February, 11 2020, 11:00pm EDT

New York, NY

Today, BlackRock, the world's largest asset manager, announced that one of its fastest-growing sustainable funds will stop investing in tar sands, one of the dirtiest fuel sources on the planet.

Last month, in response to growing public pressure, BlackRock CEO Larry Fink announced a new set of policies that aim to put climate change and sustainability at the center of BlackRock's business model, including divesting BlackRock's actively managed funds from thermal coal and expanding BlackRock's offerings of environmentally responsible funds.

Members of the BlackRock's Big Problem network issued the following statements in response to today's announcement:

Sierra Club Campaign Representative Ben Cushing said: "We're glad to see BlackRock start to act on its commitments and recognize that centering climate in its business decisions means cutting funding not only for coal but for all climate-destabilizing investments including dirty tar sands oil. This is an important step in the right direction. BlackRock should exclude tar sands from all its climate funds and make these funds the default option for investors. When BlackRock acts, asset managers like State Street and Vanguard follow -- and we'll be making sure they do."

Amazon Watch Climate & Finance Director Moira Birss said: "The exclusion of tar sands from sustainable funds is a clear indication that BlackRock is beginning to put its recent climate commitments into action; however, more steps are needed. Oil and gas extraction of all kinds are destroying our climate, especially in sensitive ecosystems like the Amazon. BlackRock and other asset managers must rapidly ramp up climate-risk standards across sustainable funds as well as their entire portfolios."

BlackRock's Big Problem is a global network of NGOs and social movements that are pushing asset managers like BlackRock to align their business practices with a climate-safe world. That means divesting from fossil fuel companies that won't change their practices, prioritizing fossil and deforestation free funds, and more actively pushing companies they own to align their businesses with the goals of the Paris climate agreement.

The Sierra Club is the most enduring and influential grassroots environmental organization in the United States. We amplify the power of our 3.8 million members and supporters to defend everyone's right to a healthy world.

(415) 977-5500LATEST NEWS

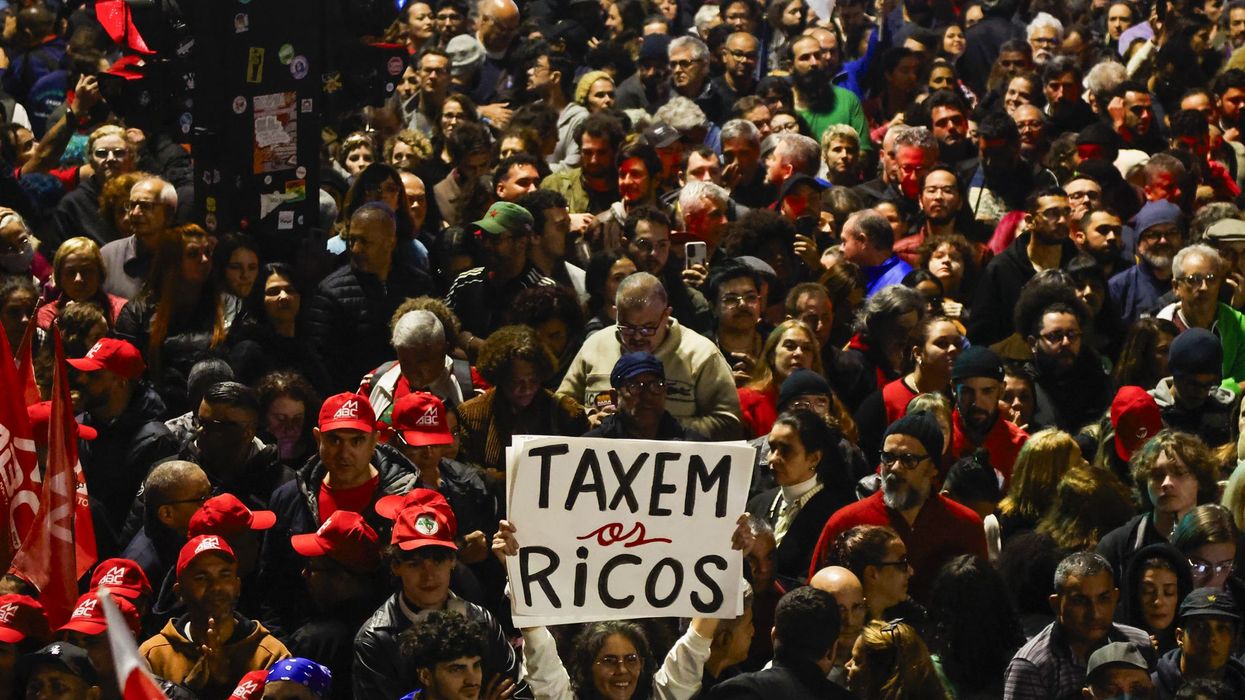

Richest 0.001% Now Own Three Times More Wealth Than Poorest Half of Humanity Combined

"The choices we make in the coming years will determine whether the global economy continues down a path of extreme concentration or moves toward shared prosperity."

Dec 10, 2025

A landmark report on global inequality published Wednesday shows that the chasm between the richest slice of humanity and everyone else continued to expand this year, leaving the top 0.001%—fewer than 60,000 multimillionaires—with three times more wealth than the poorest half of the world's population combined.

The global wealth gap has become so staggering, and its impact on economies and democratic institutions so corrosive, that policymakers should treat it as an emergency, argues the third edition of the World Inequality Report, a comprehensive analysis that draws on the work of hundreds of scholars worldwide. Ricardo Gómez-Carrera, a researcher at the World Inequality Lab, is the report's lead author.

"Inequality has long been a defining feature of the global economy, but by 2025, it has reached levels that demand urgent attention," reads the new report. "The benefits of globalization and economic growth have flowed disproportionately to a small minority, while much of the world’s population still face difficulties in achieving stable livelihoods. These divides are not inevitable. They are the outcome of political and institutional choices."

The richest 10% of the global population, according to the latest data, own three-quarters of the world's wealth and capture more income than the rest of humanity. Within most countries, it is rare for the bottom 50% to control more than 5% of national wealth.

"This concentration is not only persistent, but it is also accelerating," the report observes. "Since the 1990s, the wealth of billionaires and centimillionaires has grown at approximately 8% annually, nearly twice the rate of growth experienced by the bottom half of the population. The poorest have made modest gains, but these are overshadowed by the extraordinary accumulation at the very top."

"The result," the report adds, "is a world in which a tiny minority commands unprecedented financial power, while billions remain excluded from even basic economic stability."

The report comes as the world's richest and most powerful nation, led by President Donald Trump, abandons international cooperation on climate and taxation and works to supercharge inequality by slashing domestic and foreign aid programs while delivering massive handouts to the wealthiest Americans.

Jayati Ghosh, a member of the G20 Extraordinary Committee of Independent Experts on Global Inequality and co-author of the forward to the new report, said in a statement that "we live in a system where resources extracted from labor and nature in low-income countries continue to sustain the prosperity and the unsustainable lifestyle of people in high-income economies and rich elites across countries."

"These patterns are not accidents of markets," said Ghosh. "They reflect the legacy of history and the functioning of institutions, regulations and policies—all of which are related to unequal power relations that have yet to be rebalanced.”

Reversing the decadeslong trend of exploding inequality will require the political will to pursue obvious solutions, including fair taxation of the mega-rich and bold investments in social programs and climate action, which is disproportionately fueled by the wealthy.

"The choices we make in the coming years," the report says, "will determine whether the global economy continues down a path of extreme concentration or moves toward shared prosperity."

Keep ReadingShow Less

'Defeat for Justice': Ecuador to Pay Amazon-Polluting Chevron $220 Million

"A debt is not owed to Chevron. A debt is owed to the Amazonian families still waiting for truth, justice, and full reparation."

Dec 09, 2025

A US advocacy group, American human rights lawyer Steven Donziger, and the group in Ecuador behind a historic legal battle against Chevron over its dumping of toxic waste in the Amazon rainforest are condemning the Ecuadorian government's plans to pay the oil giant hundreds of millions of dollars due to an arbitration ruling.

In response to the legal fight in Ecuador that led to a $9.5 billion judgment against Chevron—which bought Texaco—the fossil fuel company turned to the investor-state dispute settlement (ISDS) system, suing the South American country in the Hague-based Permanent Court of Arbitration. As part of the latter case, Ecuadorian Attorney General Diana Salazar Méndez's office announced Monday that the government would pay the US company only around $220 million, rather than the over $3 billion Chevron sought.

While Chevron said in a statement that it was "pleased with the resolution of this matter" and claimed the decision "strengthened the rule of law globally," and Salazar Méndez's office celebrated the dramatically lower figure, and the Union of Peoples Affected by Chevron-Texaco (UDAPT)—the group that began the case against oil company in 1993—pushed back against the government's framing of the reduction "as if it was a success and an economic achievement."

"The reality is it is a defeat for justice," UDAPT argued in a Tuesday statement. "For 32 years, UDAPT has documented pollution, environmental crime, and lives broken by Chevron, proving what should be obvious: Communities have not recovered, health has not been restored, clean water has not returned, and the territories that sustain life remain contaminated. A debt is not owed to Chevron. A debt is owed to the Amazonian families still waiting for truth, justice, and full reparation."

Amazon Watch deputy director Paul Paz y Miño similarly said Tuesday that "this illegitimate arbitration process is nothing more than Chevron abusing the law to escape accountability for one of the worst oil disasters in history."

"Ecuador's courts ruled correctly and based largely on Chevron's own evidence, that Chevron deliberately poisoned Indigenous and rural communities, leaving behind a mass cancer zone in the Amazon," the campaigner continued. "Adding insult to injury, the idea that Ecuador's people should now pay a US oil company that admitted to deliberate pollution is the epitome of environmental racism."

Ecuadorian President Daniel Noboa "must not honor this ISDS award, and the international community must stand behind the victims of Chevron's crimes and demand that the company clean up Ecuador once and for all," Paz y Miño added. "Amazon Watch stands with the affected Indigenous peoples and communities of the Ecuadorian Amazon. We urge President Noboa to reject this illegitimate award, disclose any negotiations with Chevron, and enforce Ecuadorian law by ensuring Chevron pays its debt to those it poisoned."

Donziger—who was detained in the United States for nearly 1,000 days after Chevron went after him in the American legal system for representing Big Oil's victims in Ecuador—was also sharply critical, saying Tuesday that "the decision by a so-called private corporate arbitration panel that claims to absolve Chevron of its massive pollution liability in Ecuador has no legitimacy and does not affect the historic $9.5 billion damages judgment won by Amazonian communities."

"That judgment still stands as the definitive public court ruling in the case," he said. "The private arbitral panel has no authority over the six public appellate courts, including the Supreme Courts of Ecuador and Canada, that issued unanimous decisions against Chevron and confirmed the extensive evidence that the company devastated local communities by deliberately dumping billions of gallons of cancer-causing oil waste into rivers and streams used by thousands of people for drinking, bathing, and fishing."

"I also strongly condemn President Daniel Noboa for his plans to betray his own people by agreeing to send $220 million from the public treasury to Chevron, a company that owes Ecuador billions under multiple court orders for poisoning vulnerable Indigenous peoples with toxic oil waste," Donziger added. "Noboa would effectively grant Chevron a taxpayer-funded bailout financed by the same citizens who remain victims of the company's pollution. This would be an outrageous dereliction of duty and a violation of his oath of office, warranting removal."

Keep ReadingShow Less

After Judge Tosses GOP Lawsuit, Missouri Voters Submit Signatures for Referendum on Rigged Map

"The citizens of Missouri have spoken loudly and clearly: They deserve fair maps, not partisan manipulation,” said one campaigner.

Dec 09, 2025

Opponents of Missouri's GOP-rigged congressional map on Tuesday submitted more than twice the required number of signatures supporting a referendum on the redistricting scheme backed by US President Donald Trump, a move that followed a federal judge's refusal to block the initiative.

The political action committee People Not Politicians turned in more than 300,000 signatures in support of the referendum to Republican Missouri Secretary of State Denny Hoskins' office in what the group called an "unprecedented show of grassroots power."

The submission—which filled 691 boxes—will be reviewed by state election officials tasked with certifying the validity of the roughly 110,000 signatures required for qualification on the November 2026 ballot. If the signatures are approved, the state would be temporarily prohibited from adopting the new map until after the referendum vote.

Hoskins initially rejected People Not Politicians' referendum petition because Missouri Gov. Mike Kehoe, a Republican, had not yet signed the redrawn map into law. Hoskins said he would reject any signatures collected before Kehoe approved the map in September. At that time, People Not Politicians had collected around 92,000 signatures.

“The citizens of Missouri have spoken loudly and clearly: They deserve fair maps, not partisan manipulation,” People Not Politicians executive director Richard von Glahn said in a statement. “We are submitting a record number of signatures to shut down any doubt that Missouri voters want a say.”

The submission followed a Monday ruling by US District Judge Zachary Bluestone—a Trump appointee—rejecting Republican Missouri Attorney General Catherine Hanaway's bid to block the referendum on grounds that the court had no jurisdiction over a lawsuit filed by Hoskins and the GOP-controlled state Legislature arguing that state referendums on congressional maps are unconstitutional.

Supporters of Missouri's referendum are seeking to block redistricting legislation passed in September as part of Trump's push for Republican-controlled state legislatures to rig congressional maps in a bid to preserve GOP control of Congress by eliminating Democratic-leaning districts.

Texas was the first state to do Trump’s bidding by approving a new congressional map that could help Republicans gain five additional House seats. Last week, the US Supreme Court's right-wing majority gave Texas Republicans a green light to use the rigged map in next year's election.

Democratic California Gov. Gavin Newsom responded to Texas' move by spearheading a successful ballot initiative to redraw the Golden State's congressional map in favor his party. Under pressure from Trump, Republican lawmakers in Indiana, Missouri, and North Carolina launched their own gerrymandering efforts.

In Missouri, Republicans are aiming to win seven of the state's eight congressional seats, including by flipping the 5th District, which is currently held by Democratic Rep. Emanuel Cleaver.

Responding to Tuesday's signature submission, Missouri state Rep. Ray Reed (D-83) said on social media that "today, the people of Missouri did something powerful. Organizers across our state: young folks, retirees, faith leaders, neighbors talking to neighbors, came together to defend the idea that in a democracy, voters should choose their leaders, not the other way around."

"Missouri just showed the country what fighting back looks like and I’m proud to stand with the people who made it happen," Reed added.

Keep ReadingShow Less

Most Popular