November, 04 2011, 02:27pm EDT

G20 Continues With Failed Policies in Europe, Putting Regional and Global Economy at Risk, CEPR Co-Director Says

Risk of Increased Financial Contagion to Rest of the World

WASHINGTON

The Group of 20 (G20) leading economies are continuing failed policies in the eurozone, jeopardizing economic recovery in the region, and heightening the risk of financial contagion outside of Europe, Mark Weisbrot, Co-Director of the Center for Economic and Policy Research said today.

"It's unfortunate that the G20 continue to proceed with failed policies in Europe, putting the region at the risk of recession and also risking increased financial contagion to the rest of the world," Weisbrot said. "Let's hope that MF Global isn't the tip of any icebergs."

While much of the current analysis of Europe's crisis has focused on the political difficulties of coordinating fiscal policy among 17 governments, and reaching agreements on debt restructuring and guarantees, there are more basic problems with eurozone economic policy, Weisbrot argued.

"The European authorities continue to make things worse because they are trying to shrink their way out of the problem, which is not possible. The current crisis is a direct result of the fear in financial markets that the European authorities will do to Italy what they have done to Greece."

Weisbrot noted that when Greece was negotiating its first agreement with the International Monetary Fund (IMF) in May of 2010, Greece's debt was 115 percent of GDP, and could have been managed with low interest loans and a stimulus that restored growth. Now, he said, even the proposed 50 percent haircut on Greece's debt -- which is currently 166 percent of GDP -- won't be enough to avoid default.

"The have made a mess, and it's getting worse," said Weisbrot. "They need to do three things to get out of this: 1) restructure the Greek debt to a sustainable level, 2) provide a credible guarantee to Italian and Spanish bonds and 3) reverse their macroeconomic policy and provide a stimulus to growth and employment, especially in the weaker eurozone economies.

"So far, they haven't come close to accomplishing any of these basic pre-requisites for a resolution of the crisis."

Weisbrot just returned from Riga, where he spoke about the Latvian and eurozone economies at a forum sponsored by the Friedrich Ebert Stiftung. He also recently debated these points with Luc Everaert, Assistant Director of the European Department of the IMF during the IMF's Annual Meetings in Washington.

The Center for Economic and Policy Research (CEPR) was established in 1999 to promote democratic debate on the most important economic and social issues that affect people's lives. In order for citizens to effectively exercise their voices in a democracy, they should be informed about the problems and choices that they face. CEPR is committed to presenting issues in an accurate and understandable manner, so that the public is better prepared to choose among the various policy options.

(202) 293-5380LATEST NEWS

'Time Is Ticking': GOP Lawmakers Urged to Back Healthcare Tax Credit Extension

"Anything less is a choice to raise healthcare costs, strip millions of people of their coverage, and deepen America’s ongoing healthcare crisis," said one campaigner.

Dec 02, 2025

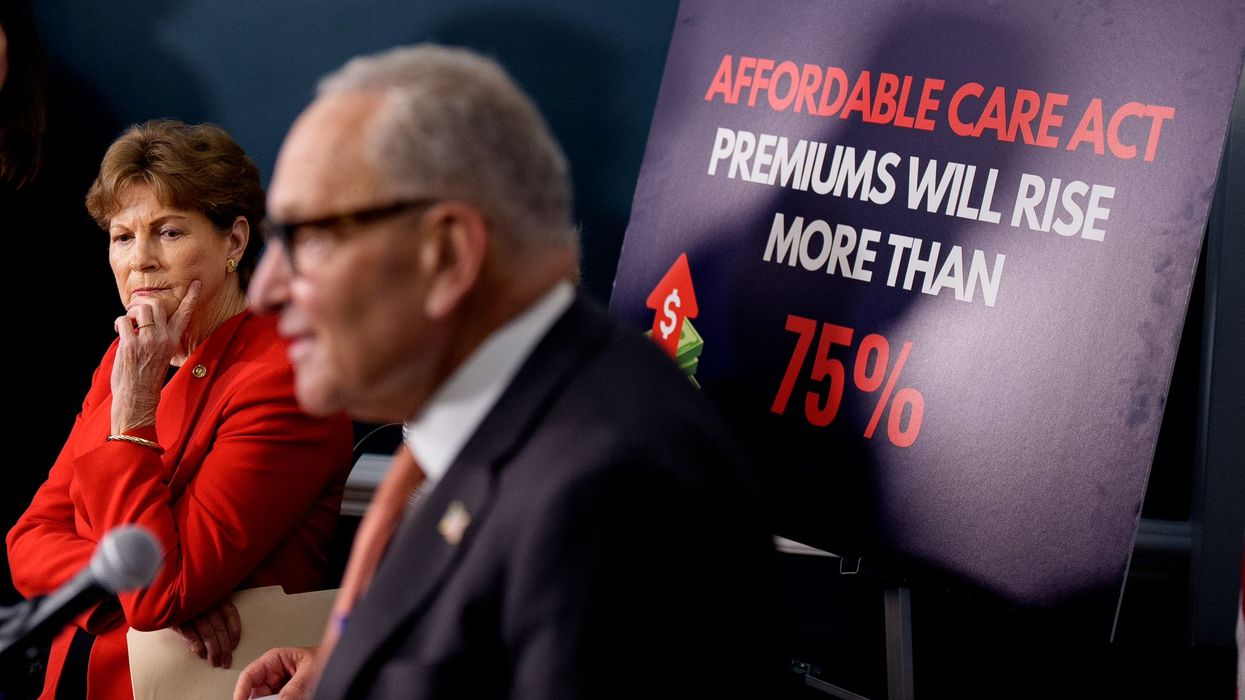

With less than a month remaining before Affordable Care Act healthcare tax credits are set to expire—which would cause monthly premiums to soar for an estimated 20 million Americans and potentially leave millions without coverage—Democratic lawmakers and progressive advocacy groups on Tuesday implored congressional Republicans to back a three-year extension on the vital subsidies.

While President Donald Trump and Republican legislators have promised lower healthcare costs, prices are soaring and millions of families are facing major premium hikes if the Affordable Care Act (ACA) subsidies end as scheduled on December 31. That leaves lawmakers with just 12 legislative days to act.

Trump has expressed openness to extending the ACA subsidies, even teasing a policy framework featuring a two-year extension with income caps and minimum premium payments for enrollees in the program also known as Obamacare.

However, the president has put the brakes on his proposal under pressure from House Speaker Mike Johnson (R-La.) and other congressional Republicans, many of whom are seeking a guarantee that the Hyde Amendment—which prohibits federal Medicaid funding for most abortion services—will be expanded to further restrict reproductive healthcare.

Calling Republicans "a total mess" who "don’t know what to do," Senate Minority Leader Chuck Schumer (D-NY) said Tuesday: "One day, Trump floats a so-called 'healthcare plan.' The next day, Speaker Johnson forces him to shoot it down. Some Republicans say they want to dismantle the ACA, probably a majority of them in the House and a large number in the Senate want to just dismantle it altogether."

"Other Republicans seem to be more focused on eradicating reproductive care in every state than helping people afford healthcare," Schumer continued. "The bottom line is that Republicans are in total disarray on healthcare."

"And while Republicans continue the infighting, who is paying the price? The American people," he added. "The people whose premiums are going up by $500 to $1,000 a month. These people know that Trump and Republicans are to blame."

Democratic lawmakers are pushing more lawmakers to sign a discharge petition, which would require Johnson to hold a vote on legislation to extend the ACA subsidies for three years. Such a bill is backed by numerous healthcare and economic advocacy groups.

"If Republicans in Congress truly cared about lowering costs for their constituents, they would swallow their pride and sign on to the discharge petition to force a vote on extending healthcare tax credits,” Unrig Our Economy campaign director Leor Tal said in a statement Tuesday.

“Republicans in Congress have spent months attacking Americans' access to healthcare while giving tax breaks to billionaires," Tal added. "Now, it is time that they finally put their constituents first, sign on to the discharge petition to extend these healthcare tax credits, and stop voting to undermine access to healthcare for millions of Americans.”

Michelle Sternthal, director of government affairs at Community Catalyst, a national health justice organization, said Tuesday that "Congress should pass a clean extension of the tax credits, repeal the dangerous healthcare provisions of the ‘Big Beautiful Bill,’ and protect the communities who rely on them the most."

"Because affordable, accessible care isn’t just good policy—it’s the foundation of a stronger, more resilient nation," she added.

Reproductive rights defenders sounded the alarm over Republican efforts to further restrict abortion care—which has been eviscerated by Trump-appointed Supreme Court justices and GOP-led state legislatures with sometimes deadly results—in any ACA tax credit extension.

Noting previous GOP efforts to strip abortion care from the ACA, Planned Parenthood Action Fund and Reproductive Freedom for All said in a joint statement on Monday:

Anti-abortion members of Congress want to create an additional abortion coverage ban on the ACA marketplace by making plans that include abortion coverage prohibitively expensive and unworkable. They want to restrict coverage for more than 20 million enrollees and prohibit people using tax credits from buying plans that cover abortion. This restriction conflicts with decisions some states have made to require coverage of abortion. In states that allow plans to cover abortion, since plans would be significantly more expensive without the availability of tax credits, insurers would likely drop abortion coverage because these plans would be unattractive and onerous to consumers.

The ACA already prohibits federal funding from being used to pay for abortion coverage under marketplace plans except in the very limited circumstances of rape, incest, and life-endangerment. What anti-abortion politicians are calling for would be an expansion of abortion restrictions into the private insurance market. This would only cause more chaos and confusion for those seeking their health insurance through the marketplace. The ACA was passed with the intent of providing affordable coverage, but anti-abortion politicians want to place new and expanded barriers to abortion coverage and push healthcare out of reach for people who rely on the marketplace.

Congressional Democrats echoed the advocacy groups' calls for their Republican colleagues to support the discharge petition.

"Democrats have an active discharge petition, and all we need are a handful of House Republicans to join us and we can trigger an up-or-down vote on a three-year extension of the Affordable Care Act tax credits to save the healthcare of the American people in every single state in this country, and protect the healthcare of people who these so-called Republican members allegedly represent, but who have failed to do a single thing to make their life better," House Minority Leader Hakeem Jeffries (D-NY) said Monday.

Congresswoman Nikki Budzkinski (D-Ill.) wrote on the social media platform Bluesky, "At the end of this month, the ACA tax credits will expire—plunging millions of Americans even deeper into the affordability crisis as their healthcare costs skyrocket."

"It’s time for President Trump and Republicans in Congress to get serious about saving healthcare," she added.

The healthcare crisis continues to loom and it’s time we extend the healthcare tax credits NOW to ensure folks are able to afford quality healthcare.TIME IS TICKING AND WE CANNOT WAIT ANY LONGER!

— Rep. Frederica Wilson (@repwilson.bsky.social) December 1, 2025 at 7:04 AM

Noting that the GOP spending bill signed by Trump in July "made the biggest Medicaid cuts in history to fund trillions in tax breaks for billionaires," Congresswoman Summer Lee (D-Pa.) warned Tuesday that "when these cuts go into effect, over 17,000 people in my district will lose healthcare."

Other lawmakers argued that Congress should go even further and pass Medicare for All legislation led by Sen. Bernie Sanders (I-Vt.) and Rep. Pramila Jayapal (D-Wash.).

"We must stop tinkering around the edges of a broken healthcare system," Sen. Chris Van Hollen (D-Md.), a cosponsor of the bill, said Monday. "Yes, let's extend the ACA tax credits to prevent a huge spike in healthcare costs for millions. Then, let's finally create a system that puts your health over corporate profits. We need Medicare for All."

Keep ReadingShow Less

As Critics Condemn 'Murder, Plain and Simple,' Hegseth Backs Admiral Order to Kill Boat Attack Survivors

"Making Adm. Bradley the fall guy in the administration's 'Protect Pete' campaign is disgraceful and destructive," said Sen. Richard Blumenthal. "Hegseth must go—resign or be fired."

Dec 02, 2025

As journalists on Tuesday continued to demand answers about the "double-tap" strike that started an illegal US bombing campaign against alleged drug-smuggling boats, Defense Secretary Pete Hegseth kept pointing the finger at Adm. Frank M. "Mitch" Bradley while still claiming to support the Navy leader who the Trump administration says ordered the military to take out two survivors of the initial attack.

Sitting beside President Donald Trump during a Cabinet meeting, Hegseth—who has denied the Washington Post and CNN's reporting that he gave a spoken directive to kill everybody on the boat before the September 2 bombing—told reporters that he left the room after the first strike, and Bradley ordered the second strike.

"I watched that first strike live. As you can imagine, at the Department of War, we got a lot of things to do, so I didn't stick around for the hour, and two hours, whatever, where all the sensitive site exploitation digitally occurs," Hegseth said, using Trump's preferred term for his department.

"So I moved on to my next meeting," the Fox News host-turned-Pentagon chief said. "Couple of hours later, I learned that that commander had made the—which he had the complete authority to do, and by the way—Adm. Bradley made the correct decision, to ultimately sink the boat and eliminate the threat... And it was the right call. We have his back."

Asked whether he saw the survivors after that first strike, Hegseth said: "I did not personally see survivors... The thing was on fire."

"This is called the fog of war," he added. "This is what you in the press don't understand. You sit in your air-conditioned offices or up on Capitol Hill, and you nitpick, and you plant fake stories in the Washington Post about 'kill everybody' phases on anonymous sources not based in anything, not based in any truth at all, and then you want to throw out really irresponsible terms about American heroes."

On Sunday, US Sen. Chris Van Hollen (D-Md.) said during an ABC News appearance that the second strike on September 2 was either "plain murder," or a war crime—if you accept the Trump administration's contested argument that the United States is "in armed conflict, at war... with the drug gangs," which many lawmakers and experts reject.

Responding to Hegseth's Tuesday remarks on the social media platform X, the Senate Foreign Relations Committee member said that "Secretary Talk Show Host may have been experiencing the 'fog of war,' but that doesn't change the fact that this was an extrajudicial killing amounting to murder or a war crime. One thing is clear: Pete Hegseth is unfit to serve. He must resign."

Calls for Hegseth's resignation or firing have mounted since Friday's reporting, exacerbated by his Monday X post in which the defense secretary said Bradley "has my 100% support" and "I stand by him and the combat decisions he has made—on the September 2 mission and all others since."

Replying to that post, Sen. Richard Blumenthal (D-Conn.) said that "making Adm. Bradley the fall guy in the administration's 'Protect Pete' campaign is disgraceful and destructive. It signals to military professionals down the ranks they'll be thrown under the bus for lawbreaking by Hegseth and other political leaders."

Despite recent bipartisan vows of "vigorous oversight" for the September 2 attack, Blumenthal said that "Republicans have shown no clear sign they'll buck the administration's blame gaming and begin a prompt investigation with subpoenas, witness depositions, hearings, and more. One immediate imperative: Demand that evidence be preserved—like all videos, emails, correspondence."

"Hegseth must go—resign or be fired," the senator added. "No question that murders or war crimes were committed on his watch. His criminal culpability may be contested, but no question that he's ultimately accountable. He directed the strikes be lethal and total. The buck stops with him."

Blumenthal is on the Senate Armed Services Committee, which, alongside the relevant House panel, is set to hold a classified briefing on Thursday with testimony from Bradley. Critics in Congress, including Senate Minority Leader Chuck Schumer (D-NY), have also called on Hegseth to testify under oath about the 22 boat bombings in the Caribbean and Pacific—which have killed at least 83 people—and potential US attacks within Venezuela, which the defense secretary and Trump teased again on Tuesday.

Ryan Goodman, a former Pentagon special counsel who’s now a New York University law professor and Just Security coeditor-in-chief, offered some potential questions lawmakers could ask based on Hegseth and Trump's Cabinet meeting comments.

The first: "Mr. Secretary, do you hereby testify—under penalty of perjury—that all your public statements about your involvement in the September 2 strike are true? We provided you a copy of all your statements before this hearing."

Noting Trump's claim that "Pete didn't know about [the] second attack having to do with two people," Goodman suggested that lawmakers inquire: "Oh. Well then, when did Pete know about it, and what did he do about it? When he found out about it, did he know the second attack was in order to kill the shipwrecked?"

Goodman and other experts argued in a Monday analysis for Just Security that "the United States is not in an armed conflict with any drug trafficking cartel or criminal gang anywhere in the Western Hemisphere," so "the individuals involved have not committed war crimes," but "the alleged Hegseth order and special forces' lethal operation amounted to unlawful 'extrajudicial killing' under human rights law," and "the federal murder statute would also apply."

Keep ReadingShow Less

Republicans Suddenly Care About US Airstrike Massacres—But Only Obama's

House Speaker Mike Johnson falsely claimed that "nobody ever questioned" Obama's hundreds of drone strikes, while defending the Trump administration's high seas murder spree.

Dec 02, 2025

Republicans on Tuesday invoked drone strikes during then-President Barack Obama's tenure in a dubious effort to justify what experts say is the Trump administration's illegal boat bombing campaign against alleged drug traffickers, while falsely claiming that Democrats and the media ignored airstrikes ordered by the former president.

US House Speaker Mike Johnson (R-La.) was asked during a Tuesday press conference about a so-called "double-tap" airstrike—military parlance for follow-up strikes on survivors and first responders after initial bombings—that killed two men who survived a September 2 attack on a boat in the southern Caribbean Sea.

Although US Defense Secretary Pete Hegseth has denied it, he reportedly gave a spoken order to “kill everybody” in the boat, which was supposedly interpreted by Adm. Frank M. “Mitch” Bradley as a green light for launching a second strike after the discovery that two of the 11 men aboard the vessel were alive and clinging to its burning wreckage.

Responding to the question concerning the strike's legality, Johnson pointed to upcoming congressional consultations on the matter and said that such attacks are "not an unprecedented thing."

“Secondary strikes are not unusual,” he noted. “It has to happen if a mission is going to be completed.”

“It’s something Congress will look at, and we’ll do that in the regular process and order," Johnson continued, referring to a classified briefing with Bradley and some lawmakers scheduled for Thursday. "I think it’s very important for everybody to reserve judgment and not leap to conclusions until you have all the facts."

“One of the things I was reminded of this morning is that under Barack Obama... I think there were 550 drone strikes on people who were targeted as enemies of the country, and nobody ever questioned it," he said.

RAJU: If defenseless survivors were killed, would that constitute a violation of the laws of war?

MIKE JOHNSON: I'm not going to prejudge any of that. I was pretty busy yesterday. I didn't follow a lot of the news. pic.twitter.com/v38JWhNx0k

— Aaron Rupar (@atrupar) December 2, 2025

The lack of attention to Obama's strikes claimed by Johnson is belied by congressional hearings, lawsuits, and copious coverage—and condemnation—of such attacks in media outlets including Common Dreams.

Progressive lawmakers and Republican Sen. Rand Paul of Kentucky were among the numerous US officials who criticized Obama-era drone strikes.

Trump administration officials have reportedly cited the Obama administration's legal rationale for bombing Libya to justify the boat strikes to members of Congress.

Other Republican lawmakers and right-wing media figures noted on Tuesday that Obama—who bombed more countries than his predecessor, former President George W. Bush and was called the "drone warrior-in-chief"—ordered strikes that resulted in massacres of civilians at events including funerals and at least one wedding.

At least hundreds of civilians were killed in such strikes, including 16-year-old US citizen Abdulrahman al-Awlaki, who according to an Obama administration official was in the wrong place at the wrong time when he was slain in Yemen in 2011. This, after al-Awlaki's father—an accused terrorist who was also American—was assassinated by a drone strike ordered by Obama.

Asked by a reporter about the legality of assassinating US citizens without charge or trial, then-White House Press Secretary Robert Gibbs infamously asserted in October 2012 that Abdulrahman al-Awlaki should have had "a far more responsible father."

Buried deep in a New York Times article published earlier that year was the revelation that Obama's secret "kill list" authorized the assassination of US citizens, and that his administration was counting all military-age males in a strike zone as "combatants" regardless of their actual status in an effort to artificially lower the reported number of civilian casualties.

“Turns out I’m really good at killing people,” Obama once boasted, according to the 2013 Mark Halperin and John Heilemann book Double Down. “Didn’t know that was gonna be a strong suit of mine.”

A third member of the al-Awlaki family, 8-year-old Nawar al-Awlaki—also an American citizen—was killed in a US commando raid in Yemen ordered by President Donald Trump in early 2017.

Tens of thousands of civilians were killed by US airstrikes in Afghanistan, Iran, Libya, Pakistan, Somalia, Syria, and Yemen during the Bush, Obama, Trump, and Biden administrations as part of the decadeslong so-called Global War on Terror, in which more than 900,000 people were slain, according to the Costs of War Project at Brown University's Watson Institute for International and Public Affairs.

At least thousands of civilians have been killed or wounded by US bombs and bullets in Afghanistan, Iran, Iraq, Somalia, Syria, and Yemen during Trump's first and second terms, during which rules of engagement aimed at protecting noncombatants have been loosened.

At least 83 people have been killed in 21 strikes on alleged drug-running boats in the Caribbean Sea and Pacific Ocean since early September, according to Trump administration figures. Officials in Venezuela and Colombia, as well as relatives of victims, claim that some of them were civilians uninvolved in narcotrafficking.

Keep ReadingShow Less

Most Popular