For-Profit Healthcare Makes Us Sick!

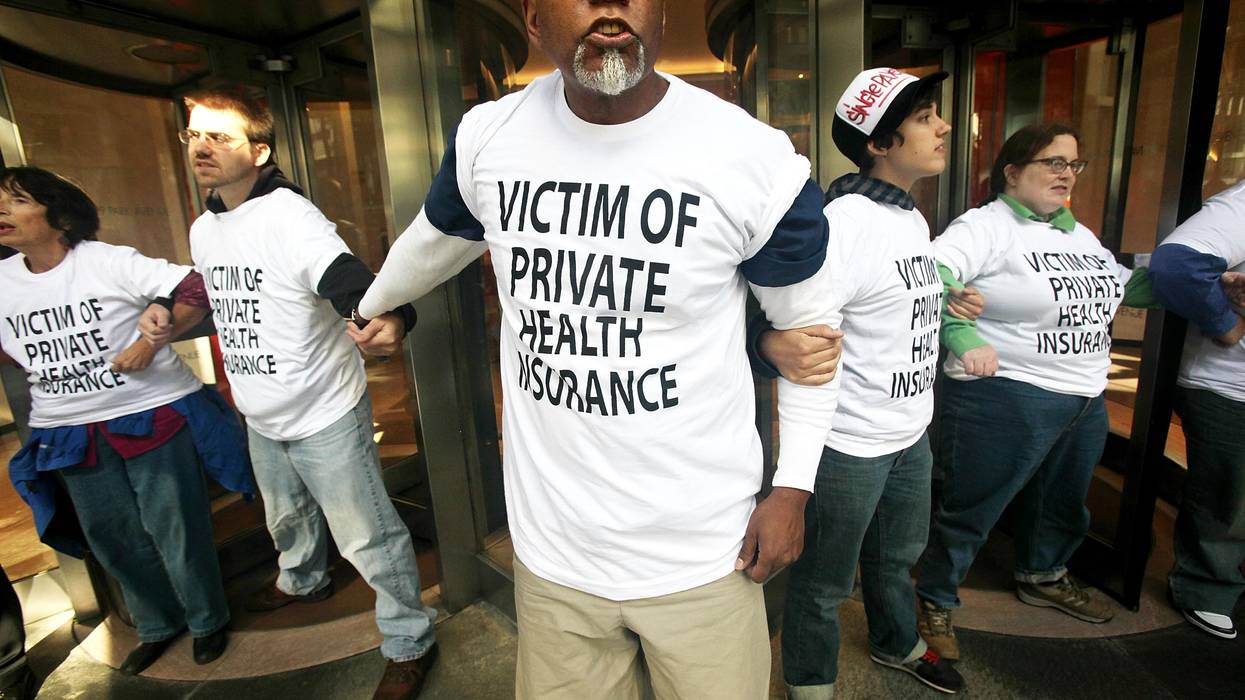

The harmful behaviors of profit-driven healthcare companies—from tax dodging to insurance denials to carelessness with patient safety—stem from the same illness: a disregard for the community they serve.

Even though most of us think of healthcare as a human right, the reality is that in the United States the provision of healthcare is big business. It places profits over people, demonstrating that priority through tax dodging, price gouging, insurance denials, and unsafe conditions for patients, as documented in a recent joint report from our two organizations, Americans for Tax Fairness and Community Catalyst.

The report, “Sick Profits,” highlights how seven healthcare corporations have together saved over $34 billion in federal taxes thanks to the 2017 Trump-GOP tax law recently extended by the current Trump administration and Republican Congress. They paid for those corporate tax breaks in part by cutting Medicaid and jeopardizing health coverage for 15 million people, and failing to preserve the enhanced premium tax credits for people buying health insurance through the Affordable Care Act (ACA) Marketplaces.

We currently have public policy that cuts taxes on corporations while ignoring nearly two-thirds of people who believe that big companies are not paying enough. Instead, healthcare corporations have each enjoyed hundreds of millions—in most cases, billions—of dollars in tax savings thanks to the Republican tax law, the most expensive part of which was a two-fifths cut in the corporate tax rate. They have also saved taxes by exploiting loopholes that the law (and its extension) failed to close, including in the accounting for stock options and the treatment of profits shifted offshore.

Not surprisingly, the companies examined in the report did not use their tax savings to lower prices, hire more providers, or improve patient care. No, the money went instead to higher executive compensation and increased payouts to shareholders through dividends and stock buybacks.

We must demand more transparency, fairer tax policy, and better oversight of these institutions.

Additionally, companies are maximizing their profits by simply not paying for care. By demanding “preauthorization” for a dizzying number of procedures then routinely denying approval, insurers can save billions at the expense of their policyholders. High percentages of initial denials are overturned on appeal, showing that “no” is simply the initial default position, taken in the hopes that patients and doctors won’t push the issue. Claim denials often result in medical debt and can also disrupt treatment for chronic medical conditions, delay or deny access to lifesaving care, and lead to avoidable complications—or even death.

Claim denials affect the health and well-being of people every day. They are people like Little John Cupp, who began feeling short of breath and experienced swelling in his feet and ankles. His doctor recommended a catheter exam to determine whether the arteries in his heart were blocked. However, the medical benefits management company EviCore (owned by Cigna) twice denied the catheter exam while eventually approving a much lower-cost stress test. The delay in diagnosis proved catastrophic. Less than two days after Mr. Cupp received the stress test, he died of cardiac arrest.

The tragedy of the end of Mr. Cupp’s life demonstrates the incredibly real risks that the first obstacle to getting care creates. Unfortunately, clearing that hurdle and receiving approval for care does not ensure quality. You could find yourself getting treatment at a facility saving money for shareholders by reducing staff and failing to maintain safe and hygienic conditions. NBC News aired a six-part investigation of hospital-operator HCA Holdings that uncovered, in the words of our report, “roaches in the operating room, leaking ceilings, essentially unmonitored vital signs, overworked nurses, overcrowded emergency rooms, closed departments, and other threats to patient health and safety.”

Or you may receive care at a facility owned or controlled by private equity interests. One cautionary tale is Prospect Medical Holdings, which operated hospitals and other health facilities in multiple states and was driven into bankruptcy after it was acquired by a private equity firm that extracted over $650 million in debt-financed dividends from the targeted company. While the private equity partners enjoyed lucrative payouts, patients suffered from unsanitary conditions, supply shortages, insufficient staffing, and shuttered departments.

Our diagnosis is simple but serious. The harmful behaviors of profit-driven healthcare companies—from tax dodging to insurance denials to carelessness with patient safety—stem from the same illness: a disregard for the community they serve. We must demand more transparency, fairer tax policy, and better oversight of these institutions. That means closing tax loopholes, raising the corporate tax rate, curbing the routine denials of coverage, and strengthening regulatory oversight of health facilities. That’s the only way to ensure that people’s needs are prioritized over corporate profits.