These wealthy need only hold on to their appreciated assets until death. What if they need cash before then? They merely borrow against the appreciated assets, typically at very low interest rates.

Are rich Americans, including billionaires, truly unable to pay tax on their investment gains before they sell the assets yielding those gains? Wanna buy a bridge?

The second avoidance strategy, buy-hold for decades-sell, lets wealthy investors pay a super low effective annual tax rate on investments that appreciate at high rates over long periods of time. These investors typically experience decades of compounding gains without taxation.

The effective tax rates involved in this second strategy won’t reach buy-borrow-die’s zero tax, but may in some cases get as low as a 4% effective annual rate. A 4% effective annual tax rate would have an investment with a pre-tax growth rate of 20% per year enjoying an after-tax growth rate of 19.2% per year.

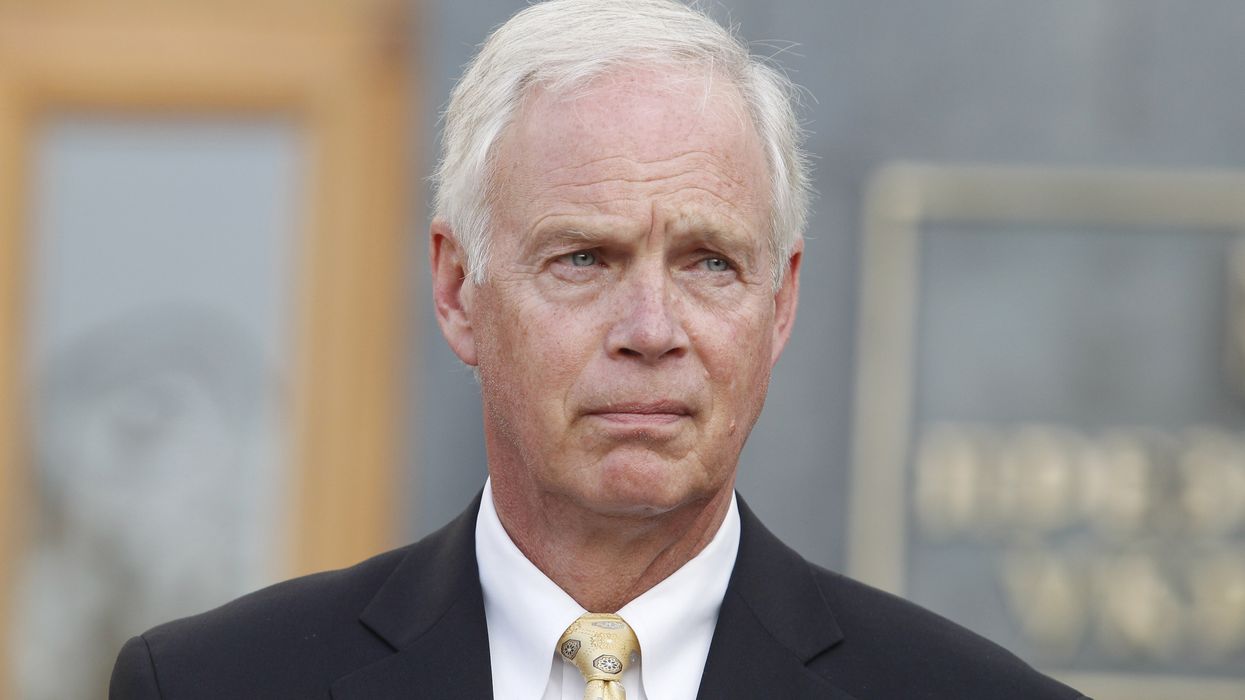

Congressional apologists for the ultra-rich on both sides of the aisle regularly claim that their wealthy patrons should be entitled to endless tax-free compounding of investment gains. Without this tax-free compounding, the argument goes, our richest wouldn’t have the “wherewithal to pay” tax on their investment gains before their assets get sold. U.S. Sen. Ron Johnson (R-Wis.) invoked this tired canard at a recent Senate Finance Committee hearing.

Funny how these same apologists for our richest don’t have much sympathy for ordinary Americans who lack the “wherewithal” to pay for medical care, adequate housing, and other necessities. Average wage earners, under current law, can’t even wait until year-end to pay Uncle Sam their taxes. Those taxes come out of each paycheck, wherewithal to pay or not.

Are rich Americans, including billionaires, truly unable to pay tax on their investment gains before they sell the assets yielding those gains? Wanna buy a bridge?

Let’s start with the easiest case: a publicly traded investment that can be sold in smaller units, an investment in stocks, for instance. Say Rich, a wealthy investor, buys 1 million shares of Nvidia at $100 per share, and those shares, by year’s end, increase in value to $120 per share.

Our investor Rich now has a $20 million gain. If that annual gain faced a 25% tax rate, Rich would have a $5 million tax liability. To raise the cash to pay that tax, Rich could sell off 41,667 of his shares, leaving him with 958,333 shares, now worth just under $115 million.

That doesn’t seem very painful.

Now, let’s say Rich didn’t want to sell any shares. He could instead just borrow $5 million against the shares to pay the tax.

Or what if Rich had bought a parcel of land instead of Nvidia shares and, for whatever reason, having him borrow to pay tax on his annual investment gains didn’t turn out to be feasible?

Still no problem for Rich. For gains on illiquid assets, Rich could defer the payment of tax until he sold the assets, but the tax could be computed as if it accrued annually. How might this work? Say, for example, that Rich’s $100 million parcel of land grew at an annual rate of 10% for 20 years, at which point he sold it at its appreciated value of $672,749,995.

Had Rich paid tax at 25% on his gain each year, his rate of return would have been 7.5% per year, and after 20 years his investment would be worth $424,785,110.

The $247,964,885 difference between his sale price and the value of his investment with its actual rate of return reduced by the tax paid would be his tax liability upon sale. Payment of that amount would leave Rich with the same sum, $424,785,110, had he been able to sell a small share of his parcel each year, to pay the tax on his investment gain.

Put another way, Rich would be left with the same amount using this tax computation as he would if he sold his parcel each year, paid tax on the gain, and reinvested the remaining proceeds in another parcel.

And if Rich died before selling his parcel? His income tax could be determined for the year of his death in the same fashion as if he’d sold the parcel for its fair market value at the time of his death. Or, in the alternative, his inheritors could step into his shoes and pay the same tax when they sold the parcel as Rich would have had he survived and sold it at that time.

The bottom line: If we closed the tax-free compounding of investment gains loophole, some situations might exist where the immediate payment of tax on investment gains could pose a problem. But we can address those situations by deferring payment of the tax until investments get sold and accounting for the tax-free compounding in the determination of the tax.

These problematic situations, in other words, don’t justify leaving a gaping loophole in place.

So the obstacle to shutting down buy-borrow-die and buy-hold for decades-sell has absolutely nothing to do with ultra-rich investors lacking the wherewithal to pay taxes. That obstacle remains the politicians in Washington, D.C. who lack the wherewithal to summon the courage to make our rich pay the taxes they owe our nation.