SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Don Owens, SSSC, (202) 587-1653, dowens@socialsecurity-works.

Kim Wright, NCPSSM, (202) 216-8414, wrightk@ncpssm.org

Michael Buckley, (202) 637-5190, mbuckley@retiredamericans.org

Recent polls released today in five 2012 battleground states show that 7 in 10 likely voters favor requiring employees and employers to pay Social Security taxes on all wages above $106,800 to make Social Security solvent. Those favoring the taxes on millionaires and billionaires include 77% of Democrats, 65% of Republicans, 68% of Independents, and 65% of Tea Party supporters. The poll was released as leaders in Washington debate how to reduce the federal deficit and as AARP in

Recent polls released today in five 2012 battleground states show that 7 in 10 likely voters favor requiring employees and employers to pay Social Security taxes on all wages above $106,800 to make Social Security solvent. Those favoring the taxes on millionaires and billionaires include 77% of Democrats, 65% of Republicans, 68% of Independents, and 65% of Tea Party supporters. The poll was released as leaders in Washington debate how to reduce the federal deficit and as AARP indicated it could support Social Security benefit cuts to make the program solvent. Social Security's long-range funding gap can be closed solely by scrapping the payroll tax cap set at $106,800 in 2011, as described in this fact sheet.

By margins of 3 to 1, voters across the key states side with the candidate who espouses subjecting all wages above $106,800 to Social Security taxes over the candidate who believes the answer is to cut benefits and raise the retirement age.

The polling conducted in Colorado, Florida, Minnesota, Missouri, and Virginia found that Social Security is a highly popular program that voters across all political and demographic groups want to protect. By a margin of 74% to 19% across all party ideology, voters these states oppose cutting Social Security benefits in order to reduce the federal deficit.

Additionally, Democratic politicians no longer have the advantage they have traditionally enjoyed on Social Security. In the five key states likely voters believed Republicans in Congress will handle Social Security better than their Democratic counterparts by a margin of two points, and better than President Obama by a margin of four points.

"These findings suggest that AARP and members of Congress should side with the people they represent by demanding no benefit cuts and supporting a plan that closes the Social Security tax loophole that benefits millionaires and billionaires," said Ed Coyle, Executive Director of the Alliance for Retired Americans. "Social Security does not contribute a penny to the deficit, in fact it has a huge surplus. This is money that belongs to all of us who contributed our entire working lives so that we could retire with dignity. Voters want politicians in Washington to keep their hands off Social Security."

"The polling confirms that what many experts believe is the best policy is also the best politics - no benefit cuts; scrap the Social Security tax cap instead," said Nancy Altman, co-chair of the Strengthen Social Security Campaign.

"This poll shows that voters are clear in their thinking: Don't cut Social Security benefits, don't reduce the COLA and don't raise the retirement age," said Max Richtman, Acting CEO of the National Committee to Preserve Social Security and Medicare. "They also agree on something else: Congress should raise the Social Security tax cap above $107,000 a year to help extend the solvency of the Social Security Trust Fund."

"Far from supporting cuts, voters see the cap on Social Security taxes as a tax-loophole that should be closed," said Pollster Celinda Lake. "In fact voters are surprised to hear there is a cap since only 6 percent of voters make over the cap. Voters are strongly willing to vote for candidates based on their position on this issue: majorities across party lines, including a majority of tea party supporters say they would be more likely to vote for the candidate that closed this loophole."

Significant findings in the poll include:

Voters were asked: Please tell me if you would favor or oppose gradually requiring employees and employers to pay Social Security taxes on all wages above $106,800, which they do not do now.

Tea Party........65% support requiring employers and employees to pay Social Security taxes on wages above $106,800

Republicans....65% support requiring employers and employees to pay Social Security taxes on wages above $106,800

Independents...68% support requiring employers and employees to pay Social Security taxes on wages above $106,800

Democrats.......77% support requiring employers and employees to pay Social Security taxes on wages above $106,800

TOTALS..........70% SUPPORT requiring employers and employees to pay Social Security taxes on wages above $106,800

Cutting Social Security benefits to save the deficit:

Tea Party........57% OPPOSE cutting Social Security benefits to save the deficit

Republicans....64% OPPOSE cutting Social Security benefits to save the deficit

Independents...72% OPPOSE cutting Social Security benefits to save the deficit

Democrats.......86% OPPOSE cutting Social Security benefits to save the deficit

TOTALS..........74% OPPOSE cutting Social Security benefits to save the deficit

Lake Research Partners designed and administered five statewide surveys, which were conducted by telephone by professional interviewers from March 3-10, 2011. The survey reached likely voters in five states including Colorado (502), Florida (503), Minnesota (584), Missouri (502), and Virginia (603). Each state's individual survey may be viewed here. The margin of error for the combined "total" survey data is +/- 1.9 percentage points.

The poll was paid for by Social Security Works, a national organization that convenes the Strengthen Social Security Campaign, which is comprised of more than 300 national and state organizations representing more than 50 million Americans from many of the nation's leading aging, labor, disability, women's, children, consumer, civil rights and equality organizations; the National Committee to Preserve Social Security and Medicare Foundation, and the Alliance for Retired Americans.

"If democracy is to survive, billionaires cannot be allowed to buy elections," said Sen. Bernie Sanders.

A yearlong investigation published Friday by the Washington Post examines how a small number of billionaires, now richer than ever, have exploited openings provided by the US Supreme Court, lawmakers, and sleepwalking regulatory agencies to flood the American political system with cash and advance their ideological—and financial—interests.

The Post analysis reveals that the nation's top 20 billionaire donors pumped close to $5 billion combined into the US political system between 2015 and 2024, attempting to exert influence over both state-level and national elections.

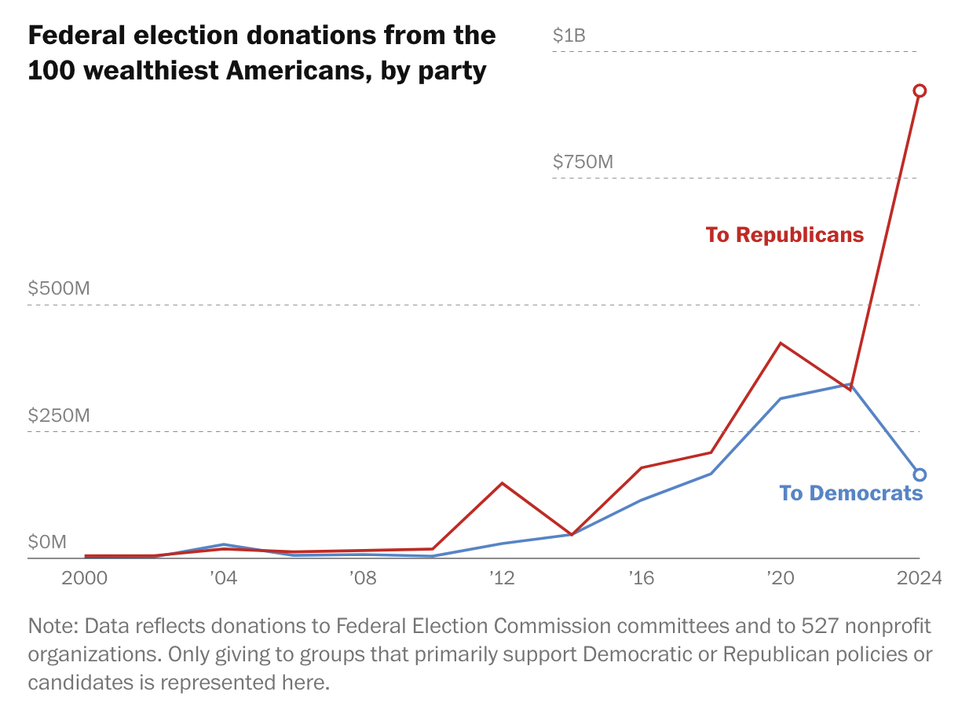

In 2024, the newspaper found, over 80% of federal campaign spending by the 100 richest Americans flowed to Republicans, who delivered once again for rich benefactors by enacting yet another round of highly regressive tax cuts this past summer.

Topping the list of billionaire donors is Miriam Adelson and her late husband Sheldon, who have spent $621 million on federal races and $37 million on state races over the past decade, mostly backing Republican campaigns—including that of President Donald Trump.

Others on the list include former New York City Mayor Michael Bloomberg, shipping magnates Richard and Elizabeth Uihlein, hedge fund manager Ken Griffin, Tesla CEO Elon Musk, and investor George Soros.

"In three landmark decisions, starting with 2010’s Citizens United vs. FEC, federal courts gutted post-Watergate campaign finance restrictions, clearing the way for donors to contribute unlimited money to elections," the Post observed. "As a result, US politicians are more dependent on the largesse of the billionaire class than ever before, giving one-four-hundredth of 1% of Americans extraordinary influence over which politicians and policies succeed."

Sen. Sheldon Whitehouse (D-RI) called Citizens United, which spawned the super PACs that many billionaires now use as vehicles for unrestrained election spending, "the original sin."

"Five Supreme Court Republican appointees, many helped onto the Court by right-wing billionaires, open the floodgates for unlimited political spending," Whitehouse wrote in a social media post on Friday. "Then they refuse to police anonymous political spending they know is corrupting. This is the result."

Sen. Bernie Sanders (I-Vt.), who has long decried the corrupting influence of billionaire and corporate money on American politics, said the Post investigation underscores why "we must overturn Citizens United and move to the public funding of elections."

"A majority of Americans agree: If democracy is to survive, billionaires cannot be allowed to buy elections," Sanders added.

As part of its probe, the Post conducted a survey aimed at determining how the US public feels about billionaires using a fraction of their immense fortunes—now at a record $8 trillion—to sway elections.

The survey of 2,500 Americans, conducted in September, found that 58% have a negative view of billionaires spending more money on elections. Forty-three percent of Americans, including 62% of Democrats and 21% of Republicans, believe billionaires have a negative impact on society overall.

“I don’t believe there is an ethical way for billionaires to even exist in this country,” Leah Welde, a 29-year-old Democrat and graduate school student in Philadelphia, told the Post. "To be sitting on that amount of money while citizens in this country are unhoused, hungry, and without medical care is abhorrent. I believe in spreading wealth."

"The CDC is now completely compromised after Trump and RFK Jr. ousted or drove out real, well-intentioned, and intelligent scientists," said one physician.

US public health officials warned this week that the country is close to following Canada in losing its measles elimination status, a deadly and preventable setback many experts attribute to the vaccine-averse policies and practices of Health and Human Services Secretary Robert F. Kennedy Jr.

Centers for Disease Control and Prevention (CDC) officials have linked the ongoing measles outbreak in Arizona and Utah with the major outbreak in Texas that began in January, both of which are being caused by the same viral subtype. With no signs of slowing, and holiday travel and gatherings fast approaching, experts worry that measles transmission could escalate and the disease will no longer be considered eliminated.

Under World Health Organization guidance, "eliminated" means an absence of endemic virus transmission for 12 months or longer in a defined geographical area under a well-performing surveillance system.

Many public health experts blame the administration of President Donald Trump—and particularly Kennedy's policies—for the measles resurgence. Kennedy, who initially downplayed the seriousness of the Texas outbreak, has endorsed vaccines, but has also made unsupported or misleading claims about the safety and efficacy of measles shots.

"Absurd yet predictable," Dr. Michael O'Brien, an urgent care pediatrician, wrote Thursday on X. "The CDC is now completely compromised after Trump and RFK Jr. ousted or drove out real, well-intentioned, and intelligent scientists. As measles approaches endemic status in the US for the first time since 2000, the CDC has abandoned science and reason."

The anti-vaccination movement is largely to blame for the continuing measles outbreak and the fact that the U.S. is going to lose our measles elimination status. Until RFK Jr. is removed from office, things are only going to get worse. @jimalwine.bsky.social and I wrote about here:

[image or embed]

— Elizabeth Jacobs, PhD (@elizabethjacobs.bsky.social) November 19, 2025 at 2:18 PM

The United States declared measles eliminated in 2000. However, with 1,753 confirmed cases and three deaths in 45 reported outbreaks so far this year, experts say the US is at risk of following Canada, which announced earlier this month that it has lost its elimination status, which it enjoyed since 1998.

As in the US, experts attribute Canada's measles backsliding to declining vaccination rates, mis- and disinformation, and vaccine aversion—especially among religious groups. The West Texas outbreak began in the close-knit, unvaccinated Mennonite community in Gaines County, while the Arizona/Utah outbreak originated among members of a fundamentalist Mormon offshoot.

More than 9 in 10 reported US measles cases this year are among people who have either not been vaccinated or whose vaccination status is unknown.

"We are in this dire situation primarily due to the explosion of the anti-vaccine movement since the start of the Covid-19 pandemic."

Writing for LiveScience, University of Pennsylvania molecular virologist James Alwine and University of Arizona professor emerita and epidemiologist Elizabeth Jacobs warned Wednesday that measles is "a bellwether of declining vaccination rates—a wailing siren that other vaccine-preventable disease outbreaks are just around the corner."

"We are in this dire situation primarily due to the explosion of the anti-vaccine movement since the start of the Covid-19 pandemic," Alwine and Jacobs asserted. "The movement is responsible for undermining trust in scientists and vaccines via a tsunami of misinformation coming from social media accounts and podcast appearances."

The authors continued:

This was made worse when Senate Republicans confirmed Kennedy as secretary of HHS, despite the objections of tens of thousands of scientists, healthcare providers, and public health practitioners. Kennedy is an avowed anti-vaccination proponent who chaired Children's Health Defense, an organization that regularly promotes vaccine misinformation. He is also a conspiracy theorist and has claimed that Covid-19 is a "bioweapon" engineered to "attack Caucasians and Black people" while sparing Ashkenazi Jews; that WiFi causes brain cancer; and that drug use, not HIV, causes AIDS. His appointment opened the door to install anti-vaccine proponents as leaders in public health, such as replacing the members of the Advisory Committee on Immunization Practices (ACIP) with several individuals with links to the anti-vaccine movement. In confirming Kennedy, Senate Republicans utterly failed the people of the US and demonstrated a cavalier disregard for decades of scientific achievement.

In June, Sen. Bernie Sanders (I-Vt.) launched an investigation into Kennedy's ACIP purge. The following month, six major US medical organizations sued Kennedy, alleging his vaccine policies are placing children at grave and immediate risk.

"As the anti-vaccine movement continues to be nurtured by Kennedy and his followers, this threat will only continue to expand and grow more severe," Alwine and Jacobs warned. "Removing state vaccine requirements for school entry—as has happened in Florida—is demonstrative of this, and represents an unacceptable risk."

"Kennedy must be removed from office," they added, echoing a September demand by more than 1,000 current and former HHS officials. "There can be no improvements in public health or vaccination rates as long as he continues his destructive reign."

In September, Congresswoman Haley Stevens (D-Mich.) filed articles of impeachment against Kennedy, declaring that he "has violated his oath of office and proven himself unfit to serve the American people."

Advocacy groups and medical organizations have gathered more than 150,000 petition signatures calling for Kennedy's removal.

On Friday, Congresswoman Kim Schrier (D-Wash.), who chairs the Democratic Doctors Caucus, led 65 colleagues demanding that Kennedy "immediately correct" the CDC website "after it was updated to promote the widely disproven and dangerous claim that vaccines may cause autism."

"RFK Jr.’s decision to spread fringe conspiracy theories and misinformation on the CDC’s official website is reckless," Schrier said in a statement. "He’s scaring parents, undermining trust in the CDC, and putting children at risk.”

"The explosion of LNG exports in recent years has already generated massive profits for the fossil fuel industry, while consumers and local communities pay the price," said one climate campaigner.

As government leaders from around the world met in Brazil to discuss solutions to the fossil fuel-driven climate emergency, the GOP-controlled US House of Representatives on Thursday advanced a bill that would lift restrictions on liquefied natural gas.

Eleven Democrats joined all Republicans present in voting for GOP Texas Congressman August Pfluger's Unlocking our Domestic LNG Potential Act, which would also grant the Federal Energy Regulatory Commission sole authority over applications for import and export facilities. It's now up to the Senate whether the bill will reach President Donald Trump.

As E&E News reported: "Pfluger and Republican leadership previously championed the bill in response to President Joe Biden's LNG pause, in which the Department of Energy paused new terminal approvals to evaluate whether they were in the public interest. It passed the House last year, but never received Senate consideration."

While Pfluger, House Speaker Mike Johnson (R-La.), and Sen. Tim Scott (R-SC), the upper chamber sponsor, celebrated Thursday's vote, climate campaigners blasted the bill—just one part of a sweeping GOP effort to boost the planet-heating fossil fuel industry during Trump's second term.

"The explosion of LNG exports in recent years has already generated massive profits for the fossil fuel industry, while consumers and local communities pay the price," Sierra Club director of beyond fossil fuels policy Mahyar Sorour said in a statement after the vote. "The last thing we need is even less oversight over these costly, polluting export projects."

"House Republicans should be focused on making investments in a clean economy and reducing energy costs for our families, not further padding the pockets of Big Oil and Gas executives," Sorour added. "The Senate should reject this dirty bill."

Energy prices are going up everywhere and Republicans just made it worse ⬇️

[image or embed]

— Energy and Commerce Democrats (@energycommerce.bsky.social) November 20, 2025 at 6:03 PM

Tyson Slocum, director of Public Citizen's Energy Program, highlighted that "President Trump explicitly promised during the campaign that he would lower Americans' utility bills by half within 12 months. Not only has Trump obviously failed on that promise, but this legislation would exacerbate the energy affordability crisis."

Slocum pointed to his group's estimates that "natural gas prices for American households have increased by $10.3 billion from January through August 2025 compared to the same time period a year earlier—a 20% increase."

"Eight LNG export terminals now consume more natural gas than all American households combined," he continued. "The US Department of Energy's Energy Information Administration's November 2025 Short Term Energy Outlook concludes that Americans face sharply higher natural gas prices 'primarily due to increased liquefied natural gas (LNG) exports.'"

"This radical and reckless deregulatory proposal eliminates the requirement that gas exports comply with the public interest, allowing fossil fuel companies to enjoy unregulated exports at the expense of affordable energy here at home," Slocum stressed. "The move by Congress to allow bypassing these safeguards could have catastrophic impacts on the consumers in the US, sending energy prices soaring, while allowing climate change to get far worse."

"Despite Trump promising he would cut Americans' energy bills, Congress is set to put consumers at risk of paying more, raising major questions about Trump's close allegiance with dirty energy executives who want to ship more fuel overseas," he added. "Creating more capacity to export US fossil fuels abroad will only accelerate the climate crisis and hurt US consumers."

Americans are already being crushed by the skyrocketing cost of living, and now the House GOP is passing legislation that will drive up monthly power bills even further by sending UNLIMITED amounts of our natural gas abroad.

[image or embed]

— Rep. Frank Pallone (@pallone.house.gov) November 20, 2025 at 4:26 PM

The vote happened on the same day that Doug Burgum, the billionaire fossil fuel industry ally whom Trump appointed to lead the US Department of the Interior, ordered the termination of the Biden administration's 2024-29 National Outer Continental Shelf Oil and Gas Leasing Program and the development of a "new, more expansive" plan "as soon as possible."

Responding to the order in a statement, Sierra Club executive director Loren Blackford said that "Donald Trump and Doug Burgum are once again trying to sell out our coastal communities and our public waters in favor of corporate polluters' bottom line."