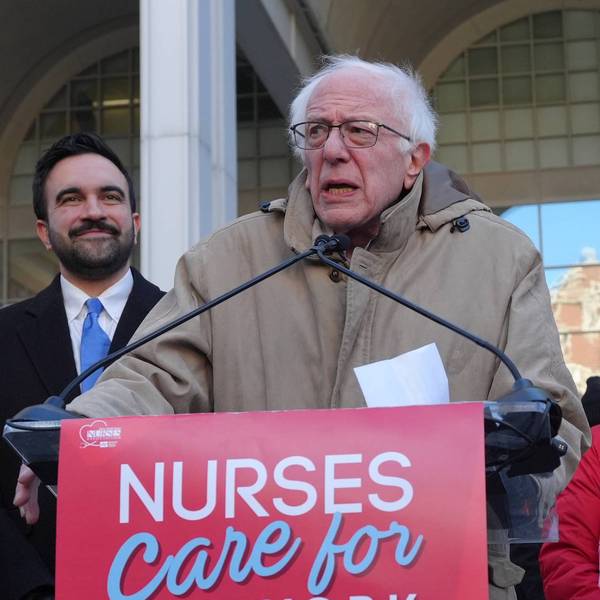

Sen. Bernie Sanders (I-Vt.) speaks during a pen and pad news conference on Capitol Hill on October 8, 2021.

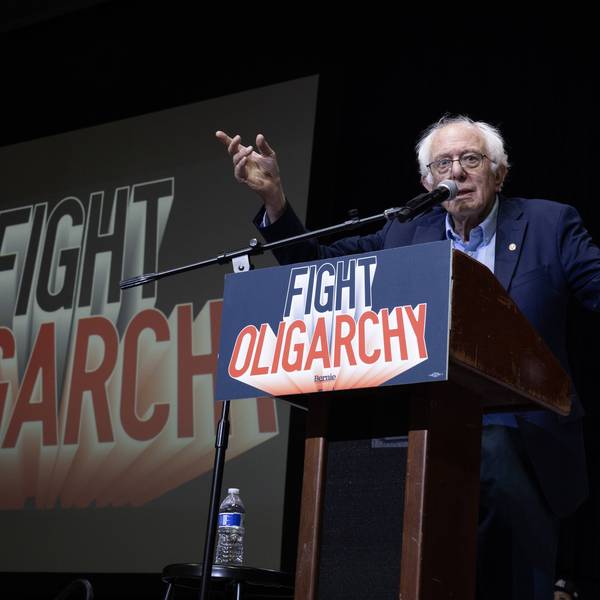

Sanders to Hold Hearing on 'How Corporate Greed and Profiteering Are Fueling Inflation'

"The American people," said the Senate Budget Committee chair, "are sick and tired of being forced to pay outrageously high prices for gas, rent, and food while large corporations make out like bandits."

U.S. Senate Budget Committee Chair Bernie Sanders announced Friday that next week he will hold a hearing to expose how corporate profiteering in the midst of multiple global crises is driving inflation.

As prices increase, corporate profits hit a record high of nearly $3 trillion in 2021, up 25% in a single year.

The event--entitled "Corporate Profits Are Soaring as Prices Rise: Are Corporate Greed and Profiteering Fueling Inflation?"--is scheduled for April 5 at 11:00 am ET and will follow his introduction last week of the Ending Corporate Greed Act.

"Let me be clear," Sanders (I-Vt.) said in a statement. "The American people are sick and tired of corporate greed. They are sick and tired of being ripped off by corporations making record-breaking profits. They are sick and tired of being forced to pay outrageously high prices for gas, rent, and food while large corporations make out like bandits.

"We cannot continue to allow large, profitable corporations to use the war in Ukraine, the Covid-19 pandemic, and the specter of inflation to make outrageous profits by price gouging Americans in every sector of our economy," he added. "It's time we discuss how corporate greed and profiteering are fueling inflation."

Sanders' statement highlighted how key sectors are behaving:

Across every major industry, prices continue to rise--this includes a 38% increase in the price of gasoline, a 44% increase in the price of heating oil, a 41% increase in the price of a used car, a 24% in the price of rental cars, and a 17% increase in the price of furniture. Further, Tyson Foods recently increased beef prices by 32%, the price of chicken by 20%, and the price of pork by 13%. As prices increase, corporate profits hit a record high of nearly $3 trillion in 2021, up 25% in a single year.

As Common Dreams reported Thursday, domestic corporate profits adjusted for inventory valuation and capital consumption hit $2.8 trillion last year, up from $2.2 trillion in 2020, according to the Commerce Department's Bureau of Economic Analysis (BEA).

"CEOs can't stop bragging on corporate earnings calls about jacking up prices on consumers to keep their profits soaring," Lindsay Owens, executive director at the Groundwork Collaborative, said in a statement about the analysis. "These megacorporations are cashing in and getting richer--and consumers are paying the price."

Owens is one of three experts set to testify at the Senate Budget Committee's Tuesday hearing. She will be joined by Robert Reich, a public policy professor at the University of California, Berkley who served as U.S. labor secretary during the Clinton administration, and Michael Faulkender, a finance professor at the University of Maryland who served as assistant secretary for economic policy at the Treasury Department under former President Donald Trump.

Both Reich and leaders from the Groundwork Collaborative, a progressive nonprofit, have praised recent proposals by Congress to curb corporate profiteering--which 82% of U.S. voters believe is fueling inflation, according to polling from last month.

Praising the Ending Corporate Greed Act--which Sanders unveiled with Sen. Ed Markey (D-Mass.) and Rep. Jamaal Bowman (D-N.Y.)--Rakeen Mabud, Groundwork Collaborative's chief economist and managing director of policy and research, said that "families, workers, and consumers expect their government to stand up against the kind of corporate abuses we're seeing today and Sen. Sanders' bill does exactly that."

If made into law, as Common Dreams reported, the proposal would impose a 95% tax on a company's profits that top its average profit level for 2015-19, adjusted for inflation. It would only impact companies with $500 million or more in annual revenue and be limited to 75% of income per year.

"A windfall corporate profits tax is badly needed to put the brakes on corporate profiteering that has run rampant over the course of the pandemic," said Mabud. "And now, the war in Ukraine is providing yet another opportunity for multinational energy giants and oil executives to drive up profit margins--while forcing families to pay more at the pump and on their energy bills."

Sanders' office estimates that the legislation, which is inspired by previous wartime measures, "would raise $31.9 billion from three of the top oil companies alone" in a single year, referring to Chevron, ExxonMobil, and ConocoPhillips.

The senator said last week that "the time has come for Congress to work for working families and demand that large, profitable corporations make a little bit less money and pay their fair share of taxes."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

U.S. Senate Budget Committee Chair Bernie Sanders announced Friday that next week he will hold a hearing to expose how corporate profiteering in the midst of multiple global crises is driving inflation.

As prices increase, corporate profits hit a record high of nearly $3 trillion in 2021, up 25% in a single year.

The event--entitled "Corporate Profits Are Soaring as Prices Rise: Are Corporate Greed and Profiteering Fueling Inflation?"--is scheduled for April 5 at 11:00 am ET and will follow his introduction last week of the Ending Corporate Greed Act.

"Let me be clear," Sanders (I-Vt.) said in a statement. "The American people are sick and tired of corporate greed. They are sick and tired of being ripped off by corporations making record-breaking profits. They are sick and tired of being forced to pay outrageously high prices for gas, rent, and food while large corporations make out like bandits.

"We cannot continue to allow large, profitable corporations to use the war in Ukraine, the Covid-19 pandemic, and the specter of inflation to make outrageous profits by price gouging Americans in every sector of our economy," he added. "It's time we discuss how corporate greed and profiteering are fueling inflation."

Sanders' statement highlighted how key sectors are behaving:

Across every major industry, prices continue to rise--this includes a 38% increase in the price of gasoline, a 44% increase in the price of heating oil, a 41% increase in the price of a used car, a 24% in the price of rental cars, and a 17% increase in the price of furniture. Further, Tyson Foods recently increased beef prices by 32%, the price of chicken by 20%, and the price of pork by 13%. As prices increase, corporate profits hit a record high of nearly $3 trillion in 2021, up 25% in a single year.

As Common Dreams reported Thursday, domestic corporate profits adjusted for inventory valuation and capital consumption hit $2.8 trillion last year, up from $2.2 trillion in 2020, according to the Commerce Department's Bureau of Economic Analysis (BEA).

"CEOs can't stop bragging on corporate earnings calls about jacking up prices on consumers to keep their profits soaring," Lindsay Owens, executive director at the Groundwork Collaborative, said in a statement about the analysis. "These megacorporations are cashing in and getting richer--and consumers are paying the price."

Owens is one of three experts set to testify at the Senate Budget Committee's Tuesday hearing. She will be joined by Robert Reich, a public policy professor at the University of California, Berkley who served as U.S. labor secretary during the Clinton administration, and Michael Faulkender, a finance professor at the University of Maryland who served as assistant secretary for economic policy at the Treasury Department under former President Donald Trump.

Both Reich and leaders from the Groundwork Collaborative, a progressive nonprofit, have praised recent proposals by Congress to curb corporate profiteering--which 82% of U.S. voters believe is fueling inflation, according to polling from last month.

Praising the Ending Corporate Greed Act--which Sanders unveiled with Sen. Ed Markey (D-Mass.) and Rep. Jamaal Bowman (D-N.Y.)--Rakeen Mabud, Groundwork Collaborative's chief economist and managing director of policy and research, said that "families, workers, and consumers expect their government to stand up against the kind of corporate abuses we're seeing today and Sen. Sanders' bill does exactly that."

If made into law, as Common Dreams reported, the proposal would impose a 95% tax on a company's profits that top its average profit level for 2015-19, adjusted for inflation. It would only impact companies with $500 million or more in annual revenue and be limited to 75% of income per year.

"A windfall corporate profits tax is badly needed to put the brakes on corporate profiteering that has run rampant over the course of the pandemic," said Mabud. "And now, the war in Ukraine is providing yet another opportunity for multinational energy giants and oil executives to drive up profit margins--while forcing families to pay more at the pump and on their energy bills."

Sanders' office estimates that the legislation, which is inspired by previous wartime measures, "would raise $31.9 billion from three of the top oil companies alone" in a single year, referring to Chevron, ExxonMobil, and ConocoPhillips.

The senator said last week that "the time has come for Congress to work for working families and demand that large, profitable corporations make a little bit less money and pay their fair share of taxes."

U.S. Senate Budget Committee Chair Bernie Sanders announced Friday that next week he will hold a hearing to expose how corporate profiteering in the midst of multiple global crises is driving inflation.

As prices increase, corporate profits hit a record high of nearly $3 trillion in 2021, up 25% in a single year.

The event--entitled "Corporate Profits Are Soaring as Prices Rise: Are Corporate Greed and Profiteering Fueling Inflation?"--is scheduled for April 5 at 11:00 am ET and will follow his introduction last week of the Ending Corporate Greed Act.

"Let me be clear," Sanders (I-Vt.) said in a statement. "The American people are sick and tired of corporate greed. They are sick and tired of being ripped off by corporations making record-breaking profits. They are sick and tired of being forced to pay outrageously high prices for gas, rent, and food while large corporations make out like bandits.

"We cannot continue to allow large, profitable corporations to use the war in Ukraine, the Covid-19 pandemic, and the specter of inflation to make outrageous profits by price gouging Americans in every sector of our economy," he added. "It's time we discuss how corporate greed and profiteering are fueling inflation."

Sanders' statement highlighted how key sectors are behaving:

Across every major industry, prices continue to rise--this includes a 38% increase in the price of gasoline, a 44% increase in the price of heating oil, a 41% increase in the price of a used car, a 24% in the price of rental cars, and a 17% increase in the price of furniture. Further, Tyson Foods recently increased beef prices by 32%, the price of chicken by 20%, and the price of pork by 13%. As prices increase, corporate profits hit a record high of nearly $3 trillion in 2021, up 25% in a single year.

As Common Dreams reported Thursday, domestic corporate profits adjusted for inventory valuation and capital consumption hit $2.8 trillion last year, up from $2.2 trillion in 2020, according to the Commerce Department's Bureau of Economic Analysis (BEA).

"CEOs can't stop bragging on corporate earnings calls about jacking up prices on consumers to keep their profits soaring," Lindsay Owens, executive director at the Groundwork Collaborative, said in a statement about the analysis. "These megacorporations are cashing in and getting richer--and consumers are paying the price."

Owens is one of three experts set to testify at the Senate Budget Committee's Tuesday hearing. She will be joined by Robert Reich, a public policy professor at the University of California, Berkley who served as U.S. labor secretary during the Clinton administration, and Michael Faulkender, a finance professor at the University of Maryland who served as assistant secretary for economic policy at the Treasury Department under former President Donald Trump.

Both Reich and leaders from the Groundwork Collaborative, a progressive nonprofit, have praised recent proposals by Congress to curb corporate profiteering--which 82% of U.S. voters believe is fueling inflation, according to polling from last month.

Praising the Ending Corporate Greed Act--which Sanders unveiled with Sen. Ed Markey (D-Mass.) and Rep. Jamaal Bowman (D-N.Y.)--Rakeen Mabud, Groundwork Collaborative's chief economist and managing director of policy and research, said that "families, workers, and consumers expect their government to stand up against the kind of corporate abuses we're seeing today and Sen. Sanders' bill does exactly that."

If made into law, as Common Dreams reported, the proposal would impose a 95% tax on a company's profits that top its average profit level for 2015-19, adjusted for inflation. It would only impact companies with $500 million or more in annual revenue and be limited to 75% of income per year.

"A windfall corporate profits tax is badly needed to put the brakes on corporate profiteering that has run rampant over the course of the pandemic," said Mabud. "And now, the war in Ukraine is providing yet another opportunity for multinational energy giants and oil executives to drive up profit margins--while forcing families to pay more at the pump and on their energy bills."

Sanders' office estimates that the legislation, which is inspired by previous wartime measures, "would raise $31.9 billion from three of the top oil companies alone" in a single year, referring to Chevron, ExxonMobil, and ConocoPhillips.

The senator said last week that "the time has come for Congress to work for working families and demand that large, profitable corporations make a little bit less money and pay their fair share of taxes."