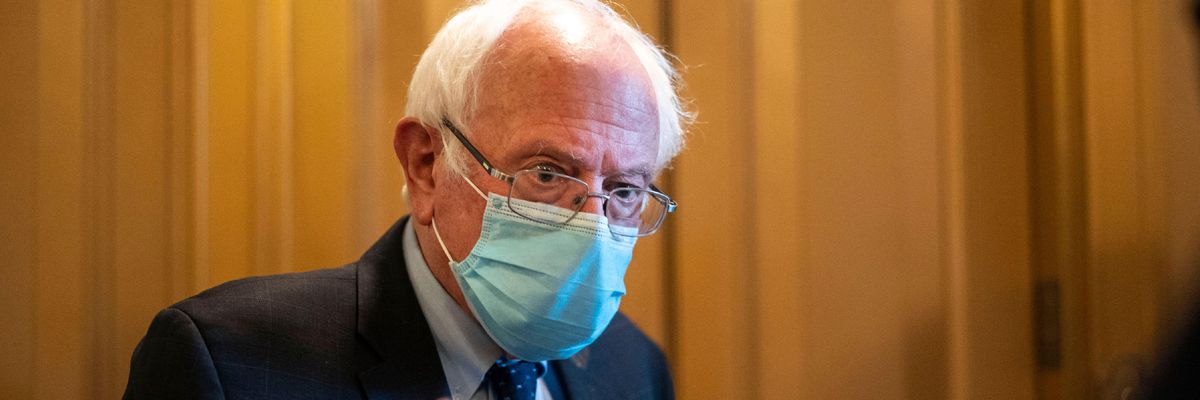

Sen. Bernie Sanders (I-Vt.) speaks to reporters following a vote at the U.S. Capitol on April 12, 2021 in Washington, D.C. (Photo: Drew Angerer/Getty Images)

'Sends a Terrible, Terrible Message': Sanders Rejects Top Dems' Push for a Big Tax Break for the Rich

"You can't be on the side of the wealthy and the powerful if you're going to really fight for working families."

Sen. Bernie Sanders made clear in an interview Sunday that he opposes the push by top Democrats to restore a tax deduction that overwhelmingly benefited the richest households in the U.S., saying such an effort "sends a terrible, terrible message" at a time of crippling economic pain for poor and working-class people.

"You have got to make it clear which side you are on--and you can't be on the side of the wealthy and powerful if you're going to really fight for working families," Sanders (I-Vt.), the chair of the Senate Budget Committee, said in an appearance on "Axios on HBO."

The tax break in question is known as the state and local tax (SALT) deduction, which former President Donald Trump and Republican lawmakers capped at $10,000 as part of their 2017 tax law. While the GOP tax measure was highly regressive--delivering the bulk of its benefits to the rich and large corporations--the SALT cap was "one of the few aspects of the Trump bill that actually promoted tax progressivity," as the Washington Post pointed out last month.

According to a recent analysis by the Institute on Taxation and Economic Policy (ITEP), 62% of the benefits of repealing the SALT cap would go to the richest 1% and 86% of the benefits would go to the top 5%. ITEP estimated that temporarily suspending the cap would cost more than $90 billion in just one year.

"There is no state where this is a primarily middle-class issue," the organization found. "In every state and the District of Columbia, more than half of the benefits would go to the richest 5% of taxpayers. In all but six states, more than half of the benefits would go to the richest 1%.

Nonetheless, prominent Democrats from blue states--which were disproportionately impacted by the SALT cap--are demanding full restoration of the tax break in President Joe Biden's infrastructure package, disingenuously characterizing the cap as a major burden on the middle class.

While Biden did not include the SALT cap repeal in his opening offer unveiled in March, Democrats such as House Speaker Nancy Pelosi (D-Calif.), Senate Majority Leader Chuck Schumer (D-N.Y.), and Tom Suozzi (D-N.Y.) are calling for a revival of the deduction.

As Common Dreams reported last month, Suozzi is part of a potentially influential faction of House Democrats that is threatening to oppose Biden's infrastructure package if the SALT cap repeal is not included.

Though much of the New York congressional delegation has come out in favor of repeal--including progressive Reps. Jamaal Bowman (D-N.Y.) and Mondaire Jones (D-N.Y.)--Rep. Alexandria Ocasio-Cortez (D-N.Y.) said last month that she doesn't "think that we should be holding the infrastructure package hostage for a 100% full repeal on SALT, especially in the case of a full repeal."

"Personally," Ocasio-Cortez added, "I can't stress how much that I believe that is a giveaway to the rich."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Sen. Bernie Sanders made clear in an interview Sunday that he opposes the push by top Democrats to restore a tax deduction that overwhelmingly benefited the richest households in the U.S., saying such an effort "sends a terrible, terrible message" at a time of crippling economic pain for poor and working-class people.

"You have got to make it clear which side you are on--and you can't be on the side of the wealthy and powerful if you're going to really fight for working families," Sanders (I-Vt.), the chair of the Senate Budget Committee, said in an appearance on "Axios on HBO."

The tax break in question is known as the state and local tax (SALT) deduction, which former President Donald Trump and Republican lawmakers capped at $10,000 as part of their 2017 tax law. While the GOP tax measure was highly regressive--delivering the bulk of its benefits to the rich and large corporations--the SALT cap was "one of the few aspects of the Trump bill that actually promoted tax progressivity," as the Washington Post pointed out last month.

According to a recent analysis by the Institute on Taxation and Economic Policy (ITEP), 62% of the benefits of repealing the SALT cap would go to the richest 1% and 86% of the benefits would go to the top 5%. ITEP estimated that temporarily suspending the cap would cost more than $90 billion in just one year.

"There is no state where this is a primarily middle-class issue," the organization found. "In every state and the District of Columbia, more than half of the benefits would go to the richest 5% of taxpayers. In all but six states, more than half of the benefits would go to the richest 1%.

Nonetheless, prominent Democrats from blue states--which were disproportionately impacted by the SALT cap--are demanding full restoration of the tax break in President Joe Biden's infrastructure package, disingenuously characterizing the cap as a major burden on the middle class.

While Biden did not include the SALT cap repeal in his opening offer unveiled in March, Democrats such as House Speaker Nancy Pelosi (D-Calif.), Senate Majority Leader Chuck Schumer (D-N.Y.), and Tom Suozzi (D-N.Y.) are calling for a revival of the deduction.

As Common Dreams reported last month, Suozzi is part of a potentially influential faction of House Democrats that is threatening to oppose Biden's infrastructure package if the SALT cap repeal is not included.

Though much of the New York congressional delegation has come out in favor of repeal--including progressive Reps. Jamaal Bowman (D-N.Y.) and Mondaire Jones (D-N.Y.)--Rep. Alexandria Ocasio-Cortez (D-N.Y.) said last month that she doesn't "think that we should be holding the infrastructure package hostage for a 100% full repeal on SALT, especially in the case of a full repeal."

"Personally," Ocasio-Cortez added, "I can't stress how much that I believe that is a giveaway to the rich."

Sen. Bernie Sanders made clear in an interview Sunday that he opposes the push by top Democrats to restore a tax deduction that overwhelmingly benefited the richest households in the U.S., saying such an effort "sends a terrible, terrible message" at a time of crippling economic pain for poor and working-class people.

"You have got to make it clear which side you are on--and you can't be on the side of the wealthy and powerful if you're going to really fight for working families," Sanders (I-Vt.), the chair of the Senate Budget Committee, said in an appearance on "Axios on HBO."

The tax break in question is known as the state and local tax (SALT) deduction, which former President Donald Trump and Republican lawmakers capped at $10,000 as part of their 2017 tax law. While the GOP tax measure was highly regressive--delivering the bulk of its benefits to the rich and large corporations--the SALT cap was "one of the few aspects of the Trump bill that actually promoted tax progressivity," as the Washington Post pointed out last month.

According to a recent analysis by the Institute on Taxation and Economic Policy (ITEP), 62% of the benefits of repealing the SALT cap would go to the richest 1% and 86% of the benefits would go to the top 5%. ITEP estimated that temporarily suspending the cap would cost more than $90 billion in just one year.

"There is no state where this is a primarily middle-class issue," the organization found. "In every state and the District of Columbia, more than half of the benefits would go to the richest 5% of taxpayers. In all but six states, more than half of the benefits would go to the richest 1%.

Nonetheless, prominent Democrats from blue states--which were disproportionately impacted by the SALT cap--are demanding full restoration of the tax break in President Joe Biden's infrastructure package, disingenuously characterizing the cap as a major burden on the middle class.

While Biden did not include the SALT cap repeal in his opening offer unveiled in March, Democrats such as House Speaker Nancy Pelosi (D-Calif.), Senate Majority Leader Chuck Schumer (D-N.Y.), and Tom Suozzi (D-N.Y.) are calling for a revival of the deduction.

As Common Dreams reported last month, Suozzi is part of a potentially influential faction of House Democrats that is threatening to oppose Biden's infrastructure package if the SALT cap repeal is not included.

Though much of the New York congressional delegation has come out in favor of repeal--including progressive Reps. Jamaal Bowman (D-N.Y.) and Mondaire Jones (D-N.Y.)--Rep. Alexandria Ocasio-Cortez (D-N.Y.) said last month that she doesn't "think that we should be holding the infrastructure package hostage for a 100% full repeal on SALT, especially in the case of a full repeal."

"Personally," Ocasio-Cortez added, "I can't stress how much that I believe that is a giveaway to the rich."