May, 23 2016, 02:00pm EDT

Over 1,500 Organizations Call on Congress to Oppose the Trans-Pacific Partnership (TPP)

A united cross-sector movement of 1,525 civil society organizations resent a letter today urging Congress to oppose the Trans-Pacific Partnership (TPP). They highlighted for each Congress member the number of groups on the letter with supporters in their state. The letter comes the same day as the corporate lobby group "U.S. Coalition for TPP" sent its own letter to Congress in support of the trade agreement.

WASHINGTON

A united cross-sector movement of 1,525 civil society organizations resent a letter today urging Congress to oppose the Trans-Pacific Partnership (TPP). They highlighted for each Congress member the number of groups on the letter with supporters in their state. The letter comes the same day as the corporate lobby group "U.S. Coalition for TPP" sent its own letter to Congress in support of the trade agreement.

"The TPP would make it even easier to ship American jobs overseas to wherever labor is the most exploited and environmental regulations are the weakest, so it's little surprise that certain corporations support this pact," said Arthur Stamoulis, executive director of Citizens Trade Campaign, which organized the civil society letter. "Civill society is unprecedentedly united against the TPP, however, due the pact's significant threats to jobs and wages, food safety, public health and the environment. This is an outrageously bad deal for working families, and Congress needs to side with constituents over corporate interest groups on this one."

The TPP is a proposed 12-nation pact that would set rules governing approximately 40% of the global economy, with a built-in mechanism so that other countries can join over time. A recent study by the U.S. International Trade Commission (ITC) -- which has traditionally overestimated the benefits and underestimated the costs of trade proposals -- found the TPP would increase the United States' global trade deficit and lead to a meager 0.15% economic growth by the year 2032.

"Given widespread public opposition, TPP supporters are now pushing to hold a vote on the agreement after the November elections during the 'lame duck' session of Congress -- that unique moment in the political calendar when Congressional accountability to constituents is at its lowest," said Stamoulis. "The offshorers aren't fooling anyone with that timing. Americans are angry about job-killing trade agreements, and voters' memories on these types of issues aren't as short as some might hope."

A copy of the letter with the full list of signers can be found online here. Text of the letter is below:

Dear Representative/Senator:

We urge you to oppose the Trans-Pacific Partnership (TPP), a binding pact that poses significant threats to American jobs and wages, the environment, food safety and public health, and that falls far short of establishing the high standards the United States should require in a 21st Century trade agreement.

If enacted, the TPP would set rules governing approximately 40% of the global economy, and includes a "docking" mechanism through which not only Pacific Rim nations, but any country in the world, could join over time. The questions policymakers should be asking about these rules is whether, on the whole, they would create American jobs, raise our wages, enhance environmental sustainability, improve public health and advance human rights and democracy. After careful consideration, we believe you will agree, the answer to these questions is no.

Our opposition to the TPP is broad and varied. Below are just some of the likely effects of the TPP that we find deeply disturbing.

Offshoring U.S. jobs and driving down wages

The TPP would offshore more good-paying American jobs, lower wages in the jobs that are left and increase income inequality by forcing U.S. employers into closer competition with companies exploiting labor in countries like Vietnam, with workers legally paid less than 65 cents an hour, and Malaysia, where an estimated one third of workers in the country's export-oriented electronics industry are the victims of human trafficking.

The TPP replicates the investor protections that reduce the risks and costs of relocating production to low wage countries. The pro-free-trade Cato Institute considers these terms a subsidy on offshoring, noting that they lower the risk premium of relocating to venues that American firms might otherwise not consider.

And the TPP's labor standards are grossly inadequate to the task of protecting human rights abroad and jobs here at home. The countries involved in the TPP have labor and human rights records so egregious that the "May 10th" model -- which was never sufficient to tackle the systemic labor abuses in Colombia -- is simply incapable of ensuring that workers in Mexico, Vietnam, Malaysia and all TPP countries will be able to exercise the rights they are promised on paper. Even if the labor standards were much stronger, the TPP is also so poorly negotiated that it allows products assembled mainly from parts manufactured in "third party" countries with no TPP obligations whatsoever to enter the United States duty free.

The TPP contains none of the enforceable safeguards against currency manipulation demanded by a bipartisan majority in both chambers of Congress. Thus, the often modest tariff cuts achieved under the pact for U.S. exporters could be easily wiped out overnight by countries' willingness to devalue their currencies in order to gain an unfair trade advantage. Already, the TPP includes several notorious currency manipulators, and would be open for countries such as China to join.

In addition, the TPP includes procurement requirements that would waive "Buy American" and "Buy Local" preferences in many types of government purchasing, meaning our tax dollars would also be offshored rather than being invested at home to create jobs here. Even the many Chinese state-owned enterprises in Vietnam would have to be treated equally with U.S. firms in bidding on most U.S. government contracts. The pact even includes financial services provisions that we are concerned might be interpreted to prohibit many of the commonsense financial stability policies necessary to head off future economic crises. The TPP is a major threat to the U.S. and global economy alike.

Undermining environmental protection

The TPP's Environment Chapter rolls back the initial progress made in the "May 10th" agreement between congressional Democrats and President George W. Bush with respect to multilateral environmental (MEAs) agreements. The TPP only includes an obligation to "adopt, maintain, and implement" domestic policies to fulfill one of the seven MEAs covered by Bush-era free trade agreements and listed in the "Fast Track" law. This omission would allow countries to violate their obligations in key environmental treaties in order to boost trade or investment without any consequences.

Of the new conservation measures in the TPP, most have extremely weak obligations attached to them, requiring countries to do things such as "exchange information and experiences" and "endeavor not to undermine" conservation efforts, rather than requiring them to "prohibit" and "ban" destructive practices. This stands in stark contrast to many of the commercial obligations found within the agreement.

The TPP's controversial investor-state dispute settlement (ISDS) system would enable foreign investors to challenge bedrock environmental and public health laws, regulations and court decisions as violations of the TPP's broad foreign investor rights in international tribunals that circumvent domestic judicial systems -- a threat felt at home and throughout the Pacific Rim.

Despite the fact that the TPP could threaten climate policies, increase shipping emissions and shift U.S. manufacturing to more carbon-intensive countries, the TPP fails to even include the words "climate change."

Jeopardizing the safety of the food we feed our families

The TPP includes language not found in past pacts that allows exporters to challenge border food safety inspection procedures. This is a dire concern given the TPP includes countries such as Vietnam and Malaysia that export massive quantities of shrimp and other seafood to the United States, significant amounts of which are now rejected as unsafe under current policies.

As well, new language in the final text replicates the industry demand for a so-called "Rapid Response Mechanism" that requires border inspectors to notify exporters for every food safety check that finds a problem and give the exporter the right to bring a challenge to that port inspection determination. This is a new right to bring a trade challenge to individual border inspection decisions (including potentially laboratory or other testing) that second-guesses U.S. inspectors and creates a chilling effect that would deter rigorous oversight of imported foods.

The TPP additionally includes new rules on risk assessment that would prioritize the extent to which a food safety policy impacts trade, not the extent to which it protects consumers.

Rolling back access to life-saving medications

Many of the TPP's intellectual property provisions would effectively delay the introduction of low-cost generic medications, increasing health care prices and reducing access to medicine both at home and abroad.

Pharmaceutical firms obtained much of their agenda in the TPP. This includes new monopoly rights that do not exist in past agreements with respect to biologic medicines, a category that includes cutting edge cancer treatments. The TPP also contains requirements that TPP nations allow additional 20-year patents for new uses of drugs already under patent, among other rules that would promote the "evergreening" of patent monopolies. Other TPP provisions may enable pharmaceutical companies to challenge Medicare drug listing decisions, Medicaid reimbursements and constrain future U.S. policy reforms to reduce healthcare costs.

With this agreement, the United States would shamefully roll back some of the hard-fought protections for access to medicine in trade agreements that were secured during the George W. Bush administration. Indeed, the pact eviscerates the core premise of the "May 10th" reforms that poor nations require more flexibility in medicine patent rules so as to ensure access. All of the TPP's extreme medicine patent rules will apply equally to developing countries with only short transition periods for application of some of the rules.

Elevating investor rights over human rights and democracy

Contrary to Fast Track negotiating objectives, the TPP's Investment Chapter and its ISDS system would grant foreign firms greater rights than domestic firms enjoy under U.S. law. One class of interests -- foreign firms -- could privately enforce this public treaty by skirting domestic laws and courts to challenge U.S. federal, state and local decisions and policies on grounds not available in U.S. law and do so before extrajudicial tribunals authorized to order payment of unlimited sums of taxpayer dollars. Under the TPP, compensation orders could include the "expected future profits" a tribunal determines that an investor would have earned in the absence of the public policy it is attacking.

Worse, the TPP would expand U.S. ISDS liability by widening the scope of domestic policies and government actions that could be challenged. For the first time in any U.S. free trade agreement, the provision used in most successful investor compensation demands would be extended to challenges of financial regulatory policies. The TPP would extend the "minimum standard of treatment" obligation to the TPP's Financial Services Chapter's terms, allowing financial firms to challenge policies as violating investors' "expectations" of how they should be treated. Meanwhile, the "safeguard" that the U.S. Trade Representative (USTR) claims would protect such policies merely replicates terms that have failed to protect challenged policies in the past.

In addition, the TPP would newly allow pharmaceutical firms to use the TPP to demand cash compensation for claimed violations of World Trade Organization (WTO) rules on creation, limitation or revocation of intellectual property rights. Currently, WTO rules are not privately enforceable by investors.

With Japanese, Australian and other firms newly empowered to launch ISDS attacks against the United States, the TPP would double U.S. ISDS exposure. More than 1,000 additional corporations in TPP nations, which own more than 9,200 subsidiaries here, could newly launch ISDS cases against the U.S. government. About 1,300 foreign firms with about 9,500 U.S. subsidiaries are so empowered under all existing U.S. investor-state-enforced pacts. Most of these are with developing nations with few investors here. That is why, until the TPP, the United States has managed largely to dodge ISDS attacks to date.

In these, and multiple other ways, the TPP elevates investor rights over human rights and democracy, threatening an even broader array of public policy decisions than described above. This, unfortunately, is the all-too-predictable result of a secretive negotiating process in which hundreds of corporate advisors had privileged access to negotiating texts, while the public was barred from even reviewing what was being proposed in its name.

The TPP does not deserve your support. Had Fast Track not become law, Congress could work to remove the misguided and detrimental provisions of the TPP, strengthen weak ones and add new provisions designed to ensure that our most vulnerable families and communities do not bear the brunt of the TPP's many risks. Now that Fast Track authority is in place for it, Congress is left with no means of adequately amending the agreement without rejecting it entirely. We respectfully ask that you do just that.

Thank you for your consideration. We will be following your position on this matter closely.

Sincerely,

Public Citizen is a nonprofit consumer advocacy organization that champions the public interest in the halls of power. We defend democracy, resist corporate power and work to ensure that government works for the people - not for big corporations. Founded in 1971, we now have 500,000 members and supporters throughout the country.

(202) 588-1000LATEST NEWS

Texas Democratic Primary Turnout Surges in Show of 'Strong Enthusiasm' From Base Voters

Texas Democratic primary turnout has already broken records in both Harris County and Tarrant County.

Feb 26, 2026

Turnout among early Democratic voters in Texas has been surging in what election analysts say is a key sign for what's to come in the 2026 midterm elections.

As CNN reported on Thursday, early voting data shows that more than 850,000 ballots have so far been cast in the Texas Democratic primary, which is "nearly 60% more than the number of votes cast at the same point in the 2020 Democratic presidential primary."

CNN said that this high turnout points to "a continuing trend of strong enthusiasm among the party's base."

To put this in perspective, the Texas Tribune noted that "more ballots have been cast in Texas through the first seven days of early voting for the 2026 midterms than any recent midterm or presidential election year," driven primarily by Democratic turnout.

The Tribune added that Democratic turnout has already broken records in Harris County, the most populous county in Texas, and in Tarrant County, where Democrat Taylor Rehmet earlier this year pulled off an upset victory in a district that President Donald Trump carried by 17 points in the 2024 election.

In breaking down the early turnout numbers so far, CNN polling analyst Harry Enten said on Wednesday that Democrats in Texas may actually outvote Republicans in a primary this year for the first time since 2002.

Enten also said that the turnout surge has big implications for the 2026 midterms.

"When we're talking nationally, primary turnout matters," he explained. "The fact that more people are voting on the Democratic side in Texas at this point, that translates nationally, that would suggest Democrats [are] well on their way to winning the House. And in a red state like Texas? As I said: Mind blown."

Mind blown about the early vote in Texas. TX Dems may outvote the GOP for the 1st time in a midterm primary since 2002!

This indicates they're well on their way to having higher primary turnout nationally & since 06 the party w/ higher primary turnout won the House every time. pic.twitter.com/QaBlWZOCi2

— (((Harry Enten))) (@ForecasterEnten) February 25, 2026

While winning the primary turnout battle wouldn't guarantee a Democratic victory the Texas US Senate general election, Politico reported on Thursday that Republicans in the state are growing nervous about the race.

In particular, Republicans fear that Texas Attorney General Ken Paxton, a highly divisive figure even among Texas Republicans, could win the nomination over incumbent Sen. John Cornyn (R-Texas).

Senate Majority Leader John Thune (R-SD) told Politico that Cornyn is "the best candidate on the ballot in a general election, not only for the Senate, but also for down-ballot races in the House that could be impacted by the Senate race too. He added that the GOP would likely have to spend more money propping up Paxton should he win the Republican nomination.

"Honestly, if you look at the polling in a general election setting," said Thune, "I don’t think it’s outside the realm of possibility that the seat [flips], depending on who the Democrats nominate."

US Rep. Jasmine Crockett (D-Texas) and Texas state Rep. James Talarico are the two leading Democrats battling for the party's US Senate nomination. A survey released Wednesday by pollsters from the University of Texas found that Crockett is leading Talarico in the primary race by 12 percentage points.

Keep ReadingShow Less

Trump March to War With Iran Is 'Iraq Redux,' Says Former Head of UN Nuclear Watchdog

"The US is intensifying the drumbeat of war against Iran, with zero explanation of the nonexistent legal authority to use force and zero evidence of an 'imminent threat,'" said Mohamed ElBaradei.

Feb 26, 2026

The former head of the International Atomic Energy Agency said Wednesday that a US war on Iran would have "horrific costs," a warning that came before American and Iranian officials gathered in Geneva for the latest round of closely watched negotiations.

"The US is intensifying the drumbeat of war against Iran, with zero explanation of the nonexistent legal authority to use force and zero evidence of an 'imminent threat' other than hypothetical scenarios based on possible future intentions," Mohamed ElBaradei, a Nobel Peace Prize laureate who served as IAEA director-general from 1997 to 2009, wrote in a social media post.

"All wars, including 'wars of choice,' have horrific costs," he added. "That is the reason for the restraints and limitations established by international norms. This is Iraq redux... It seems we never learn."

US President Donald Trump and members of his administration have repeatedly claimed, without evidence, that Iran desires and is on the brink of making a nuclear weapon, even after Trump claimed to have "obliterated" the country's nuclear program with airstrikes last year.

Iran has said its nuclear program is entirely for peaceful purposes; the nation's foreign minister, Abbas Araghchi, said earlier this week that Iran would "under no circumstances ever develop a nuclear weapon."

"A deal is within reach, but only if diplomacy is given priority," said Araghchi.

In recent weeks, the Trump administration has assembled a massive fleet of warplanes and aircraft in the Middle East as the US president has threatened to attack Iran, accusing the country of harboring "sinister nuclear ambitions."

But Rafael Grossi, the current head of the IAEA, said last week that the nuclear agency had not seen any evidence that Iran is currently working to develop nuclear weapons capacity.

"On the contrary, I see, today, a willingness on both sides to reach an agreement," said Grossi.

Keep ReadingShow Less

Nearly Blind Rohingya Refugee Found Dead After Being Stranded by Border Patrol in Freezing Cold

"There must be a full investigation and real accountability from US Customs and Border Protection," said one lawmaker.

Feb 26, 2026

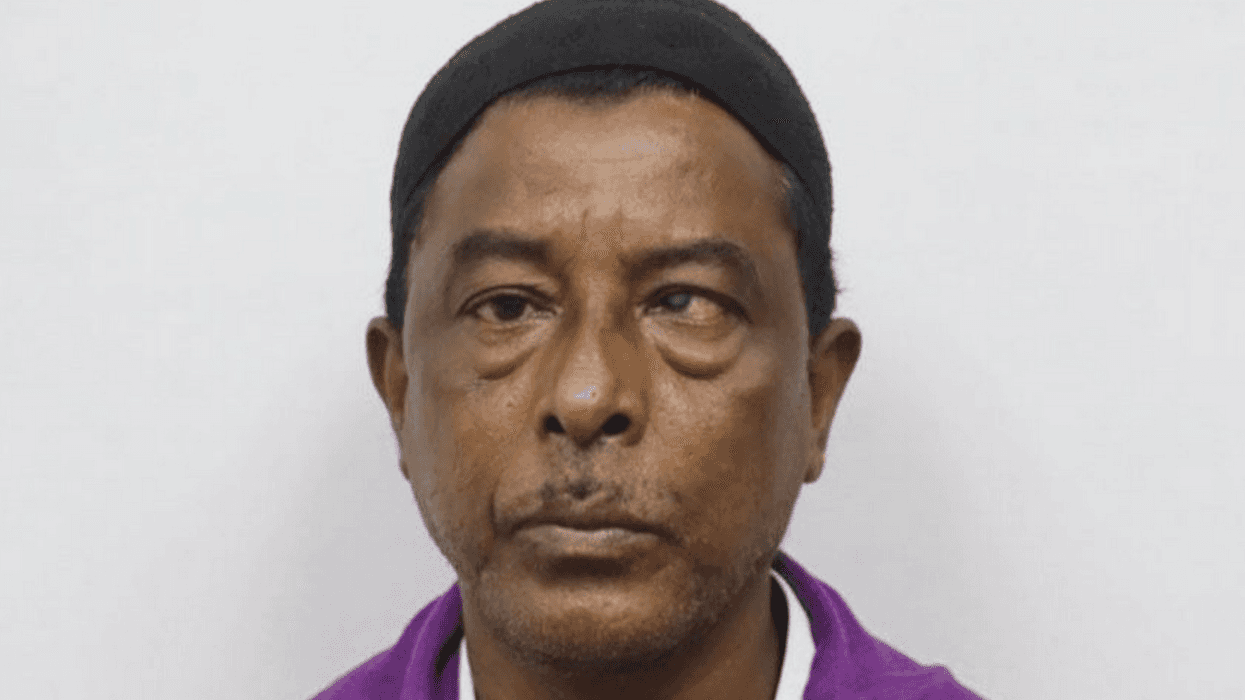

The latest chapter in what one historian called "the ongoing horror story of American immigration enforcement" unfolded in Buffalo, New York this week after Nurul Amin Shah Alam, a 56-year-old Rohingya refugee from Myanmar, was released from a county jail where he'd been held for a year.

As Buffalo-based outlet the Investigative Post reported Wednesday, the nearly blind man was found dead on Tuesday evening, five days after US Border Patrol agents who had picked him up from the jail dropped him off at a coffee shop. They neglected to inform his lawyer or family where he was, making it impossible for Shah Alam to find his way home in sub-freezing temperatures.

Shah Alam, who was blind in one eye and had partial, blurry vision in the other, had gotten lost one day in February 2025 and ended up on a woman's porch with a curtain rod he used as a walking stick.

The woman called the police, who ordered Shah Alam to drop his "weapon"—the walking stick—and then Tasered, beat, and arrested him.

Shah Alam, who could not speak English and did not understand the police officers' orders, was charged with assault, trespassing, and possession of a weapon and taken to Erie County Holding Center.

His family, which includes a wife and two sons, chose not to bail him out of the county jail. His arrest had come a month into President Donald Trump's second term, and they feared US Immigration and Customs Enforcement would detain him if he was released and send him to a detention center out of state.

Benjamin Macaluso, an attorney with Legal Aid Bureau who was representing Shah Alam, told the Investigative Post that he had been released on bail last week after reaching a deal with the Erie County District Attorney’s office, agreeing to plead guilty to trespassing and possession of a weapon. The agreement allowed him to avoid detention by federal immigration agents even though authorities had previously placed an immigration detainer on Shah Alam.

Despite that, the Erie County Sheriff’s Office contacted US Border Patrol to pick Shah Alam up from the Holding Center. When the agents determined Shah Alam was not eligible for immigration detention, Border Patrol told the Investigative Post, they "offered him a courtesy ride, which he chose to accept to a coffee shop.”

An agency spokesperson claimed the nearly blind man "showed no signs of distress, mobility issues, or disabilities requiring special assistance."

Mohamad Faisal, one of Shah Alam's two sons, told Al Jazeera that his father was not able to read, write, or use electronic devices.

Macaluso told the Investigative Post that Shah Alam's family spent days searching for him in the cold before his body was found. The lawyer also said he had expected Shah Alam to be taken to an ICE detention center in Batavia, New York to be released.

A spokesperson for City Hall in Buffalo told the Investigative Post that homicide detectives were "investigating the circumstances and timeframe of events leading up to his death, following his release from custody," but said homicide and exposure to the elements had been ruled out as the cause of death by a medical examiner.

US Rep. Grace Meng (D-NY) was among those who called for a "full investigation" into Border Patrol's decision to leave Shah Alam miles from his home despite his disability.

Buffalo Mayor Sean Ryan, a Democrat, accused US Customs and Border Protection, which oversees Border Patrol, of a "dereliction of duty" and said the agency's treatment of Shah Alam was "inhumane."

"US Customs and Border Protection must answer for how and why this happened," said Ryan. "Buffalo is a city that welcomes refugees and believes government should protect human dignity, not endanger it. US Customs and Border Protection failed that basic standard."

Chuck Park, a Democrat who is running for Congress in New York's 6th District, said the New York for All Act, which would prohibit state and local law enforcement from collaborating with federal immigration agencies, would have prevented the sheriff's office from calling Border Patrol upon Shah Alam's release.

Alexandre Burgos of the New York State Hate and Bias Prevention Unit invited community members to a gathering to demand accountability to Shah Alam's death.

"We are coming together to demand accountability and transparency in the case of Nurul Amin Shah Alam," reads a flyer for the event, scheduled for Thursday evening at 5:30 pm Eastern at Lafayette High School in Buffalo.

Keep ReadingShow Less

Most Popular