The Upside of Crypto's Catering Value

If the value of crypto plunges, wealthy people highly invested in those digital currencies are less able to pay high prices for houses and Superbowl tickets. To put it simply: there’s more for everyone else.

I realize most people have not been shorting crypto, although that would have been a smart move in the last couple of months. But the general public is nonetheless a big gainer from the sharp drop in crypto prices since October highs.

In fairness, the sum may not be “trillions,” more likely somewhere a bit over a single trillion. But in the era of Donald Trump, trillions would be far more accurate than most of what comes out of the president’s mouth.

Crypto and Counterfeit Currency

Before doing the numbers, it’s worth laying out the basic story. Imagine that a tremendously talented gang of counterfeiters was able to produce hundred-dollar bills that were indistinguishable from the ones printed by the Treasury. Suppose that they printed up tens of billions of these bills and got them into circulation.

The gang would be able to buy all sorts of things with their counterfeit money, possibly creating general inflation, but almost certainly pushing up the price of items in short supply, like houses, and tickets to big-name concerts and major sports events, like the Superbowl and the World Cup.

If some supersleuth detective figured out a way to recognize the counterfeit bills, they could then remove trillions of dollars of fake money from circulation. This would benefit the general public by reducing demand in the economy and reversing the run-up in the price of housing and Superbowl tickets.

It is the same story with plunging crypto prices. Crypto has no inherent value, but people with large fortunes in crypto can demand large chunks of what the economy produces. If the value of crypto plunges, they are less able to pay high prices for houses and Superbowl tickets. To put it simply: there’s more for everyone else.

This is why those who don’t have big bucks invested in crypto should applaud the plunge in Bitcoin, Ethereum, and the rest. This isn’t like shares of stock, where the price can affect the ability of a company to make a useful product such as cars or computers. The only possible impact of lower crypto prices on production is that we will make less crypto. The horror! The horror!

Doing the Numbers

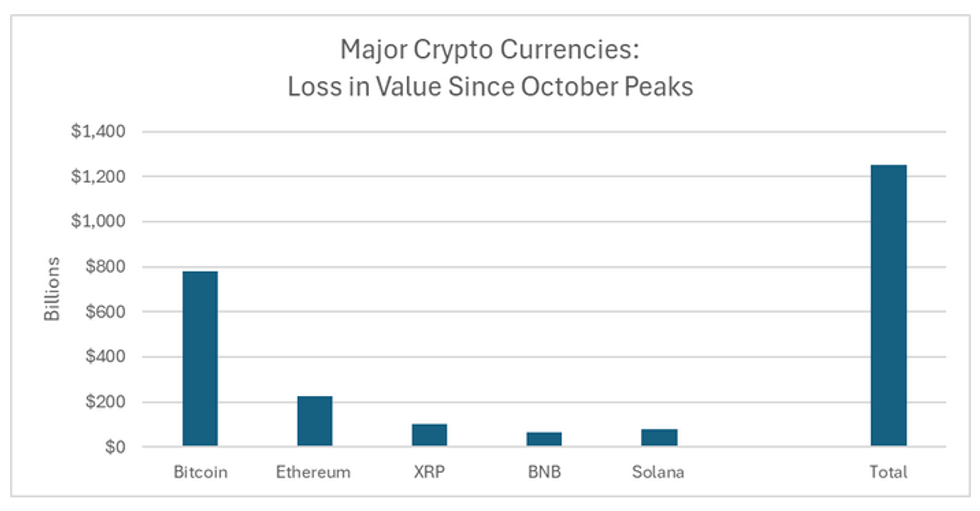

I’m not sure what exactly happened in early October, but it seems the world became much less friendly to crypto for some reason. Bitcoin hit a peak value of $124,800 on October 4th. Its price has since fallen sharply, standing at $85,900 at the close of trading on December 17th. The other major crypto currencies had similar tumbles.

In total, between early October and this writing on December 17, the major crypto currencies lost a total of more than $1.2 trillion in market capitalization. This would be enough to send every household in the United States a check for $10,000. In other words, it is real money.

Lacking a crystal ball, I can’t say whether this is just a temporary low, from which these currencies will bounce back or it’s a step towards reaching their fundamental value (zero). In any case, as it stands now, the crypto bros have lots less money to push up prices for houses, resort hotels, and all sorts of other things they do with their money. That’s a good story.