over the financing reported in 2021 for the top fracking companies. This increase is especially disturbing given the extreme methane emissions from fracking. RBC and JPMorgan Chase are the top financiers of fracked oil and gas for 2022 and since the Paris Agreement.

- Offshore oil and gas: European banks BNP Paribas, Crédit Agricole, and Japanese bank SMBC Group top the list of worst financiers of offshore oil and gas for 2022. Financing totaled $34 billion in 2022.

- Coal mining: Of the $13.0 billion in financing that went to the world’s 30 largest coal mining companies, 87% was provided by banks located in China, led by China CITIC Bank, China Everbright Bank, and Industrial Bank.

- Coal power: Of the financing to the world’s top 30 companies in coal power, 97% of financing was provided by Chinese banks. These companies, which have plans to expand coal power capacity, received $29.5 billion from the profiled banks in 2022.

More information

Full data sets – including fossil fuel finance data, policy scores, and stories from the frontlines – are available for download at bankingonclimatechaos.org.

Additional quotes from authoring, frontline, and key organizations including Center for Energy, Ecology & Development, BankTrack, Indigenous Environmental Network, Oil Change International, Reclaim Finance, Stand.earth, and Urgewald, are available at bankingonclimatechaos.org.

Quotes from elected officials

“Corporate greed is killing us. Despite the world’s dirtiest fossil fuel companies making $4 trillion in profits in 2022, the world’s largest banks still provided $673 billion in financing for projects that are poisoning our communities and destroying the planet. This report makes it clear that banks’ ‘net zero’ commitments aren’t worth the paper they’re printed on – they’re simply cheap PR cover for pouring fuel on the climate crisis. Banks will not act in the public interest unless we force them to, and while grassroots movements around the world continue to build pressure, it’s long past time that the Federal Reserve, White House, and Congress take more aggressive action that meets this critical moment for the planet.” -Rep. Rashida Tlaib (D-Mich)

“Climate risk is a financial risk that poses an existential threat to our economy. As this important new report shows, big banks are financing fossil fuels by the billions, contributing to the climate crisis, and threatening the stability of our financial systems. That is why Congress must pass my Fossil Free Finance Act — to protect Americans’ savings, reject backwards-looking and risky investments into fossil fuels, and move toward a clean energy future that supercharges our economy.” -Sen. Edward J. Markey (D-Mass)

“Big banks continue to funnel money into risky fossil fuel investments, ignoring the looming costs and economic risks of climate upheaval we are documenting in the Senate Budget Committee. By turning their backs on their climate pledges and doubling down on their support for the fossil fuel industry, Wall Street banks are increasing the likelihood of systemic risks to the economy, including a coastal property values collapse, a carbon bubble crash, and insurance market turmoil. Neither our planet nor our economy can afford these massive investments in new fossil fuel projects." -Sen. Sheldon Whitehouse (D-RI), Chairman of the Senate Budget Committee

The Sierra Club is the most enduring and influential grassroots environmental organization in the United States. We amplify the power of our 3.8 million members and supporters to defend everyone's right to a healthy world.

(415) 977-5500LATEST NEWS

Footage Contradicts DHS Claim That It Dropped Blind Rohingya Refugee at 'Safe Location' in Buffalo

Nurul Shah Alam was found dead on a Buffalo street this week, days after being released from a county jail and dropped at a closed coffee shop by Border Patrol agents.

Feb 27, 2026

Surveillance footage taken at a Tim Hortons donut shop in Buffalo, New York contradicts the US Department of Homeland Security's claim that Border Patrol agents dropped Nurul Shah Alam, a 56-year-old nearly blind Rohingya refugee, at a "warm, safe location" after he was released from jail last week, days before he was found dead.

The video obtained by the Buffalo-based outlet Investigative Post late Wednesday showed a white van pulling up to the shop at about 8:18 pm Eastern, more than an hour after the store—except its drive-thru window—had closed for the night.

A man identified by the Investigative Post as Shah Alam is seen walking by the drive-thru window and then approaching the locked door before walking across the parking lot.

Breaking: IPost has obtained footage showing a Border Patrol van dropping off Nurul Shah Alam at a closed Tim Hortons last Thursday.

Shah Alam, nearly-blind & unable to enter the shop, then wandered the city for days. He was found dead Tuesday.https://t.co/fCtRtaxaU9 pic.twitter.com/VkEqgiAUVe

— Investigative Post (@ipostnews) February 27, 2026

The Border Patrol agents who dropped off Shah Alam—who spoke no English and was blind in one eye with partial, blurry vision in the other—appeared to make no attempt to ensure the Tim Hortons was actually a "safe, warm location" that he could access. The van pulled out of the parking lot less than a minute after Shah Alam was seen exiting it.

When the news broke Wednesday that Shah Alam's body had been found on a Buffalo street days after he was dropped off following his release—and after subfreezing temperatures hit the Western New York city over the weekend—a spokesperson for Border Patrol said the agents had "offered him a courtesy ride, which he chose to accept to a coffee shop" that was "determined to be a warm, safe location near his last known address."

They also claimed that Shah Alam, who used a walking stick to get around before his arrest last year, "showed no signs of distress, mobility issues, or disabilities requiring special assistance."

The agents never notified Shah Alam's wife and children or his lawyers that he had been dropped off.

"So when [the Department of Homeland Security] says they 'offered him a courtesy ride to a warm, safe location'... they mean they abandoned him in the parking lot of a closed Tim Hortons in the middle of a winter evening in Buffalo," said Jeremy Konyndyk, president of Refugees International. "They lie about EVERYTHING."

Shah Alam had been detained at the Erie County Holding Center since February 2025, when he got lost on the way home from a store where he'd purchased a curtain rod to use as a walking stick. He ended up in the backyard of a woman who called the police, who later reported Shah Alam was swinging the rod "in a menacing manner"—a claim his lawyer denies.

The Investigative Post also obtained police body camera footage of the arrest, which shows Shah Alam saying, "OK" and dropping one end of the curtain rod when an officer told him to put the stick on the ground. The footage also showed the officers Tasering Shah Alam and tackling him to the ground.

After the incident, Shah Alam was charged with assault, trespassing, and possession of a weapon—his walking stick—and held at Erie County Holding Center until last Thursday, after he took a plea deal. He agreed to plead guilty to trespassing and possession of a weapon and was able to avoid immigration detention even though Border Patrol had issued a detainer on him after the arrest, saying he was eligible for deportation.

Buffalo Mayor Sean Ryan told the Investigative Post Thursday that upon finding the Tim Hortons closed last week, Border Patrol should have taken Shah Alam back to the Erie County Holding Center, where sheriff's deputies who knew his family from their frequent visits to the jail could have called them.

“The lawyer was not informed, and the family is just saying, ‘You had our contact information, you had our address,'” a family friend named Khaleda Shah, told the outlet. “Why not drop him at the address that’s on file for him? Why not bring you back to the holding center, rather than Tim Hortons?”

When New York Times columnist Nicholas Kristof posted on X about Shah Alam's death on Thursday, DHS responded with its claim that the agents had brought him to a safe location.

"Video shows that it was night and the coffee shop was closed, so he never entered it," Kristof replied, "Instead, mostly blind and in need of a cane, unable to speak English, he tried to walk home through the freezing night—because your agents never called his family or lawyer but seem to have left him to die. Do you see how your credibility is undermined when you repeatedly make claims that are later contradicted by video evidence? Why should we trust statements from an agency with such a record of deceit?"

DHS had not publicly responded at press time.

Refugees International was among those calling for a full investigation into Border Patrol's "abandonment" of Shah Alam.

Daniel P. Sullivan, the group's director Africa, Asia, and the Middle East, noted that the US determined in 2022 that the Myanmar military had committed genocide against the Rohingya people, and Shah Alam was resettled in the US in 2024 after surviving the violence and persecution.

"The death of Shah Alam comes in the midst of ongoing violent immigration enforcement operations by [Customs and Border Protection and Immigration and Customs Enforcement] agents that have led to widespread abuse and neglect of legally resettled refugees as well as deaths of immigrants and American citizens alike," said Sullivan.

"Refugees International, once again, strongly condemns the Trump administration’s hateful and dehumanizing targeting of those who seek refuge," he said. "We express solidarity with Mr. Shah Alam’s family, the broader Rohingya community, and all of our neighbors who face increased uncertainty and risks of harm due to the Trump administration’s current policies.”

He also said that one member of the Rohingya community had told the organization that Shah Alam's "safe haven became a tragedy for him.”

Keep ReadingShow Less

Green Party Scores Upset Win in UK Election in Blow to Labour, Far-Right Reform

"Instead of working for a nice life, we’re working to line the pockets of billionaires," victorious Green Party candidate Hannah Spencer said during her victory speech. "We’re being bled dry."

Feb 27, 2026

Green Party candidate Hannah Spencer on Thursday won an upset victory in a byelection in the Gorton and Denton constituency, delivering a blow to both Labour Prime Minister Keir Starmer and the far-right Reform Party led by Nigel Farage.

As reported by the Guardian, Spencer, a local plumber, won by overturning a 13,000-vote majority that the Labour Party achieved in the 2024 general election.

In fact, Labour fell to third place in the Thursday election, winning 9,364 votes, compared to 14,980 votes for the Greens and 10,578 votes for Reform.

In her victory speech, Spencer emphasized major class divides in the UK, where she said people are working increasingly harder for fewer benefits.

"Working hard used to get you something," she said. "It got you a house. A nice life. Holidays. It got you somewhere. But now—working hard? What does that get you?... Instead of working for a nice life, we’re working to line the pockets of billionaires. We’re being bled dry."

The Green Party said Spencer's victory showed it was now a viable force in national elections, projecting that it is "on track to win over a hundred seats at the next general election, if the historic swing achieved to win Gorton and Denton is replicated nationwide."

Green Party leader Zack Polanski hailed the election result and predicted "a tidal wave of new Green MPs" in future elections should current trends continue.

"When I was elected Leader of the Greens I said we were here to replace Labour and I meant it," Polanski said. "Hannah was a fantastic candidate and I know she’ll make a brilliant MP."

Starmer, who has pushed the Labour Party to the right on issues such as immigration and transgender rights during his tenure, reacted bitterly to the defeat in a letter he sent to other Labour MPs.

"The result in Gorton and Denton is deeply disappointing," Starmer wrote. "Instead of a Labour MP who can be a local champion delivering for Gorton and Denton alongside a Labour Government and a Labour mayor, the people of Gorton and Denton now have a representative who is more interested in dividing people than uniting them."

Starmer, whose job approval rating in polls is consistently under 20%, also predicted that "over the coming months, people will feel the benefit of the long-term decisions this government is taking."

Socialist commentator Owen Jones, a longtime Starmer critic, gloated over the result in a social media post in which he reminded followers of Starmer's past statement that left-wing voters could "leave" if they didn't like the changes he was making to Labour.

"OK, Keir Starmer, we did as you asked us!" he wrote. "Happy now?"

Keep ReadingShow Less

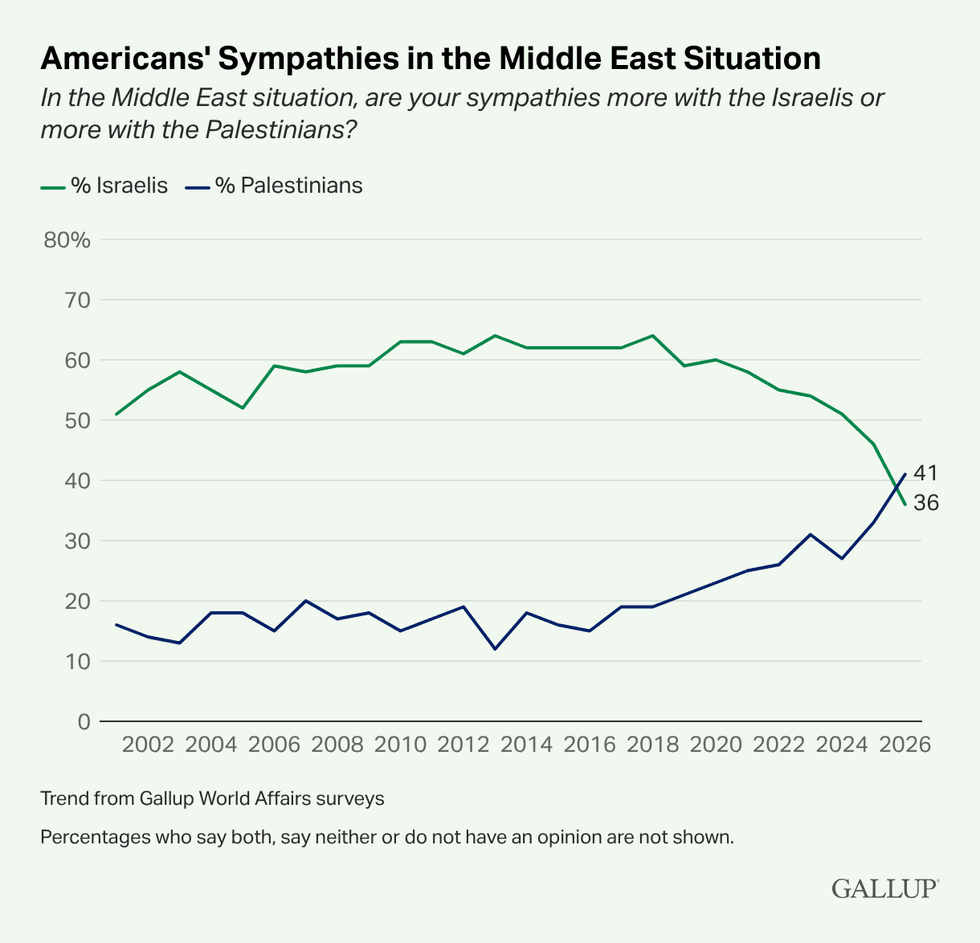

For First Time, Gallup Poll Shows Americans Sympathize More With Palestinians Than With Israelis

"It is difficult to overstate the significance of this," said one analyst. "This is a key reason why Israel—and its supporters in the US—have a sense of desperate urgency when it comes to war with Iran and annexation of Palestine."

Feb 27, 2026

A Gallup survey released Friday found that a larger percentage of Americans sympathize with the Palestinians than with the Israelis in the decades-long Middle East conflict, which has exploded over the past two and a half years with the Hamas-led attack on Israel and the latter's genocidal response—fueled by military and diplomatic support from the US government.

The new poll marks the first time since Gallup began tracking the question in 2001 that a larger portion of respondents (41%) expressed sympathy for the Palestinians than the Israelis (36%) "in the Middle East situation." The organization noted that while "the five-percentage-point difference is not statistically significant," it "contrasts with a clear lead for the Israelis only a year ago (46% vs. 33%) and larger leads over the prior 24 years."

"From 2001 to 2025, Israelis consistently held double-digit leads in Americans’ Middle East sympathies, with the gap averaging 43 points between 2001 and 2018," Gallup reported. "However, public opinion began narrowing in 2019, several years before the Oct. 7, 2023, Hamas attack on Israel and the subsequent war in Gaza. The cumulative effect of gradual changes in US attitudes since then has led to the Israelis no longer being viewed more sympathetically."

Notably, the Gallup survey shows that "Americans of all age groups have grown more sympathetic to the Palestinians in recent years." A majority of Americans between the ages of 18 and 34 (53%) said they sympathize more with the Palestinians and 23% said they sympathize more with the Israelis, "a record low for the age group," according to Gallup.

The survey also showed a "near reversal" among Americans aged 35 to 54—with 46% now saying they sympathize more with the Palestinians—and the "narrowest gap in sympathies" Gallup has ever recorded for Americans aged 55 and older.

In terms of political affiliation, Gallup found that "Americans’ shifting sympathies in the Middle East situation this year are mostly driven by changes among political independents," who now sympathize more with the Palestinians than the Israelis by a margin of 41% to 30%.

"It is difficult to overstate the significance of this," Trita Parsi, executive vice president of the Quincy Institute for Responsible Statecraft, wrote in response to the Gallup survey. "This is a key reason why Israel—and its supporters in the US—have a sense of desperate urgency when it comes to war with Iran and annexation of Palestine."

"The window for these aggressions with US support is closing," Parsi added.

The new poll also found that Americans' support for a Palestinian state is at its highest level in more than two decades as current Israeli leaders vow to prevent Palestinian statehood and ramp up their illegal annexation of territory—an effort effectively endorsed by the Trump administration.

Keep ReadingShow Less

Most Popular