For years U.S. Environmental Protection Agency publications and

reports about uses and dangers of coal combustion waste have been

edited by coal ash industry representatives, according to EPA documents

released today by Public Employees for Environmental Responsibility

(PEER). Not surprisingly, the coal ash industry watered down official

reports, brochures and fact-sheets to remove references to potential

dangers and play up "environmental benefits" of a wide range of

applications for coal combustion wastes - the same materials that EPA

is currently deciding whether to classify as hazardous wastes following

the disastrous December 2008 coal ash spill in Tennessee.

During

the Bush administration, EPA entered into a formal partnership with the

coal industry, most prominently, the American Coal Ash Association, to

promote coal combustion wastes for industrial, agricultural and

consumer product uses. This effort has helped grow a multi-billion

dollar market which the industry worries would be crimped by a

hazardous waste designation.

The documents obtained by PEER

under the Freedom of Information Act show how this partnership gave the

coal ash industry a chance to change a variety of EPA draft

publications and presentations, including -

- Removal of

"cautionary language" about application of coal combustion wastes on

agricultural lands in an EPA brochure to be replaced with "exclamation

point ! language" "re-affirming the environmental benefits...that

reinforces the idea that FGD [flue gas desulfurization] gypsum is a

good thing" in the word of an American Coal Ash Association

representative; - A draft of EPA's 2007 Report to Congress

caused industry to lobby for insertion of language about the need for

"industry and EPA [to] work together" to weaken or block "state

regulations [that] are hindering progress" for greater use of the coal

combustion wastes; and - EPA fact-sheets and PowerPoint

presentations were altered at industry urging to delete significant

references to certain potential "high risk" uses of coal combustion

wastes.

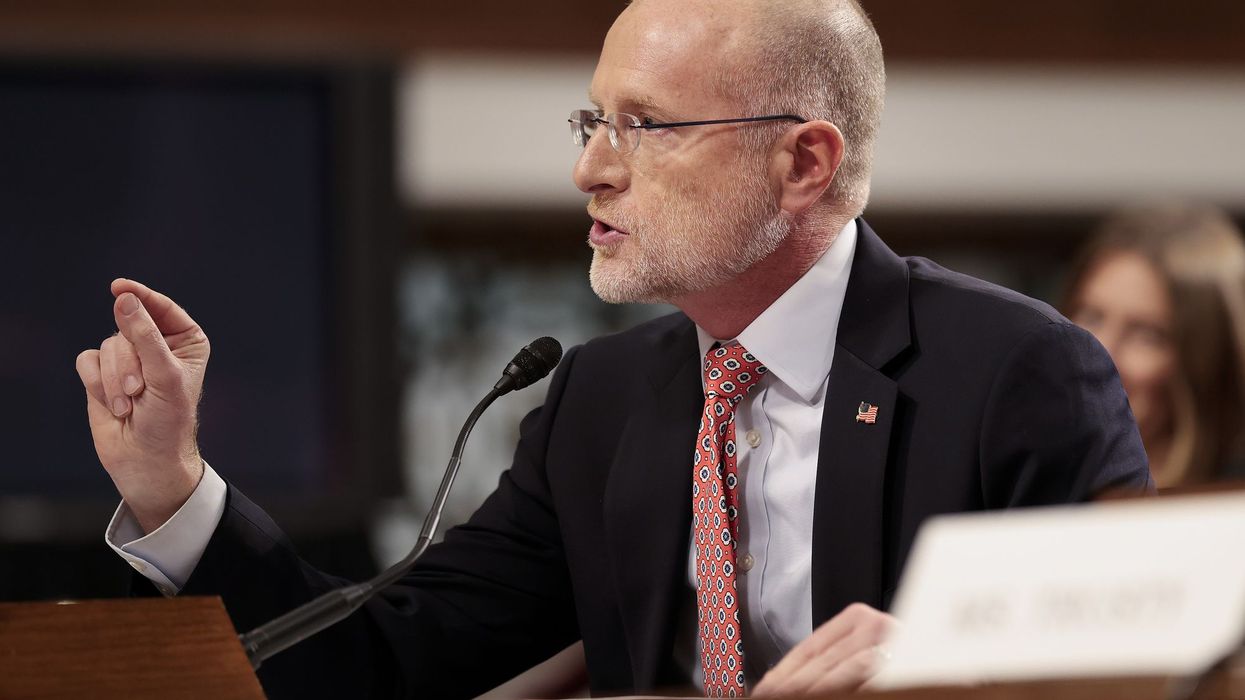

"For most of the past decade, it appears that

every EPA publication on the subject was ghostwritten by the American

Coal Ash Association," stated PEER Executive Director Jeff Ruch, who

examined thousands of industry-EPA communications. "In this partnership

it is clear that industry is EPA's senior partner."

This

collaboration is not limited to publications, however. EPA staff also

forewarned industry about conference calls and other intra-agency

deliberations, such as growing concerns about "increased leaching of

arsenic" from "increased use of fly ash" in order to let industry know

where to target its lobbying efforts. The working relationship is so

close that a coal ash industry representative joked to EPA staff in an

October 27, 2008 e-mail, referring to a news article about mercury

contamination from coal ash:

"We are in bed with

the EPA again, it looks, at least according to this article. The

advocacy groups are well organized and have the ready ear of the

press."

"It is no joke - the terms of the coal ash

partnership tucks EPA snugly into bed with industry for the purpose of

marketing coal combustion wastes as a product," Ruch added noting that

the partnership is still in effect. "EPA is supposed to be an objective

regulatory agency dedicated to protecting the public instead of

protecting a gigantic subsidy for a powerful industry."

###

Review the EPA partnership with the coal industry

Read e-mail about replacing cautionary with exclamation point language

See industry comments on draft EPA Report to Congress

Examine alterations to EPA PowerPoint presentation

Trace industry changes to EPA "fact-sheet"

Look at EPA heads-up to industry

View the "in bed with EPA" e-mail

Revisit partnership to promote coal waste in agriculture