December, 03 2010, 10:11am EDT

For Immediate Release

Contact:

Michelle Bazie,202-408-1080,bazie@cbpp.org

Statement: Chad Stone, Chief Economist, on the November Employment Report

WASHINGTON

Today's disappointing employment report shows that the economy is

continuing to create jobs, but job growth is far too slow to bring down

the painfully high long-term unemployment rate (see chart).

With such a high percentage of the unemployed unable to find a job

within 26 weeks, Congress' failure to renew federal

emergency unemployment insurance (UI) benefits for another year before

the program expired this week represents very unsound policy

that will slow the economy, cause large additional job losses, and

result in widespread hardship.

Overall job growth this year (an

average of fewer than 100,000 jobs a month) has not been strong enough

even to start lowering the unemployment rate. We need job

growth at least two to three times stronger to get back to full

employment in any reasonable time frame. That will take a much

stronger economic recovery than we have seen so far.

Failure

to renew federal emergency unemployment insurance while jobs continue

to be so hard to find is not just cruel to unemployed workers and

their families; it also is a drag on an economic recovery that is

struggling to gain traction. It makes little sense to lose the

job-creating consumer spending those emergency UI benefits

support. Among 11 tax and spending measures analyzed by the

Congressional Budget Office for increasing economic growth

and employment in the next year or two, aid to the unemployed stands at

the top of the list.

A new report issued yesterday by the

President's Council of Economic Advisers estimates that federal

emergency UI increased employment in September 2010 by

nearly 800,000 jobs - and that failure to continue the program will cost

the economy 600,000 jobs by December 2011. Congress has provided

emergency UI in every major recession since the 1950s and the highest

unemployment rate at which any past program expired was 7.2

percent; it was 9.8 percent in November.

About the November Jobs Report

- Private

and government payrolls rose by a disappointing 39,000 jobs in

November. Private employers on net added just 50,000 jobs, while local

government employment fell by 14,000 jobs. - So far

this year, private employers have added jobs every month, expanding

private payrolls by 1.2 million jobs (a pace of 106,000 jobs a month);

total nonfarm employment (private plus government jobs) has grown

by 951,000, or 86,000 a month. Job creation of 100,000 to 125,000 a

month is necessary just to keep up with population growth and

keep the unemployment rate from rising; growth of 200,000 to 300,000

jobs a month is typical in strong economic recoveries. - In

November, there were 7.4 million fewer jobs on nonfarm payrolls than

there were when the recession began in December 2007, and 7.3 million

fewer jobs on private payrolls. - After remaining steady

at 9.6 percent for three months, the unemployment rate rose to 9.8

percent in November, and the number of unemployed rose to 15.1

million. - The job growth reported by employers was not

reflected in the Labor Department's household survey, which showed a

decline in the number of people with jobs. The thin silver

lining in these data is that enough more people entered the labor force

than left it to maintain the labor force participation rate (the

share of the population aged 16 and over working or looking for work)

at 64.5 percent. On balance, however, job losers and new entrants

who did not immediately find jobs added 276,000 people to the ranks of

the unemployed. - The labor force participation rate in the

past two months is the lowest it has been since 1984. The share of the

population with a job, which plummeted in the recession to levels

last seen in the mid-1980s, edged down to 58.2 percent; it has not been

lower since July 1983. - It remains very hard to find a

job. The Labor Department's most comprehensive alternative unemployment

rate measure - which includes people who want to work but are

discouraged from looking and people working part time because they can't

find full-time jobs - remained at 17.0 percent in November, not

much below its all-time high of 17.4 percent in November 2009 in data

that go back to 1994. - Long-term unemployment remains a

significant concern. Over two-fifths (41.9 percent) of the 15.1 million

people who are unemployed - 6.3 million people - have been

looking for work for 27 weeks or longer. These long-term unemployed

represent 4.1 percent of the labor force. Prior to this recession,

the previous highs for these statistics over the past six decades were

26.0 percent and 2.6 percent, respectively, in June 1983.

The Center on Budget and Policy Priorities is one of the nation's premier policy organizations working at the federal and state levels on fiscal policy and public programs that affect low- and moderate-income families and individuals.

LATEST NEWS

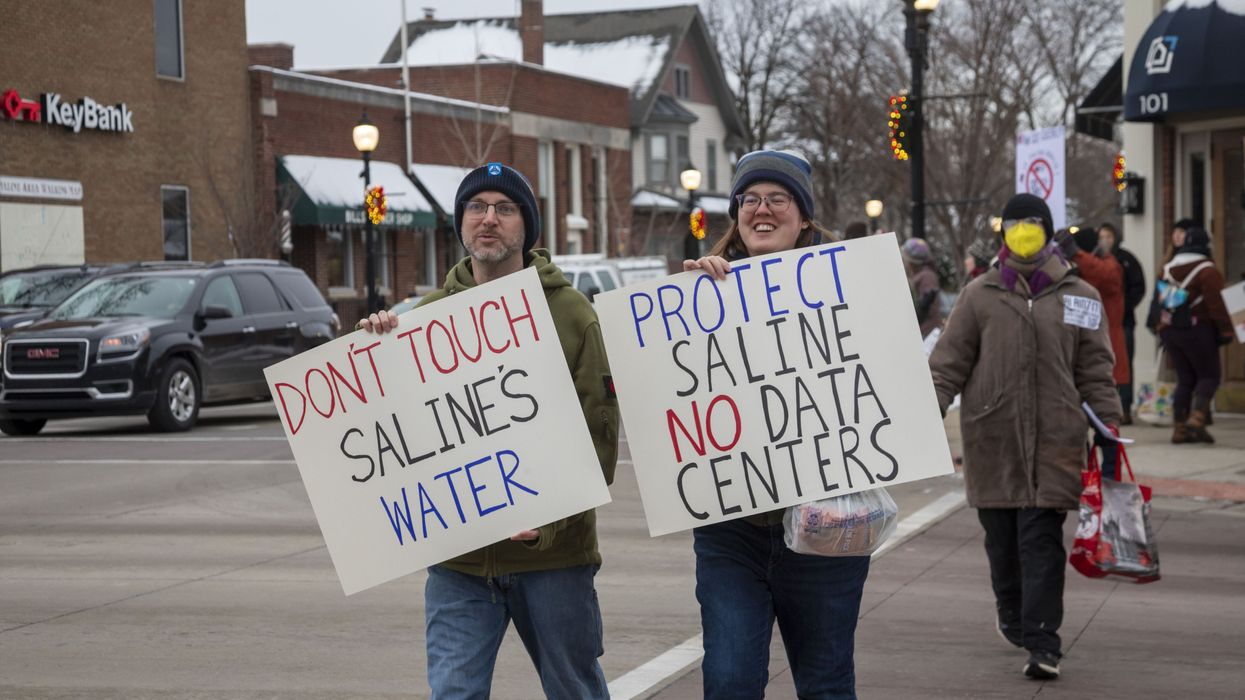

Sanders Champions Those Fighting Back Against Water-Sucking, Energy-Draining, Cost-Boosting Data Centers

Dec 10, 2025

Americans who are resisting the expansion of artificial intelligence data centers in their communities are up against local law enforcement and the Trump administration, which is seeking to compel cities and towns to host the massive facilities without residents' input.

On Wednesday, US Sen. Bernie Sanders (I-Vt.) urged AI data center opponents to keep up the pressure on local, state, and federal leaders, warning that the rapid expansion of the multi-billion-dollar behemoths in places like northern Virginia, Wisconsin, and Michigan is set to benefit "oligarchs," while working people pay "with higher water and electric bills."

"Americans must fight back against billionaires who put profits over people," said the senator.

In a video posted on the social media platform X, Sanders pointed to two major AI projects—a $165 billion data center being built in Abilene, Texas by OpenAI and Oracle and one being constructed in Louisiana by Meta.

The centers are projected to use as much electricity as 750,000 homes and 1.2 million homes, respectively, and Meta's project will be "the size of Manhattan."

Hundreds gathered in Abilene in October for a "No Kings" protest where one local Democratic political candidate spoke out against "billion-dollar corporations like Oracle" and others "moving into our rural communities."

"They’re exploiting them for all of their resources, and they are creating a surveillance state,” said Riley Rodriguez, a candidate for Texas state Senate District 28.

In Holly Ridge, Lousiana, the construction of the world's largest data center has brought thousands of dump trucks and 18-wheelers driving through town on a daily basis, causing crashes to rise 600% and forcing a local school to shut down its playground due to safety concerns.

And people in communities across the US know the construction of massive data centers are only the beginning of their troubles, as electricity bills have surged this year in areas like northern Virginia, Illinois, and Ohio, which have a high concentration of the facilities.

The centers are also projected to use the same amount of water as 18.5 million homes normally, according to a letter signed by more than 200 environmental justice groups this week.

And in a survey of Pennsylvanians last week, Emerson College found 55% of respondents believed the expansion of AI will decrease the number of jobs available in their current industry. Sanders released an analysis in October showing that corporations including Amazon, Walmart, and UnitedHealth Group are already openly planning to slash jobs by shifting operations to AI.

In his video on Wednesday, Sanders applauded residents who have spoken out against the encroachment of Big Tech firms in their towns and cities.

"In community after community, Americans are fighting back against the data centers being built by some of the largest and most powerful corporations in the world," said Sanders. "They are opposing the destruction of their local environment, soaring electric bills, and the diversion of scarce water supplies."

Keep ReadingShow Less

Protest in Oslo Denounces Nobel Peace Prize for Right-Wing Machado

"No peace prize for warmongers," said one of the banners displayed by demonstrators, who derided Machado's support for President Donald Trump's regime change push in Venezuela.

Dec 10, 2025

As President Donald Trump issued new threats of a possible ground invasion in Venezuela, protesters gathered outside the Norwegian Nobel Institute in Oslo on Tuesday to protest the awarding of the prestigious peace prize to right-wing opposition leader Maria Corina Machado, whom they described as an ally to US regime change efforts.

“This year’s Nobel Prize winner has not distanced herself from the interventions and the attacks we are seeing in the Caribbean, and we are stating that this clearly breaks with Alfred Nobel’s will," said Lina Alvarez Reyes, the information adviser for the Norwegian Solidarity Committee for Latin America, one of the groups that organized the protests.

Machado's daughter delivered a speech accepting the award on her behalf on Wednesday. The 58-year-old engineer was unable to attend the ceremony in person due to a decade-long travel ban imposed by Venezuelan authorities under the government of President Nicolás Maduro.

Via her daughter, Machado said that receiving the award "reminds the world that democracy is essential to peace... And more than anything, what we Venezuelans can offer the world is the lesson forged through this long and difficult journey: that to have a democracy, we must be willing to fight for freedom."

But the protesters who gathered outside the previous day argue that Machado—who dedicated her acceptance of the award in part to Trump and has reportedly worked behind the scenes to pressure Washington to ramp up military and financial pressure on Venezuela—is not a beacon of democracy, but a tool of imperialist control.

As Venezuelan-American activist Michelle Ellner wrote in Common Dreams in October after Machado received the award:

She worked hand in hand with Washington to justify regime change, using her platform to demand foreign military intervention to “liberate” Venezuela through force.

She cheered on Donald Trump’s threats of invasion and his naval deployments in the Caribbean, a show of force that risks igniting regional war under the pretext of “combating narco-trafficking.” While Trump sent warships and froze assets, Machado stood ready to serve as his local proxy, promising to deliver Venezuela’s sovereignty on a silver platter.

She pushed for the US sanctions that strangled the economy, knowing exactly who would pay the price: the poor, the sick, the working class.

The protesters outside the Nobel Institute on Tuesday felt similarly: "No peace prize for warmongers," read one banner. "US hands off Latin America," read another.

The protest came on the same day Trump told reporters that an attack on the mainland of Venezuela was coming soon: “We’re gonna hit ‘em on land very soon, too,” the president said after months of extrajudicial bombings of vessels in the Caribbean that the administration has alleged with scant evidence are carrying drugs.

On the same day that Machado received the award in absentia, US warplanes were seen circling over the Gulf of Venezuela. Later, in what Bloomberg described as a "serious escalation," the US seized an oil tanker off the nation's coast.

Keep ReadingShow Less

Princeton Experts Speak Out Against Trump Boat Strikes as 'Illegal' and Destabilizing 'Murders'

"Deploying an aircraft carrier and US Southern Command assets to destroy small yolas and wooden boats is not only unlawful, it is an absurd escalation," said one scholar.

Dec 10, 2025

Multiple scholars at the Princeton School of Public and International Affairs on Wednesday spoke out against the Trump administration's campaign of bombing suspected drug boats, with one going so far as to call them acts of murder.

Eduardo Bhatia, a visiting professor and lecturer in public and international affairs at Princeton, argued that it was "unequivocal" that the attacks on on purported drug boats are illegal.

"They violate established maritime law requiring interdiction and arrest before the use of lethal force, and they represent a grossly disproportionate response by the US," stressed Bhatia, the former president of the Senate of Puerto Rico. "Deploying an aircraft carrier and US Southern Command assets to destroy small yolas and wooden boats is not only unlawful, it is an absurd escalation that undermines regional security and diplomatic stability."

Deborah Pearlstein, director of the Program in Law and Public Policy at Princeton, said that she has been talking with "military operations lawyers, international law experts, national security legal scholars," and other experts, and so far has found none who believe the administration's boat attacks are legal.

Pearlstein added that the illegal strikes are "a symptom of the much deeper problem created by the purging of career lawyers on the front end, and the tacit promise of presidential pardons on the back end," the result of which is that "the rule of law loses its deterrent effect."

Visiting professor Kenneth Roth, former executive director of Human Rights Watch, argued that it was not right to describe the administration's actions as war crimes given that a war, by definition, "requires a level of sustained hostilities between two organized forces that is not present with the drug cartels."

Rather, Roth believes that the administration's policy should be classified as straight-up murder.

"These killings are still murders," he emphasized. "Drug trafficking is a serious crime, but the appropriate response is to interdict the boats and arrest the occupants for prosecution. The rules governing law enforcement prohibit lethal force except as a last resort to stop an imminent threat of death or serious bodily injury, which the boats do not present."

International affairs professor Jacob N. Shapiro pointed to the past failures in the US "War on Drugs," and predicted more of the same from Trump's boat-bombing spree.

"In 1986, President Ronald Reagan announced the 'War on Drugs,' which included using the Coast Guard and military to essentially shut down shipment through the Caribbean," Shapiro noted. "The goal was to reduce supply, raise prices, and thereby lower use. Cocaine prices in the US dropped precipitously from 1986 through 1989, and then dropped slowly through 2006. Traffickers moved from air and sea to land routes. That policy did not work, it's unclear why this time will be different."

The scholars' denunciation of the boat strikes came on the same day that the US seized an oil tanker off the coast of Venezuela in yet another escalatory act of aggression intended to put further economic pressure on the government of Venezuelan President Nicolás Maduro.

Keep ReadingShow Less

Most Popular