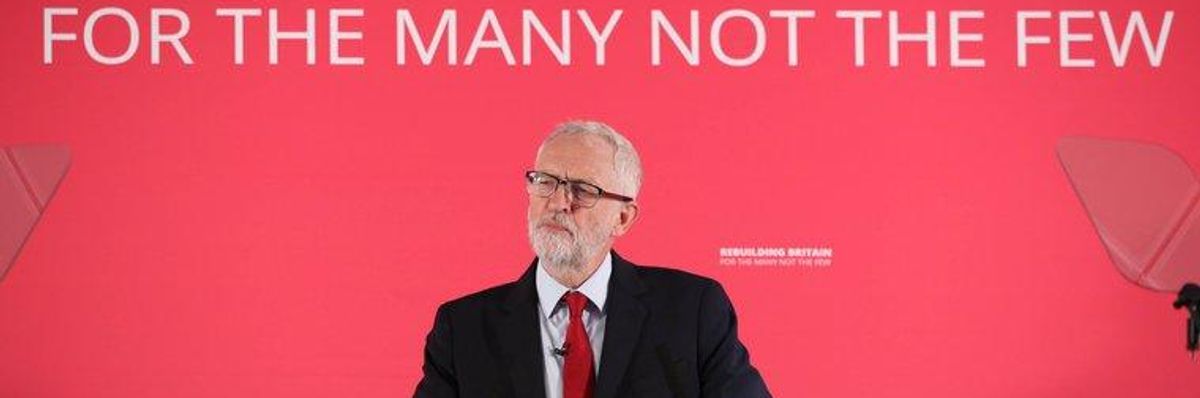

Labour leader Jeremy Corbyn making a keynote speech at The Landing in MediaCityUK in Salford on 2 September. (Photo: Danny Lawson/PA Wire/PA Images)

The Financial Times Is Right--Labour's Ownership Funds Will Transfer Wealth and Power

Democratising the corporation and empowering workers is an essential part of moving beyond neoliberalism.

The corporation is an extraordinary social institution. Endowed with a set of expansive legal privileges that enable it to structure external capital investment, produce profits and accumulate wealth, its productive capacity has created the world we live in. Yet in its current form the modern corporation is profoundly undemocratic, and acts as a driving force for inequality in the heart of our economy. Both the uneven wealth of society and the depth of crises confronting us are consequently inseparable from the corporation.

Any attempt to overcome the democratic neutering, economic inequality, and accelerating forms of planetary breakdown endemic to capitalism must therefore have a strategy for transforming the corporation.

Any attempt to overcome the democratic neutering, economic inequality, and accelerating forms of planetary breakdown endemic to capitalism must therefore have a strategy for transforming the corporation. It is in this light that the importance of Labour's Inclusive Ownership Fund - which a recent Financial Times analysis suggested would redistribute corporate wealth and spread share capital to workers worth up to PS300bn over a decade - becomes clear. It is a part of a wider progressive policy agenda for transforming and democratising the corporation and therefore reshaping wealth and power in society.

Reimagining how the corporation operates requires us to go beyond the policy tools of a regulatory or redistributive state into rearranging the distribution and nature of property, governance and control rights that shape its behaviour. This is because how the corporation is owned and governed fundamentally affects how it operates and in whose interest. Today, a combination of shareholder primacy in the governance of the company, the intermediation of corporate ownership by rentier-like financial institutions, and the deep financialisation of the corporation has turned many companies into engines of wealth extraction, detached from their original purpose.

Yet in an economy marked by low levels of investment, a decade of sluggish real wage growth, and a prolonged productivity crisis, we urgently need companies that are purposeful, democratic, and inclusive by design. Shifting to more generative forms of enterprise will require a deep institutional turn in the ownership and control of companies.

The Inclusive Ownership Fund is an attempt to reshape the corporation toward those ends. The policy would require large companies to issue 1% of outstanding equity annually into a locked fund, democratically controlled by the workforce, which would grant dividend and voting rights equal to the Fund's equity share. By diluting stock, rather than expropriating existing shareholders, it would not adversely impact the working capital of the company but would broaden income and control rights within it, ensuring everyone within it had a genuine stake and a say. There are important debates over design but its direction is clear.

Instead of the governance of the firm being dominated by external investors and their managerial agents, many of whom hold important ownership stakes in their own right, the Funds would help ensure labour had a powerful voice in shaping strategic decision-making. Alongside wider corporate governance reforms and the strengthening of organised labour, it would democratise the governance of the firm. Through broadening ownership via new collective forms of property, the Funds could act as a powerful mechanism towards the redistribution of resources and power within companies and wider society. By removing a growing proportion of corporate ownership from financial intermediation - and the short-termism and poor decision-making that often occurs as a result - the ownership funds could act as a powerful steward for the sustainable creation of value, helping foster a more prosperous and inventive economy. In short, the funds could help enable a more generative and committed company form to emerge.

Reimagining patterns of income and control within the firm may appear radical. Yet the privileges ascribed to the corporation and the powerful governance and income rights assigned to shareholders - in contrast to labour - are socially assigned and politically mediated. As Katrina Pistor demonstrates in her brilliant new book, the law produces new forms of capital through the encoding power of legal instruments. How capital is produced, and for whom, is malleable and a site for political struggle. We have before and must again remake the governance of the firm and how it distributes its surplus. At the same time, it is also worth noting the existing scale of share issuance to senior management through remuneration in shares and share options. In many ways this process mimics the mechanisms of Inclusive Ownership Funds, but in ways that deepen inequality and narrow power.

Strategies for democratising ownership - not just through ownership funds but through an array of interventions to thicken out and scale up a richer ecology of company forms that are democratic and inclusive by design and that radically broaden capital ownership in society - is also a critical step in moving beyond neoliberalism. Neoliberalism is many things: a mode of governance and rationality, an often-contradictory strategy for regulating capitalism, a reshaping of the state to enforce market-based forms of measurement and evaluation into ever-more domains of life, and an ideology and class project that has extracted wealth and power upwards. Yet at its core, in every form, it is a conscious strategy to insulate the economic from the political, to zone off the economy from democratic intervention.

As Quinn Slobodian demonstrates in Globalists, his superb history of the end of empire and the birth of neoliberalism, the neoliberal project was and is a constructive project, based on creating rules, institutions, and law to protect property from the demos, maintaining and amplifying existing hierarchies of wealth and power that flow from the nature and unequal distribution of capital. By insisting on the plasticity of the corporation as a social institution, its political ordering, and hence its capacity for change, interventions to reshape the nature and distribution of property in the economy can reassert our ability and need to consciously design economic life in ways that provide the conditions for universal flourishing. After all, if capitalism is in part a set of exploitation rights related to an asset - from the landlords right to extract rent to the right of shareholders to control a company's surplus - then a post-capitalist political economy will be anchored in new arrangements of ownership and control that deepen and extend social and economic freedom and prioritise generative forms of enterprise.

Accelerating environmental breakdown and the crisis of democratic capitalism makes transformative action the safest course. Twice before in living memory we have transformed how and for whom we organise our economy on a dimension and pace the moment now demands. Critically, both times it was radical changes in property and ownership that were fundamental to change, from the extension of public ownership that underpinned the post-war consensus, to the mass privatisation that was the tip of the spear of neoliberalism's counter-assault. Any transformation of our economy in the decades ahead, albeit in radically different directions to the past - toward the deepening of democracy in all spheres of life - will depend on similarly deep shifts in ownership.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The corporation is an extraordinary social institution. Endowed with a set of expansive legal privileges that enable it to structure external capital investment, produce profits and accumulate wealth, its productive capacity has created the world we live in. Yet in its current form the modern corporation is profoundly undemocratic, and acts as a driving force for inequality in the heart of our economy. Both the uneven wealth of society and the depth of crises confronting us are consequently inseparable from the corporation.

Any attempt to overcome the democratic neutering, economic inequality, and accelerating forms of planetary breakdown endemic to capitalism must therefore have a strategy for transforming the corporation.

Any attempt to overcome the democratic neutering, economic inequality, and accelerating forms of planetary breakdown endemic to capitalism must therefore have a strategy for transforming the corporation. It is in this light that the importance of Labour's Inclusive Ownership Fund - which a recent Financial Times analysis suggested would redistribute corporate wealth and spread share capital to workers worth up to PS300bn over a decade - becomes clear. It is a part of a wider progressive policy agenda for transforming and democratising the corporation and therefore reshaping wealth and power in society.

Reimagining how the corporation operates requires us to go beyond the policy tools of a regulatory or redistributive state into rearranging the distribution and nature of property, governance and control rights that shape its behaviour. This is because how the corporation is owned and governed fundamentally affects how it operates and in whose interest. Today, a combination of shareholder primacy in the governance of the company, the intermediation of corporate ownership by rentier-like financial institutions, and the deep financialisation of the corporation has turned many companies into engines of wealth extraction, detached from their original purpose.

Yet in an economy marked by low levels of investment, a decade of sluggish real wage growth, and a prolonged productivity crisis, we urgently need companies that are purposeful, democratic, and inclusive by design. Shifting to more generative forms of enterprise will require a deep institutional turn in the ownership and control of companies.

The Inclusive Ownership Fund is an attempt to reshape the corporation toward those ends. The policy would require large companies to issue 1% of outstanding equity annually into a locked fund, democratically controlled by the workforce, which would grant dividend and voting rights equal to the Fund's equity share. By diluting stock, rather than expropriating existing shareholders, it would not adversely impact the working capital of the company but would broaden income and control rights within it, ensuring everyone within it had a genuine stake and a say. There are important debates over design but its direction is clear.

Instead of the governance of the firm being dominated by external investors and their managerial agents, many of whom hold important ownership stakes in their own right, the Funds would help ensure labour had a powerful voice in shaping strategic decision-making. Alongside wider corporate governance reforms and the strengthening of organised labour, it would democratise the governance of the firm. Through broadening ownership via new collective forms of property, the Funds could act as a powerful mechanism towards the redistribution of resources and power within companies and wider society. By removing a growing proportion of corporate ownership from financial intermediation - and the short-termism and poor decision-making that often occurs as a result - the ownership funds could act as a powerful steward for the sustainable creation of value, helping foster a more prosperous and inventive economy. In short, the funds could help enable a more generative and committed company form to emerge.

Reimagining patterns of income and control within the firm may appear radical. Yet the privileges ascribed to the corporation and the powerful governance and income rights assigned to shareholders - in contrast to labour - are socially assigned and politically mediated. As Katrina Pistor demonstrates in her brilliant new book, the law produces new forms of capital through the encoding power of legal instruments. How capital is produced, and for whom, is malleable and a site for political struggle. We have before and must again remake the governance of the firm and how it distributes its surplus. At the same time, it is also worth noting the existing scale of share issuance to senior management through remuneration in shares and share options. In many ways this process mimics the mechanisms of Inclusive Ownership Funds, but in ways that deepen inequality and narrow power.

Strategies for democratising ownership - not just through ownership funds but through an array of interventions to thicken out and scale up a richer ecology of company forms that are democratic and inclusive by design and that radically broaden capital ownership in society - is also a critical step in moving beyond neoliberalism. Neoliberalism is many things: a mode of governance and rationality, an often-contradictory strategy for regulating capitalism, a reshaping of the state to enforce market-based forms of measurement and evaluation into ever-more domains of life, and an ideology and class project that has extracted wealth and power upwards. Yet at its core, in every form, it is a conscious strategy to insulate the economic from the political, to zone off the economy from democratic intervention.

As Quinn Slobodian demonstrates in Globalists, his superb history of the end of empire and the birth of neoliberalism, the neoliberal project was and is a constructive project, based on creating rules, institutions, and law to protect property from the demos, maintaining and amplifying existing hierarchies of wealth and power that flow from the nature and unequal distribution of capital. By insisting on the plasticity of the corporation as a social institution, its political ordering, and hence its capacity for change, interventions to reshape the nature and distribution of property in the economy can reassert our ability and need to consciously design economic life in ways that provide the conditions for universal flourishing. After all, if capitalism is in part a set of exploitation rights related to an asset - from the landlords right to extract rent to the right of shareholders to control a company's surplus - then a post-capitalist political economy will be anchored in new arrangements of ownership and control that deepen and extend social and economic freedom and prioritise generative forms of enterprise.

Accelerating environmental breakdown and the crisis of democratic capitalism makes transformative action the safest course. Twice before in living memory we have transformed how and for whom we organise our economy on a dimension and pace the moment now demands. Critically, both times it was radical changes in property and ownership that were fundamental to change, from the extension of public ownership that underpinned the post-war consensus, to the mass privatisation that was the tip of the spear of neoliberalism's counter-assault. Any transformation of our economy in the decades ahead, albeit in radically different directions to the past - toward the deepening of democracy in all spheres of life - will depend on similarly deep shifts in ownership.

The corporation is an extraordinary social institution. Endowed with a set of expansive legal privileges that enable it to structure external capital investment, produce profits and accumulate wealth, its productive capacity has created the world we live in. Yet in its current form the modern corporation is profoundly undemocratic, and acts as a driving force for inequality in the heart of our economy. Both the uneven wealth of society and the depth of crises confronting us are consequently inseparable from the corporation.

Any attempt to overcome the democratic neutering, economic inequality, and accelerating forms of planetary breakdown endemic to capitalism must therefore have a strategy for transforming the corporation.

Any attempt to overcome the democratic neutering, economic inequality, and accelerating forms of planetary breakdown endemic to capitalism must therefore have a strategy for transforming the corporation. It is in this light that the importance of Labour's Inclusive Ownership Fund - which a recent Financial Times analysis suggested would redistribute corporate wealth and spread share capital to workers worth up to PS300bn over a decade - becomes clear. It is a part of a wider progressive policy agenda for transforming and democratising the corporation and therefore reshaping wealth and power in society.

Reimagining how the corporation operates requires us to go beyond the policy tools of a regulatory or redistributive state into rearranging the distribution and nature of property, governance and control rights that shape its behaviour. This is because how the corporation is owned and governed fundamentally affects how it operates and in whose interest. Today, a combination of shareholder primacy in the governance of the company, the intermediation of corporate ownership by rentier-like financial institutions, and the deep financialisation of the corporation has turned many companies into engines of wealth extraction, detached from their original purpose.

Yet in an economy marked by low levels of investment, a decade of sluggish real wage growth, and a prolonged productivity crisis, we urgently need companies that are purposeful, democratic, and inclusive by design. Shifting to more generative forms of enterprise will require a deep institutional turn in the ownership and control of companies.

The Inclusive Ownership Fund is an attempt to reshape the corporation toward those ends. The policy would require large companies to issue 1% of outstanding equity annually into a locked fund, democratically controlled by the workforce, which would grant dividend and voting rights equal to the Fund's equity share. By diluting stock, rather than expropriating existing shareholders, it would not adversely impact the working capital of the company but would broaden income and control rights within it, ensuring everyone within it had a genuine stake and a say. There are important debates over design but its direction is clear.

Instead of the governance of the firm being dominated by external investors and their managerial agents, many of whom hold important ownership stakes in their own right, the Funds would help ensure labour had a powerful voice in shaping strategic decision-making. Alongside wider corporate governance reforms and the strengthening of organised labour, it would democratise the governance of the firm. Through broadening ownership via new collective forms of property, the Funds could act as a powerful mechanism towards the redistribution of resources and power within companies and wider society. By removing a growing proportion of corporate ownership from financial intermediation - and the short-termism and poor decision-making that often occurs as a result - the ownership funds could act as a powerful steward for the sustainable creation of value, helping foster a more prosperous and inventive economy. In short, the funds could help enable a more generative and committed company form to emerge.

Reimagining patterns of income and control within the firm may appear radical. Yet the privileges ascribed to the corporation and the powerful governance and income rights assigned to shareholders - in contrast to labour - are socially assigned and politically mediated. As Katrina Pistor demonstrates in her brilliant new book, the law produces new forms of capital through the encoding power of legal instruments. How capital is produced, and for whom, is malleable and a site for political struggle. We have before and must again remake the governance of the firm and how it distributes its surplus. At the same time, it is also worth noting the existing scale of share issuance to senior management through remuneration in shares and share options. In many ways this process mimics the mechanisms of Inclusive Ownership Funds, but in ways that deepen inequality and narrow power.

Strategies for democratising ownership - not just through ownership funds but through an array of interventions to thicken out and scale up a richer ecology of company forms that are democratic and inclusive by design and that radically broaden capital ownership in society - is also a critical step in moving beyond neoliberalism. Neoliberalism is many things: a mode of governance and rationality, an often-contradictory strategy for regulating capitalism, a reshaping of the state to enforce market-based forms of measurement and evaluation into ever-more domains of life, and an ideology and class project that has extracted wealth and power upwards. Yet at its core, in every form, it is a conscious strategy to insulate the economic from the political, to zone off the economy from democratic intervention.

As Quinn Slobodian demonstrates in Globalists, his superb history of the end of empire and the birth of neoliberalism, the neoliberal project was and is a constructive project, based on creating rules, institutions, and law to protect property from the demos, maintaining and amplifying existing hierarchies of wealth and power that flow from the nature and unequal distribution of capital. By insisting on the plasticity of the corporation as a social institution, its political ordering, and hence its capacity for change, interventions to reshape the nature and distribution of property in the economy can reassert our ability and need to consciously design economic life in ways that provide the conditions for universal flourishing. After all, if capitalism is in part a set of exploitation rights related to an asset - from the landlords right to extract rent to the right of shareholders to control a company's surplus - then a post-capitalist political economy will be anchored in new arrangements of ownership and control that deepen and extend social and economic freedom and prioritise generative forms of enterprise.

Accelerating environmental breakdown and the crisis of democratic capitalism makes transformative action the safest course. Twice before in living memory we have transformed how and for whom we organise our economy on a dimension and pace the moment now demands. Critically, both times it was radical changes in property and ownership that were fundamental to change, from the extension of public ownership that underpinned the post-war consensus, to the mass privatisation that was the tip of the spear of neoliberalism's counter-assault. Any transformation of our economy in the decades ahead, albeit in radically different directions to the past - toward the deepening of democracy in all spheres of life - will depend on similarly deep shifts in ownership.