Oil refinery, owned by Exxon Mobil, is the second largest in the country on 28th February 2020 in Baton Rouge, Louisiana, United States.

US Tax Payers Are Funding the Industry That Is Destroying Our Earth

Aggressive Big Oil lobbying has secured enormous government giveaways so extensive that the largest US oil and gas companies now pay more in taxes to foreign governments than to the US Treasury.

For more than a century, Big Oil lobbying has tyrannized American climate and tax policy, driving climate catastrophe while deepening economic inequality. Lavish tax breaks and subsidies for fossil fuel companies help explain why corporate giants like Chevron enjoy single-digit tax rates—lower than what many nurses or firefighters pay. After fossil fuel lobbyists flooded COP30 in unprecedented numbers, outnumbering nearly every other country’s delegation and stalling calls for a rapid fossil fuel phaseout, it’s more transparent than ever how the fossil fuel industry maintains its grip on global climate policy.

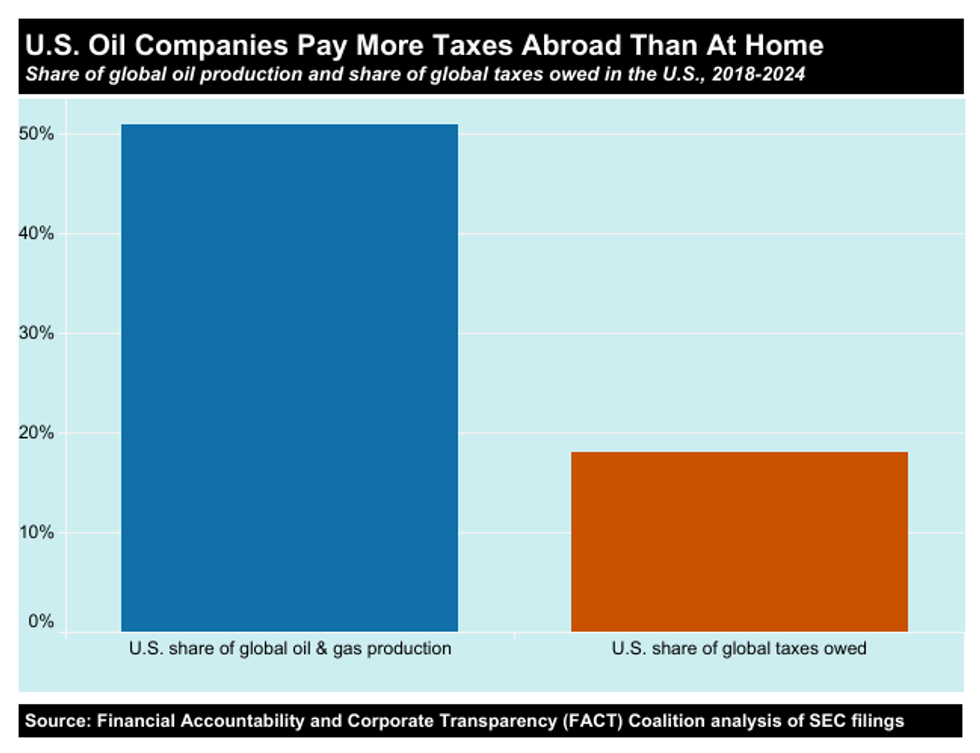

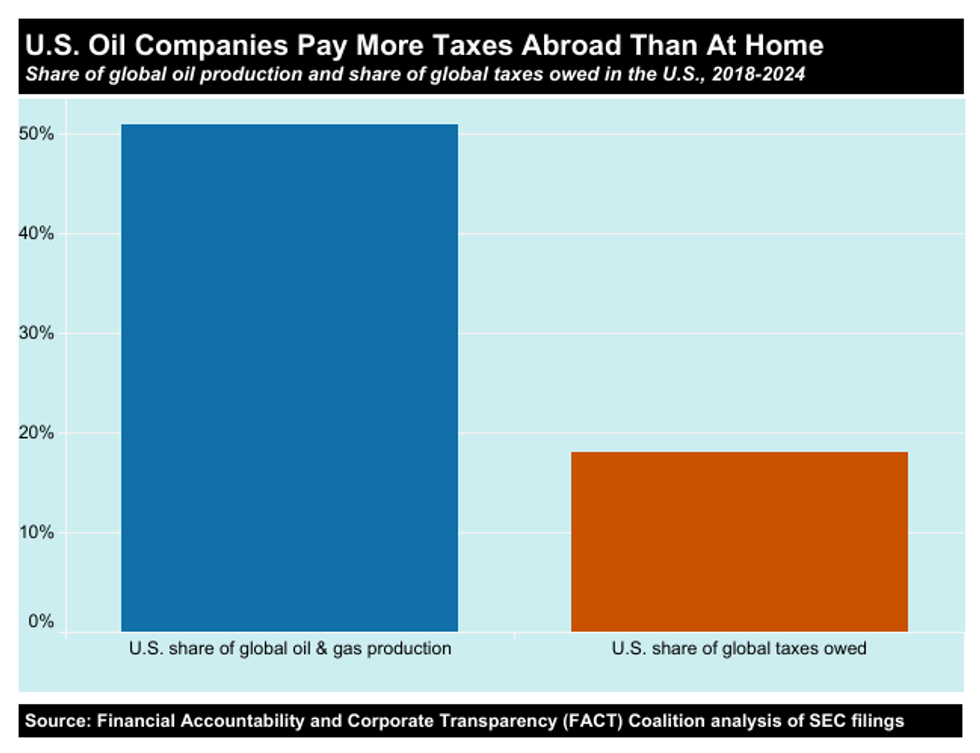

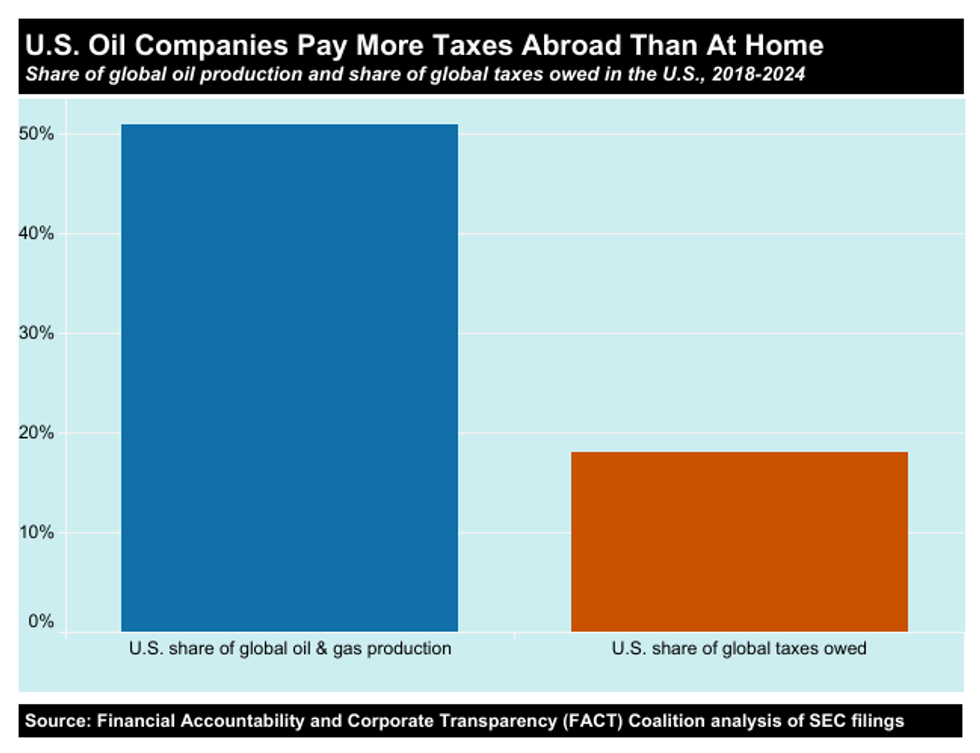

In the US, aggressive Big Oil lobbying has secured enormous government giveaways so extensive that the largest US oil and gas companies now pay more in taxes to foreign governments than to the US Treasury, finds a recent report by the FACT Coalition.

The report analyzed the financial disclosures of 11 US oil and gas companies with extensive overseas operations and concluded that decades of heavy industry lobbying has engineered a US tax code that pays for a dying fossil fuel industry, specifically for new oil and gas development abroad.

At the report’s launch in DC earlier this fall, Sen. Sheldon Whitehouse (D-RI) explained how US taxpayers are effectively forced to subsidize fossil fuel production through a tax code highly favorable to Big Oil. The report’s researchers explained that under the Global Intangible Low-Taxed Income (GILTI) regime, multinational companies that shift operations offshore already receive a 50% income tax deduction. But Big Oil lobbying has successfully created special exemptions allowing the largest fossil fuel companies to bypass all US tax on foreign oil and gas extraction income.

US taxpayers not only subsidize the fossil-fuel industry by nearly $35 billion every year, they also shoulder more than $100 billion annually in climate-related costs.

As a result, despite producing more oil and gas domestically than in all other countries combined, American multinational oil and gas companies collectively pay more in taxes to foreign governments than to the US. While domestic operations account for more than 57% of total upstream production among the companies studied in the report, they generate less than a quarter of total taxes due.

Before Trump’s 2017 tax law, corporate income earned abroad from refining, transporting, and selling oil was taxed immediately at the full US rate. But Trump’s Big Oil tax breaks shifted this income into GILTI. Although the 2022 Inflation Reduction Act (IRA) tried to curtail government subsidies to fossil fuels, the 2025 “One Big Beautiful Bill” expanded 2017-level tax giveaways, including more direct incentives for foreign drilling. To secure the sweeping benefits contained in the 2025 tax law, the industry’s largest players spent nearly $20 million lobbying Congress in the six months preceding the bill’s passage.

The bill adds $30.8 billion per year in existing subsidies for the fossil fuel industry, restores federal royalty rates to their pre-IRA levels of 12.5-16.7%, and introduces a new carve out allowing oil and gas companies to deduct intangible drilling costs (IDCs)—which represent 60-80% of total well expenses—from income subject to the Corporate Alternative Minimum Tax (CAMT) (a 15% minimum tax on corporations earning more than $1 billion in book profits). The president of the American Petroleum Institute (API), said that Trump’s 2025 tax reform “includes almost all of our priorities.”

Allowing the wishes of Big Oil to take precedent over the well-being of people and the planet is dooming our shared ecosystem. Today, US taxpayers not only subsidize the fossil-fuel industry by nearly $35 billion every year, they also shoulder more than $100 billion annually in climate-related costs. A Brookings study estimates that climate change now costs the average US household $220 to $570 per year.

Our government continues to prop up oil and gas companies over people and the planet, and is fueling climate disaster at home and abroad.

Meanwhile, the companies driving these damages continue to profit. Chevron and ExxonMobil rank among the world’s five highest-emitting corporations, and a 2025 Nature study estimates that each is responsible for nearly $2 trillion in climate damages. The report notes that federal handouts to US fossil fuel companies operating overseas are especially damaging. They erode the US tax base, accelerate the climate crisis, undermine American energy independence, and fail to generate well-paying domestic jobs.

Working-class people are paying for the continued life support of an already dying industry that’s fueling the climate crisis. Erich Pica, president of Friends of the Earth, noted during the report launch that without federal subsidies, 60% of US oil and gas production would be economically unviable. This sentiment has been well known by economic and political advisers across the political spectrum for decades. For instance, the report quotes Kevin Hassett, a current Trump top economic adviser, who said in a 2006 article that, “ending subsidies for fossil fuel production would level the playing field among energy sources and shift us from a policy of promoting fossil fuel supply to encouraging a reduction in fossil fuel consumption.” The entrenched government support incentivizing our current extractive economy starves the renewable energy sector of crucial federal investment necessary to curb polluting emissions. And eliminating these tax breaks would save US taxpayers more than $75 billion over the next decade.

The FACT Coalition recommends several essential reforms to counter traditional pro-oil tax policies. Eliminating domestic fossil fuel tax preferences and subsidies that fund oil and gas production abroad, ensuring that multinational corporations cannot shift production overseas to scapegoat domestic tax rates, and strengthening corporate tax transparency policy to include how much companies pay in taxes country-by-country.

“Tax fairness is climate justice,” Whitehouse concluded his remarks at the report launch.

Corporate and political greed deepens multigenerational economic vulnerability by eroding safety nets like the Supplemental Nutrition Assistance Program and Medicaid, while financially and politically killing the potential of a thriving renewable energy sector that could create stable, well-paying jobs to replace those declining under Big Oil. Our government continues to prop up oil and gas companies over people and the planet, and is fueling climate disaster at home and abroad. We must refuse to let our paychecks fund the industry that is destroying our homes, our lands, and our loved ones.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

For more than a century, Big Oil lobbying has tyrannized American climate and tax policy, driving climate catastrophe while deepening economic inequality. Lavish tax breaks and subsidies for fossil fuel companies help explain why corporate giants like Chevron enjoy single-digit tax rates—lower than what many nurses or firefighters pay. After fossil fuel lobbyists flooded COP30 in unprecedented numbers, outnumbering nearly every other country’s delegation and stalling calls for a rapid fossil fuel phaseout, it’s more transparent than ever how the fossil fuel industry maintains its grip on global climate policy.

In the US, aggressive Big Oil lobbying has secured enormous government giveaways so extensive that the largest US oil and gas companies now pay more in taxes to foreign governments than to the US Treasury, finds a recent report by the FACT Coalition.

The report analyzed the financial disclosures of 11 US oil and gas companies with extensive overseas operations and concluded that decades of heavy industry lobbying has engineered a US tax code that pays for a dying fossil fuel industry, specifically for new oil and gas development abroad.

At the report’s launch in DC earlier this fall, Sen. Sheldon Whitehouse (D-RI) explained how US taxpayers are effectively forced to subsidize fossil fuel production through a tax code highly favorable to Big Oil. The report’s researchers explained that under the Global Intangible Low-Taxed Income (GILTI) regime, multinational companies that shift operations offshore already receive a 50% income tax deduction. But Big Oil lobbying has successfully created special exemptions allowing the largest fossil fuel companies to bypass all US tax on foreign oil and gas extraction income.

US taxpayers not only subsidize the fossil-fuel industry by nearly $35 billion every year, they also shoulder more than $100 billion annually in climate-related costs.

As a result, despite producing more oil and gas domestically than in all other countries combined, American multinational oil and gas companies collectively pay more in taxes to foreign governments than to the US. While domestic operations account for more than 57% of total upstream production among the companies studied in the report, they generate less than a quarter of total taxes due.

Before Trump’s 2017 tax law, corporate income earned abroad from refining, transporting, and selling oil was taxed immediately at the full US rate. But Trump’s Big Oil tax breaks shifted this income into GILTI. Although the 2022 Inflation Reduction Act (IRA) tried to curtail government subsidies to fossil fuels, the 2025 “One Big Beautiful Bill” expanded 2017-level tax giveaways, including more direct incentives for foreign drilling. To secure the sweeping benefits contained in the 2025 tax law, the industry’s largest players spent nearly $20 million lobbying Congress in the six months preceding the bill’s passage.

The bill adds $30.8 billion per year in existing subsidies for the fossil fuel industry, restores federal royalty rates to their pre-IRA levels of 12.5-16.7%, and introduces a new carve out allowing oil and gas companies to deduct intangible drilling costs (IDCs)—which represent 60-80% of total well expenses—from income subject to the Corporate Alternative Minimum Tax (CAMT) (a 15% minimum tax on corporations earning more than $1 billion in book profits). The president of the American Petroleum Institute (API), said that Trump’s 2025 tax reform “includes almost all of our priorities.”

Allowing the wishes of Big Oil to take precedent over the well-being of people and the planet is dooming our shared ecosystem. Today, US taxpayers not only subsidize the fossil-fuel industry by nearly $35 billion every year, they also shoulder more than $100 billion annually in climate-related costs. A Brookings study estimates that climate change now costs the average US household $220 to $570 per year.

Our government continues to prop up oil and gas companies over people and the planet, and is fueling climate disaster at home and abroad.

Meanwhile, the companies driving these damages continue to profit. Chevron and ExxonMobil rank among the world’s five highest-emitting corporations, and a 2025 Nature study estimates that each is responsible for nearly $2 trillion in climate damages. The report notes that federal handouts to US fossil fuel companies operating overseas are especially damaging. They erode the US tax base, accelerate the climate crisis, undermine American energy independence, and fail to generate well-paying domestic jobs.

Working-class people are paying for the continued life support of an already dying industry that’s fueling the climate crisis. Erich Pica, president of Friends of the Earth, noted during the report launch that without federal subsidies, 60% of US oil and gas production would be economically unviable. This sentiment has been well known by economic and political advisers across the political spectrum for decades. For instance, the report quotes Kevin Hassett, a current Trump top economic adviser, who said in a 2006 article that, “ending subsidies for fossil fuel production would level the playing field among energy sources and shift us from a policy of promoting fossil fuel supply to encouraging a reduction in fossil fuel consumption.” The entrenched government support incentivizing our current extractive economy starves the renewable energy sector of crucial federal investment necessary to curb polluting emissions. And eliminating these tax breaks would save US taxpayers more than $75 billion over the next decade.

The FACT Coalition recommends several essential reforms to counter traditional pro-oil tax policies. Eliminating domestic fossil fuel tax preferences and subsidies that fund oil and gas production abroad, ensuring that multinational corporations cannot shift production overseas to scapegoat domestic tax rates, and strengthening corporate tax transparency policy to include how much companies pay in taxes country-by-country.

“Tax fairness is climate justice,” Whitehouse concluded his remarks at the report launch.

Corporate and political greed deepens multigenerational economic vulnerability by eroding safety nets like the Supplemental Nutrition Assistance Program and Medicaid, while financially and politically killing the potential of a thriving renewable energy sector that could create stable, well-paying jobs to replace those declining under Big Oil. Our government continues to prop up oil and gas companies over people and the planet, and is fueling climate disaster at home and abroad. We must refuse to let our paychecks fund the industry that is destroying our homes, our lands, and our loved ones.

- How to Make Sure People and the Planet Don’t Pay for the Data Center Buildout ›

- Add It Up: The Average American Family Pays $6,000 a Year in Subsidies to Big Business ›

- Big Oil Is Dangerously Going After Fossil Fuel Extraction in Africa ›

- 'Disgusting': Pipeline Company Moves to Claim $15 Billion From US Over Canceled Keystone XL ›

- 'Colossal Waste': US Leads Way in Public Spending on False Climate Solutions ›

For more than a century, Big Oil lobbying has tyrannized American climate and tax policy, driving climate catastrophe while deepening economic inequality. Lavish tax breaks and subsidies for fossil fuel companies help explain why corporate giants like Chevron enjoy single-digit tax rates—lower than what many nurses or firefighters pay. After fossil fuel lobbyists flooded COP30 in unprecedented numbers, outnumbering nearly every other country’s delegation and stalling calls for a rapid fossil fuel phaseout, it’s more transparent than ever how the fossil fuel industry maintains its grip on global climate policy.

In the US, aggressive Big Oil lobbying has secured enormous government giveaways so extensive that the largest US oil and gas companies now pay more in taxes to foreign governments than to the US Treasury, finds a recent report by the FACT Coalition.

The report analyzed the financial disclosures of 11 US oil and gas companies with extensive overseas operations and concluded that decades of heavy industry lobbying has engineered a US tax code that pays for a dying fossil fuel industry, specifically for new oil and gas development abroad.

At the report’s launch in DC earlier this fall, Sen. Sheldon Whitehouse (D-RI) explained how US taxpayers are effectively forced to subsidize fossil fuel production through a tax code highly favorable to Big Oil. The report’s researchers explained that under the Global Intangible Low-Taxed Income (GILTI) regime, multinational companies that shift operations offshore already receive a 50% income tax deduction. But Big Oil lobbying has successfully created special exemptions allowing the largest fossil fuel companies to bypass all US tax on foreign oil and gas extraction income.

US taxpayers not only subsidize the fossil-fuel industry by nearly $35 billion every year, they also shoulder more than $100 billion annually in climate-related costs.

As a result, despite producing more oil and gas domestically than in all other countries combined, American multinational oil and gas companies collectively pay more in taxes to foreign governments than to the US. While domestic operations account for more than 57% of total upstream production among the companies studied in the report, they generate less than a quarter of total taxes due.

Before Trump’s 2017 tax law, corporate income earned abroad from refining, transporting, and selling oil was taxed immediately at the full US rate. But Trump’s Big Oil tax breaks shifted this income into GILTI. Although the 2022 Inflation Reduction Act (IRA) tried to curtail government subsidies to fossil fuels, the 2025 “One Big Beautiful Bill” expanded 2017-level tax giveaways, including more direct incentives for foreign drilling. To secure the sweeping benefits contained in the 2025 tax law, the industry’s largest players spent nearly $20 million lobbying Congress in the six months preceding the bill’s passage.

The bill adds $30.8 billion per year in existing subsidies for the fossil fuel industry, restores federal royalty rates to their pre-IRA levels of 12.5-16.7%, and introduces a new carve out allowing oil and gas companies to deduct intangible drilling costs (IDCs)—which represent 60-80% of total well expenses—from income subject to the Corporate Alternative Minimum Tax (CAMT) (a 15% minimum tax on corporations earning more than $1 billion in book profits). The president of the American Petroleum Institute (API), said that Trump’s 2025 tax reform “includes almost all of our priorities.”

Allowing the wishes of Big Oil to take precedent over the well-being of people and the planet is dooming our shared ecosystem. Today, US taxpayers not only subsidize the fossil-fuel industry by nearly $35 billion every year, they also shoulder more than $100 billion annually in climate-related costs. A Brookings study estimates that climate change now costs the average US household $220 to $570 per year.

Our government continues to prop up oil and gas companies over people and the planet, and is fueling climate disaster at home and abroad.

Meanwhile, the companies driving these damages continue to profit. Chevron and ExxonMobil rank among the world’s five highest-emitting corporations, and a 2025 Nature study estimates that each is responsible for nearly $2 trillion in climate damages. The report notes that federal handouts to US fossil fuel companies operating overseas are especially damaging. They erode the US tax base, accelerate the climate crisis, undermine American energy independence, and fail to generate well-paying domestic jobs.

Working-class people are paying for the continued life support of an already dying industry that’s fueling the climate crisis. Erich Pica, president of Friends of the Earth, noted during the report launch that without federal subsidies, 60% of US oil and gas production would be economically unviable. This sentiment has been well known by economic and political advisers across the political spectrum for decades. For instance, the report quotes Kevin Hassett, a current Trump top economic adviser, who said in a 2006 article that, “ending subsidies for fossil fuel production would level the playing field among energy sources and shift us from a policy of promoting fossil fuel supply to encouraging a reduction in fossil fuel consumption.” The entrenched government support incentivizing our current extractive economy starves the renewable energy sector of crucial federal investment necessary to curb polluting emissions. And eliminating these tax breaks would save US taxpayers more than $75 billion over the next decade.

The FACT Coalition recommends several essential reforms to counter traditional pro-oil tax policies. Eliminating domestic fossil fuel tax preferences and subsidies that fund oil and gas production abroad, ensuring that multinational corporations cannot shift production overseas to scapegoat domestic tax rates, and strengthening corporate tax transparency policy to include how much companies pay in taxes country-by-country.

“Tax fairness is climate justice,” Whitehouse concluded his remarks at the report launch.

Corporate and political greed deepens multigenerational economic vulnerability by eroding safety nets like the Supplemental Nutrition Assistance Program and Medicaid, while financially and politically killing the potential of a thriving renewable energy sector that could create stable, well-paying jobs to replace those declining under Big Oil. Our government continues to prop up oil and gas companies over people and the planet, and is fueling climate disaster at home and abroad. We must refuse to let our paychecks fund the industry that is destroying our homes, our lands, and our loved ones.

- How to Make Sure People and the Planet Don’t Pay for the Data Center Buildout ›

- Add It Up: The Average American Family Pays $6,000 a Year in Subsidies to Big Business ›

- Big Oil Is Dangerously Going After Fossil Fuel Extraction in Africa ›

- 'Disgusting': Pipeline Company Moves to Claim $15 Billion From US Over Canceled Keystone XL ›

- 'Colossal Waste': US Leads Way in Public Spending on False Climate Solutions ›