SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Rachel Berger

rberger@nationalnursesunited.org

National Nurses United applauds today's reintroduction of the Inclusive Prosperity Act by Sen. Bernie Sanders and Rep. Barbara Lee. This important legislation would raise an estimated $220 billion dollars a year to fund critical social programs including Medicare for All, public college for all and student debt relief, lifesaving global HIV/AIDS treatment and prevention, climate crisis mitigation and adaptation, housing assistance, job creation and job training programs, and investments in rebuilding our water and wastewater infrastructure and our physical infrastructure.

National Nurses United applauds today's reintroduction of the Inclusive Prosperity Act by Sen. Bernie Sanders and Rep. Barbara Lee. This important legislation would raise an estimated $220 billion dollars a year to fund critical social programs including Medicare for All, public college for all and student debt relief, lifesaving global HIV/AIDS treatment and prevention, climate crisis mitigation and adaptation, housing assistance, job creation and job training programs, and investments in rebuilding our water and wastewater infrastructure and our physical infrastructure.

The legislation, also known as the Robin Hood Tax, would establish a small financial transaction tax which would substantially reduce the high-frequency trading that puts our financial markets and economy at risk, while ensuring that Wall Street pays its fair share to help protect our communities and our environment.

"Nurses know that economic inequality and poor health go hand in hand. Every day, we see people who come into our emergency rooms in medical crisis because they went without preventative care or medicine because they couldn't afford it," said NNU President Jean Ross, RN. "This small tax on Wall Street will improve the lives of millions of people by funding Medicare for All, public college for all, critical environmental and climate crisis mitigation programs, job creation, housing assistance, and HIV/AIDS treatment and prevention programs. We applaud Sen. Sanders and Rep. Lee for their leadership on this vital issue."

Economists estimate that a tiny surcharge of no more than a nickel on every $10 in trades of stocks, and a lesser tax on the trading of bonds and derivatives, could increase revenues collected by the Treasury Department by $220 billion a year.

"As a nation the time is long overdue for us to get our priorities right," said Sen. Bernie Sanders. "It is time we made Wall Street pay their fair share in taxes and stop the type of reckless gambling by Wall Street speculators that nearly destroyed the economy over ten years ago." Sen. Sanders said the trillions raise by the tax would help improve the lives of millions of people. "That is money we could be using to make public colleges and universities tuition free, and substantially reduce student debt. It is money that we could use to reduce childhood poverty, to fix our crumbling infrastructure, to invest in affordable housing, childcare, renewable energy and energy efficiency. The middle class bailed out Wall Street in 2008, now it is Wall Street's turn to help rebuild the middle class."

"I am proud to introduce the House version of the Inclusive Prosperity Act because taxing Wall Street is not an extreme idea. The government already taxes everyday families for basic items like food, clothes, and housing. Wall Street gets away with no taxes, even when conducting high-risk financial transactions," said Rep. Lee. "This has to stop. It's past time to make sure Wall Street pays their fair share so that we can provide funding for things that make us a better nation like jobs, housing, infrastructure, and college education."

More than 10 years after the Great Recession, many Americans are still in worse shape than they were before the collapse, and nearly 40 million people are living in poverty. Income inequality is staggering, with Forbes reporting the wealthiest 10 percent of Americans owning 70 percent of the nation's assets while the bottom 50 percent of American households had virtually no net worth at all.

The taxes set by the bill would not affect households earning less than $75,000 annually. Instead, its principle targets are institutional and individual stock, bond, and derivative traders whose reckless speculation fueled the 2008 recession.

Some 40 nations have some form of a financial transaction tax and the U.S. had a similar tax from 1914 until 1966. For decades, the United Kingdom has had a tax on stock trades at the same stock tax rate proposed by this bill, and its volume of trading has still grown robustly.

National Nurses United, with close to 185,000 members in every state, is the largest union and professional association of registered nurses in US history.

(240) 235-2000"Your Department of Justice initially released this list of 32 survivors' names, with only one name redacted," Rep. Pramila Jayapal told Attorney General Pam Bondi.

US Attorney General Pam Bondi on Wednesday refused to apologize to victims of late sex offender Jeffrey Epstein during a contentious hearing before the House Judiciary Committee.

During the hearing, Rep. Pramila Jayapal (D-Wash.) grilled Bondi on why her office failed repeatedly to comply with a law passed in 2025 requiring the US Department of Justice (DOJ) to release "all unclassified records, documents, communications, and investigative materials in DOJ’s possession that relate to the investigation and prosecution of Jeffrey Epstein."

In particular, Jayapal noted that some of the files released by the DOJ so far have kept victims' names intact, even while redacting the names of several powerful men who are implicated in Epstein's sex trafficking operation.

"Your Department of Justice initially released this list of 32 survivors' names, with only one name redacted," said Jayapal, who then slammed the DOJ for releasing files that not only included victims' names but also their email and residential addresses, and even nude photographs of them.

🚨HISTORIC. Rep. Jayapal asks Epstein survivors to raise their hand if they still haven't been invited to meet with Pam Bondi or the DOJ.

Every single one raises their hand.

Sometimes gestures are more powerful than words. Damn this Administration.

pic.twitter.com/jyYG7Mj6tN

— CALL TO ACTIVISM (@CalltoActivism) February 11, 2026

"Survivors are now telling us that their families are finding out for the first time that they were trafficked by Epstein," Jayapal continued. "In their words, 'This release does not provide closure, it feels like a deliberate attempt to intimidate survivors, punish those who came forward, and reinforce the same culture of secrecy that allowed Epstein's crimes to continue for decades.'"

Jayapal then invited the Epstein survivors who were in attendance at the hearing to stand if they so wished, and asked them to raise their hands if they had still yet to meet with the DOJ to discuss the case.

After several women stood and raised their hands, Jayapal asked Bondi if she would apologize to them failing to redact their names and personal information before releasing the Epstein files.

Bondi responded by trying to deflect blame for past failures onto former Attorney General Merrick Garland. Jayapal interrupted the attorney general and asked her if she would apologize to the survivors for disclosing their information.

Bondi again tried to redirect the conversation to Garland, after which Jayapal again objected.

Finally, Bondi responded, "I'm not going to get in the gutter for [Jayapal's] theatrics."

A report released Wednesday by a key Democratic senator details how President Donald Trump's "economic policies are making life unaffordable for millions of American small businesses, their workers, and their customers."

Since Trump returned to power last year, "America's 36 million small businesses and their workers have faced increased costs for everything from healthcare to electricity, groceries, childcare, housing, and other everyday necessities," notes Pain Street, the new report from Sen. Ed Markey (D-Mass.), ranking member of the Senate Committee on Small Business and Entrepreneurship.

The report highlights Republicans' so-called One Big Beautiful Bill Act (OBBBA), which slashed various benefits for US families, and their refusal to extend Affordable Care Act (ACA) subsidies that helped over 20 million Americans afford health insurance.

The OBBBA's $1 trillion Medicaid cut "is devastating for small businesses," the document declares, noting that 630,000 owners and more than 7.5 million workers at such companies rely on the federal program for healthcare coverage. Additionally, over 10 million owners and employees relied on the ACA tax credits that expired at the end of last year.

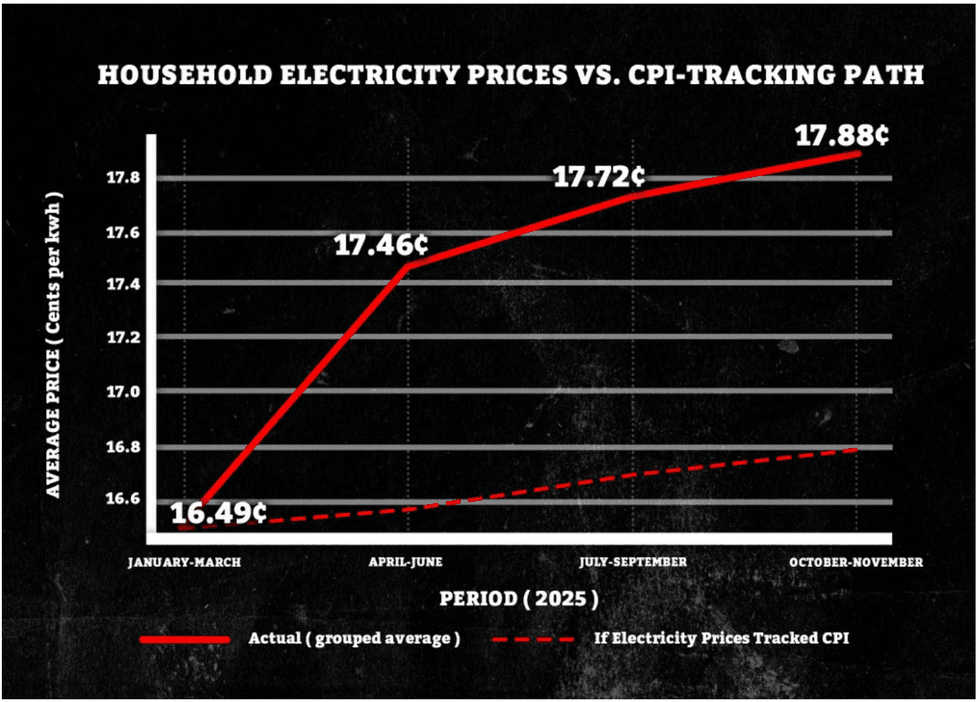

The publication also points to the president's attacks on clean energy and support for the planet-wrecking fossil fuel industry that helped him secure a second term. It says that "household electric bills have increased by 11.5%, and commercial electric bills have increased by 9%," stressing that such costs have climbed "more than three times faster than the overall rate of inflation."

The report also spotlights the "whiplash and cost of Trump's reckless tariffs," emphasizing that while the president often claims foreign countries are paying for his import taxes, "analysis by the Kiel Institute for the World Economy found that 96% of Trump's tariffs are being paid by American importers and consumers."

Specifically, since last March, US small businesses have shelled out more than $63.1 billion because of Trump tariffs. California—the world's fifth-largest economy—leads the state-by-state breakdown, at $14.3 billion, followed by Texas ($7 billion), New York ($4.9 billion), New Jersey ($4.1 billion), Georgia ($3.9 billion), Florida ($3.6 billion), Illinois ($2.3 billion), Ohio ($2 billion), Michigan ($1.7 billion), and South Carolina ($1.6 billion).

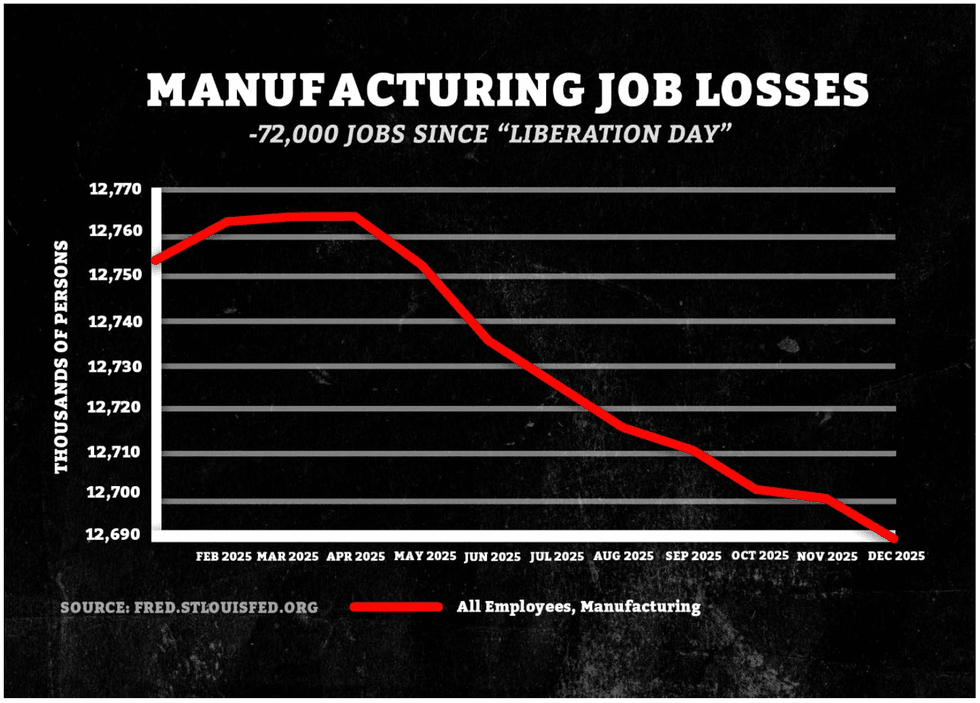

The president also claims that his tariffs are spurring a "manufacturing renaissance," but "approximately 98% of manufacturers in the United States employ fewer than 500 workers, with 75% of manufacturers employing fewer than 20," the report states. "US manufacturing shrank for the 10th consecutive month in December, and US factories have shed 72,000 jobs since Trump's 'liberation day' in April."

Adding to the evidence of Trump's negative impact, the Bureau of Labor Statistics announced Wednesday that across all sectors, US employers added just 181,000 jobs last year, far below its initial estimate of 584,000, and the country's economy has more than a million fewer jobs than previously reported.

Markey's staff further found that "soaring rents have left a record 22.6 million renters—approximately 50% of all renters in the US—struggling to afford their rent," 70% of families said last year that raising children is too expensive, and Trump's deportation agenda is estimated to reduce the number of immigrant and US-born workers by more than 5 million.

"Small businesses don't have Mar-a-Lago memberships, golden gifts, or ballroom invitations granting them special exemptions from Trump’s reckless economic policies, including his tariff taxes," Markey said in a statement announcing the report.

"Since Inauguration Day, Trump has made life more expensive for Americans—driving up costs on everything from healthcare, electricity, and groceries to childcare and housing—all while giving tax cuts to CEO billionaires and currying favors with big business," he continued. "As Trump's affordability crisis wreaks havoc on Main Street, we must fight back to protect small businesses, working families, and communities in Massachusetts and across the country."

As part of that fight, Markey has tried to pass multiple pieces of legislation that would exempt small businesses from Trump's tariffs, but both chambers of Congress remain narrowly controlled by the president's Republican Party.

"The American people want real change," the senator said. "Let's do it."

Recent progressive electoral victories have been followed by assurances from centrist Democratic politicians and strategists that such successes can't be replicated elsewhere, and congressional candidate Analilia Mejía's primary win this week was no exception—but Sen. Bernie Sanders implored voters not to listen to the naysayers who continue to insist that "moderation" is the key to winning elections for Democrats.

Emphasizing that Mejía, a grassroots organizer, was known to just 5% of voters in New Jersey's 11th Congressional District when she launched her campaign in November, Sanders said Wednesday: "Make no mistake. This can be done everywhere."

Mejía ran against 10 other candidates, including former US Rep. Tom Malinowski (D-NJ), in the Democratic primary ahead of the April 16 special election to fill the seat left vacant by Gov. Mikie Sherrill.

The progressive candidate was outspent 4-1, said Sanders, but proved unstoppable "because she had the courage to stand up for the working class in her area and throughout this country."

Mejía is a vocal supporter of shifting from the for-profit health insurance system to Medicare for All and has called for other progressive policies including tuition-free community college, a moratorium on new artificial intelligence data centers, and a federal law guaranteeing paid sick leave.

She has also called to abolish US Immigration and Customs Enforcement, the 23-year-old agency that President Donald Trump has deployed to cities across the US to carry out his violent mass deportation agenda, demanded an end to ICE's mass surveillance, and held training sessions for voters on anti-authoritarianism, civil disobedience, and how to prepare for encounters with federal immigration agents.

After Malinowski conceded to Mejía, Democratic strategist Steve Schale, who led former President Barack Obama's campaign operations in Florida in 2008, attempted to throw cold water on the progressive victory.

“The loudest voices are on the progressive left, but I don’t know if that’s where the party is,” Schale told The Hill Wednesday, asserting that Democratic voters in “southern states with large Black populations... don’t sound like progressives in New York and Northern New Jersey."

After New York Mayor Zohran Mamdani's victory in the Democratic primary last June against former Gov. Andrew Cuomo, former Transportation Secretary Pete Buttigieg—who has been named as a possible contender in the 2028 presidential race—was similarly dismissive, even though Mamdani, like Mejía, went from being barely known among voters to beating his establishment rival in just a few short months after focusing relentlessly on affordability and working-class issues.

Other progressive victories victories could be on the horizon in Maine, where Democratic Senate candidate Graham Platner has had a double-digit lead over Gov. Janet Mills in polls ahead of the June primary and raised three times as much as Mills and Sen. Susan Collins (R-Maine) combined in small donations in the final quarter of 2025; and North Carolina, where Durham County Commissioner Nida Allam is challenging Rep. Valerie Foushee for a second time after losing a close race in 2022.

Allam raised more than twice as much money as Foushee in the last quarter, according to numbers released last week.

Like Sanders, the New Jersey Working Families Party expressed optimism about Mejía's victory, with Antoinette Miles, the party's state director, saying Tuesday that "she has sent a clear signal that it’s a new day in New Jersey politics, and that our country is ready for bold, working-class leadership."

"In just 10 weeks, through the dead of winter, Analilia built a grassroots campaign for and by all New Jerseyans. Her bold message of an economy that works for all of us and an end to ICE’s brutality resonated with voters who are fed up with the status quo," said Miles. "Together, we’ve proved that organized people can defeat organized money."

Sanders added that "what Analilia did in New Jersey can in fact be done in every part of this country."

"The American people want real change," he said. "Let's do it."