SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

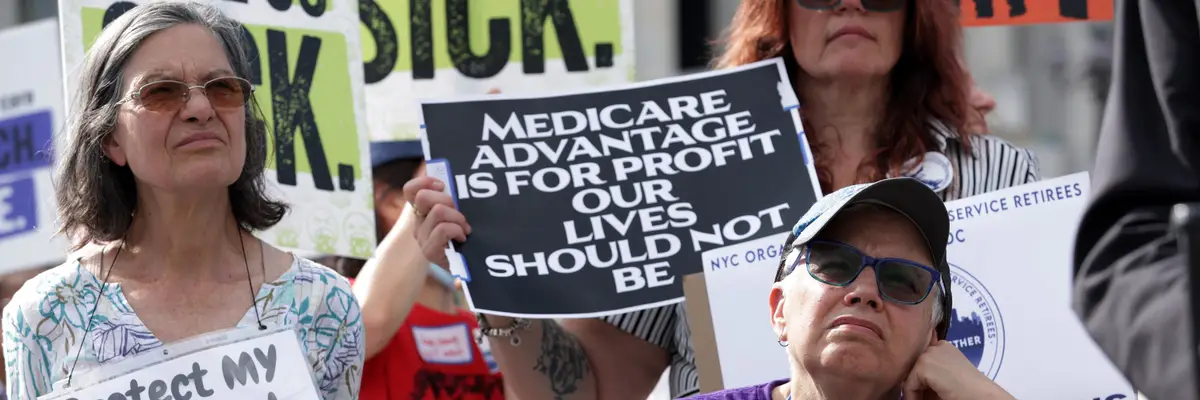

Advocates hold signs during a news conference on Medicare Advantage plans in front of the U.S. Capitol on July 25, 2023 in Washington, DC.

"These private insurer-run plans are more expensive AND lead to worse outcomes for patients," said Rep. Pramila Jayapal. "It’s time to rein in Medicare DisAdvantage and protect traditional Medicare."

A report released earlier this month to little fanfare estimated that federal overpayments to privately run Medicare Advantage plans could total $76 billion this year—or potentially a staggering $1.2 trillion over the next decade if current trends persist.

The Medicare Payment Advisory Commission (MedPAC), an independent congressional agency that advises lawmakers on Medicare, calculates overpayments by comparing spending on Medicare Advantage (MA) plans to what the federal government would have spent if MA enrollees were on traditional fee-for-service Medicare.

In a report published earlier this month, MedPAC showed that overpayments to MA plans this year are projected to be around $76 billion. Roughly $22 billion of that total is due to coding practices by MA providers, which are notorious for making patients appear sicker than they are to receive larger payments from the federal government. MA plans are paid lump sums to cover expected future healthcare services for patients based on their risk scores.

Another factor driving overpayments to MA plans—which now cover 55% of eligible Medicare beneficiaries—is a phenomenon known as favorable selection. MA enrollees tend to be healthier on average than recipients of traditional Medicare, resulting in higher payments to Medicare Advantage plans than are necessary based on patients' healthcare needs.

According to MedPAC, favorable selection will account for $57 billion of the expected overpayments to MA plans this year. The Trump administration gave Medicare Advantage plans a more than $25 billion boost in federal payments for 2026, even amid mounting bipartisan concerns about fraud in the program.

The National Committee to Preserve Social Security and Medicare (NCPSSM) said the MedPAC analysis "confirms that these private plans are bleeding taxpayers for billions of dollars more than traditional Medicare would cost for comparable enrollees."

US Rep. Pramila Jayapal (D-Wash.) wrote in response to the MedPAC findings that "Medicare DisAdvantage will rip off American taxpayers to the tune of $76 billion in 2026."

"These private insurer-run plans are more expensive AND lead to worse outcomes for patients," Jayapal, a leading supporter of Medicare for All legislation in the House, wrote in a social media post. "It’s time to rein in Medicare DisAdvantage and protect traditional Medicare."

The MedPAC analysis was released days after Republicans on the Senate Judiciary Committee published a report revealing how UnitedHealth Group, the largest provider of MA plans in the US, "has turned risk adjustment into a major profit-centered strategy," reaping massive payments from the federal government through upcoding.

NCPSSM noted that "while UnitedHealth... has emerged as the worst offender, it’s abundantly clear that many MA insurers are engaged in these shady practices."

"Look no further than insurers’ reliance on prior authorizations for procedures and treatments that normally would be automatically covered in traditional Medicare," the group said. "This includes denying skilled nursing care that jeopardizes older patients who have nowhere else to turn."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

A report released earlier this month to little fanfare estimated that federal overpayments to privately run Medicare Advantage plans could total $76 billion this year—or potentially a staggering $1.2 trillion over the next decade if current trends persist.

The Medicare Payment Advisory Commission (MedPAC), an independent congressional agency that advises lawmakers on Medicare, calculates overpayments by comparing spending on Medicare Advantage (MA) plans to what the federal government would have spent if MA enrollees were on traditional fee-for-service Medicare.

In a report published earlier this month, MedPAC showed that overpayments to MA plans this year are projected to be around $76 billion. Roughly $22 billion of that total is due to coding practices by MA providers, which are notorious for making patients appear sicker than they are to receive larger payments from the federal government. MA plans are paid lump sums to cover expected future healthcare services for patients based on their risk scores.

Another factor driving overpayments to MA plans—which now cover 55% of eligible Medicare beneficiaries—is a phenomenon known as favorable selection. MA enrollees tend to be healthier on average than recipients of traditional Medicare, resulting in higher payments to Medicare Advantage plans than are necessary based on patients' healthcare needs.

According to MedPAC, favorable selection will account for $57 billion of the expected overpayments to MA plans this year. The Trump administration gave Medicare Advantage plans a more than $25 billion boost in federal payments for 2026, even amid mounting bipartisan concerns about fraud in the program.

The National Committee to Preserve Social Security and Medicare (NCPSSM) said the MedPAC analysis "confirms that these private plans are bleeding taxpayers for billions of dollars more than traditional Medicare would cost for comparable enrollees."

US Rep. Pramila Jayapal (D-Wash.) wrote in response to the MedPAC findings that "Medicare DisAdvantage will rip off American taxpayers to the tune of $76 billion in 2026."

"These private insurer-run plans are more expensive AND lead to worse outcomes for patients," Jayapal, a leading supporter of Medicare for All legislation in the House, wrote in a social media post. "It’s time to rein in Medicare DisAdvantage and protect traditional Medicare."

The MedPAC analysis was released days after Republicans on the Senate Judiciary Committee published a report revealing how UnitedHealth Group, the largest provider of MA plans in the US, "has turned risk adjustment into a major profit-centered strategy," reaping massive payments from the federal government through upcoding.

NCPSSM noted that "while UnitedHealth... has emerged as the worst offender, it’s abundantly clear that many MA insurers are engaged in these shady practices."

"Look no further than insurers’ reliance on prior authorizations for procedures and treatments that normally would be automatically covered in traditional Medicare," the group said. "This includes denying skilled nursing care that jeopardizes older patients who have nowhere else to turn."

A report released earlier this month to little fanfare estimated that federal overpayments to privately run Medicare Advantage plans could total $76 billion this year—or potentially a staggering $1.2 trillion over the next decade if current trends persist.

The Medicare Payment Advisory Commission (MedPAC), an independent congressional agency that advises lawmakers on Medicare, calculates overpayments by comparing spending on Medicare Advantage (MA) plans to what the federal government would have spent if MA enrollees were on traditional fee-for-service Medicare.

In a report published earlier this month, MedPAC showed that overpayments to MA plans this year are projected to be around $76 billion. Roughly $22 billion of that total is due to coding practices by MA providers, which are notorious for making patients appear sicker than they are to receive larger payments from the federal government. MA plans are paid lump sums to cover expected future healthcare services for patients based on their risk scores.

Another factor driving overpayments to MA plans—which now cover 55% of eligible Medicare beneficiaries—is a phenomenon known as favorable selection. MA enrollees tend to be healthier on average than recipients of traditional Medicare, resulting in higher payments to Medicare Advantage plans than are necessary based on patients' healthcare needs.

According to MedPAC, favorable selection will account for $57 billion of the expected overpayments to MA plans this year. The Trump administration gave Medicare Advantage plans a more than $25 billion boost in federal payments for 2026, even amid mounting bipartisan concerns about fraud in the program.

The National Committee to Preserve Social Security and Medicare (NCPSSM) said the MedPAC analysis "confirms that these private plans are bleeding taxpayers for billions of dollars more than traditional Medicare would cost for comparable enrollees."

US Rep. Pramila Jayapal (D-Wash.) wrote in response to the MedPAC findings that "Medicare DisAdvantage will rip off American taxpayers to the tune of $76 billion in 2026."

"These private insurer-run plans are more expensive AND lead to worse outcomes for patients," Jayapal, a leading supporter of Medicare for All legislation in the House, wrote in a social media post. "It’s time to rein in Medicare DisAdvantage and protect traditional Medicare."

The MedPAC analysis was released days after Republicans on the Senate Judiciary Committee published a report revealing how UnitedHealth Group, the largest provider of MA plans in the US, "has turned risk adjustment into a major profit-centered strategy," reaping massive payments from the federal government through upcoding.

NCPSSM noted that "while UnitedHealth... has emerged as the worst offender, it’s abundantly clear that many MA insurers are engaged in these shady practices."

"Look no further than insurers’ reliance on prior authorizations for procedures and treatments that normally would be automatically covered in traditional Medicare," the group said. "This includes denying skilled nursing care that jeopardizes older patients who have nowhere else to turn."