SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

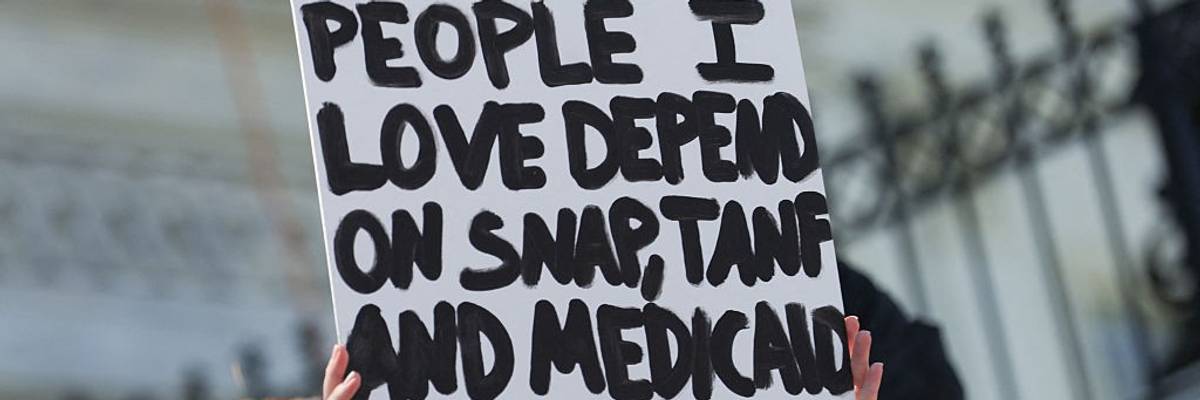

A demonstrator holds a sign reading 'People I love depend on SNAP, TANF, and Medicaid' during a sit-in protest against a Republican budget plan on the steps of the U.S. Capitol in Washington, D.C. on April 27, 2025.

"I'll tell you what's coming: handouts for billionaires, healthcare cuts for the people," warned one Democratic lawmaker.

House Democrats and civil society groups led condemnation of legislation introduced Monday by congressional Republicans and backed by President Donald Trump that one lawmaker said is "about tax breaks for billionaires and kickbacks to corporate donors" at the expense of working class families.

The 389-page bill includes trillions of dollars in tax cuts that would disproportionately benefit the ultra-wealthy and corporations, largely by extending Trump's first-term reductions in taxation mainly for top earners derided as the "GOP tax scam." The proposal also broadens the estate tax exemption for the superrich and makes permanent a massive tax break on offshore corporate profits, a top wish-list item for Big Business.

The proposal would reduce government revenue by trillions of dollars and swell the national debt—currently a staggering $36.2 trillion, or the equivalent of 127% of U.S. gross domestic product—and cost over $5 trillion.

The bill partially offsets the revenue loss by sharply slashing social spending, including on the Supplemental Nutrition Assistance Program (SNAP) and Medicaid. The legislation would impose work and cost-sharing requirements on many Medicaid beneficiaries and increase eligibility checks. Critics warn that millions of people would lose their health insurance coverage if the bill is passed in its current form.

Former Democratic U.S. Labor Secretary Robert Reich called the proposed legislation "trickle-down economics on steroids."

The Trump-GOP tax bill proposal: -Extend 2017 cuts for top earners -Increase the "pass-through" loophole for big businesses -Expand the estate tax exemption for the ultra-rich -Make a huge tax break for offshore corporate profits permanent Trickle down economics on steroids.

— Robert Reich (@rbreich.bsky.social) May 12, 2025 at 11:32 AM

On the positive side, the popular Child Tax Credit would grow for many households under the proposal. So would the standard deduction. There would also be temporary tax breaks for overtime pay, car-loan interest, and tips. The proposal also establishes a new tax-preferred savings account for children younger than 8 years old under which the government would contribute the first $1,000 for kids born between 2025-28.

However, critics noted that millions of families would receive no benefit from the Child Tax Credit increase, wealthy business partnerships would get an even bigger passthrough deduction than in an earlier draft of the bill, and taxes on many tips and overtime work remain.

"This bill isn't about balancing the budget—it's about tax breaks for billionaires and kickbacks to corporate donors and billionaires, while silencing public voices," said Rep. Melanie Stansbury (D-N.M.). "We see the grift and we're calling it out."

Rep. Brendan Boyle (D-Pa.), the ranking member of the House Budget Committee, noted that "Trump loves to call his budget the 'big, beautiful bill.'"

"It is—for billionaires," he added. "While Trump's billionaire donors get trillions in tax cuts, working Americans get the largest Medicaid cuts in American history."

House Ways and Means Committee Ranking Member Rep. Richard Neal (D-Mass.) warned, "I'll tell you what's coming: handouts for billionaires, healthcare cuts for the people."

The GOP agenda: rip health care away from millions of Americans to pay for massive tax breaks for the ultra-rich. This is the moment to fight back with everything we’ve got.

[image or embed]

— Elizabeth Warren (@elizabeth-warren.bsky.social) May 12, 2025 at 1:50 PM

Civil society groups also sounded the alarm over the bill.

"Families across the country are struggling now more than ever to get food on the table, visit the doctor, and afford lifesaving medication," ParentsTogether Action executive director Ailen Arreaza said Monday. "But instead of finding ways to offer some relief, Republicans in Congress are racing to pass a bill to hand massive new tax breaks to the ultra-wealthy."

"Even worse? Their plan is to pay for it by ripping healthcare and nutrition aid away from millions," Arreaza added. "One thing is clear: Gutting Medicaid and SNAP to fund tax breaks for the rich is cruelty disguised as policy—and parents across the country will take note of how their representatives vote this week as evidence of who they're fighting for, their constituents or their wealthy donors."

David Kass, executive director of Americans for Tax Fairness, said in a statement that "the House GOP has revealed in broad daylight that their tax bill is a clear scam—one that hands out massive giveaways to their billionaire and corporate donors off the backs of their constituents with a price tag of over $5 trillion."

"The plan's massive cuts to vital programs like Medicaid and SNAP will drive up healthcare and food prices for millions of workers and families, while billionaires pocket the money and the national debt soars," Kass added. "Working and middle-class families—and future generations—shouldn't have to pay higher prices simply to enrich billionaire elites and the politicians in their pocket."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

House Democrats and civil society groups led condemnation of legislation introduced Monday by congressional Republicans and backed by President Donald Trump that one lawmaker said is "about tax breaks for billionaires and kickbacks to corporate donors" at the expense of working class families.

The 389-page bill includes trillions of dollars in tax cuts that would disproportionately benefit the ultra-wealthy and corporations, largely by extending Trump's first-term reductions in taxation mainly for top earners derided as the "GOP tax scam." The proposal also broadens the estate tax exemption for the superrich and makes permanent a massive tax break on offshore corporate profits, a top wish-list item for Big Business.

The proposal would reduce government revenue by trillions of dollars and swell the national debt—currently a staggering $36.2 trillion, or the equivalent of 127% of U.S. gross domestic product—and cost over $5 trillion.

The bill partially offsets the revenue loss by sharply slashing social spending, including on the Supplemental Nutrition Assistance Program (SNAP) and Medicaid. The legislation would impose work and cost-sharing requirements on many Medicaid beneficiaries and increase eligibility checks. Critics warn that millions of people would lose their health insurance coverage if the bill is passed in its current form.

Former Democratic U.S. Labor Secretary Robert Reich called the proposed legislation "trickle-down economics on steroids."

The Trump-GOP tax bill proposal: -Extend 2017 cuts for top earners -Increase the "pass-through" loophole for big businesses -Expand the estate tax exemption for the ultra-rich -Make a huge tax break for offshore corporate profits permanent Trickle down economics on steroids.

— Robert Reich (@rbreich.bsky.social) May 12, 2025 at 11:32 AM

On the positive side, the popular Child Tax Credit would grow for many households under the proposal. So would the standard deduction. There would also be temporary tax breaks for overtime pay, car-loan interest, and tips. The proposal also establishes a new tax-preferred savings account for children younger than 8 years old under which the government would contribute the first $1,000 for kids born between 2025-28.

However, critics noted that millions of families would receive no benefit from the Child Tax Credit increase, wealthy business partnerships would get an even bigger passthrough deduction than in an earlier draft of the bill, and taxes on many tips and overtime work remain.

"This bill isn't about balancing the budget—it's about tax breaks for billionaires and kickbacks to corporate donors and billionaires, while silencing public voices," said Rep. Melanie Stansbury (D-N.M.). "We see the grift and we're calling it out."

Rep. Brendan Boyle (D-Pa.), the ranking member of the House Budget Committee, noted that "Trump loves to call his budget the 'big, beautiful bill.'"

"It is—for billionaires," he added. "While Trump's billionaire donors get trillions in tax cuts, working Americans get the largest Medicaid cuts in American history."

House Ways and Means Committee Ranking Member Rep. Richard Neal (D-Mass.) warned, "I'll tell you what's coming: handouts for billionaires, healthcare cuts for the people."

The GOP agenda: rip health care away from millions of Americans to pay for massive tax breaks for the ultra-rich. This is the moment to fight back with everything we’ve got.

[image or embed]

— Elizabeth Warren (@elizabeth-warren.bsky.social) May 12, 2025 at 1:50 PM

Civil society groups also sounded the alarm over the bill.

"Families across the country are struggling now more than ever to get food on the table, visit the doctor, and afford lifesaving medication," ParentsTogether Action executive director Ailen Arreaza said Monday. "But instead of finding ways to offer some relief, Republicans in Congress are racing to pass a bill to hand massive new tax breaks to the ultra-wealthy."

"Even worse? Their plan is to pay for it by ripping healthcare and nutrition aid away from millions," Arreaza added. "One thing is clear: Gutting Medicaid and SNAP to fund tax breaks for the rich is cruelty disguised as policy—and parents across the country will take note of how their representatives vote this week as evidence of who they're fighting for, their constituents or their wealthy donors."

David Kass, executive director of Americans for Tax Fairness, said in a statement that "the House GOP has revealed in broad daylight that their tax bill is a clear scam—one that hands out massive giveaways to their billionaire and corporate donors off the backs of their constituents with a price tag of over $5 trillion."

"The plan's massive cuts to vital programs like Medicaid and SNAP will drive up healthcare and food prices for millions of workers and families, while billionaires pocket the money and the national debt soars," Kass added. "Working and middle-class families—and future generations—shouldn't have to pay higher prices simply to enrich billionaire elites and the politicians in their pocket."

House Democrats and civil society groups led condemnation of legislation introduced Monday by congressional Republicans and backed by President Donald Trump that one lawmaker said is "about tax breaks for billionaires and kickbacks to corporate donors" at the expense of working class families.

The 389-page bill includes trillions of dollars in tax cuts that would disproportionately benefit the ultra-wealthy and corporations, largely by extending Trump's first-term reductions in taxation mainly for top earners derided as the "GOP tax scam." The proposal also broadens the estate tax exemption for the superrich and makes permanent a massive tax break on offshore corporate profits, a top wish-list item for Big Business.

The proposal would reduce government revenue by trillions of dollars and swell the national debt—currently a staggering $36.2 trillion, or the equivalent of 127% of U.S. gross domestic product—and cost over $5 trillion.

The bill partially offsets the revenue loss by sharply slashing social spending, including on the Supplemental Nutrition Assistance Program (SNAP) and Medicaid. The legislation would impose work and cost-sharing requirements on many Medicaid beneficiaries and increase eligibility checks. Critics warn that millions of people would lose their health insurance coverage if the bill is passed in its current form.

Former Democratic U.S. Labor Secretary Robert Reich called the proposed legislation "trickle-down economics on steroids."

The Trump-GOP tax bill proposal: -Extend 2017 cuts for top earners -Increase the "pass-through" loophole for big businesses -Expand the estate tax exemption for the ultra-rich -Make a huge tax break for offshore corporate profits permanent Trickle down economics on steroids.

— Robert Reich (@rbreich.bsky.social) May 12, 2025 at 11:32 AM

On the positive side, the popular Child Tax Credit would grow for many households under the proposal. So would the standard deduction. There would also be temporary tax breaks for overtime pay, car-loan interest, and tips. The proposal also establishes a new tax-preferred savings account for children younger than 8 years old under which the government would contribute the first $1,000 for kids born between 2025-28.

However, critics noted that millions of families would receive no benefit from the Child Tax Credit increase, wealthy business partnerships would get an even bigger passthrough deduction than in an earlier draft of the bill, and taxes on many tips and overtime work remain.

"This bill isn't about balancing the budget—it's about tax breaks for billionaires and kickbacks to corporate donors and billionaires, while silencing public voices," said Rep. Melanie Stansbury (D-N.M.). "We see the grift and we're calling it out."

Rep. Brendan Boyle (D-Pa.), the ranking member of the House Budget Committee, noted that "Trump loves to call his budget the 'big, beautiful bill.'"

"It is—for billionaires," he added. "While Trump's billionaire donors get trillions in tax cuts, working Americans get the largest Medicaid cuts in American history."

House Ways and Means Committee Ranking Member Rep. Richard Neal (D-Mass.) warned, "I'll tell you what's coming: handouts for billionaires, healthcare cuts for the people."

The GOP agenda: rip health care away from millions of Americans to pay for massive tax breaks for the ultra-rich. This is the moment to fight back with everything we’ve got.

[image or embed]

— Elizabeth Warren (@elizabeth-warren.bsky.social) May 12, 2025 at 1:50 PM

Civil society groups also sounded the alarm over the bill.

"Families across the country are struggling now more than ever to get food on the table, visit the doctor, and afford lifesaving medication," ParentsTogether Action executive director Ailen Arreaza said Monday. "But instead of finding ways to offer some relief, Republicans in Congress are racing to pass a bill to hand massive new tax breaks to the ultra-wealthy."

"Even worse? Their plan is to pay for it by ripping healthcare and nutrition aid away from millions," Arreaza added. "One thing is clear: Gutting Medicaid and SNAP to fund tax breaks for the rich is cruelty disguised as policy—and parents across the country will take note of how their representatives vote this week as evidence of who they're fighting for, their constituents or their wealthy donors."

David Kass, executive director of Americans for Tax Fairness, said in a statement that "the House GOP has revealed in broad daylight that their tax bill is a clear scam—one that hands out massive giveaways to their billionaire and corporate donors off the backs of their constituents with a price tag of over $5 trillion."

"The plan's massive cuts to vital programs like Medicaid and SNAP will drive up healthcare and food prices for millions of workers and families, while billionaires pocket the money and the national debt soars," Kass added. "Working and middle-class families—and future generations—shouldn't have to pay higher prices simply to enrich billionaire elites and the politicians in their pocket."