January, 30 2019, 11:00pm EDT

For The 99.8% Act Will End Billionaire Class' Gluttony and Political Manipulation

"The question is do any of America’s billionaires care more about the nation than their pocketbooks."

WASHINGTON

Today, Senator Bernie Sanders (D-VT) introduced a new estate tax bill called the For The 99.8% Act. The bill, in direct opposition to an earlier bill introduced by Senator John Thune (R-SD) this week, calls for a stronger and more graduated estate tax, with a top tax rate of 77% on estates over $1 billion. Clearly, one side of the aisle is listening to what the American people want, while the other side of the aisle is still listening to their donor class. Now, America's billionaire class needs to pick a side.

In response to this bill, Morris Pearl, former managing director at BlackRock, Inc., and Chair of the Patriotic Millionaires issued the following remarks:

"Rather than being content with the enormous slice of pie they have already been given, America's billionaires are trying to keep the entire pie for themselves and their offspring. Their gluttony - and the political manipulation they employ to feed it - is ripping our country apart. Voters tried to change that at the ballot box. If that doesn't work, they are going to stop putting up with the billionaires altogether and do something more drastic. That is going to end poorly for billionaires who have been enjoying the good life, and for most of the rest of us as well.

We call ourselves the Patriotic Millionaires for a reason - because our country is more important to us than our money. The question is do any of America's billionaires care more about the nation than their pocketbooks. If they do, they will support this legislation."

This legislation would lower the current exemption to $3.5 million of an individual's estate, impacting only the wealthiest 0.2% of Americans. It would also introduce a progressive, marginal tax rate structure to the estate tax, with the highest tax rate being 77% of the value of estates over $1 billion. In addition, the bill would close loopholes in the estate and gift tax, including the ability to claim the value of an inherited asset is lower for estate tax purposes than what is claimed for income tax purposes. Protections for family farms are also included, as the bill allows family farmers to lower the value of their farmland by up to $3 million for estate tax purposes.

The Patriotic Millionaires is a group of high-net worth Americans who share a profound concern about the destabilizing level of inequality in America. Our work centers on the two things that matter most in a capitalist democracy: power and money. Our goal is to ensure that the country's political economy is structured to meet the needs of regular Americans, rather than just millionaires. We focus on three "first" principles: a highly progressive tax system, a livable minimum wage, and equal political representation for all citizens.

(202) 446-0489LATEST NEWS

Billionaire-Funded ‘Trump Accounts’ for Kids Slammed as 'Another Tax Shelter' for the Rich

"If the White House were serious about supporting families struggling with the costs of living, it would be advocating for investments in childcare," said one children's advocate.

Dec 02, 2025

After Silicon Valley CEO Michael Dell and his wife, philanthropist Susan Dell, announced Tuesday their plan to invest $250 in seed money in individual investment accounts for 25 million American children, adding to the number of kids who would receive so-called "Trump Accounts" that were included in the Republican spending bill this year, advocates acknowledged that a direct cash investment could feasibly help some families.

But the National Women's Law Center (NWLC) was among those wondering whether the Dells' investment of $6.25 billion—a fraction of their $148 billion fortune—would ultimately benefit wealthy investors far more.

“While we support direct investments in families, the Trump Accounts being hailed by the White House are a policy solution that doesn’t meet most families’ needs,” said Amy Matsui, the vice president of income security and child care at NWLC. “As currently structured, these accounts will just become another tax shelter for the wealthiest, while the overwhelming majority of American families, who are struggling to cover basic costs like food, childcare, and housing, will be hard pressed to find the extra money that could turn the seed money into a meaningful investment."

The Dells, who are behind Dell Technologies, announced the investment plan months after President Donald Trump signed the One Big Beautiful Bill into law. The tax and spending law includes a provision that would start an investment account for every US citizen child born between January 2025-December 2028, with a $1,000 investment from the US government.

As Jezebel reported, the couple's contribution would got to an additional 25 million children, up to age 10, who were born prior to the 2025 cut-off date for the initial Trump Accounts.

"Around 80% of children born between 2016-2024 would theoretically qualify, although there are cutoffs based on household income: Applying families would have to live in ZIP codes where the median household income is less than $150,000 per year," wrote Jim Vorel.

In the corporate press, the Dells were applauded for making what they called the largest single private charitable donation to US children, but Vorel questioned the real-world impact of "a gift of $250, thrown vaguely in the direction of millions of American families by members of our billionaire ruling class."

"What can that money realistically do in terms of providing for a child’s future?" he wrote. "Is it the seed that is going to allow them to go to college, to buy a house some day? Does that really seem likely? Or are we primarily talking about billionaires running PR campaigns for a president who recently hit new second term lows in his overall approval numbers?"

The success of the individual investment accounts hinges on whether Americans and their employers—who can contribute up to $2,500 per year without counting it as taxable income—will be able to consistently and meaningfully invest money in the accounts until their children turn 18, considering that about a quarter of US households are living paycheck to paycheck, according to a recent poll.

"Do you know many families in 2025 that would describe themselves as having a spare $5,000 per year to immediately start investing in a government-backed investment account, even if that might be relatively sound financial strategy? Or are the families in your orbit already scraping to get by, without being able to commit much attention to investing in the future?" asked Vorel, adding that the artificial intelligence "bubble" is widely expected to soon burst and drag the stock market in which Trump is urging families to invest "into a deep pit of despair."

"As is so often the case, the families most benefited by the concept of Trump Accounts will be those ones who are already on the best financial footing, aka the wealthiest Americans," he wrote.

Jonathan Cohn of Progressive Mass was among those who said the Dells' investment only served to demonstrate how "they should pay more in taxes" to ensure all US children can benefit from public, not private, investment in education, healthcare, and other social supports.

"The government should not be funding only what can secure the sympathies of erratic rich people," said Cohn.

The NWLC argued the Trump Accounts are an example of the White House's embrace of "pronatalism"—the belief that the government should incentivize Americans to have more children—but fall short of being a policy that would actually make a measurable positive impact on families.

“In the end, this policy mirrors the rest of the law: another giveaway to the richest Americans that leaves everyone else further behind," said Matsui. "If the White House were serious about supporting families struggling with the costs of living, it would be advocating for investments in childcare, an expanded Child Tax Credit, and undoing the historic cuts to SNAP and Medicaid.”

Keep ReadingShow Less

‘What Is the Administration Trying to Hide?’ Dems Demand Public Testimony From Trump Budget Chief

"He has unlawfully blocked funding and created a massive affordability crisis across the country. Congress and the American people deserve answers."

Dec 02, 2025

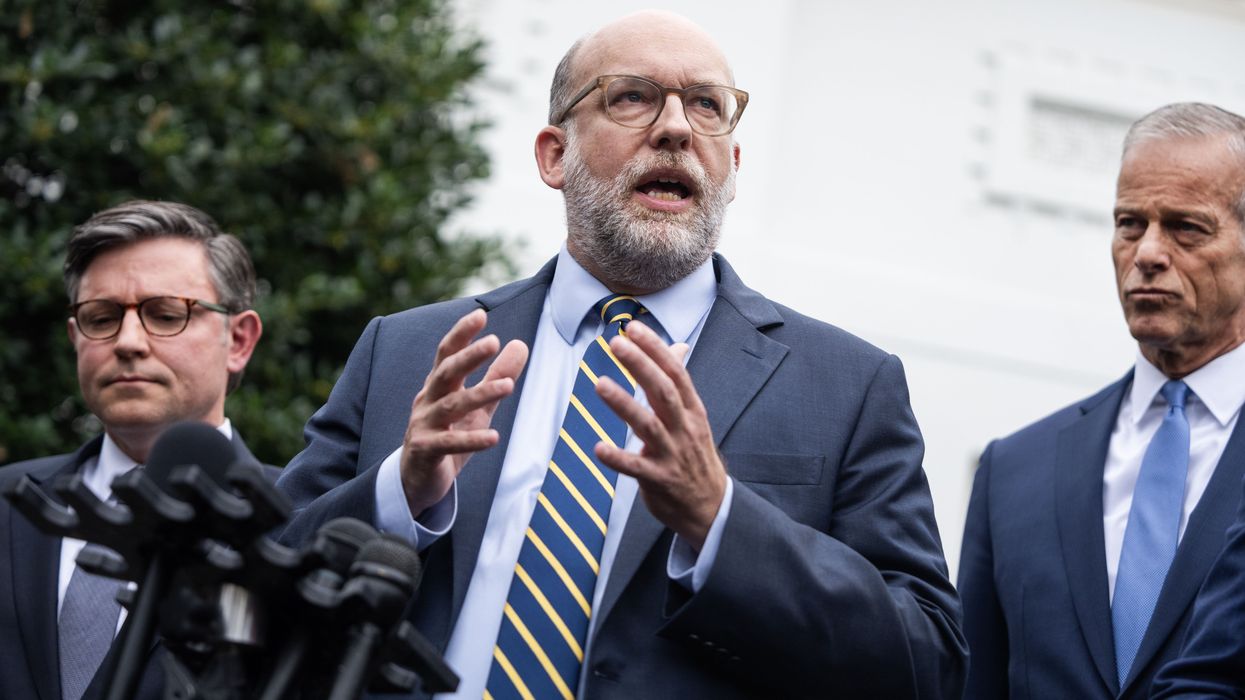

A group of House Democrats on Tuesday called on President Donald Trump's budget chief, Russell Vought, to publicly testify on the administration's unlawful withholding of funds approved by Congress and broader economic agenda, which the lawmakers said is "driving up costs, weakening the labor market, and inflicting real economic harm on the American people."

"We remain alarmed that you persist in implementing an extreme agenda that jeopardizes the economic security of the American people and shows open disregard for Congress' constitutional power of the purse," House Budget Committee Democrats, led by Rep. Brendan Boyle (D-Pa.), wrote in a letter to Vought, the director of the Office of Management and Budget (OMB) and a lead architect of the far-right Project 2025 agenda.

The lawmakers accused Vought of dodging the House Budget Committee, noting that the head of OMB typically appears before the panel shortly after the release of the president's annual budget request. Trump unveiled his budget blueprint all the way back in May.

"Not only has the committee yet to hear from OMB, you have also found time for multiple closed-door meetings with House Republicans," the Democrats wrote. "Under Democratic chairs, the public was never shut out from these important exchanges. What is the administration trying to hide?"

The letter points to Government Accountability Office (GAO) reports finding that the Trump administration has repeatedly violated federal law by withholding or delaying the disbursement of funds authorized by Congress, including National Institutes of Health research grants and money for Head Start.

The House Democrats also condemned Vought's attacks on government transparency, citing his agency's decision earlier this year to cut off public access to a database that tracks federal spending. OMB later partially restored the database after losing a court fight.

"If you fail to appear before this committee before the end of the year, this will be the only administration in the last 50 years to not send the OMB director—a basic standard you yourself met during President Trump’s first administration (appearing in both 2019 and 2020)," the lawmakers wrote on Tuesday. "If you disagree... it will make one point unmistakably clear: you know you cannot defend an extreme agenda."

We’re demanding that Russ Vought, Trump’s OMB Director and the architect of Project 2025, testify before the House Budget Committee.

He has unlawfully blocked funding and created a massive affordability crisis across the country. Congress and the American people deserve answers. pic.twitter.com/kxde5mCYs9

— Rep. Pramila Jayapal (@RepJayapal) December 2, 2025

After playing a key role in crafting the notorious Project 2025 agenda ahead of Trump's 2024 election win, Vought has emerged as one of the most powerful figures in the administration, wielding power at OMB so aggressively that ProPublica recently dubbed him "the shadow president."

"What Vought has done in the nine months since Trump took office goes much further than slashing foreign aid," the investigative outlet noted. "Relying on an expansive theory of presidential power and a willingness to test the rule of law, he has frozen vast sums of federal spending, terminated tens of thousands of federal workers and, in a few cases, brought entire agencies to a standstill."

One anonymous administration official told ProPublica that "it feels like we work for Russ Vought."

"He has centralized decision-making power to an extent that he is the commander-in-chief," the official said.

Keep ReadingShow Less

Second US Strike on Boat Attack Survivors Was Illegal—But Experts Stress That the Rest Were, Too

"It is blatantly illegal to order criminal suspects to be murdered rather than detained," said one human rights leader.

Dec 02, 2025

As the White House claims that President Donald Trump "has the authority" to blow up anyone he dubs a "narco-terrorist" and Adm. Frank M. "Mitch" Bradley prepares for a classified congressional briefing amid outrage over a double-tap strike that kicked off the administration's boat bombing spree, rights advocates and legal experts emphasize that all of the US attacks on alleged drug-running vessels have been illegal.

"Trump said he will look into reports that the US military (illegally) conducted a follow-up strike on a boat in the Caribbean that it believed to be ferrying drugs, killing survivors of an initial missile attack. But the initial attack was illegal too," Kenneth Roth, the former longtime director of the advocacy group Human Rights Watch, said on social media Monday.

Roth and various others have called out the US military's bombings of boats in the Caribbean and Pacific as unlawful since they began on September 2, when the two strikes killed 11 people. The Trump administration has confirmed its attacks on 22 vessels with a death toll of at least 83 people.

Shortly after the first bombing, the Intercept reported that some passengers initially survived but were killed in a follow-up attack. Then, the Washington Post and CNN reported Friday that Bradley ordered the second strike to comply with an alleged spoken directive from Defense Secretary Pete Hegseth to kill everyone on board.

The administration has not denied that the second strike killed survivors, but Hegseth and the White House press secretary, Karoline Leavitt, have insisted that the Pentagon chief never gave the spoken order.

However, the reporting has sparked reminders that all of the bombings are "war crimes, murder, or both," as the Former Judge Advocates General (JAGs) Working Group put it on Saturday.

Following Leavitt's remarks about the September 2 strikes during a Monday press briefing, Roth stressed Tuesday that "it is not 'self-defense' to return and kill two survivors of a first attack on a supposed drug boat as they clung to the wreckage. It is murder. No amount of Trump spin will change that."

"Whether Hegseth ordered survivors killed after a US attack on a supposed drug boat is not the heart of the matter," Roth said. "It is blatantly illegal to order criminal suspects to be murdered rather than detained. There is no 'armed conflict' despite Trump's claim."

The Trump administration has argued to Congress that the strikes on boats supposedly smuggling narcotics are justified because the United States is in an "armed conflict" with drug cartels that the president has labeled terrorist organizations.

During a Sunday appearance on ABC News' "This Week," US Sen. Chris Van Hollen (D-Md.) said that "I think it's very possible there was a war crime committed. Of course, for it to be a war crime, you have to accept the Trump administration's whole construct here... which is we're in armed conflict, at war... with the drug gangs."

"Of course, they've never presented the public with the information they've got here," added Van Hollen, a member of the Senate Foreign Relations Committee. "But it could be worse than that. If that theory is wrong, then it's plain murder."

Michael Schmitt, a former Air Force lawyer and professor emeritus at the US Naval War College, rejects the Trump administration's argument that it is at war with cartels. Under international human rights law, he told the Associated Press on Monday, "you can only use lethal force in circumstances where there is an imminent threat," and with the first attack, "that wasn't the case."

"I can't imagine anyone, no matter what the circumstance, believing it is appropriate to kill people who are clinging to a boat in the water... That is clearly unlawful," Schmitt said. Even if the US were in an actual armed conflict, he explained, "it has been clear for well over a century that you may not declare what's called 'no quarter'—take no survivors, kill everyone."

According to the AP:

Brian Finucane, a senior adviser with the International Crisis Group and a former State Department lawyer, agreed that the US is not in an armed conflict with drug cartels.

"The term for a premeditated killing outside of armed conflict is murder," Finucane said, adding that US military personnel could be prosecuted in American courts.

"Murder on the high seas is a crime," he said. "Conspiracy to commit murder outside of the United States is a crime. And under the Uniform Code of Military Justice, Article 118 makes murder an offense."

Finucane also participated in a related podcast discussion released in October by Just Security, which on Monday published an analysis by three experts who examined "the law that applies to the alleged facts of the operation and Hegseth's reported order."

Michael Schmitt, Ryan Goodman, and Tess Bridgeman emphasized in Just Security that the law of armed conflict (LOAC) did not apply to the September 2 strikes because "the United States is not in an armed conflict with any drug trafficking cartel or criminal gang anywhere in the Western Hemisphere... For the same reason, the individuals involved have not committed war crimes."

"However, the duty to refuse clearly unlawful orders—such as an order to commit a crime—is not limited to armed conflict situations to which LOAC applies," they noted. "The alleged Hegseth order and special forces' lethal operation amounted to unlawful 'extrajudicial killing' under human rights law... The federal murder statute would also apply, whether or not there is an armed conflict."

Goodman added on social media Monday that the 11 people killed on September 2 "would be civilians even if this were an armed conflict... It's not even an armed conflict. It's extrajudicial killing."

Keep ReadingShow Less

Most Popular